Milestone Furniture - Auditor mil nahi raha h so as Financial data bhi nahi mil raha h

Co running without MD CEO CS

They intimated about the CEO resignation on 25th May-23 who actually resigned on 12th May-23

Promoter stake 0%

#Redflag

Co running without MD CEO CS

They intimated about the CEO resignation on 25th May-23 who actually resigned on 12th May-23

Promoter stake 0%

#Redflag

The same auditor on 26th May-23 signed the financials of Mangalam Organics - bseindia.com/xml-data/corpf…

Zero Revenue of the co #milestonefurniture

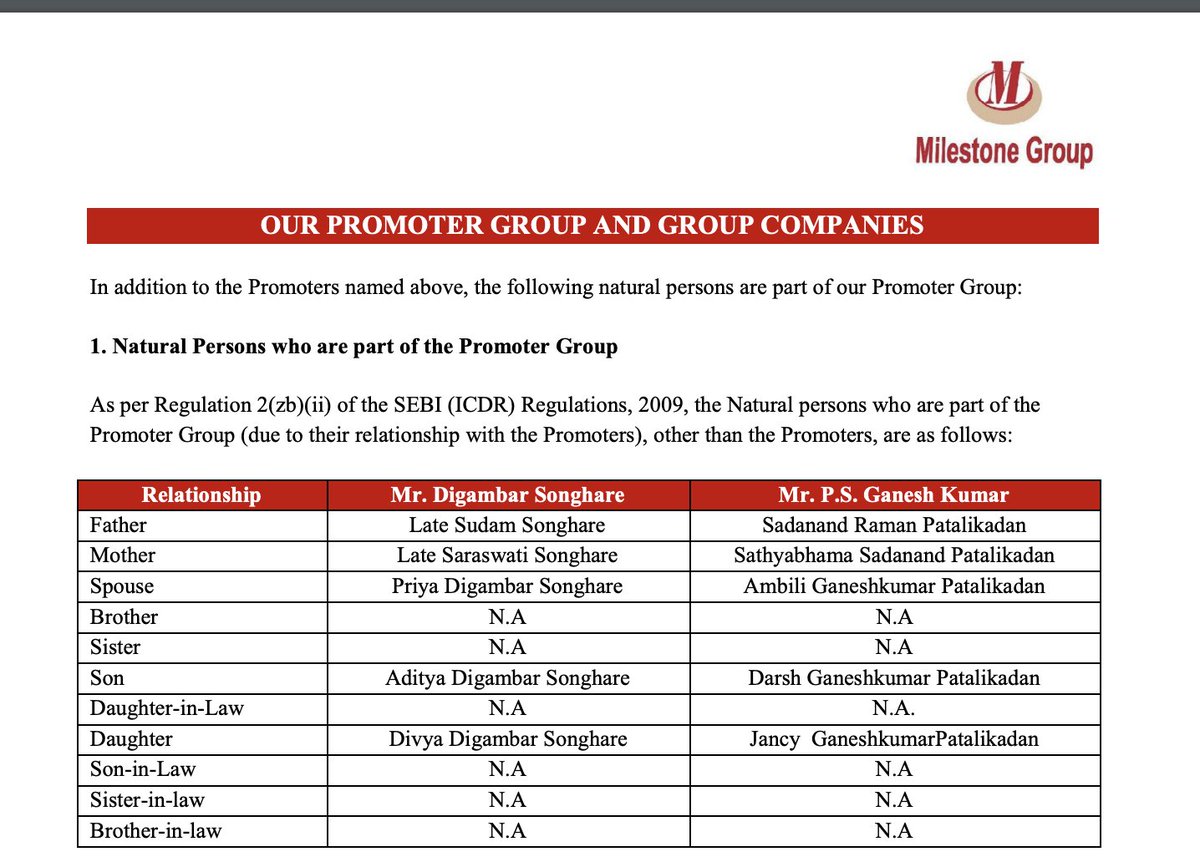

As per DRHP Promoter's daughter forms part of Promoter Group

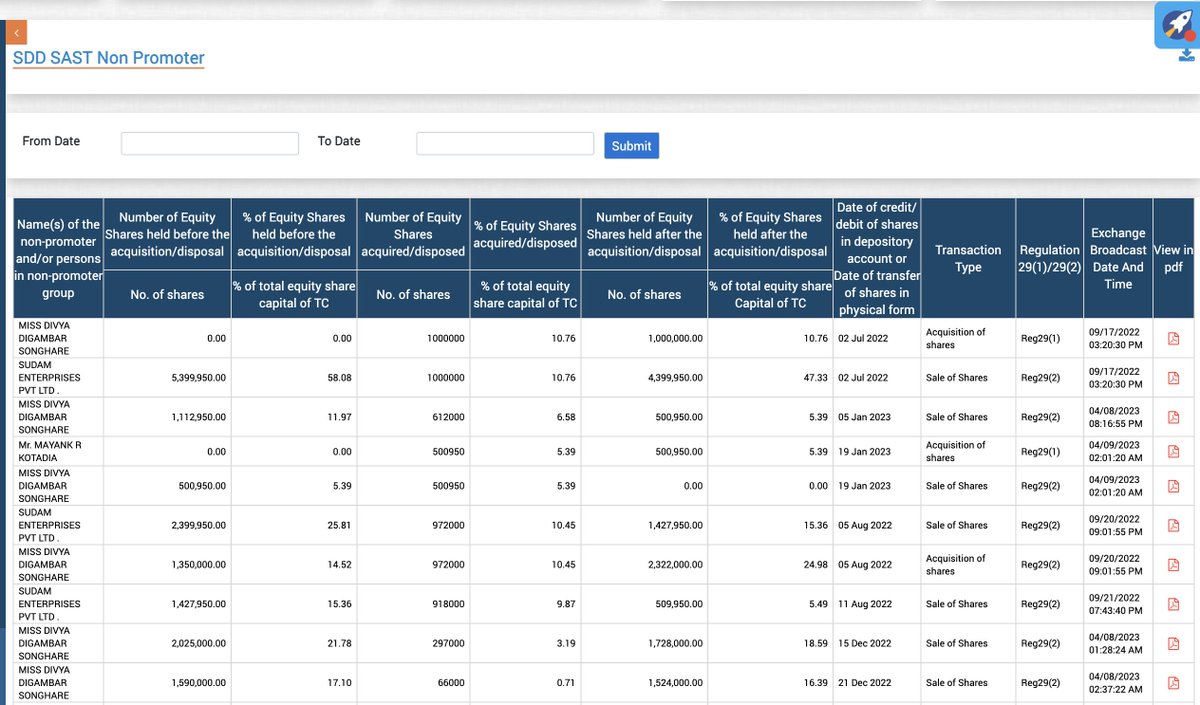

As per BSE SDD data - its non-Promoter

How its possible when there in reclassification

Also this Sudam Enterprises includes promoter as the director

As per BSE SDD data - its non-Promoter

How its possible when there in reclassification

Also this Sudam Enterprises includes promoter as the director

• • •

Missing some Tweet in this thread? You can try to

force a refresh