IKIO Lightening IPO Alert! 📢🚀

This IPO is making a buzz in the stock market.

A detailed thread on this IPO🧵⤵️

#StockMarket #IPOAlert

This IPO is making a buzz in the stock market.

A detailed thread on this IPO🧵⤵️

#StockMarket #IPOAlert

The company is coming up with fresh issues along with the OFS.

The borrowed funds will be utilised to repay debts and invest in its own subsidiary, IKIO solutions pvt. Ltd.

The details of the IPO are as follows⤵️

The borrowed funds will be utilised to repay debts and invest in its own subsidiary, IKIO solutions pvt. Ltd.

The details of the IPO are as follows⤵️

IKIO Lighting is a leading manufacturer of LED lighting systems founded by Hardeep Singh & Sumeet Kaur in 2016.

They r committed to sustainability & provide low-energy LED lighting to assist India in meeting its sustainability targets.

They r committed to sustainability & provide low-energy LED lighting to assist India in meeting its sustainability targets.

IKIO is an Indian maker of light-emitting diodes ("LED").💡

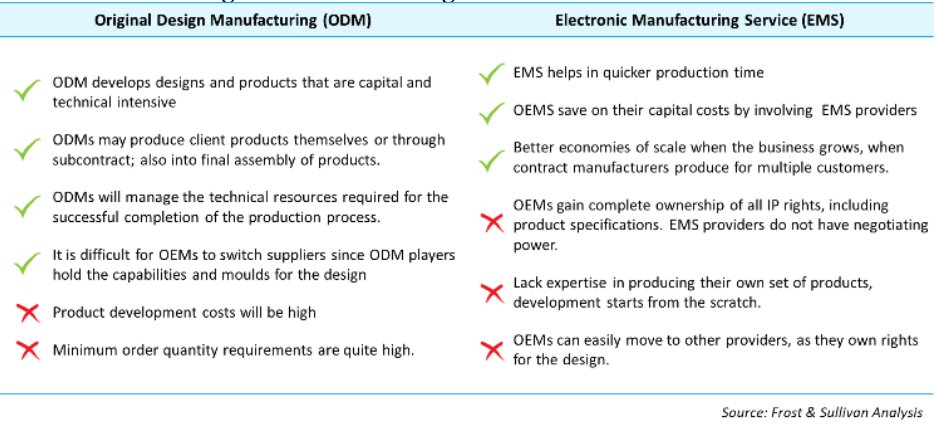

They are original design manufacturers ("ODM"), designing, developing, manufacturing, and supplying items to customers who subsequently distribute them under their own names.

Curious to know what are ODM and EMS?🤔

They are original design manufacturers ("ODM"), designing, developing, manufacturing, and supplying items to customers who subsequently distribute them under their own names.

Curious to know what are ODM and EMS?🤔

IKIO products are divided into four categories:

1️⃣LED lighting:

2️⃣Refrigeration lights

3️⃣ABS (acrylonitrile butadiene styrene) pipework and

4️⃣Other items.

1️⃣LED lighting:

2️⃣Refrigeration lights

3️⃣ABS (acrylonitrile butadiene styrene) pipework and

4️⃣Other items.

1️⃣LED lighting offerings are geared towards the luxury market and include lighting, fixtures, accessories, and components

2️⃣IKIO also provides lighting solutions (lights, drivers and controls) to commercial refrigeration equipment under the refrigeration light segment.

3️⃣IKIO also manufactures an alternative PVC piping called ABS piping that is primarily used by US customers for plumbing applications.

Signify (Philips) is IKIO's top customer.

Other customers include - Western Refrigeration Pvt. Ltd., Panasonic Life Solutions India Pvt. Ltd. and Novateur Electrical & Digital Systems Pvt. Ltd.

International customers include - Everlast Lighting Inc and Znergy Inc.

Other customers include - Western Refrigeration Pvt. Ltd., Panasonic Life Solutions India Pvt. Ltd. and Novateur Electrical & Digital Systems Pvt. Ltd.

International customers include - Everlast Lighting Inc and Znergy Inc.

They have four manufacturing plants, one in Uttarakhand's SIDCUL Haridwar industrial park and three in the National Capital Region's Noida.

The description of manufacturing units is as follows:

The description of manufacturing units is as follows:

The Key Performance Indicators of IKIO are as follows:

➡️Revenue from operations has grown at a CAGR of 25.04% from FY20 to FY22

➡️EBITDA has increased at a 23.47% CAGR from FY20 to FY2.

➡️EBITDA margins have improved significantly, along with an increase in PAT margins.

➡️Revenue from operations has grown at a CAGR of 25.04% from FY20 to FY22

➡️EBITDA has increased at a 23.47% CAGR from FY20 to FY2.

➡️EBITDA margins have improved significantly, along with an increase in PAT margins.

The Indian government has taken steps to enhance manufacturing capability within India, such as imposing customs duties for certain products or removal of duties on components.

This move will surely act as a catalyst for the growth of IKIO’s business.

This move will surely act as a catalyst for the growth of IKIO’s business.

Hit retweet🔁if you find the thread helpful.

Also, follow us - @Finology_Quest for more informative content.

We mostly post on:

• Financial Concepts

• Personal Finance

• Stock/Industry Analysis

Also, follow us - @Finology_Quest for more informative content.

We mostly post on:

• Financial Concepts

• Personal Finance

• Stock/Industry Analysis

• • •

Missing some Tweet in this thread? You can try to

force a refresh