https://t.co/SgaSuGdrox macro & beta @2Graybeards for beta. Both for investor education, Brevan Howard, Bridgewater, Salomon, Dad of 4. Go Penn, No tweet is advice

85 subscribers

How to get URL link on X (Twitter) App

Note yields are driven lower by

Note yields are driven lower by

https://twitter.com/lukegromen/status/1978250481941037223The Fed bears only partial responsibility to the muting of QT. QT impact is two fold reducing reserves HAS occurred. Though not much and mostly just reduced pseudo reserves in the form or RRP reduction to zero.

TFF is moderately more useful because the cohorts are more sensible.

TFF is moderately more useful because the cohorts are more sensible.

The 1940 example rings true to me as "the customers" are convinced that the services provided by "the brokers" will let the customers beat their competitors. "Keeping up with the Jones" has motivated Americans as long as I can remember. Brokers tapped that competitive spirit

The 1940 example rings true to me as "the customers" are convinced that the services provided by "the brokers" will let the customers beat their competitors. "Keeping up with the Jones" has motivated Americans as long as I can remember. Brokers tapped that competitive spirit

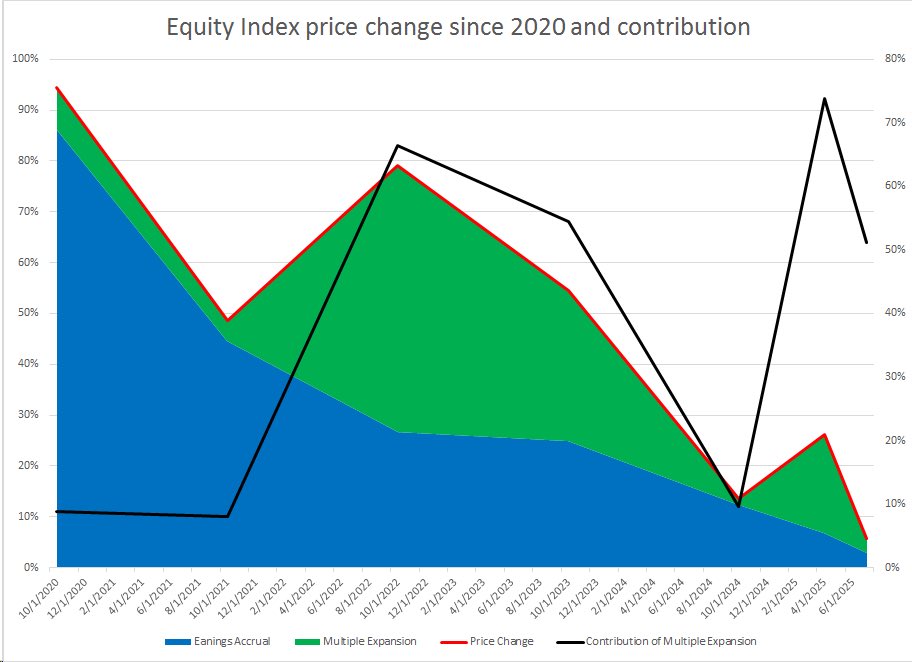

Here is his write up and some helpful charts

Here is his write up and some helpful charts