Friends, sharing Sovrenn Times of yesterday to spread awareness about Sovrenn Times. We have also clubbed Sovrenn Education and Sovrenn Times together so that one has access to both education and information at an excellent price making Sovrenn Times really powerful.

Get… twitter.com/i/web/status/1…

Get… twitter.com/i/web/status/1…

#HGInfra: Company has received Letter of Acceptance from North Central Railways for redevelopment of Kanpur Central Railway Station worth INR 677 Cr over 36 months.

Buy sovrenn.com/times at Rs. 999 for 1 year and get Sovrenn Education free

Buy sovrenn.com/times at Rs. 999 for 1 year and get Sovrenn Education free

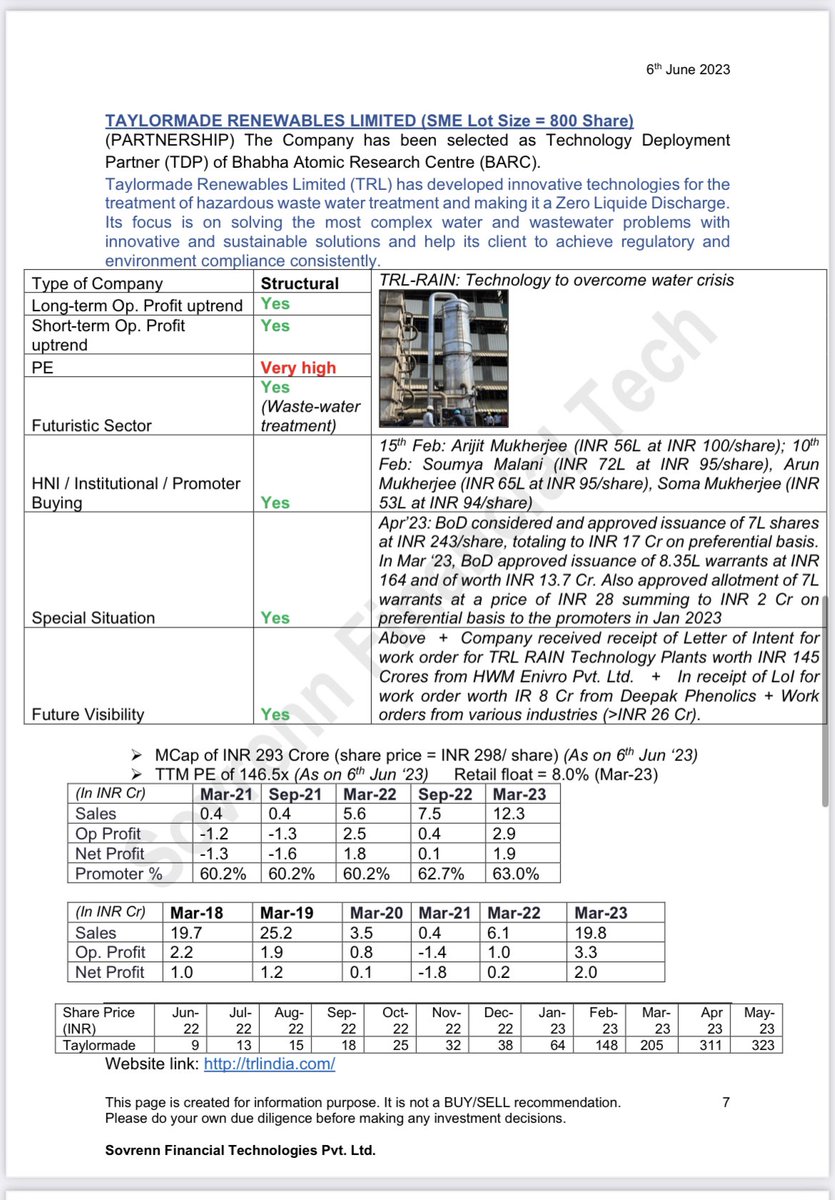

#TaylormadeRenewables: The Company has been selected as Technology Deployment Partner (TDP) of Bhabha Atomic Research Centre (BARC).

Buy sovrenn.com/times at Rs. 999 for 1 year and get Sovrenn Education free

Buy sovrenn.com/times at Rs. 999 for 1 year and get Sovrenn Education free

#BaluForge: Ecotek General Trading LLC bought 14.5L shares at INR 109/share, aggregating to INR 15.8Cr. Tano Investment Opportunity Funds sold the same quantity of shares at the same price.

Buy sovrenn.com/times at Rs. 999 for 1 year and get Sovrenn Education free

Buy sovrenn.com/times at Rs. 999 for 1 year and get Sovrenn Education free

#Exhicon: Vijay Kumar Pahwa bought 64k shares at INR 139/share, aggregating to INR 89L

Buy sovrenn.com/times at Rs. 999 for 1 year and get Sovrenn Education free

Buy sovrenn.com/times at Rs. 999 for 1 year and get Sovrenn Education free

Macro news: Vehicle sales for Mar’23 up by 10% on a YOY basis

Buy sovrenn.com/times at Rs. 999 for 1 year and get Sovrenn Education free

Buy sovrenn.com/times at Rs. 999 for 1 year and get Sovrenn Education free

For more such information, follow @sovrennofficial @SwaroopAkriti and @Aditya_joshi12

Please do retweet to spread awareness :)

Please do retweet to spread awareness :)

https://twitter.com/aditya_joshi12/status/1666428889806295043

• • •

Missing some Tweet in this thread? You can try to

force a refresh