The '2nd-anniversary' special edition of #DSPNetra is out now!🤩

It helps you keep track of the latest economic trends & gives you the insights that matter.📊

Follow the thread🧵below or download dspim.co/NetJun23

It helps you keep track of the latest economic trends & gives you the insights that matter.📊

Follow the thread🧵below or download dspim.co/NetJun23

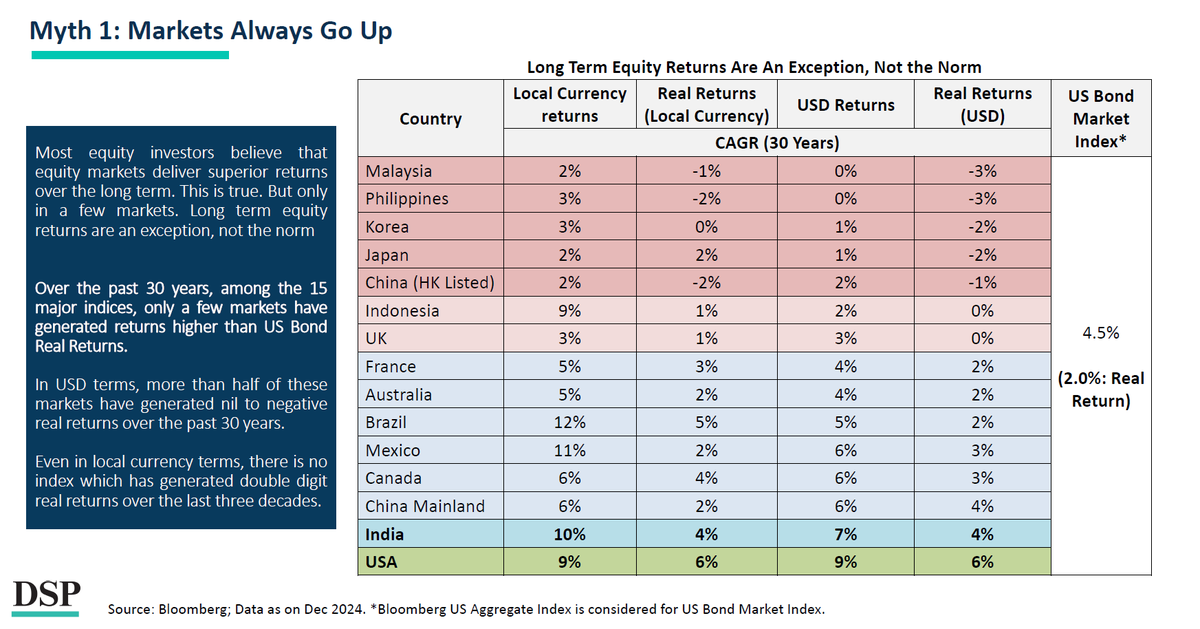

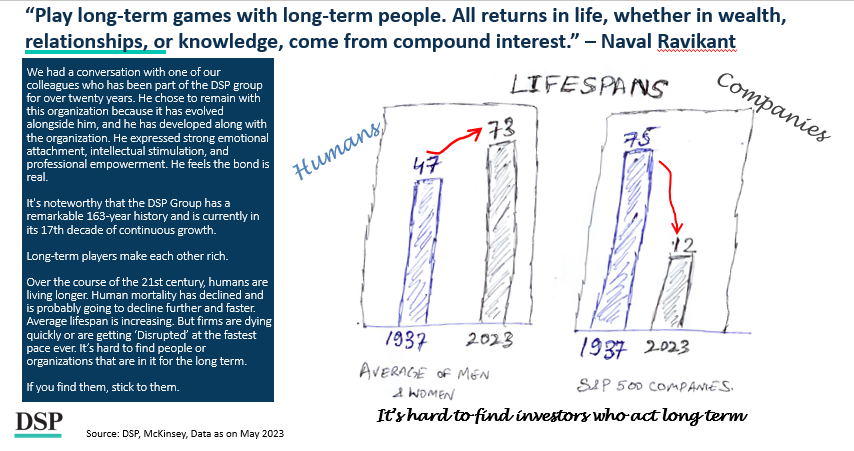

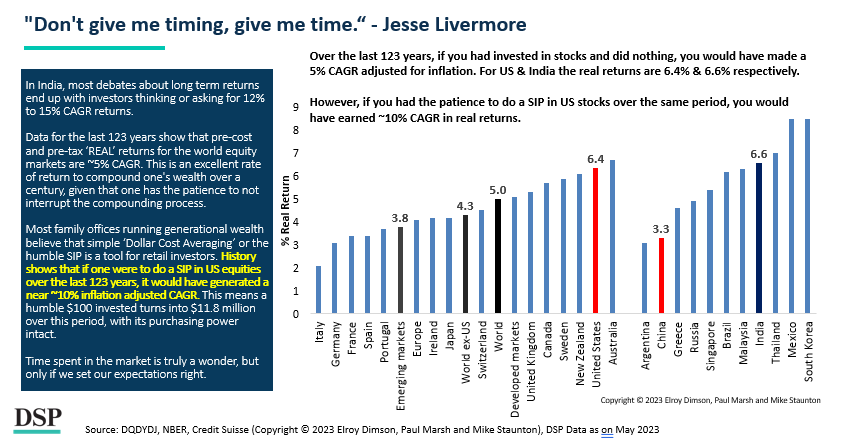

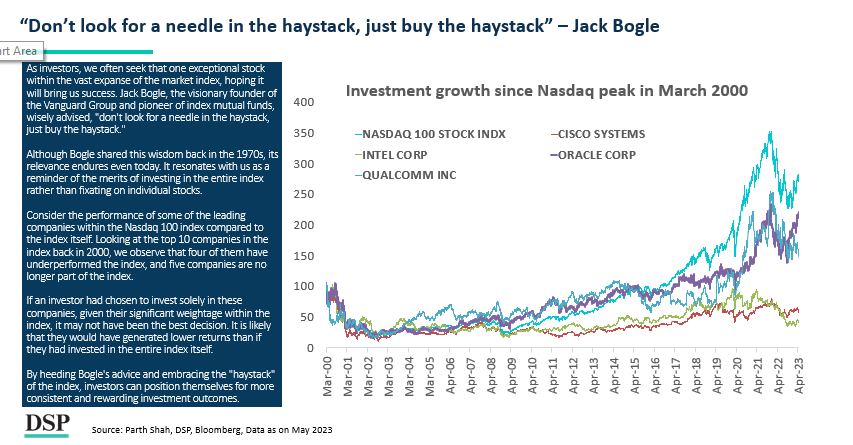

The relentless speed of modern life impedes our ability to act with a long-term perspective. However, those who can consciously prioritize long-term thinking and identify enduring people, organizations, and investments gain a distinct advantage.

Download: dspim.co/NetJun23

Download: dspim.co/NetJun23

Have you ever wondered, adjusted for inflation, at what rate has investments grown since the year 1900? What is the real rate that Mr. Market has offered?

Download: dspim.co/NetJun23

Download: dspim.co/NetJun23

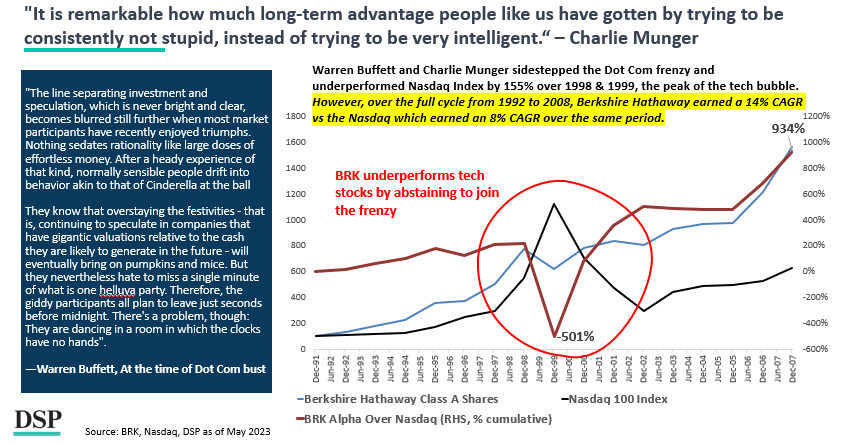

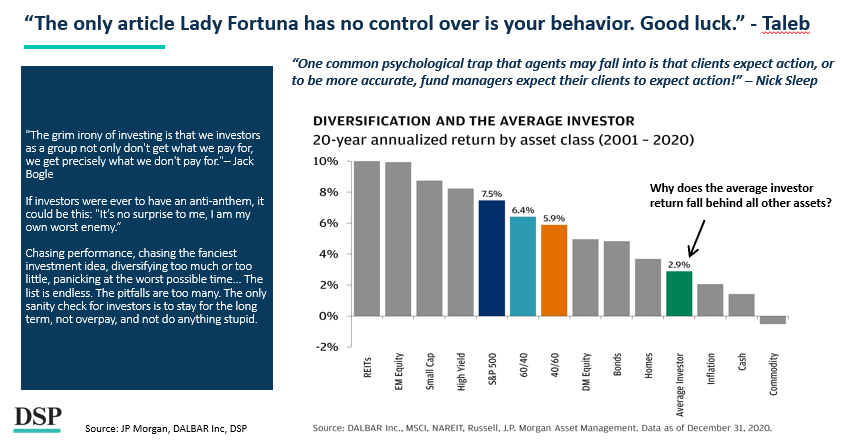

The magnitude of improvement in our long-term outcomes is astonishing simply by avoiding acts of stupidity.

Download: dspim.co/NetJun23

Download: dspim.co/NetJun23

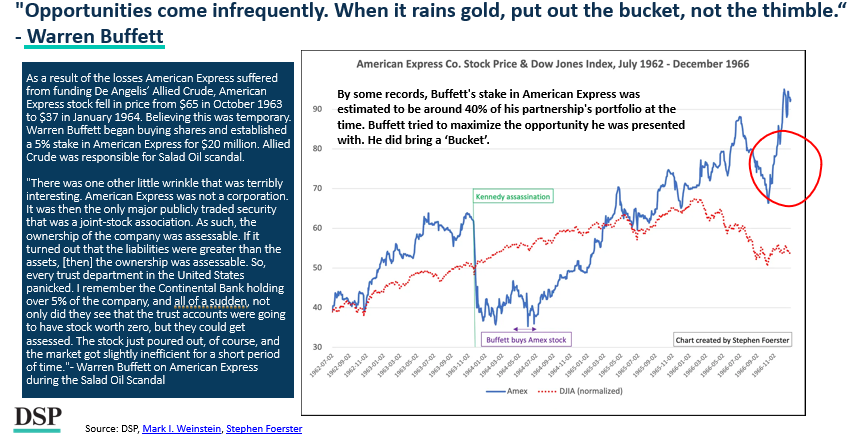

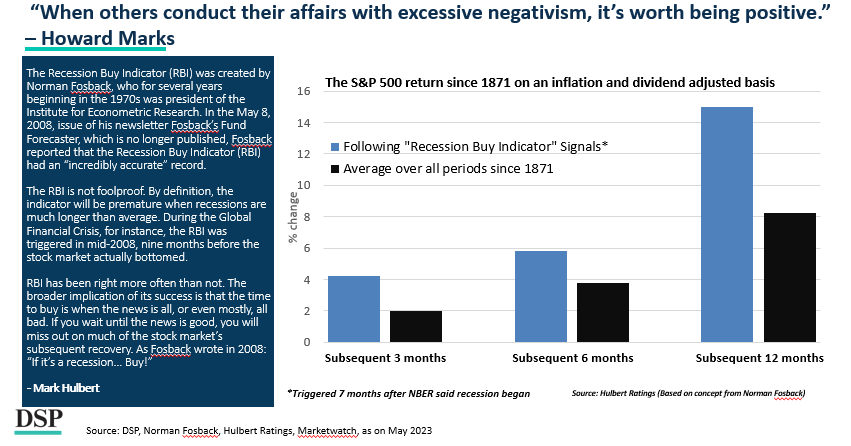

What do you do when the opportunity knocks on your door? Are you prepared to act or are numb because of the unknown?

Download: dspim.co/NetJun23

Download: dspim.co/NetJun23

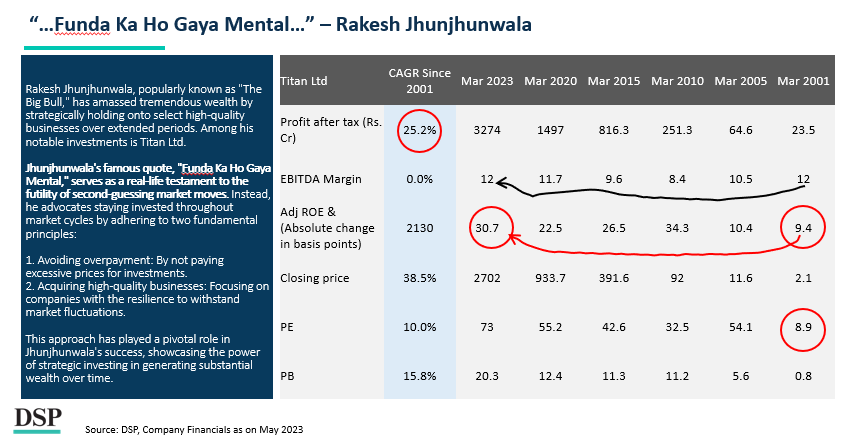

What’s the ‘Big Bull’ recipe for investing success? Stick around, if you have got it right.

Download: dspim.co/NetJun23

Download: dspim.co/NetJun23

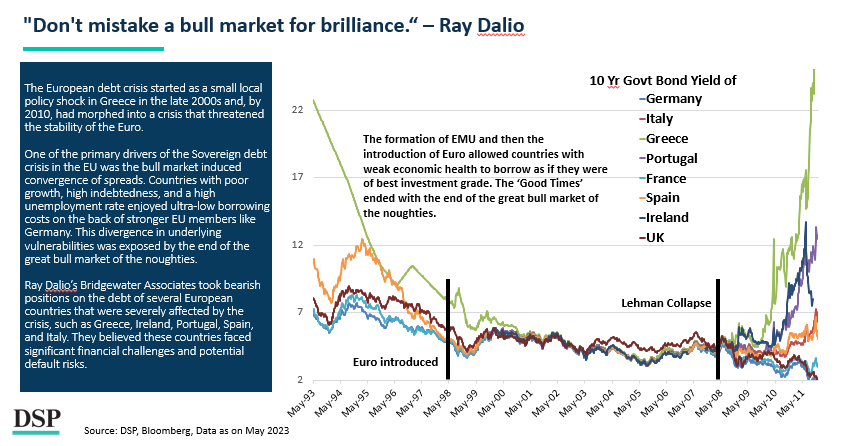

Each winning investment inflates our ego & creates the possibility of the next investment going sour. The best start to investing happens during a bear market. Learn the right lessons and avoid mistaking market returns for investor intelligence.

Download: dspim.co/NetJun23

Download: dspim.co/NetJun23

Contrarianism in action is hard. When done with sound principles and a process, the rewards are disproportionately high.

Download: dspim.co/NetJun23

Download: dspim.co/NetJun23

Your investment returns are more a function of how you behave rather than how the market behaves. ‘Know thyself’.

Download: dspim.co/NetJun23

Download: dspim.co/NetJun23

Simplicity over complexity. Structure over activity. Consistency over intensity.

Download: dspim.co/NetJun23

Download: dspim.co/NetJun23

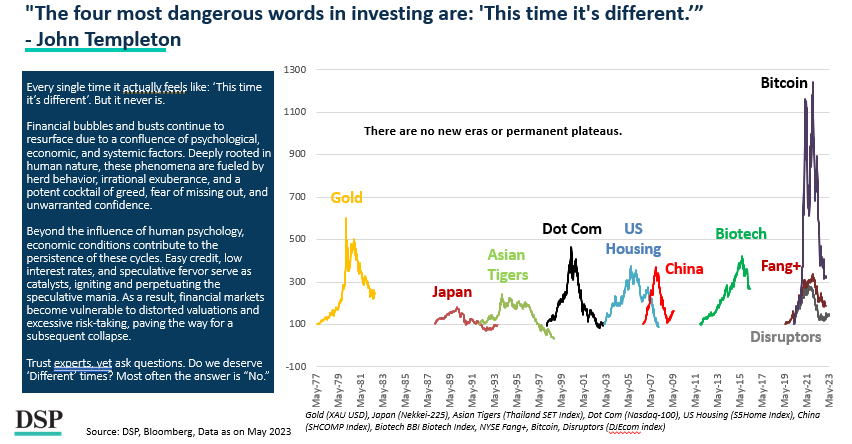

There are no new eras. Stupidity is repetitive. Question all manias and depths of despair.

Download: dspim.co/NetJun23

Download: dspim.co/NetJun23

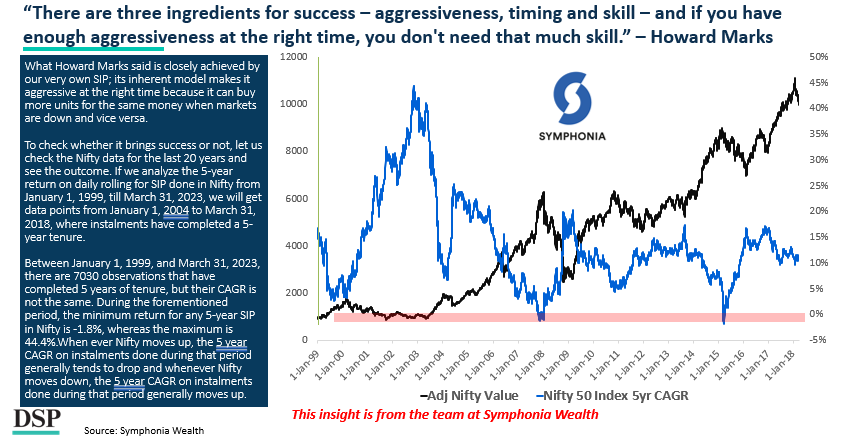

Can a process create better outcomes? Discipline is rewarding indeed. Here’s what a simple ‘Systematic Investment Plan’ can achieve over time.

Download: dspim.co/NetJun23

Download: dspim.co/NetJun23

• • •

Missing some Tweet in this thread? You can try to

force a refresh