One Investing Concept Explained Every Day

Unlearn Fluff. Learn what works in Real Life.🧐

Made with ❤️ by Finology #ForInvestors

5 subscribers

How to get URL link on X (Twitter) App

Before talking about the order book, it's essential to understand the company's core operations. The company operates in two sectors:

Before talking about the order book, it's essential to understand the company's core operations. The company operates in two sectors:

1️⃣Software Services Companies:

1️⃣Software Services Companies:

1️⃣Asset Management Companies (AMCs):

1️⃣Asset Management Companies (AMCs):

👉 In FY19, Relaxo did ₹1075cr more sales than Metro. Now, in FY23, gap is ₹655cr.

👉 In FY19, Relaxo did ₹1075cr more sales than Metro. Now, in FY23, gap is ₹655cr.

The merger is approved only by the bank's board and the approval from RBI, SEBI, NCLT, and stock exchanges is still pending.

The merger is approved only by the bank's board and the approval from RBI, SEBI, NCLT, and stock exchanges is still pending.

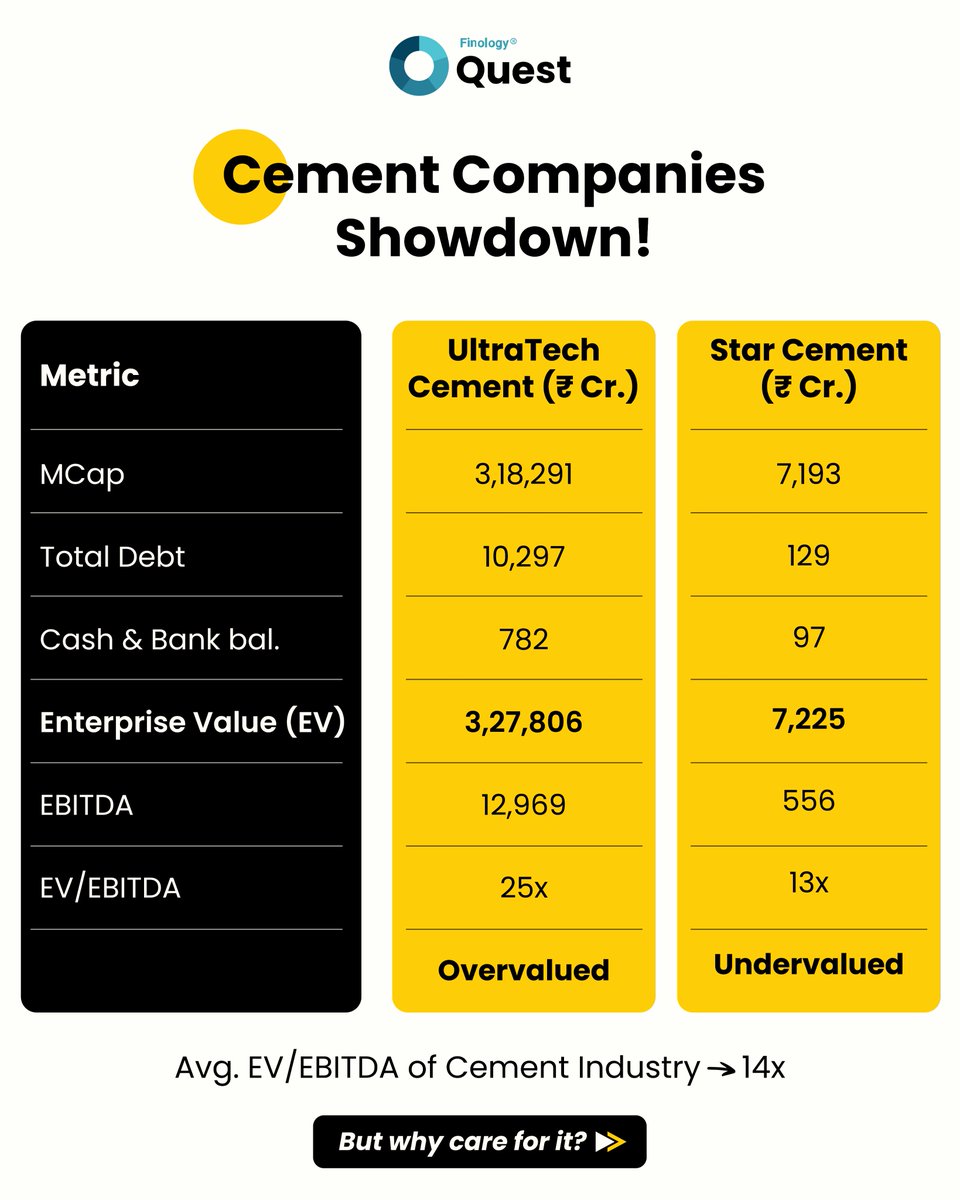

While valuing companies, analysts use different methods to determine if a particular company is undervalued or overvalued.

While valuing companies, analysts use different methods to determine if a particular company is undervalued or overvalued.

What is P/E Ratio?

What is P/E Ratio?

The company is coming up with fresh issues along with the OFS.

The company is coming up with fresh issues along with the OFS.

Q. What was the objective of ₹2000 banknotes?

Q. What was the objective of ₹2000 banknotes?

SBI Bank has achieved a remarkable whopping 83% growth in standalone net profit, rising from Rs 9,113 cr YoY to Rs 16,695 cr in Q4.

SBI Bank has achieved a remarkable whopping 83% growth in standalone net profit, rising from Rs 9,113 cr YoY to Rs 16,695 cr in Q4.