Just a REMINDER 🧵 on this beautiful weekend…

$gTii is an OTC company holding a TRAPPED ‘someone’, deep in the red. And the only way out is to buy back all the #counterfeits they’ve created & sold.

So when, IF it goes… no DARKPOOLS and ‘Options’ to manipulate the share price.

$gTii is an OTC company holding a TRAPPED ‘someone’, deep in the red. And the only way out is to buy back all the #counterfeits they’ve created & sold.

So when, IF it goes… no DARKPOOLS and ‘Options’ to manipulate the share price.

There’s multiple recorded phone calls of independent “brokers” recently calling large-block holders offering to “purchase” shares of a shitty revenue-less company, because they care & want to save YOU in the long run. Good folks want to relieve you of your $gTii “bags”. How nice.

The original Toxic Lender, let’s call him “Charlie”, left a voicemail asking to “work some numbers” illegally in the backroom, to buy back millions of shares HE SHORTED, which were NEVER on the books as FTD’s. But YOU’RE CRAZY to believe there’s an actual short problem in $gTii.

WHY would the SEC DENY a #SHIB #DigitalDividend $gTii wanted to ‘gift’ to LOYAL shareholders… unless they KNEW there was no way to deliver it and Pandora’s Box would split open wider than an 18yr old Jenna Jameson on Prom night.

Didn’t your Broker tell you they would REFUSE to accept your warrants back from $gTii Transfer Agent, once they finally hit in the $2.75 money?

Mine DID, and I know quite a few people who experienced that SAME EXACT issue.

Again… WHY refuse a company gift UNLESS a real problem?

Mine DID, and I know quite a few people who experienced that SAME EXACT issue.

Again… WHY refuse a company gift UNLESS a real problem?

What’s up with that $gTii Officer Kathy Griffin filing a Form 4 in December, 6 months ago, totaling around $11 MILLION of purchased stock, if she didn’t intend for the company to GROW significantly, prob thanks to some major acquisition?

And lastly, why do SO MANY Twitter folks GIVE TWO SH!TS about your $gTii investments, and whether or not you get scammed by a ShitCo who can’t produce a solid business foundation?

UNLESS they have a vested interest to get you to sell?

ALOT of Capt. Sav-A-Ho’s out here recently.

UNLESS they have a vested interest to get you to sell?

ALOT of Capt. Sav-A-Ho’s out here recently.

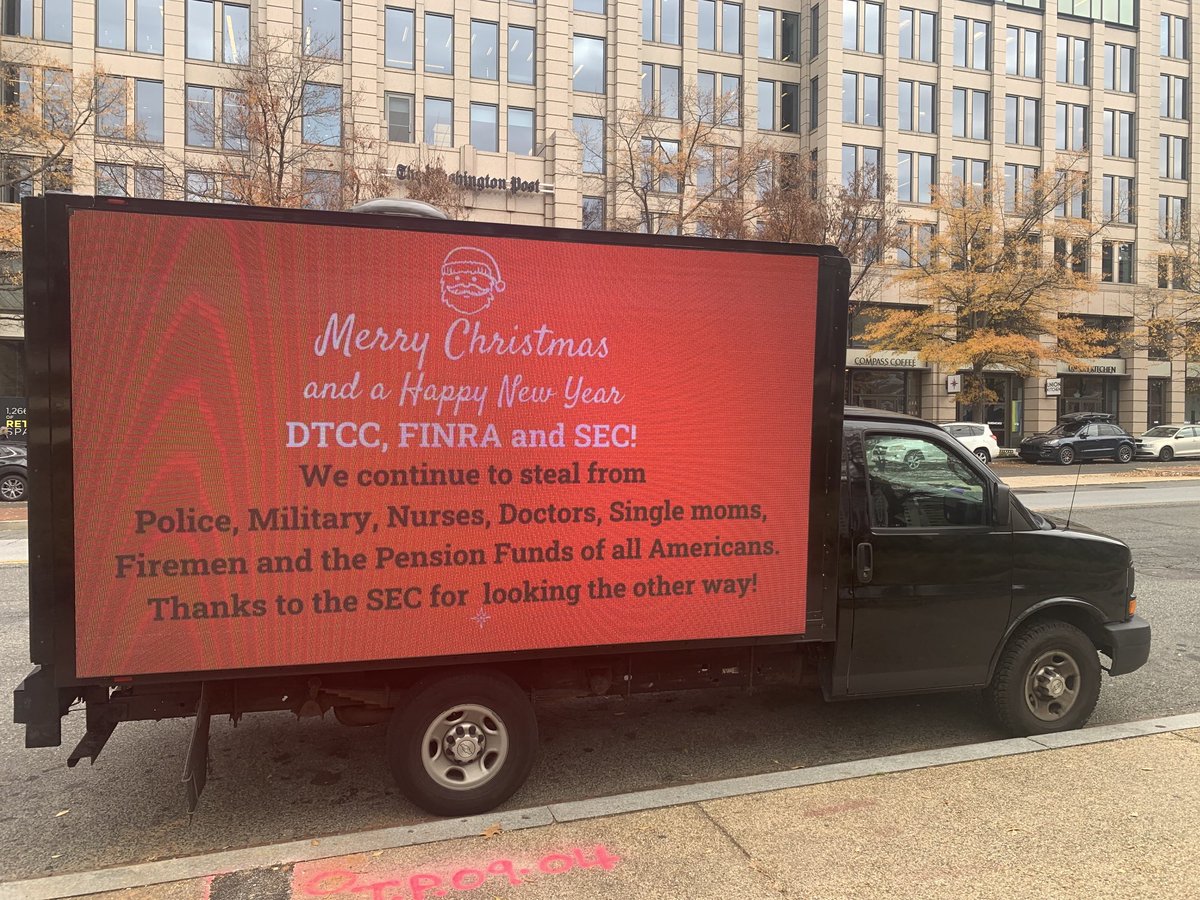

$gTii struggles to build an actual business since the VERY 1ST TIME they went public regarding the #nakedshorting of their company stock, way back in 2011. These crimes are NO DOUBT a major contributor to WHY they’ve been unable to grow and prosper.

Enter @JWesChristian. Explain logically, why on gods green earth would $gTii go and spend the $3million secured from shareholders exercising ‘warrants’, on a seemingly unwinnable lawsuit… UNLESS they believed to have a SOLID CASE & EVIDENCE of #nakedshorts?

Oh… and then there’s Alpine, the Prime allegedly responsible for clearing a good majority of OTC #counterfeits, soon to be forced out of the Industry FOREVER, the major catalyst being a ‘Concentrated Short position in $gTii ‘.

I’ll remain LONG & see this thru to the end. GL!

I’ll remain LONG & see this thru to the end. GL!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter