Chief Economist at IFM Investors. Aussie macro-focus. Views expressed are my own and not necessarily those of my employer. RTs not necessarily endorsements

How to get URL link on X (Twitter) App

The RBA sees upside risks to the inflation outlook and decided to act. While economic activity is clearly slowing there hasn't been convincing evidence as yet, in the Australian context, that inflation is on a sustainable downward trajectory

The RBA sees upside risks to the inflation outlook and decided to act. While economic activity is clearly slowing there hasn't been convincing evidence as yet, in the Australian context, that inflation is on a sustainable downward trajectory

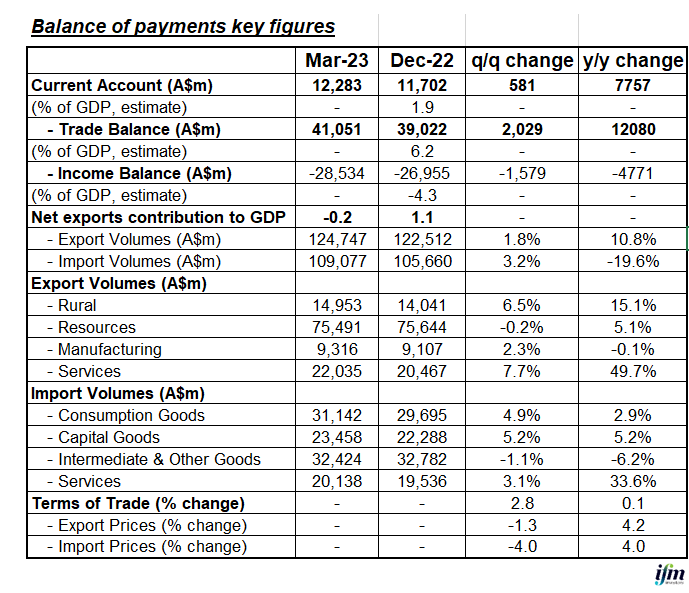

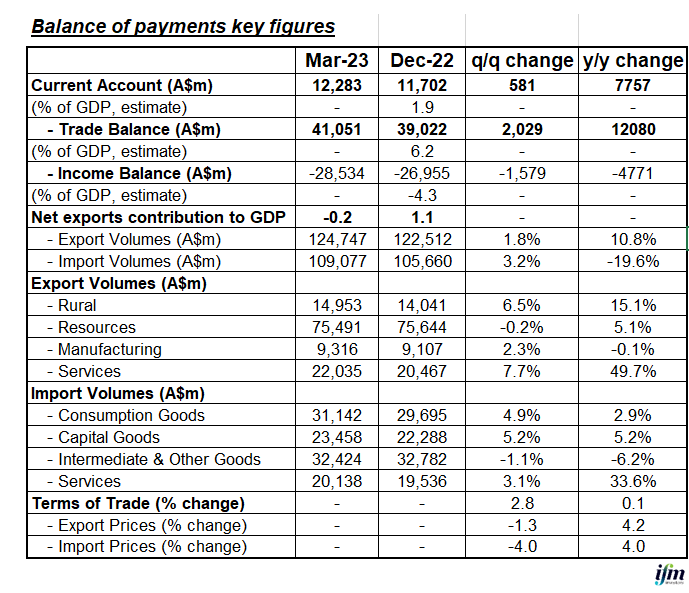

The trade surplus offset by the net income deficit to a large degree. Fair to say foreign entities investing in Australia has have a good year or so.

The trade surplus offset by the net income deficit to a large degree. Fair to say foreign entities investing in Australia has have a good year or so.

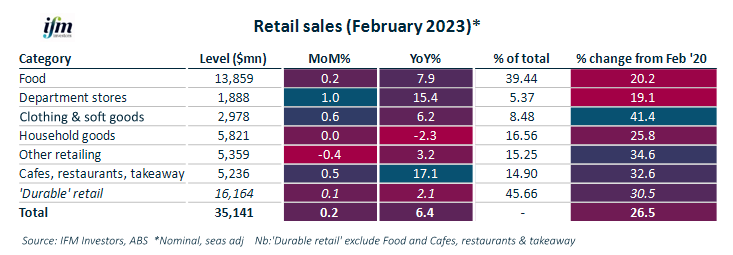

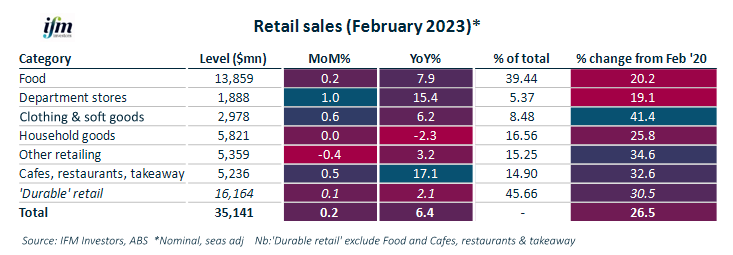

In level terms retail sales remain well above where the pre-pandemic trend suggests they should be

In level terms retail sales remain well above where the pre-pandemic trend suggests they should be