In this Detailed Thread 🧵 we'll look to analyse a Microcap Company 🧢 'PRIMA PLASTICS LTD' Each and every neeche details about this company will be covered in this thread from its Business, to its fundamentals, to its product mix, to its financials, to its

#PrimaPlastics

#PrimaPlastics

Management, to its Chart Pattern analysis📉📈, to its valuation gap⚖️♎ and at last I'll give my final commentary👨💻 about this stock.

☑️ABOUT THE COMPANY

💫Prima Plastics, incorporated in 1993 is a manufacturer and exporter of Plastic Products in India.

☑️ABOUT THE COMPANY

💫Prima Plastics, incorporated in 1993 is a manufacturer and exporter of Plastic Products in India.

💫It started by manufacturing chairs and has since then expanded the product range to include Moulded Furniture, Pallets, Insulated box, Crates, Road Safety.

☑️Client Network

💫The clients range from diverse industries from hotels, restaurants to household use for swimming

☑️Client Network

💫The clients range from diverse industries from hotels, restaurants to household use for swimming

pools, gardens, etc from domestic and international markets.

💫It exports to more than 20 countries like the USA, Africa, and the Middle East which contributes 9% of the revenue.

💫It exports to more than 20 countries like the USA, Africa, and the Middle East which contributes 9% of the revenue.

☑️Manufacturing and Distribution Network

💫At present Prima has 7 production facilities worldwide out of which 4 plants operate in India and the other 3 operate globally.

💫It has almost 450 distributors & 5500 dealers that make its products accessible.

💫At present Prima has 7 production facilities worldwide out of which 4 plants operate in India and the other 3 operate globally.

💫It has almost 450 distributors & 5500 dealers that make its products accessible.

☑️Expansion

💫Co. invested 3 Cr to increase the capacity of Guatmela plant by 30% from Feb 2021.

☑️Subsidiary and Joint Venture

It established a Subsidiary, Prima Union Plasticos S.A. in Central America with a local partner in which it holds a 90% stake.

💫Co. invested 3 Cr to increase the capacity of Guatmela plant by 30% from Feb 2021.

☑️Subsidiary and Joint Venture

It established a Subsidiary, Prima Union Plasticos S.A. in Central America with a local partner in which it holds a 90% stake.

The commercial production had commenced w.e.f. March 13, 2017.

☑️Recent Development

💫It is one of the largest suppliers of Waste Management Products (for which it had set up Roto and Blow moulding machines) under the Swachh Bharat Abhiyan to various municipal bodies around

☑️Recent Development

💫It is one of the largest suppliers of Waste Management Products (for which it had set up Roto and Blow moulding machines) under the Swachh Bharat Abhiyan to various municipal bodies around

💫India such as Greater Hyderabad Municipal Corporation.

💫It also entered Asia's largest e-tailer for baby products, showcasing over 30 products from the Kids Range through FIRSTCRY.COM, Amazon, and Pepperfry.(Prima Plastics Products can be found on Amazon)

💫It also entered Asia's largest e-tailer for baby products, showcasing over 30 products from the Kids Range through FIRSTCRY.COM, Amazon, and Pepperfry.(Prima Plastics Products can be found on Amazon)

☑️Future Plans

💫It is expanding its business online on e-commerce platforms.

💫It is also expanding its territory and focusing on Pan India and its International presence.

💫It is expanding its business online on e-commerce platforms.

💫It is also expanding its territory and focusing on Pan India and its International presence.

☑️Product Mix Pictures of Prima Plastics

💫Insulated Box and crates & Pallets

(Insulated-Box, Insulated- Shippers, Crates)

(2-Way, 4-Way, Euro-Pallets, Reversible-Pallets, ASRS-Pallets, Cage-Pallets, Pallet-Contaniers)

💫Insulated Box and crates & Pallets

(Insulated-Box, Insulated- Shippers, Crates)

(2-Way, 4-Way, Euro-Pallets, Reversible-Pallets, ASRS-Pallets, Cage-Pallets, Pallet-Contaniers)

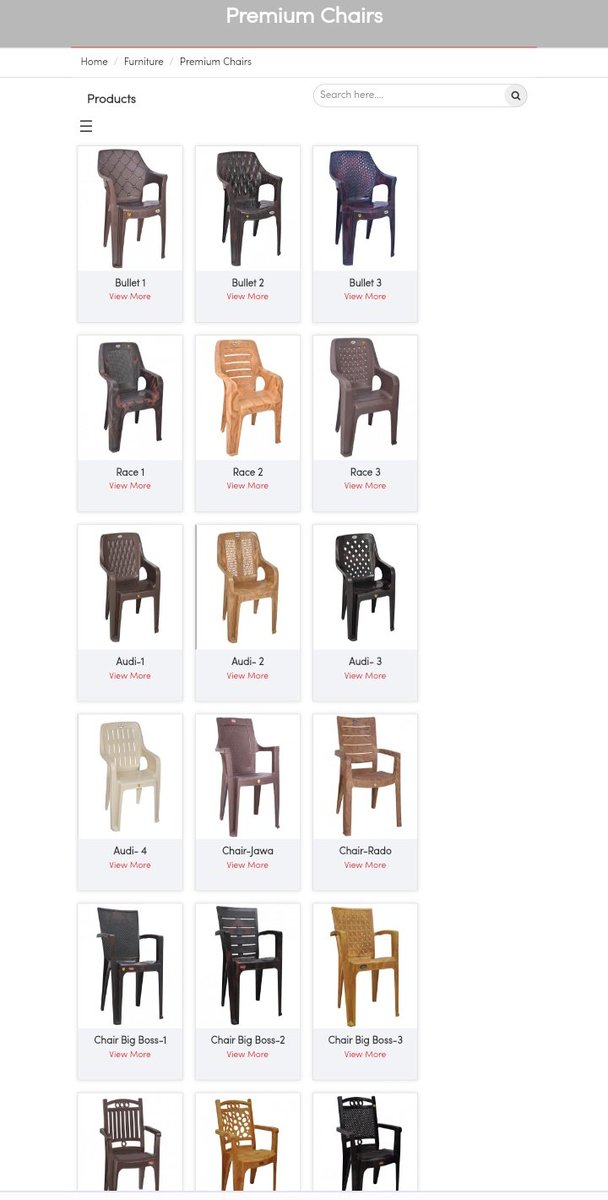

☑️Furniture

Regular Chairs, Premium Chairs, Storage solutions, Stools Range, Kids Range, Armless Chairs, Home Accessories Range, Dinning Tables/Teapoys/Troylleys

Regular Chairs, Premium Chairs, Storage solutions, Stools Range, Kids Range, Armless Chairs, Home Accessories Range, Dinning Tables/Teapoys/Troylleys

☑️Fundamental Analysis♎⚖️

✅Market Capitalisation:- Rs 171 Cr(Microcap)

✅Stock PE:- 10.7(Undervalued)

✅Industry PE:- 40.8

✅Book Value:- Rs 124

✅Dividend Yield:- 0.97%

✅ROCE:- 13.7%

✅ROE:- 12.5%

✅Face Value:- 10

✅Intrinsic Value:- Rs 313

✅Graham No:- Rs 201

✅Market Capitalisation:- Rs 171 Cr(Microcap)

✅Stock PE:- 10.7(Undervalued)

✅Industry PE:- 40.8

✅Book Value:- Rs 124

✅Dividend Yield:- 0.97%

✅ROCE:- 13.7%

✅ROE:- 12.5%

✅Face Value:- 10

✅Intrinsic Value:- Rs 313

✅Graham No:- Rs 201

✅Sales Growth:- 29.9%

✅Operating Profits Growth:- 127%

✅Net Profits Growth:- 83.1%

✅EPS:- 14.5

✅Debt to Equity:- 0.34

✅Debt:- Rs 46 Cr

✅Reserves:- Rs 125 Cr

✅Fixed Assets:- 55 Cr

✅Piotroski Score:- 8

✅PEG:- 0.93

Last 3/5/10 Years Sales Growth💹Profit💹,CAGR,ROE,AR,CF👇

✅Operating Profits Growth:- 127%

✅Net Profits Growth:- 83.1%

✅EPS:- 14.5

✅Debt to Equity:- 0.34

✅Debt:- Rs 46 Cr

✅Reserves:- Rs 125 Cr

✅Fixed Assets:- 55 Cr

✅Piotroski Score:- 8

✅PEG:- 0.93

Last 3/5/10 Years Sales Growth💹Profit💹,CAGR,ROE,AR,CF👇

☑️Chart Pattern Analysis📉📈, Financial Analysis♎⚖️, Valuation Gap and My Final Commentary

Chart Pattern Analysis(Monthly Timeframe)

✅The stock is trading above all the EMAs and DMAs

✅The stock is rising in an uptrend pattern

✅22- Months old Breakout will come above Rs 165

Chart Pattern Analysis(Monthly Timeframe)

✅The stock is trading above all the EMAs and DMAs

✅The stock is rising in an uptrend pattern

✅22- Months old Breakout will come above Rs 165

✅2 Years old Breakout will come in it above Rs 187+

✅5- Years old Breakout will come in it above Rs 190+

✅In Chart a strong Accumulation can be observed

✅Targets 🎯 of Prima Plastics as per TA is placed at Rs 165/190/200/220/240/260/280/300+

✅ATH of the stock was @315+

✅5- Years old Breakout will come in it above Rs 190+

✅In Chart a strong Accumulation can be observed

✅Targets 🎯 of Prima Plastics as per TA is placed at Rs 165/190/200/220/240/260/280/300+

✅ATH of the stock was @315+

☑️Fundamental Analysis, Valuation and my Commentary

Fundamental Analysis⚖️♎ Part 1

💫In FY23, Prima Plastics has done a Sales of Rs 192 Cr. Prima Plastics Sales has increased by about 29.90% on YOY Basis from Rs 148 Cr

Fundamental Analysis⚖️♎ Part 1

💫In FY23, Prima Plastics has done a Sales of Rs 192 Cr. Prima Plastics Sales has increased by about 29.90% on YOY Basis from Rs 148 Cr

💫This is Prima Plastics, Highest ever Growth💹💹 in Sales on YOY Basis and also this is Prima Plastics Highest ever Sales in the History

💫Prima Plastics Operating Profits of FY23 was at Rs 25 Cr the company's Operating Profits has increased by about 127% on YOY Basis

💫Prima Plastics Operating Profits of FY23 was at Rs 25 Cr the company's Operating Profits has increased by about 127% on YOY Basis

💫This was Prima Plastics best ever Operating Profits in history its last best operating profits came in FY16 at Rs 20 Cr

Prima Plastics| Fundamental Analysis ♎⚖️ Part 2

💫The company has observed a EPS Breakout, its EPS has increased from 7.88 to 14.48

Prima Plastics| Fundamental Analysis ♎⚖️ Part 2

💫The company has observed a EPS Breakout, its EPS has increased from 7.88 to 14.48

💫Its last best EPS came in FY21 at 13.63(But in FY21 the company saw a other income of Rs 10 Cr this majorly contributed to the EPS)

💫Prima Plastics made its ATH @315 in May-2017

💫At its ATH, the market Rewarded it with 33 PE Ratio

💫Prima Plastics made its ATH @315 in May-2017

💫At its ATH, the market Rewarded it with 33 PE Ratio

💫Prima Plastics looks Extremely cheap at CMP even though it is at its 52 week highs

💫Prima Plastics Current PE Ratio is 10.7 whereas Industry PE Ratio is at 40.9

💫Prima Plastics Intrinsic Value is at 313 and Graham No is Rs 201

💫As per both Intrinsic Value and Graham No it is

💫Prima Plastics Current PE Ratio is 10.7 whereas Industry PE Ratio is at 40.9

💫Prima Plastics Intrinsic Value is at 313 and Graham No is Rs 201

💫As per both Intrinsic Value and Graham No it is

Very Undervalued.

Prima Plastics| Fundamental Analysis ♎⚖️ Part 3

💫The market has Rewarded it with 13.5 PE Ratio in 2023, between FY16-18 Prima Plastics has even traded at 20-35+ PE Ratio

Prima Plastics| Fundamental Analysis ♎⚖️ Part 3

💫The market has Rewarded it with 13.5 PE Ratio in 2023, between FY16-18 Prima Plastics has even traded at 20-35+ PE Ratio

💫Promoters+ Big Investors are Holding 70.19% Stake or 113 Cr worth Shares. The public are holding 49 Cr worth Shares or 29.81% Stake

💫A company with Rs 192 Cr sales, Rs 25 Cr operating profits and 13% Margin available at just 170 Cr Market Capitalisation is a very fair deal🤝

💫A company with Rs 192 Cr sales, Rs 25 Cr operating profits and 13% Margin available at just 170 Cr Market Capitalisation is a very fair deal🤝

Disclaimer : Kindly consult your FA before buying / Selling any shares. This analysis is only for educational purposes and not recommendations.

Don't Buy on the basis of this thread 🧵 if you make profits you gonna not share with me likewise I'll not be responsible for loss too

Don't Buy on the basis of this thread 🧵 if you make profits you gonna not share with me likewise I'll not be responsible for loss too

Try to Retweet ♻️ this thread 🧵 so that it reaches more market participants as this company is very unknown. This thread took about 5 Hours time to be made to try to Retweet it so that it motivates me to bring more such Business thread in the future.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter