Research service with the goal of democratizing finance. Making institutional-quality insights and research available to the public.

18 subscribers

How to get URL link on X (Twitter) App

2/ The forces behind the reflation—strong households and AI capex—now face a labor-market drag that’s hard to ignore.

2/ The forces behind the reflation—strong households and AI capex—now face a labor-market drag that’s hard to ignore.

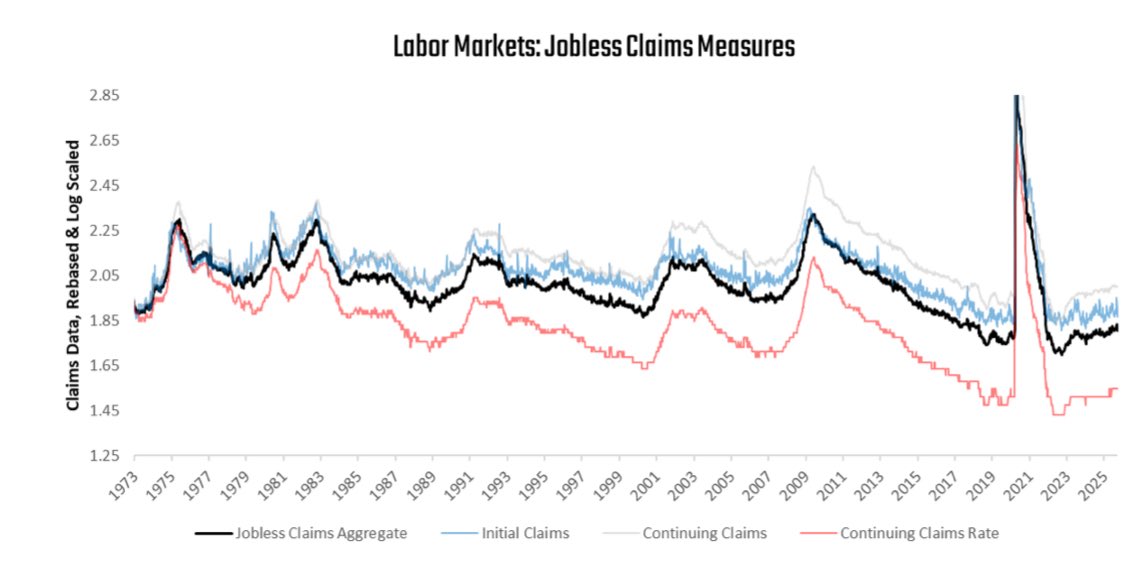

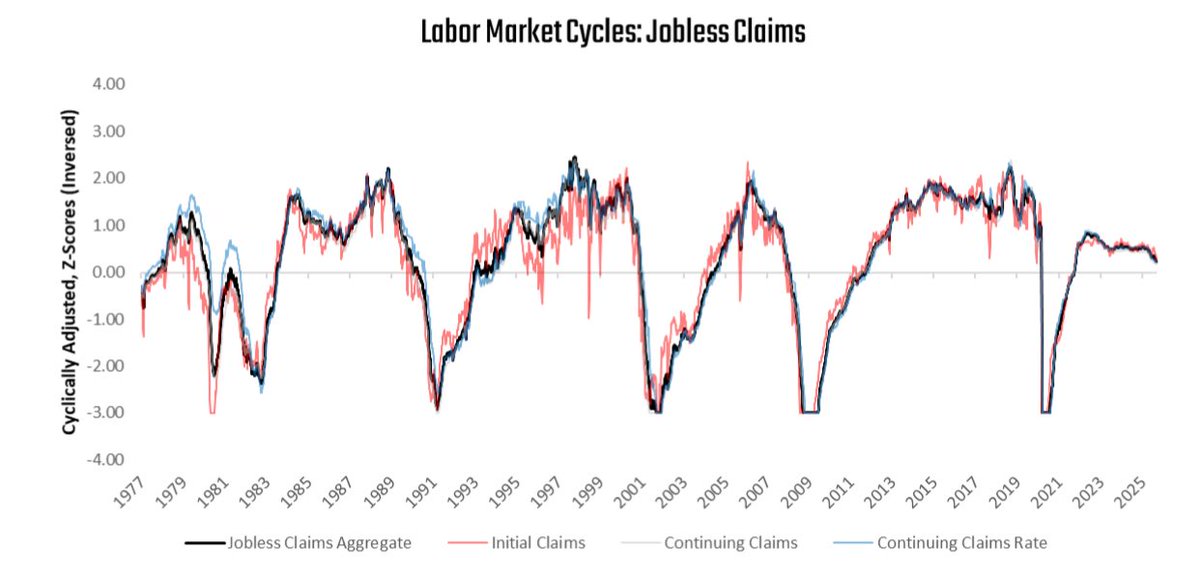

2/ Jobless claims disappointed expectations, but the level of claims remains far from recessionary territory—slowing, not contracting.

2/ Jobless claims disappointed expectations, but the level of claims remains far from recessionary territory—slowing, not contracting.

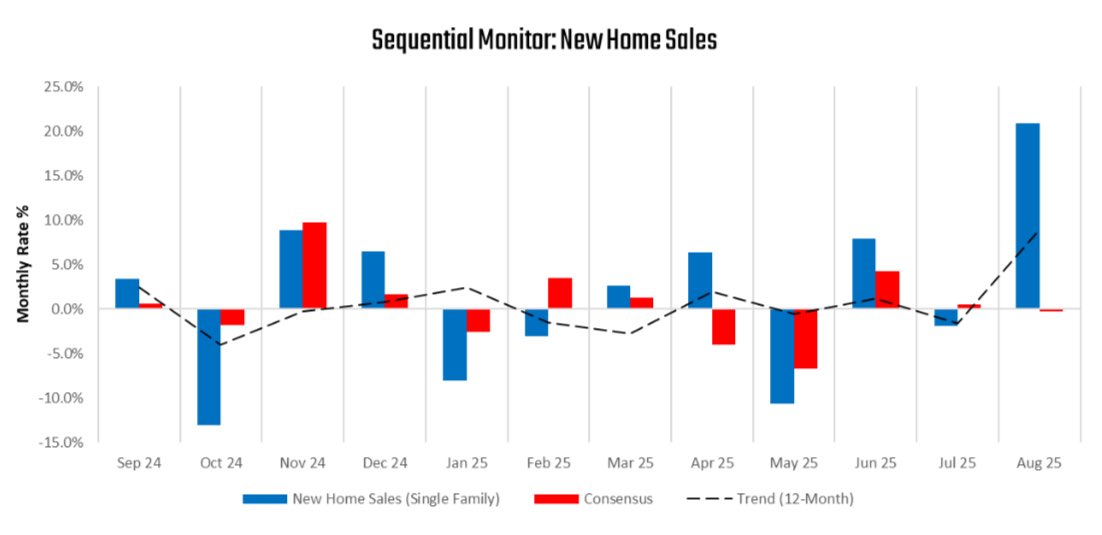

2/ New home sales surged +20.9% in August (vs –0.3% expected). Y/y single-family sales ~+3.2%. Big print; high volatility.

2/ New home sales surged +20.9% in August (vs –0.3% expected). Y/y single-family sales ~+3.2%. Big print; high volatility.

2/ Construction is rolling over.

2/ Construction is rolling over.

2/ For a variety of reasons, many investors want to maintain passive exposure to the S&P 500. But the stock market can go through periods of very weak performance.

2/ For a variety of reasons, many investors want to maintain passive exposure to the S&P 500. But the stock market can go through periods of very weak performance.

2/ Most investors are seeking to either match S&P 500 returns or outpace them over the long term. Regardless of whether investors seek to match our outperform equity returns, most investors seek higher risk-adjusted returns than simply holding market beta...

2/ Most investors are seeking to either match S&P 500 returns or outpace them over the long term. Regardless of whether investors seek to match our outperform equity returns, most investors seek higher risk-adjusted returns than simply holding market beta...

2/

2/

2/5 Using a blend of fundamental & market data, we can try to estimate which of four regimes we can be in:

2/5 Using a blend of fundamental & market data, we can try to estimate which of four regimes we can be in:

2/ Prometheus ETF Portfolio aims to allow everyday investors to access an investment solution that combines active macro alpha, passive beta, and strict risk control, all in an easy-to-follow, low-turnover solution. Thus far, we have been successful in generating these outcomes.

2/ Prometheus ETF Portfolio aims to allow everyday investors to access an investment solution that combines active macro alpha, passive beta, and strict risk control, all in an easy-to-follow, low-turnover solution. Thus far, we have been successful in generating these outcomes.

2/Employment & output are at odds. To understand what’s driving the gap between them, we examine each individually. We then reconstruct the gaps between spending & employment for major industries, allowing us to assess 1) what’s driving divergence, & 2) its sustainability

2/Employment & output are at odds. To understand what’s driving the gap between them, we examine each individually. We then reconstruct the gaps between spending & employment for major industries, allowing us to assess 1) what’s driving divergence, & 2) its sustainability

2/20 Like economic growth, inflation represents a mechanical framework that has more power than any specific definition.

2/20 Like economic growth, inflation represents a mechanical framework that has more power than any specific definition.

2/ The exact measure & definition of growth are less important than conceptually understanding why growth matters to macro assets, i.e., stocks, bonds, commodities, constantly experience price changes to reflect ongoing shifts ..

2/ The exact measure & definition of growth are less important than conceptually understanding why growth matters to macro assets, i.e., stocks, bonds, commodities, constantly experience price changes to reflect ongoing shifts ..

2/ Let's start with GDP numbers. Our current GDP Nowcast currently shows a nominal GDP of about 5.3%, while real GDP accounts for about 2.5%. Not close to recessionary.

2/ Let's start with GDP numbers. Our current GDP Nowcast currently shows a nominal GDP of about 5.3%, while real GDP accounts for about 2.5%. Not close to recessionary.

2/ The labor market is dominant in driving variation in overall economic activity. While business cycle pressures may originate in other areas of the economy, the labor market is the ultimate transmission mechanism for cyclical conditions to aggregate spending and income...

2/ The labor market is dominant in driving variation in overall economic activity. While business cycle pressures may originate in other areas of the economy, the labor market is the ultimate transmission mechanism for cyclical conditions to aggregate spending and income...

2/4 However, upon zooming in we observe that most of this acceleration is attributable to current inventory dynamics which are volatile and not durable.

2/4 However, upon zooming in we observe that most of this acceleration is attributable to current inventory dynamics which are volatile and not durable.

2/6 Over the last week, macro market rose in aggregate. Equities and gold rose significantly, bonds were modestly positive, and commodities fell significantly.

2/6 Over the last week, macro market rose in aggregate. Equities and gold rose significantly, bonds were modestly positive, and commodities fell significantly.

2. Prometheus Asset Allocation:

2. Prometheus Asset Allocation: