Shree Ganesha remedies

#SGRL

MKT CAP - 450 CR

PRICE -360( 4/6/23)

Promoter 63% - 69% (strong idea of generation)

P/E- 26 fairly valued

ROCE - 25%

ROE- 22%

PEG - 0.90

ALMOST DEBT FREE.

Betting on promoter 80% & 20% with good OPM % .🧵

#SGRL

MKT CAP - 450 CR

PRICE -360( 4/6/23)

Promoter 63% - 69% (strong idea of generation)

P/E- 26 fairly valued

ROCE - 25%

ROE- 22%

PEG - 0.90

ALMOST DEBT FREE.

Betting on promoter 80% & 20% with good OPM % .🧵

1/n

SGRL is engaged in the business of Pharma Intermediate.

In July 2021, SGRL successfully commenced the commercial production of a newly developed Cyclo-Propyl derivative. This is used in drugs like Naltrexone google.com/url?sa=t&sourc…. & Buprenorphine ncbi.nlm.nih.gov/books/NBK45912…

SGRL is engaged in the business of Pharma Intermediate.

In July 2021, SGRL successfully commenced the commercial production of a newly developed Cyclo-Propyl derivative. This is used in drugs like Naltrexone google.com/url?sa=t&sourc…. & Buprenorphine ncbi.nlm.nih.gov/books/NBK45912…

2/n

Both drugs are used as medication used to manage alcohol and opioid use disorder by reducing cravings and easing the pain. This Cyclo-Propyl derivative is mainly being imported into India.

Both drugs are used as medication used to manage alcohol and opioid use disorder by reducing cravings and easing the pain. This Cyclo-Propyl derivative is mainly being imported into India.

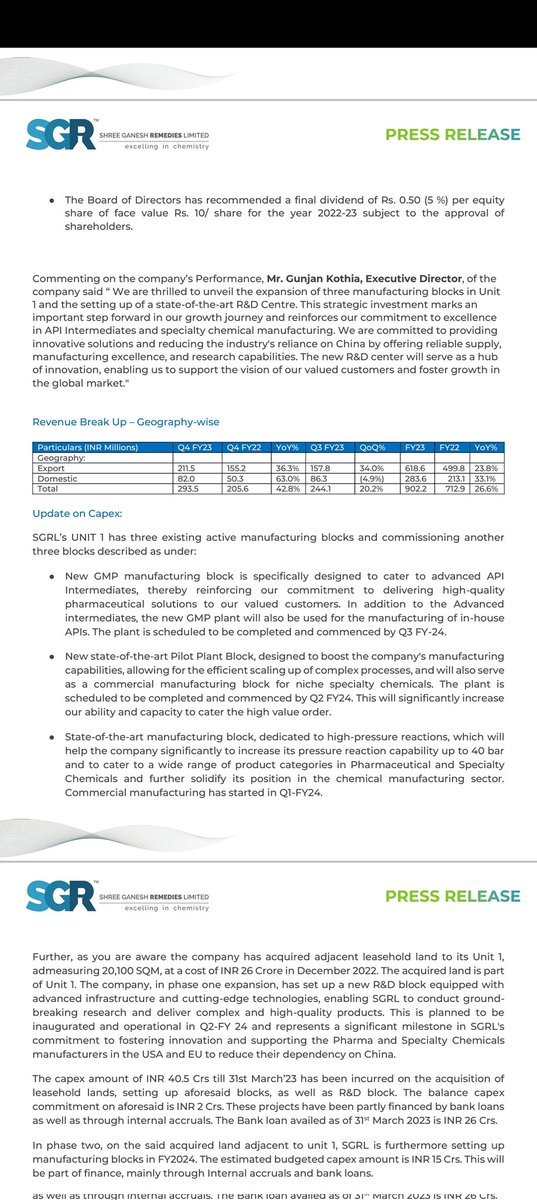

3/n SGRL succesfuly commision new Plant in 21 at Ankleshwar,with install production capacity of 54 kL for its existing products, funded entirely thru internal accruals,focused on value added products, any threats to margins due to increase supply & raw material cost inflatiIon

4/n

Exports accounted for ~80% of FY20 sales.SGRL exports Drug Intermediates & Pharmaceuticals to more than 30 countries & is focused on growing export

SGRL acquired Ashok Pharma Chem, an API mfg & leader in Di Nitro Ortho Tolumide Bp Vet. SGRL is part of Ganesh Grp Of Ind.

Exports accounted for ~80% of FY20 sales.SGRL exports Drug Intermediates & Pharmaceuticals to more than 30 countries & is focused on growing export

SGRL acquired Ashok Pharma Chem, an API mfg & leader in Di Nitro Ortho Tolumide Bp Vet. SGRL is part of Ganesh Grp Of Ind.

5/n

Wide Product Range

Company mfg products relating to antipsychotic,antiseptic, deprotonation reactions, hyperlipidemia, alzheimers & anti-viral.

Experienced Promoters

Promoters have experience of about 2 decades in pharmaceutical industry.

Most of note ready on screener

Wide Product Range

Company mfg products relating to antipsychotic,antiseptic, deprotonation reactions, hyperlipidemia, alzheimers & anti-viral.

Experienced Promoters

Promoters have experience of about 2 decades in pharmaceutical industry.

Most of note ready on screener

6/n

SGRL has extensive portfolio of 39 products of drug intermediate & 18 speciality chemicals products, with an operational areaof over 1,90,000 sq foot , we also have technology advance modern pilot plant backed by strong research and analytics facilities

SGRL has extensive portfolio of 39 products of drug intermediate & 18 speciality chemicals products, with an operational areaof over 1,90,000 sq foot , we also have technology advance modern pilot plant backed by strong research and analytics facilities

7/n

SGRL is spread over 15 country,covering a good number of customers &strategic mkt alliance

Our mfg focus

✨API intermediate for human & veterinary life sciences

✨ Speciality chemicals for aroma & Pharma industry

✨Fine chemicals for agro & polymer industry

SGRL is spread over 15 country,covering a good number of customers &strategic mkt alliance

Our mfg focus

✨API intermediate for human & veterinary life sciences

✨ Speciality chemicals for aroma & Pharma industry

✨Fine chemicals for agro & polymer industry

8/n

✨ 4 products with 50% or more mkt share

✨Clientele spead over 15 country

Strong export performance

✨ 3.4 % avg annual R& D SPEND

tradeindia.com/products/dinit…

✨ 4 products with 50% or more mkt share

✨Clientele spead over 15 country

Strong export performance

✨ 3.4 % avg annual R& D SPEND

tradeindia.com/products/dinit…

13/n

Lots of Greenfield expansion is there , prmoters is very smart and ethical, believing in long-term relationship with profit, this more on betting on promoter with good margin in biz , own conviction of ground research may be biased.

Lots of Greenfield expansion is there , prmoters is very smart and ethical, believing in long-term relationship with profit, this more on betting on promoter with good margin in biz , own conviction of ground research may be biased.

14/n

Concern

✨Inventory days

✨China dumping

✨Any changes in relationship with company

✨In Future pricing power

Concern

✨Inventory days

✨China dumping

✨Any changes in relationship with company

✨In Future pricing power

15/n

Source

Screener

AR.

Not sebi registered

Pls consult your financial advisor.

Disc invested no reco .

This is my first company with own conviction, scuttlebutt & less tracking 🙏🧵

Source

Screener

AR.

Not sebi registered

Pls consult your financial advisor.

Disc invested no reco .

This is my first company with own conviction, scuttlebutt & less tracking 🙏🧵

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter