Here's 16 reasons why the Stage 3 tax cuts should be scrapped 🧵

1/ FACT: the Stage 3 tax cuts are massively expensive and massively unfair

They will cost at least $313 billion over a decade, of which $157.5 billion will go to those earning more than $180,000 a year. #auspol

1/ FACT: the Stage 3 tax cuts are massively expensive and massively unfair

They will cost at least $313 billion over a decade, of which $157.5 billion will go to those earning more than $180,000 a year. #auspol

2/

Every dollar of the Stage 3 tax cuts to the wealthy ($313billion), is a dollar not spent on government services that are crying out for funds like Aged Care and Medicare, or increasing the rate of Jobseeker above the poverty line. #auspol

Every dollar of the Stage 3 tax cuts to the wealthy ($313billion), is a dollar not spent on government services that are crying out for funds like Aged Care and Medicare, or increasing the rate of Jobseeker above the poverty line. #auspol

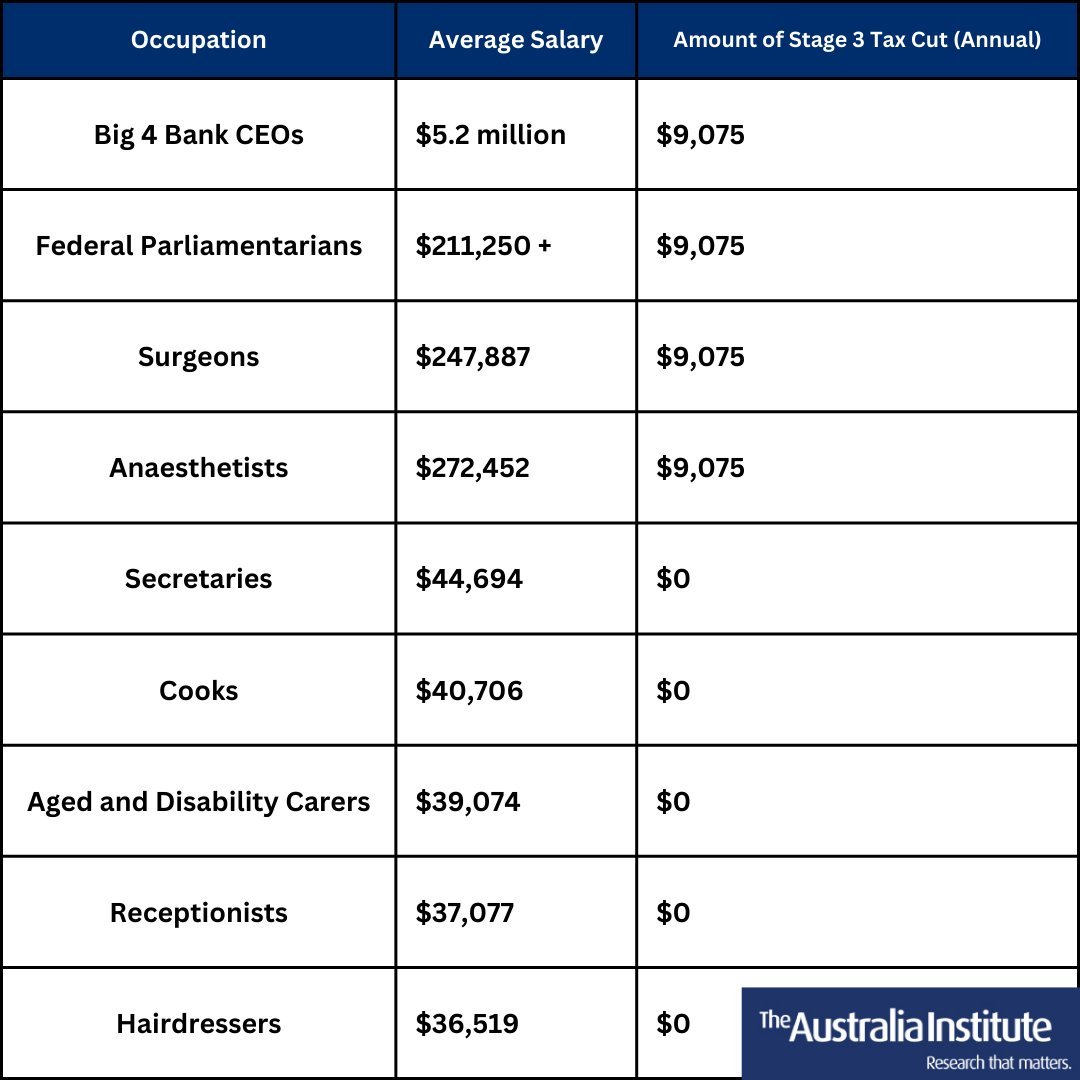

3/ They will give bankers, surgeons, and MPs an extra $9075 a year, while hospo workers get nothing.

Australia is in the middle of a cost-of-living crisis, and the Stage 3 tax cuts will deliver 0 for those struggling to make ends meet on the minimum wage or low incomes. #auspol

Australia is in the middle of a cost-of-living crisis, and the Stage 3 tax cuts will deliver 0 for those struggling to make ends meet on the minimum wage or low incomes. #auspol

4/ Men get twice as much benefit as women.

For every dollar of Stage 3 tax cuts women get, men will get two dollars. This will only serve to increase the wealth divide, and worsen gender inequality. #auspol

For every dollar of Stage 3 tax cuts women get, men will get two dollars. This will only serve to increase the wealth divide, and worsen gender inequality. #auspol

5/ Gen Z will receive only 2.8% of the Stage 3 tax cuts in the first year.

Despite making up 12.7% of taxpayers, Gen Z (those under 25) will only receive 2.8% of the benefit in the first year of operation of the Stage 3 tax cuts. #auspol

Despite making up 12.7% of taxpayers, Gen Z (those under 25) will only receive 2.8% of the benefit in the first year of operation of the Stage 3 tax cuts. #auspol

6/ Rural & regional areas miss out, metro areas get most of the benefit.

Of the 20 electorates that get the least benefit from Stage 3, 12 are rural seats (60%). Of the 20 that get the most benefit, 17 are inner metro seats, with half in Sydney, a quarter in Melbourne. #auspol

Of the 20 electorates that get the least benefit from Stage 3, 12 are rural seats (60%). Of the 20 that get the most benefit, 17 are inner metro seats, with half in Sydney, a quarter in Melbourne. #auspol

7/ The Stage 3 tax cuts will be responsible for up to 58% of the Budget deficit in 2025-26.

Treasury estimates the Budget deficit in 2024-25 will fall to $35.1b, but the cost of Stage 3 cuts in that year will rise to $20.4b. #auspol

Treasury estimates the Budget deficit in 2024-25 will fall to $35.1b, but the cost of Stage 3 cuts in that year will rise to $20.4b. #auspol

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter