In this Detailed Thread 🧵 I'll look to analyse "TCPL PACKAGING"📦 I'll look to analyse TCPL PACKAGING Business, Fundamentals, Financials, Product Mix, Management, Trigger, Story, CAPEX, Valuation Gap etc.

#TCPLPACKAGING

#TCPLPACKAGING

Each and every neeche details about this company will be covered in this thread 🧵

☑️ABOUT THE COMPANY

💫TCPL manufactures folding cartons, printed blanks and outers, litho-lamination, plastic cartons, blister packs, and shelf-ready packaging.

☑️ABOUT THE COMPANY

💫TCPL manufactures folding cartons, printed blanks and outers, litho-lamination, plastic cartons, blister packs, and shelf-ready packaging.

💫TCPL has also ventured into the flexible packaging industry, with the capability to produce printed cork-tipping paper, laminates, sleeves, and wrap-around labels.

💫TCPL Packaging is promoted by the Kanoria family, which has varied business

💫TCPL Packaging is promoted by the Kanoria family, which has varied business

interests such as jute, tea, textiles, pharmaceuticals, and chemicals.

💫In 1990, the Kanoria family, which holds a 55.74% stake in the company as of 1st June, 2023 ventured into folding cartons manufacturing, with a unit in Silvassa.

💫In 1990, the Kanoria family, which holds a 55.74% stake in the company as of 1st June, 2023 ventured into folding cartons manufacturing, with a unit in Silvassa.

💫TCPL is a leading supplier to the tobacco, liquor, consumer goods, and food packaging industry in India

☑️Revenue Mix FY22

✅Folding cartons: ~85%

✅Flexible packaging: ~15%

☑️Manufacturing Unit

💫The company has 8 manufacturing units as of FY22.

☑️Revenue Mix FY22

✅Folding cartons: ~85%

✅Flexible packaging: ~15%

☑️Manufacturing Unit

💫The company has 8 manufacturing units as of FY22.

💫It operates multiple manufacturing units situated at Haridwar, Silvassa, Goa, Guwahati, and Greater Noida.

💫In FY22, the company expanded its offset capacity by adding a new printing line at its Goa plant.

💫In FY22, the company expanded its offset capacity by adding a new printing line at its Goa plant.

☑️Distribution Network

💫TCPL is headquartered in Mumbai, India, and maintains marketing offices in Mumbai, New Delhi, Greater Noida, Kolkata, and Bengaluru to cater to customers across the country,and around the world.

☑️Exports

💫In FY22, Exports contributed 23% to the total

💫TCPL is headquartered in Mumbai, India, and maintains marketing offices in Mumbai, New Delhi, Greater Noida, Kolkata, and Bengaluru to cater to customers across the country,and around the world.

☑️Exports

💫In FY22, Exports contributed 23% to the total

Revenue.

☑️Customers

💫The company’s products are used in packaging in various end-user industries, including pharmaceuticals, food and beverages, cosmetics, toiletries, cigarettes, liquor, etc.

💫Some of the major customers are HUL, Patanjali, Bosch, etc

☑️Customers

💫The company’s products are used in packaging in various end-user industries, including pharmaceuticals, food and beverages, cosmetics, toiletries, cigarettes, liquor, etc.

💫Some of the major customers are HUL, Patanjali, Bosch, etc

☑️New Subsidiary

💫In FY22, Co. has set up their wholly owned subsidiary company in UAE called TCPL Middle East FZE and has opened a marketing office in Dubai

☑️Acquisition

💫The Co. has acquired a majority stake in Creative Offset Printers Private Limited (COPPL),

💫In FY22, Co. has set up their wholly owned subsidiary company in UAE called TCPL Middle East FZE and has opened a marketing office in Dubai

☑️Acquisition

💫The Co. has acquired a majority stake in Creative Offset Printers Private Limited (COPPL),

a company based in Greater Noida which specializes in manufacturing printed rigid boxes and leaflets, for a consideration of 3 crores

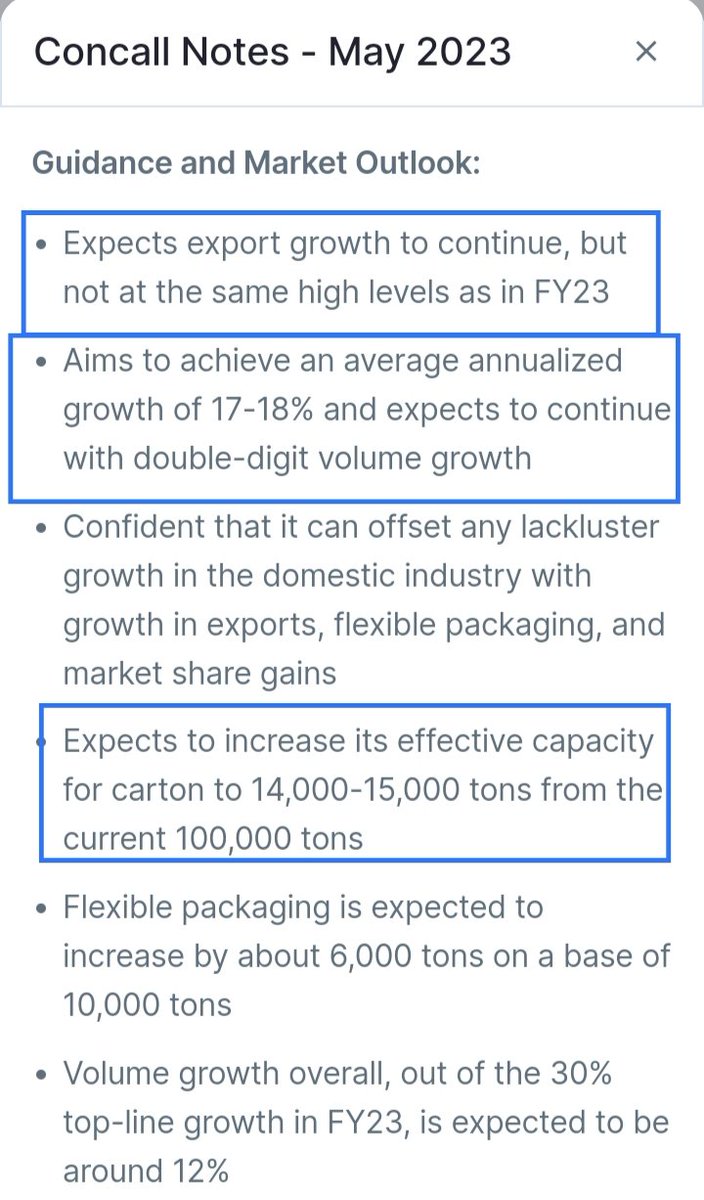

☑️Focus

💫Post capacity expansion and acquisition of COPPL, the co. is continually focussed on diversifying its business operations.

☑️Focus

💫Post capacity expansion and acquisition of COPPL, the co. is continually focussed on diversifying its business operations.

☑️Fundamental Analysis

✅Market Capitalisation:- Rs 1302 Cr(Smallcap)

✅Stock PE:- 12.4(Undervalued)

✅Industry PE:- 16.2

✅ROCE:- 22%

✅ROE:- 26.3%

✅Book Value:- Rs 497

✅Intrinsic Value:- Rs 1795

✅Graham No:- Rs 1202

✅Face Value:- 10

✅Dividend Yield:- 1.40%

✅Market Capitalisation:- Rs 1302 Cr(Smallcap)

✅Stock PE:- 12.4(Undervalued)

✅Industry PE:- 16.2

✅ROCE:- 22%

✅ROE:- 26.3%

✅Book Value:- Rs 497

✅Intrinsic Value:- Rs 1795

✅Graham No:- Rs 1202

✅Face Value:- 10

✅Dividend Yield:- 1.40%

✅Profit Growth:- 117%

✅Sales Growth:- 33.1%

✅Piotroski Score:- 9

✅Debt to Equity:- 1.01

✅Debt:- Rs 459 Cr

✅Reserves:- Rs 443 Cr

✅EPS:- 129

✅Promoters Holding:- 55.7%

✅PEG Ratio:- 0.32

Last 3/5/10 Years Sales & Profit Growth, Stock Price CAGR, ROE below👇

✅Sales Growth:- 33.1%

✅Piotroski Score:- 9

✅Debt to Equity:- 1.01

✅Debt:- Rs 459 Cr

✅Reserves:- Rs 443 Cr

✅EPS:- 129

✅Promoters Holding:- 55.7%

✅PEG Ratio:- 0.32

Last 3/5/10 Years Sales & Profit Growth, Stock Price CAGR, ROE below👇

☑️Chart Pattern📉📈 Analysis, Financial Analysis and my Commentary👨💻

✅Chart Pattern(Daily Timeframe)

✅CMP of the stock is at Rs 1427

✅The stock is Trading below 9/20/50 EMA

✅200- DMA of the stock is placed @Rs1392

✅Since last 2.5 Years, this stock has taken 6-Times support

✅Chart Pattern(Daily Timeframe)

✅CMP of the stock is at Rs 1427

✅The stock is Trading below 9/20/50 EMA

✅200- DMA of the stock is placed @Rs1392

✅Since last 2.5 Years, this stock has taken 6-Times support

Near its 200-DMA

✅The price fell below 200-DMA only 2 times and again formed a uptrend pattern by forming a Bullish Marubazu Candle

✅As per RSI, this stock is already in the oversold zone as RSI is @36

✅This stock is correcting from Rs 1685+ its 52 week highs was at Rs 1802

✅The price fell below 200-DMA only 2 times and again formed a uptrend pattern by forming a Bullish Marubazu Candle

✅As per RSI, this stock is already in the oversold zone as RSI is @36

✅This stock is correcting from Rs 1685+ its 52 week highs was at Rs 1802

✅As per my viewpoints, I would have bought this stock at CMP @1427 as I'm getting about 260 points discounts from the recent highs of Rs 1685 and I'm getting about 375 points discount from the 52 week highs

✅The margin of safety is at about 20%

✅The margin of safety is at about 20%

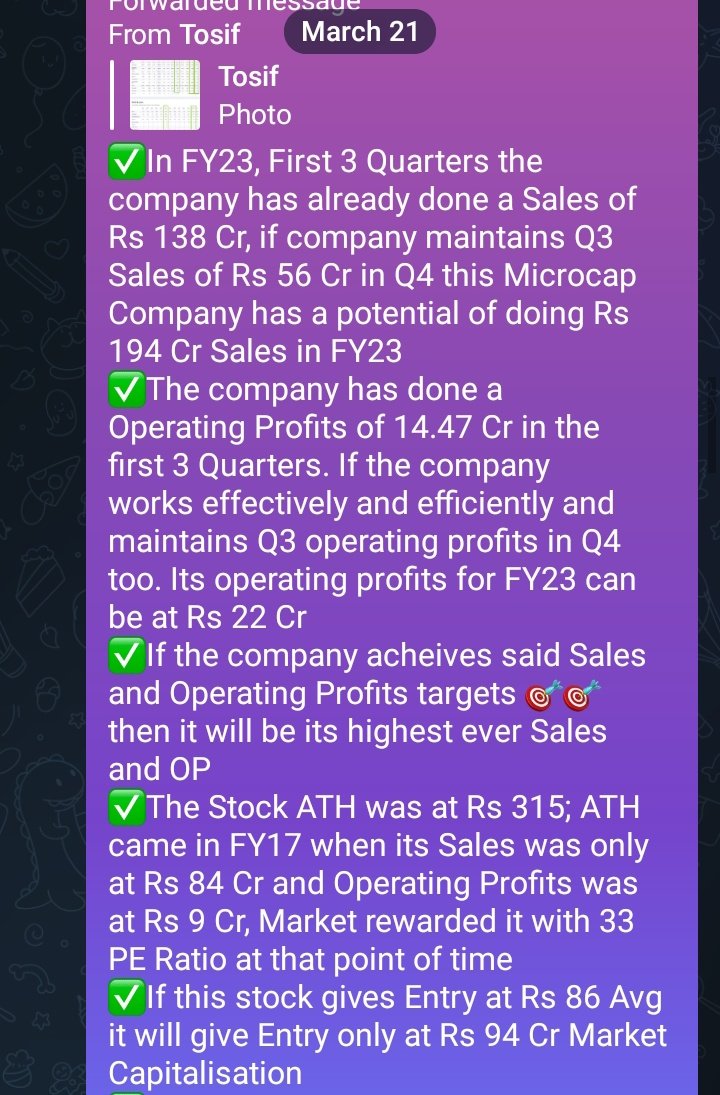

☑️Fundamental Analysis and Valuation♎⚖️

✅TCPL PACKAGING has done a Sales of Rs 1432 Cr in FY23

✅The company has performed exceptionally well its Sales has increased by about 33.07%💹 on YOY Basis from Rs 1076 Cr

✅TCPL PACKAGING has done a Sales of Rs 1432 Cr in FY23

✅The company has performed exceptionally well its Sales has increased by about 33.07%💹 on YOY Basis from Rs 1076 Cr

✅This is highest ever YOY growth in TCPL Revenue since last 11 Years

✅Company's Operating Profits has increased by about 51%💹 on YOY Basis at Rs 236 Cr from Rs 156 Cr

✅The company has maintained a Margin of 16% best Margin after FY17

✅Company's Operating Profits has increased by about 51%💹 on YOY Basis at Rs 236 Cr from Rs 156 Cr

✅The company has maintained a Margin of 16% best Margin after FY17

✅A Company doing Rs 1432 Cr Sales and Operating Profits at Rs 236 Cr, Rs 118 Cr Net Profits, Rs 129 Earnings(EPS) and maintaining 16% Margins looks dirt cheap🐢🐢 at 12.4 PE Ratio and at Rs 1302 Cr Market Capitalisation

✅Its 1 Peer with mere 8% Margins and no decent growth

✅Its 1 Peer with mere 8% Margins and no decent growth

In Sales and Net Profits is trading at 35.2 PE Ratio

✅TCPL is the most undervalued stock from its industry

✅The market has rewarded TCPL PACKAGING with 15.2 PE Ratio in 2023, 18.2, 19.9, 21 PE Ratio in 2022

✅TCPL is now available at a discounted valuation its Market Cap<Sales

✅TCPL is the most undervalued stock from its industry

✅The market has rewarded TCPL PACKAGING with 15.2 PE Ratio in 2023, 18.2, 19.9, 21 PE Ratio in 2022

✅TCPL is now available at a discounted valuation its Market Cap<Sales

✅Even, if market rewards it with its Industry PE it share price can reach at Rs 2050+

✅At the most premium valuations its Share price can reach at Rs 2100/2200(Most Bull 🐂 Case)

✅As per my viewpoints the R:R is favorable as their is a Margin of safety of 20%

✅At the most premium valuations its Share price can reach at Rs 2100/2200(Most Bull 🐂 Case)

✅As per my viewpoints the R:R is favorable as their is a Margin of safety of 20%

Note:-This analysis was only and only done for educational purposes. I'll not be responsible for any profits/loss made.If you make profits you'll not share with me likewise I've no compulsion in case of losses too.I studied this company in details that's why I shared my analysis

Try to Retweet ♻️ this thread 🧵 I've been busy making this thread since 4 PM even after the market hours I didn't slept. This took 6 Hours to be made and the research was almost of weeks.Your 1 Retweet will motivate me to bring more such good Company's for knowledge purposes.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter