The #RBA raised rates to 4.1%, (in a move not expected by market economist median) "to provide greater confidence that inflation will return to target within a reasonable timeframe.". The final paragraph is unchanged noting further tightening "may be required".

The RBA sees upside risks to the inflation outlook and decided to act. While economic activity is clearly slowing there hasn't been convincing evidence as yet, in the Australian context, that inflation is on a sustainable downward trajectory

#RBA notes the award wage decision. It notes that wages growth it expects is consistent with the inflation target "provided that productivity growth picks up". Productivity that it hopes will pick up as businesses come under pressure, policymakers have done little to ensure this

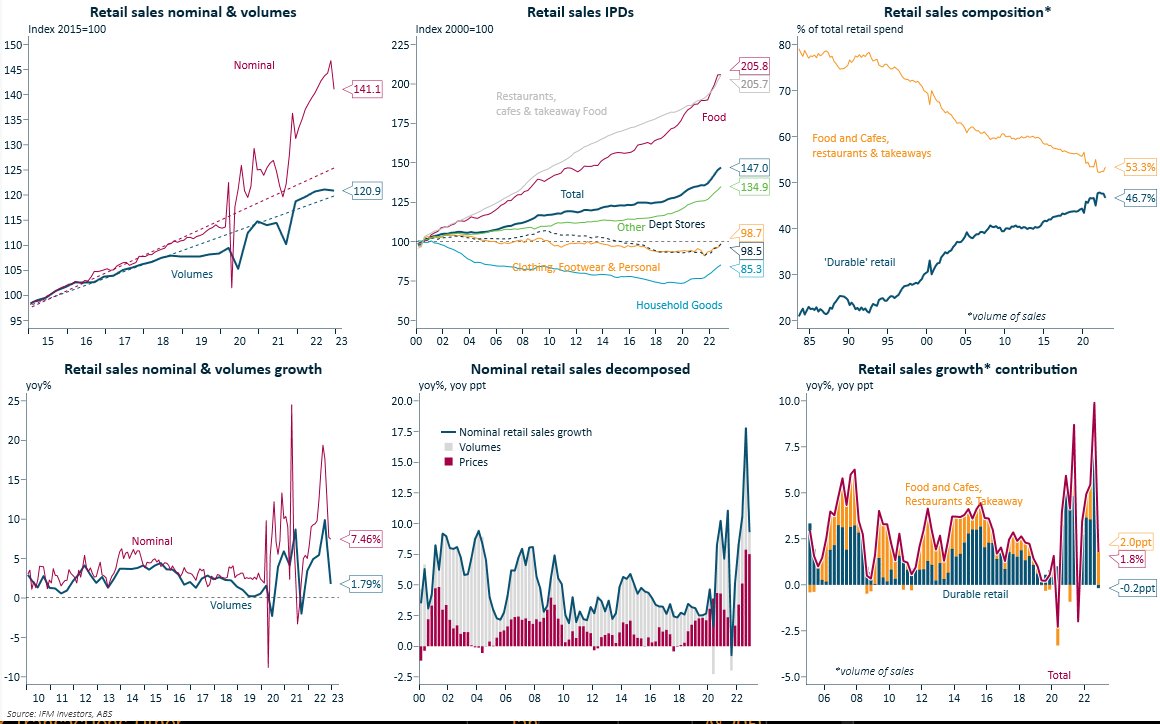

Growth will more than likely slow in tomorrow's national accounts, but the #RBA's focus is squarely on this chart. The absurdity of the national accounts being released a day after the Bank meets manifest yet again. I trust it will change as the review measures are implemented

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter