An overview of Transaction Capital focusing on;

1) ownership of SA Taxi

2) all things WeBuyCars.

Warning ⚠️: this is a very long thread, but it is worth the read.

[Thread]

1) ownership of SA Taxi

2) all things WeBuyCars.

Warning ⚠️: this is a very long thread, but it is worth the read.

[Thread]

SA Taxi provides asset-backed developmental credit lending for an

income generating vehicle.

Taxi owners are able to buy the vehicle, finance, insurance, car tracking, vehicle servicing and panel beating services all from SA Taxi.

Fully vertically integrated business model.

income generating vehicle.

Taxi owners are able to buy the vehicle, finance, insurance, car tracking, vehicle servicing and panel beating services all from SA Taxi.

Fully vertically integrated business model.

Ownership of SA Taxi.

November 2018, SANTACO bought a 25% stake in SA Taxi for R1.7 billion.

SA Taxi used R1bn of the net proceeds of R1.2bn to settle interest-bearing external and shareholder debt.

November 2018, SANTACO bought a 25% stake in SA Taxi for R1.7 billion.

SA Taxi used R1bn of the net proceeds of R1.2bn to settle interest-bearing external and shareholder debt.

Transaction Capital stated that this was not a BEE deal, which would only enrich certain individuals, but rather, it is an equity partnership that will enable the equitable distribution of the value generated in the minibus taxi industry verticals to all taxi industry participant

How did SANTACO finance the R1.7bn purchase price?

R1.2bn was funded jointly by Standard Bank and Futuregrowth Asset Management for 15.7% of the ordinary shares and

R521m was facilitated by SA Taxi in the form of vendor finance for 9.3% vendor finance shares.

R1.2bn was funded jointly by Standard Bank and Futuregrowth Asset Management for 15.7% of the ordinary shares and

R521m was facilitated by SA Taxi in the form of vendor finance for 9.3% vendor finance shares.

How much dividends will SANTACO receive and when?

Of the future dividend flows accruing to SANTACO, 90% will be applied towards reducing debt (the 25% was debt funded), with a 10% trickle flowing directly to the SANTACO trust from the outset.

Of the future dividend flows accruing to SANTACO, 90% will be applied towards reducing debt (the 25% was debt funded), with a 10% trickle flowing directly to the SANTACO trust from the outset.

The dividends that have been paid to SANTACO to date stands at R196.8 million.

Example of a typical vendor financing arrangement.

X Ltd needs sells 5% shares to a consortium.

Buyers don’t have the money to buy the 5% stake.

X Ltd then sells and simultaneously lends buyer money to buy the shares.

Buyers use dividends to repay the debt and the interest.

X Ltd needs sells 5% shares to a consortium.

Buyers don’t have the money to buy the 5% stake.

X Ltd then sells and simultaneously lends buyer money to buy the shares.

Buyers use dividends to repay the debt and the interest.

The vendor finance by SA Taxi resulted in Transaction Capital consolidating 81.4% of SA Taxi’s earnings.

Transaction Capital owns 74,9% of SA Taxi.

SANTACO owns 25.1%.

SANTACO is the umbrella body governing the industry and act as the principal mouthpiece for taxis.

Transaction Capital owns 74,9% of SA Taxi.

SANTACO owns 25.1%.

SANTACO is the umbrella body governing the industry and act as the principal mouthpiece for taxis.

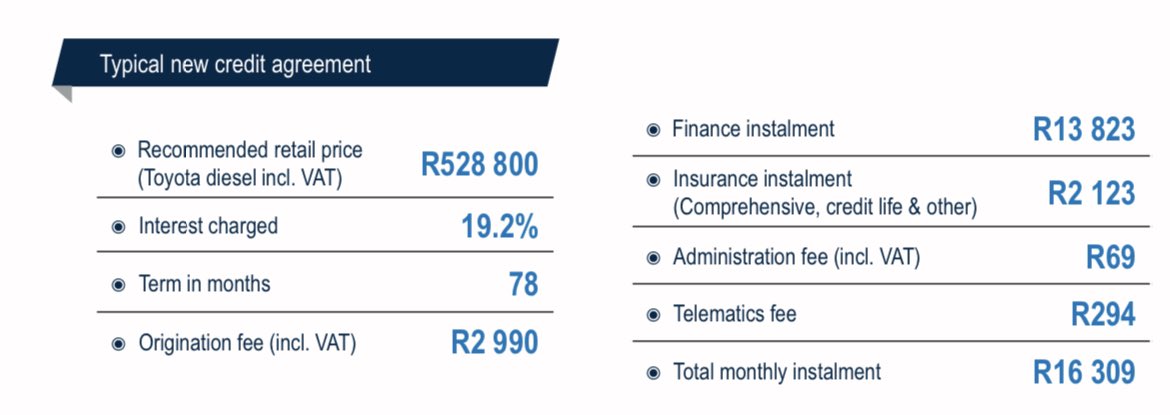

The taxi industry has seen monthly instalments increase by ~R6 022 FY2015, calculated on new loan originations.

SA Taxi said it’s instalments have decreased by ~R1 536 since FY2015.

SA Taxi has originated loans to the value of R37.7bn since 2008, with 9357 new loans in HY2023.

SA Taxi said it’s instalments have decreased by ~R1 536 since FY2015.

SA Taxi has originated loans to the value of R37.7bn since 2008, with 9357 new loans in HY2023.

SA Taxi has an average 19.2% interest rate at origination since FY2015.

It had a net interest margin of 9% which is slightly below its target of 11% to 12% range.

It had a net interest margin of 9% which is slightly below its target of 11% to 12% range.

How are the repossession numbers there by SA Taxi?

HY2023, SA Taxi vehicle repossessions was ~368 per month and 425 per month in HY2022.

Recovery on repossession >75% of settlement value. This helps to limit loss in event of default.

HY2023, SA Taxi vehicle repossessions was ~368 per month and 425 per month in HY2022.

Recovery on repossession >75% of settlement value. This helps to limit loss in event of default.

SA Taxi does huge repossessions does each year to keep the credit loss ratio low. It is currently at 5.6% and above the target of 3% - 4%.

In HY2023, SA Taxi received 9 357 new applications per month and originated 657 loans per month.

It has an approval rate of 30%.

In HY2023, SA Taxi received 9 357 new applications per month and originated 657 loans per month.

It has an approval rate of 30%.

SA Taxi’s Corporate Social Investment (CSI) spend in FY2022 was only R4.9m.

SA Taxi previously reported that ~75% of its clients are classified as previously under- banked or financially excluded.

It has R17.1 billion gross loans

& advances and 36 963 loans on its books.

SA Taxi previously reported that ~75% of its clients are classified as previously under- banked or financially excluded.

It has R17.1 billion gross loans

& advances and 36 963 loans on its books.

Bridgestone partnered with SA Taxi.

Santaco president stated that he wanted Santaco to adopt a resolution at its 2019 conference for members to only use Bridgestone tyres.

Bridgestone sells the tyre for R1679 to SA Taxi members vs its price of R1900 and sells 45k tyres a year.

Santaco president stated that he wanted Santaco to adopt a resolution at its 2019 conference for members to only use Bridgestone tyres.

Bridgestone sells the tyre for R1679 to SA Taxi members vs its price of R1900 and sells 45k tyres a year.

Quick check in:

WeBuyCars was founded by brothers Dirk and Faan van der Walt in 2001.

It is a buyer, distributor and retailer of vehicles, also offering allied products and services, that trades through its vertically integrated, data and technology-led e-commerce and physical infrastructure.

It is a buyer, distributor and retailer of vehicles, also offering allied products and services, that trades through its vertically integrated, data and technology-led e-commerce and physical infrastructure.

What sets WeBuyCars apart from competitors is the connivence that is created for customers.

Vehicle sellers get instant quotes, WeBuyCars comes to you, does the paperwork, and pays “immediately”.

Vehicle buyers have a wider and deeper selection of models.

Vehicle sellers get instant quotes, WeBuyCars comes to you, does the paperwork, and pays “immediately”.

Vehicle buyers have a wider and deeper selection of models.

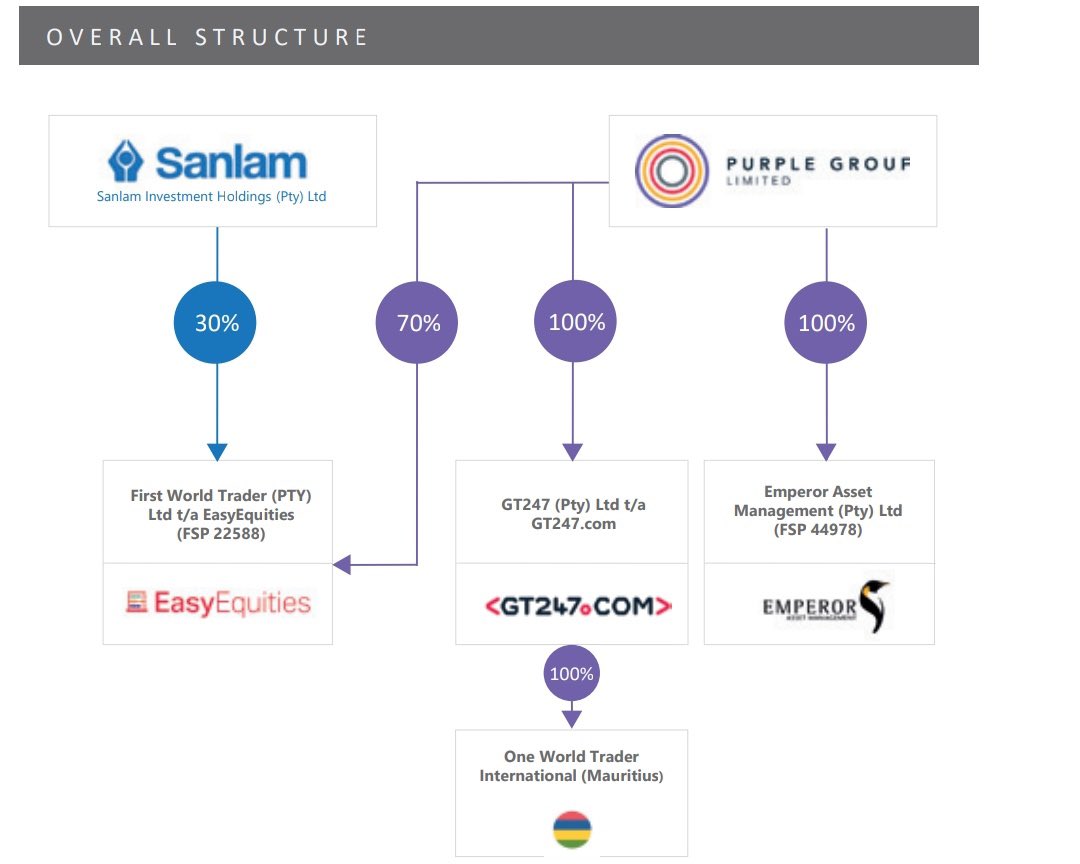

WeBuyCars earns a risk adjusted gross margin on vehicle sales (vehicle margin), with additional gross margin earned on add-on products (product margin).

Product margin includes agency fees earned from finance, insurance related and allied products sold on behalf of banks.

Product margin includes agency fees earned from finance, insurance related and allied products sold on behalf of banks.

Vehicle valuations are determined by artificial intelligence and not individual buyer sentiment,so sellers can be certain of a ‘fair price’ and immediate cash settlement on acceptance of the offer.

Transaction Capital saw the potential that WeBuyCars has and made a move for it.

Transaction Capital saw the potential that WeBuyCars has and made a move for it.

Transaction Capital’s total investment in WeBuyCar amounts to R3.4bn which results in an 8.9x price to earnings on the estimated earnings of WeBuyCars of R384.9m.

R3.4bn will be settled as to:

80%m-85% in cash, and

15-20% by the issue of ordinary shares in Transaction Capital.

R3.4bn will be settled as to:

80%m-85% in cash, and

15-20% by the issue of ordinary shares in Transaction Capital.

11 Sept 2020 Transaction Capital, concluded a transaction with WeBuyCars and its shareholders to become a 49.9% non-controlling shareholder in WeBuyCars.

26 May 2021, Transaction Capital increased its shareholding to 74.9%.

25.1% is retained by the WeBuyCars’ founders.

26 May 2021, Transaction Capital increased its shareholding to 74.9%.

25.1% is retained by the WeBuyCars’ founders.

WeBuyCars’ revenue for H1 FY23 ⬆️ by 19% to R9.8bn.

In the last 2yr, WeBuyCars’ revenue ⬆️ by a compounded annual growth rate (CAGR) of 52%.

The used vehicle segment trades more than 1m vehicles a year, and has shown a CAGR of 1.7% over the last 5 years.

In the last 2yr, WeBuyCars’ revenue ⬆️ by a compounded annual growth rate (CAGR) of 52%.

The used vehicle segment trades more than 1m vehicles a year, and has shown a CAGR of 1.7% over the last 5 years.

There is a big shift from new to used vehicles due to affordability constraints caused by the pandemic.

Used vehicle sales ⬆️ from FY19 as used cars have proven to be a more affordable option to a new vehicle.

Used vehicles inflation stands at 5.4% vs 5.2% of new vehicles.

Used vehicle sales ⬆️ from FY19 as used cars have proven to be a more affordable option to a new vehicle.

Used vehicles inflation stands at 5.4% vs 5.2% of new vehicles.

WeBuyCars said that in the South African motor industry, in 2021, 1.2 million of used vehicle sales were made and 32% of those were financed. This was a 2.9% year-on-year increase.

There were 474 000 new vehicle sales and 44% of those were financed.

There were 474 000 new vehicle sales and 44% of those were financed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter