Disinflation requires a Recession, but we are not there yet 🧵

1. Economic #cycles generally follow cause-and-effect templates, and this cycle has followed the archetype, albeit with its unique twists.

1. Economic #cycles generally follow cause-and-effect templates, and this cycle has followed the archetype, albeit with its unique twists.

2. As an economic expansion ages, the ability for output to accelerate begins to stall as the economy runs up on capacity constraints in the form of production and labor limitations.

3. However, if nominal growth remains strong relative to debt service burdens, credit and income can support employment and production to remain faster than population growth and production capacity.

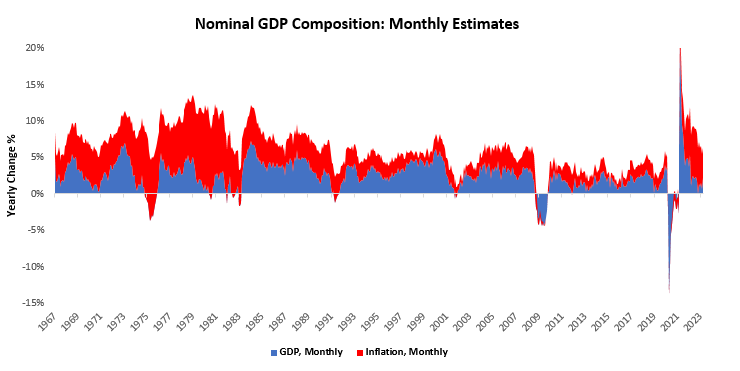

4. The confluence of these factors creates tightness in economic capacity, which fuels inflation. Below, we show periods when these forces have come together to fuel inflation:

5. This tight economic capacity can usually only be loosened through a recession by reducing production, employment, and nominal spending. Below, we show how sustained declines in a combined measure of employment, production, and nominal spending facilitate disinflation:

6. While there are periods when inflation has slowed outside of a recession, the largest decelerations in inflation occur during recessions, i.e., when real economic activity across the economy contracts.

7. This contraction in output brings down spending, which brings nominal spending more in line with the economy's output capacity. Below, we highlight periods where recessionary conditions have facilitated disinflation:

8. Above, we use our estimates of recessionary pressures, which consider changes in real business sales, production, employment, and unemployment, to categorize periods of disinflation

9. This approach is identical to using NBER recession dates but offers the advantage of being available in real-time and avoids the discretion involved in the NBER's recession dating committee. Below, we show the weighted average of these recession indicators:

10. Recessions are a broad-based decline in activity, which include persistent declines in production, real spending, and employment. Therefore, it is not just the magnitude of the decline in the weighted average of these indicators that matters but also the breadth.

11. Today, production and business sales have begun to soften, but labor market data remains robust. Below, we show how the labor market remains extremely tight relative to measures of sustainable unemployment (NAIRU).

12. Additionally, we complement the picture above by highlighting periods when our systems guage that economic conditions were tight. As we can see, unemployment continues to be extremely low.

13. Further, capacity utilization and nominal GDP relative to debt service burdens both remain elevated. As it can be seen below, capacity utilization has slowed modestly; however, they remain supported by extremely high levels of nominal spending.

14. Overall, the constellation of these factors suggest that conditions are still inflationary and with employment gains keeping the consumer resilient, the inflationary pressures remain entrenched.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter