Did volatility go up or down today? 101. Easy question? Not really. I will keep it as simple as possible. There are many great vol guys to give a better answer on here, But here goes. The symbol most use for vol is $VIX

Don't use $VIX. Never use VIX. It is not tradable and on Friday's it is always pressed down more than it "should" be and always pressed up more than it "should" be on Monday. Use front month VIX Futures. This sub thread explains it.

https://twitter.com/dampedspring/status/1457775232140206091

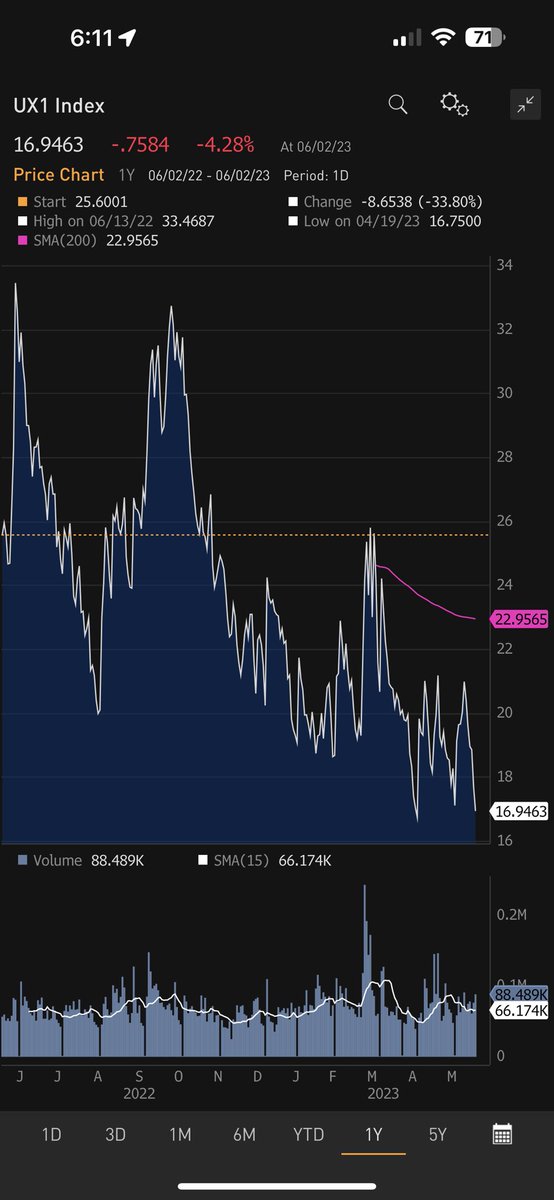

Okay so use VIX futures. Let's use the most liquid front month symbol $VXMM23 Bloomberg code UX1. It fell too but hasn't yet made a new low.

So we're done right. VIX Futures fell vol was down today. Not so fast. Whenever the market rises VIX and VIX futures fall with high correlation of 72%

Why is that? Well you might think it's because in a rally people sell their hedges and markets are more confident and all sorts of other fundamental reasons. But mostly it's just mechanical. Stay with me because this is where the math comes in.

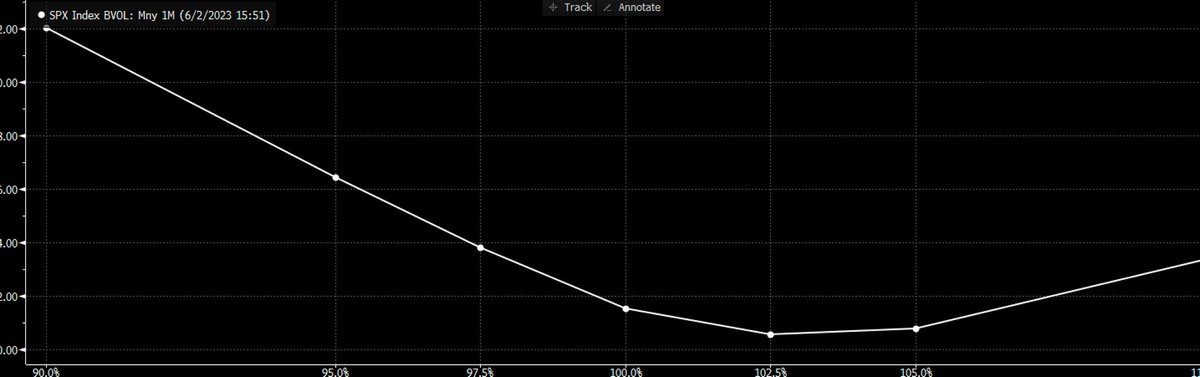

**Let's start by looking at the implied volatility of options with strikes ranging from 90% of Spot to 110%. Notice how the IV drops from the left to the middle bottoms around 102.5% and starts going up as you go right. This is an example of skew called a Smirk 😏 vs one you see

In other markets called a smile 😀 Risky assets tend to have a smirk. Anyway enough about emojis. Let's put a particular strike on a couple. Let's say the IV of 99 strike is 16 the IV of the 100% strike is 15.5 and the 101 is 15.

Now let's not use percentages and instead use actual strikes. The 4240 strike is the 99

4280 is the 100

4320 is the 101. Jeez we are close to the JHEQX collar. Anyhow. Let's assume the market rallied from 4240 to 4280 today.

4280 is the 100

4320 is the 101. Jeez we are close to the JHEQX collar. Anyhow. Let's assume the market rallied from 4240 to 4280 today.

What does VIX measure roughly. It measures the 100% strike IV.

Now let's think about market participants who traded the 4240 put which yesterday was at 16 IV. There was a buyer and a seller at the IV for that option. Similarly there was a buyer and seller of the 4280 at 15.5

Now let's think about market participants who traded the 4240 put which yesterday was at 16 IV. There was a buyer and a seller at the IV for that option. Similarly there was a buyer and seller of the 4280 at 15.5

Both sides of each strike have no particular reason to change their view on IV of the option they bought just because the market moved a paltry 1%. So the 4240 strike IV stays at 16 and the 4280 stays at 15.5. BUT wait the vix changed its reference strike from 4240 to 4280

It reports the ATM vol fell 50bp. But no actual options IV changed at all!!! All that happened is the reference atm vol rolled higher. The slope of that graph above is literally the mechanical reason that VIX Fell and the correlation between VIX and SPX is so strongly negative.

See. Just because VIX (or vix futures for that matter) fell does not mean vol fell.

Okay go back up to the ** tweet and do loop until you understand.

Okay you understand and are out of the infinite loop. Time to label this. It's called sticky strike vol. when you measure vol

Okay go back up to the ** tweet and do loop until you understand.

Okay you understand and are out of the infinite loop. Time to label this. It's called sticky strike vol. when you measure vol

Based on moneyness like 100% moneyness that VIX has you miss the skew effect. But you do get information to. For instance if a market moves up and VIX (Sticky moneyness) doesn't fall that's a big deal because it means vol has actually risen on specific strike options and

Market participants are making and losing money on vol. What happened in the last day to stick moneyness vol. The red line is yesterday the white is today. Looks like stick strike dominated and vol was essential mechanical lower for ATM

Of course it's way more complicated and the best participants keep strike IV changes to see if vol is rising or falling. But you at home can plot this very roughly. The correlation of VIX to SPX changes is 72%.

Regressing VIX changes to SPX changes with a long history gives a coefficient of -4.6. That means a 1% change in SPX price roughly means a -4.6% change in VIX level. Now that coefficient depends on the skew today. A better way would be to look at the vol of the 99/101

And you can tell what VIX should read if we move up or down 1% the after the day is over you can see if the vix was up or down after correcting for rolling up or down the skew.

Then and only then can you come close to answering the question. FWIW vol was up today!

Then and only then can you come close to answering the question. FWIW vol was up today!

When my friends @Jimmyjude13 or @jam_croissant talk about market up vol up and you see vix down now you know what they are talking about.

BTW the correlation of Weekly and Monthly Vix Changes vs SPX changes is 70 and 69 respectively

This is partly just the simple fact that smirk is consistently part of options pricing. Do people who buy Vix Options know this?🤔

This is partly just the simple fact that smirk is consistently part of options pricing. Do people who buy Vix Options know this?🤔

• • •

Missing some Tweet in this thread? You can try to

force a refresh