🇦🇴 #Angola's economy has been heavily dependent on oil exports, the primary source of its forex.

There's a need for economic diversification and it remains muted; however, we see some green shoots, exports rising

Follow the thread🧵 #AngolanEconomy

(+)

There's a need for economic diversification and it remains muted; however, we see some green shoots, exports rising

Follow the thread🧵 #AngolanEconomy

(+)

According to the Harvard Growth Lab Atlas of Economic Complexity, Angola's exports indicated the lowest ranking in the World in 2020.

Exports are 99% crude, refined oil, LNG, and diamonds.

(+)

Exports are 99% crude, refined oil, LNG, and diamonds.

(+)

👀Looking at tax authority data up to April 2023, we look at what non-oil exports are beginning to appear in statistics.

Legacy non-oil exports include wood, shrimp and cement.

Except for wood, no sustainable growth there.

(+)

Legacy non-oil exports include wood, shrimp and cement.

Except for wood, no sustainable growth there.

(+)

🌾🍌🥦The agriculture sector shows great promise.

Banana exports begun in 2019 & visibly growing

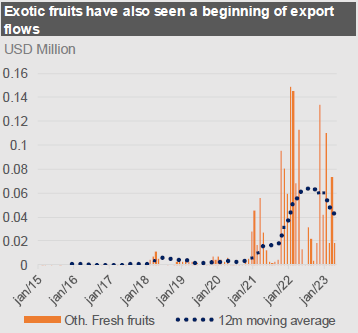

Exotic fruits also with beginning exports flows

Papaya still below USD 100k but growing fast

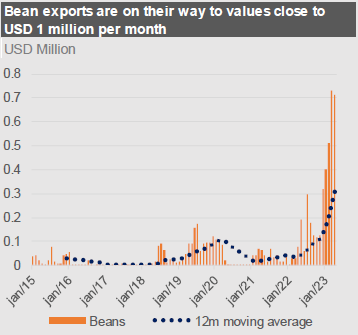

Bean exports on their way to values close to USD 1 million per month

(+)

Banana exports begun in 2019 & visibly growing

Exotic fruits also with beginning exports flows

Papaya still below USD 100k but growing fast

Bean exports on their way to values close to USD 1 million per month

(+)

🍝The development of Agriculture in recent years has given rise to a small food processing industry.

🍞Wheat derivates are testimony to a nascent industry.

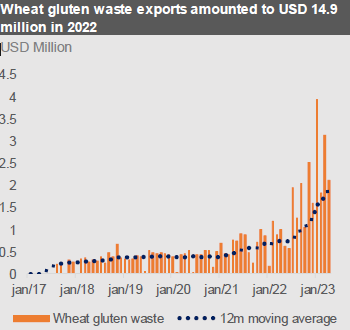

Who knew gluten waste was exported? even more valuable than flour exports these days, at least in the case of Angola.

(+)

🍞Wheat derivates are testimony to a nascent industry.

Who knew gluten waste was exported? even more valuable than flour exports these days, at least in the case of Angola.

(+)

🍾Beverage exports on the whole are not rising, but whiskey is!

🍝Cooked pasta is another example of those non-existing exports that might come to exist.

(+)

🍝Cooked pasta is another example of those non-existing exports that might come to exist.

(+)

And where is it all going?

Wheat flour & whiskey for the DRC🇨🇩

Wheat gluten waste all around🌍

Cooked pasta to both Congos and other African countries 🇨🇩🇨🇬

(+)

Wheat flour & whiskey for the DRC🇨🇩

Wheat gluten waste all around🌍

Cooked pasta to both Congos and other African countries 🇨🇩🇨🇬

(+)

🏭Non-agriculture-linked industry also show limited progress:

🍶Glass bottle exports are shooting up in the last 2 years

🧱Ceramic tiles also rising a lot since mid-2021

And also aluminum and aluminum articles seem to be recovering from pandemic stop to exports

(+)

🍶Glass bottle exports are shooting up in the last 2 years

🧱Ceramic tiles also rising a lot since mid-2021

And also aluminum and aluminum articles seem to be recovering from pandemic stop to exports

(+)

Where to?

Glass bottles to SA, Namibia, and other African economies🇿🇦🇳🇦

Ceramic to both Congos🇨🇩🇨🇬

Aluminum to UAE and all around🇦🇪🌍

(+)

Glass bottles to SA, Namibia, and other African economies🇿🇦🇳🇦

Ceramic to both Congos🇨🇩🇨🇬

Aluminum to UAE and all around🇦🇪🌍

(+)

⛏Finally mining, a sector that could prove to be fundamental in the near term:

🔩Iron & steel with sustainable export growth for last 3 yrs

Granite blocks with peaks in 2022

A recent new export: alabaster

🧂And some peaks hinting at possible growth of salt exports

(+)

🔩Iron & steel with sustainable export growth for last 3 yrs

Granite blocks with peaks in 2022

A recent new export: alabaster

🧂And some peaks hinting at possible growth of salt exports

(+)

And where are these exports to?

Iron & Steel to teh DRC and Ghana🇨🇩🇬🇭

Granite to China, Spain, others 🇨🇳🇪🇸

Alabaster to China🇨🇳

Salt to Namibia & DRC🇳🇦🇨🇩

(+)

Iron & Steel to teh DRC and Ghana🇨🇩🇬🇭

Granite to China, Spain, others 🇨🇳🇪🇸

Alabaster to China🇨🇳

Salt to Namibia & DRC🇳🇦🇨🇩

(+)

2 conclusions from this:

1. 🇨🇩 DRC economy growing is key for future of Angolan economy...!

2. The diversification of exports is still a work in progress. If these sectors continue to grow and are joined by others

(+)

1. 🇨🇩 DRC economy growing is key for future of Angolan economy...!

2. The diversification of exports is still a work in progress. If these sectors continue to grow and are joined by others

(+)

the diversification of exports can truly take place.

Key to this is maintaining exchange rate reform, ensuring a competitive environment, and creating a better business environment.

Much easier said than done.

Key to this is maintaining exchange rate reform, ensuring a competitive environment, and creating a better business environment.

Much easier said than done.

• • •

Missing some Tweet in this thread? You can try to

force a refresh