8 acquisition addicts who built their wealth with business:

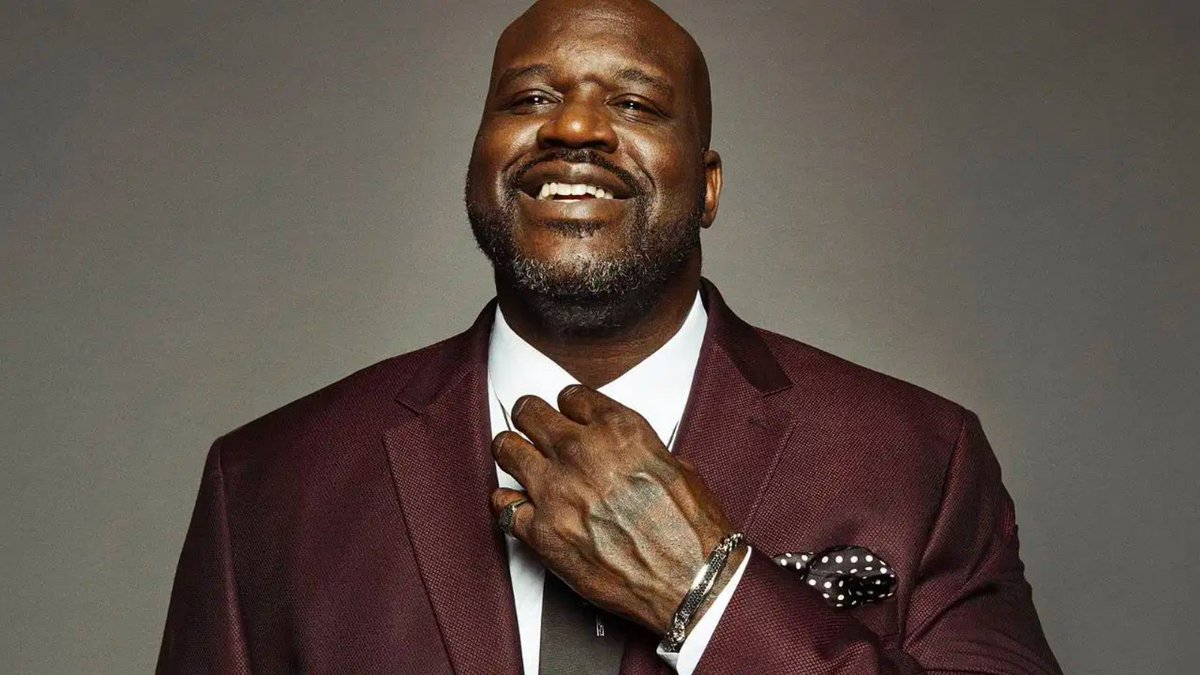

1) Shaquille O'Neal.

Shaq has gained ownership in several businesses (Lyft, Icy Hot, Gold Bond, Forever 21, Reebok, and more).

1) Shaquille O'Neal.

Shaq has gained ownership in several businesses (Lyft, Icy Hot, Gold Bond, Forever 21, Reebok, and more).

2) Ryan Reynolds.

Ryan is known for investing in Aviation American Gin and launching his own marketing agency, Maximum Effort.

Ryan is known for investing in Aviation American Gin and launching his own marketing agency, Maximum Effort.

3) Warren Buffett.

Uncle Warren is the chairman of Berkshire Hathaway, known for numerous acquisitions in various industries.

Uncle Warren is the chairman of Berkshire Hathaway, known for numerous acquisitions in various industries.

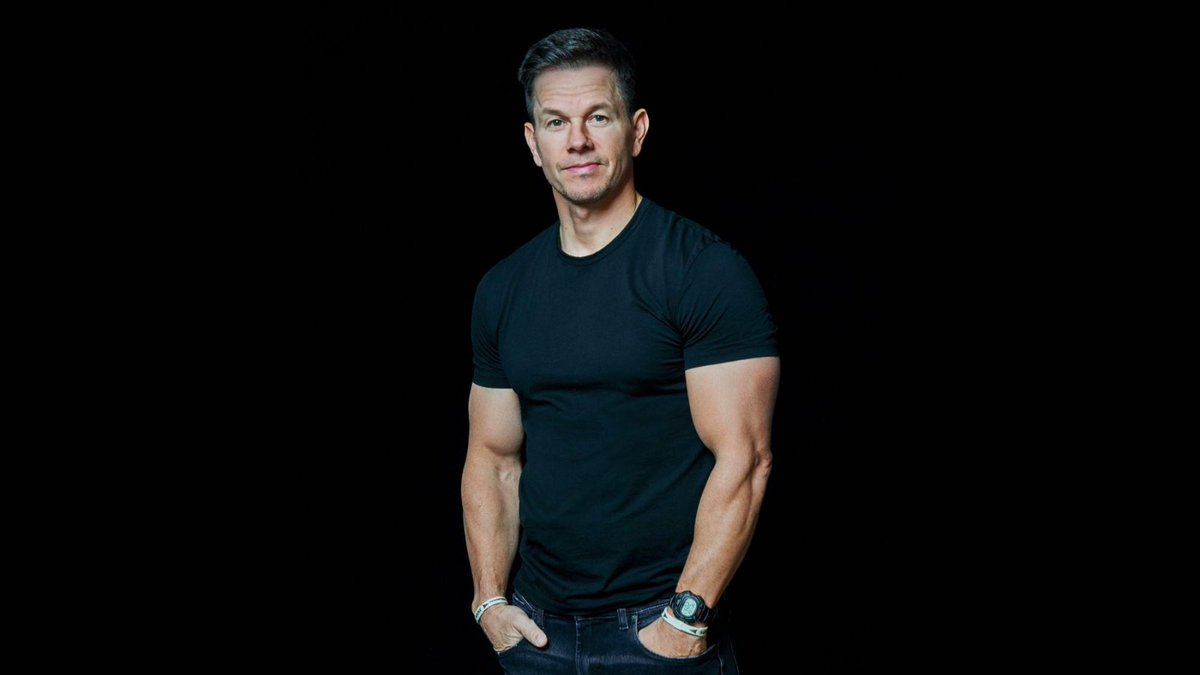

4) Mark Wahlberg.

Mark Wahlberg acquired a car dealership and is the face of F45 (fitness training business) while investing in multiple restaurants and production companies.

Mark Wahlberg acquired a car dealership and is the face of F45 (fitness training business) while investing in multiple restaurants and production companies.

5) Elon Musk.

Elon is trailblazing the renewable energy space by acquiring SolarCity and many other entrepreneurial ventures (Tesla, SpaceX, The Boring Company, X Corp.).

Elon is trailblazing the renewable energy space by acquiring SolarCity and many other entrepreneurial ventures (Tesla, SpaceX, The Boring Company, X Corp.).

6) Mark Zuckerberg.

The co-founder and CEO of Facebook, acquired Instagram and WhatsApp, among other companies in the virtual reality space.

The co-founder and CEO of Facebook, acquired Instagram and WhatsApp, among other companies in the virtual reality space.

7) Alex Hormozi.

Alex started a business called "Acquisition(dot)com" which seeks out high-performing businesses that are looking to scale.

Alex started a business called "Acquisition(dot)com" which seeks out high-performing businesses that are looking to scale.

8) Mark Cuban.

Mark the Shark is famous for selling his company before the dotcom bubble and acquired a majority stake in the Dallas Mavericks.

Mark the Shark is famous for selling his company before the dotcom bubble and acquired a majority stake in the Dallas Mavericks.

BONUS: Ben Kelly (Me)

I've acquired 5+ businesses that do ~$5,000,000 in annual revenue.

And now?

I give back by teaching...

I've acquired 5+ businesses that do ~$5,000,000 in annual revenue.

And now?

I give back by teaching...

Do you see what's happening here?

Business acquisition is everywhere.

And if you're looking to grow your wealth, I can help you buy the business of your dreams.

Let's chat.

Business acquisition is everywhere.

And if you're looking to grow your wealth, I can help you buy the business of your dreams.

Let's chat.

Thanks for reading!

If you learned something:

1. Follow me @benkellyone

2. DM me "Biz" if you want to build wealth by purchasing profitable businesses.

If you learned something:

1. Follow me @benkellyone

2. DM me "Biz" if you want to build wealth by purchasing profitable businesses.

https://twitter.com/1291052954158616576/status/1666428620196200454

If you are ready to:

-Buy a Business

-Systematize your Operations

-Scale your Wealth

Then book a time to chat here:

calendly.com/aquisitionacea…

-Buy a Business

-Systematize your Operations

-Scale your Wealth

Then book a time to chat here:

calendly.com/aquisitionacea…

• • •

Missing some Tweet in this thread? You can try to

force a refresh