WSJ reporter @GunjanJS writes, "When #BBBY filed for bankruptcy, it had a gaping hole in its financials: assets of $4.4b and liabilities of $5.2b," but are these numbers currently accurate?

This post looks into two strategies which create net-positive value for shareholders.

This post looks into two strategies which create net-positive value for shareholders.

To begin, these figures were reported in FY22 Q3 earnings for the period ending Nov 26th. Much has changed in the six+ months since.

These figures will not include $360m in equity capital from the Feb securities offering, nor the assuredly negative cash flow from operations.

These figures will not include $360m in equity capital from the Feb securities offering, nor the assuredly negative cash flow from operations.

The first category to address is the company's net operating losses (NOLs).

From bankruptcy docket #10 filed on Apr 23rd, "As of the end of February 25, 2023, the Debtors estimate they had NOLs in the amount of approximately $1.6 billion..."

From bankruptcy docket #10 filed on Apr 23rd, "As of the end of February 25, 2023, the Debtors estimate they had NOLs in the amount of approximately $1.6 billion..."

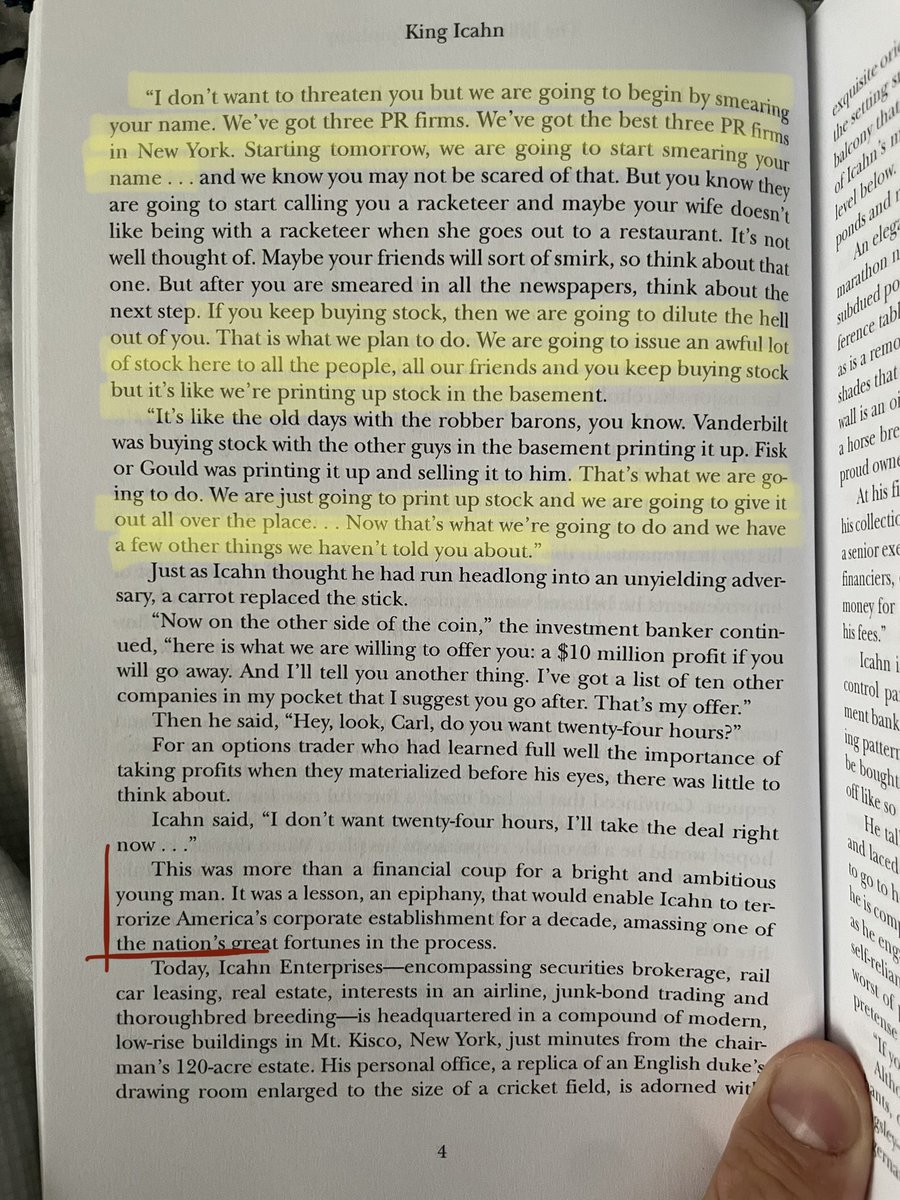

This excerpt from the book 'King Icahn' regarding NOLs with USX caught my eye,

"Corry argued that an immediate spin-off would be shortchanging the company on two fronts: It would fail to secure top dollar for the assets and it would squander $900m in tax-loss carry-forwards..."

"Corry argued that an immediate spin-off would be shortchanging the company on two fronts: It would fail to secure top dollar for the assets and it would squander $900m in tax-loss carry-forwards..."

It appears Section 382 imposes limitations on tax-loss carry-forwards of a company's NOLs in the event of an ownership change, which would jeopardize the Tax Attributes the company "earned" in FY22 had Bed Bath otherwise spun-off Baby or sold the business.

"In general, a loss corporation's NOLs will be subject to severe limitation upon a change of control which generally occurs under IRC s382 if the percentage of the stock loss corporation that is owned by 5% of shareholders increases by more than 50% over a 3-year testing period."

"...a partial exemption from the change in control limitation is available for an ownership change pursuant to a bankruptcy organization, so long as the historic ~shareholders~ and 'qualified creditors' of the debtor corporation own at least 50% of the value and voting power..."

Fortunately, no relevant parties own greater than 5% of Bed Bath's shares outstanding, noted from this Docket 345 list of relevant shareholders owning more than 4.5% equity.

And Docket 10 explicitly claims Bed Bath can leverage it's NOLs in the event of a transaction in bankruptcy,

"In addition, the Debtors may utilize such Tax Attributes to offset any taxable income generated by transactions consummated during these Chapter 11 Cases."

"In addition, the Debtors may utilize such Tax Attributes to offset any taxable income generated by transactions consummated during these Chapter 11 Cases."

Cohen did suggest in his letter to #BBBY he, "suspects Bed Bath's core business -excluding BABY -could generate attractive earnings."

It seems likely then any strategy to acquire Bed Bath last year would include bankruptcy proceedings to capture tax-loss carry-forwards.

It seems likely then any strategy to acquire Bed Bath last year would include bankruptcy proceedings to capture tax-loss carry-forwards.

In fact, Bed Bath may have schemed to maximize their NOLs in FY22 as incentive for future acquisition.

The company launched a business update following Q2 to be completed by end of FY22, including a transition in inventory and store closure program.

The company launched a business update following Q2 to be completed by end of FY22, including a transition in inventory and store closure program.

This work involved long-lived asset impairment testing performed by the company at length in preparing for their Jan Q3 earnings report.

$305m in expenses were incurred in the first nine months of the year for Impairments and Restructuring costs, up almost $200m year-over-year.

$305m in expenses were incurred in the first nine months of the year for Impairments and Restructuring costs, up almost $200m year-over-year.

The second category to address is the company's leasing valuation.

From the same Q3 10-Q, those figures include $1.39b in total lease assets against $1.76b in total lease liabilities (-$378m net-value).

From the same Q3 10-Q, those figures include $1.39b in total lease assets against $1.76b in total lease liabilities (-$378m net-value).

While in bankruptcy, however, Bed Bath appears to have it's unexpired lease agreements rejected by the courts. On May 5th (doc 225), the first round of 480 leases were rejected and on May 17th (doc 373), the second round of 476 leases were rejected.

These terminated leases constitute all of Bed Bath's retail footprint as they wind down operations. The first 480 leases represent stores closed in the past 12 months. The second 476 leases remained in operation as of the bankruptcy petition date, as noted.

Bed Bath is looking to sell their remaining lease assets, including their 475 operating stores as of the petition date (figures approximate, as noted).

The lease sale takes place over two phased auction events on June 26th and July 10th.

The lease sale takes place over two phased auction events on June 26th and July 10th.

The company suggests in Doc 10 they will receive $718m in proceeds for the auction sale of those 475 leases, validating the $1.39b book value of the original 955 stores.

If they can sell their lease assets for book value at auction, they can achieve $378m in shareholder value.

If they can sell their lease assets for book value at auction, they can achieve $378m in shareholder value.

Of note, Bed Bath had newly announced the closure of an additional 126 stores on Jan 30th and another 290 stores on Feb 7th. Only 11 of these were of the BABY variety.

This development tracks as an unnamed retailer is rumored to have interest in operating 75% of BABY stores.

This development tracks as an unnamed retailer is rumored to have interest in operating 75% of BABY stores.

These store closures came within days of Bed Bath onboarding two new members to it's Board and C-suite.

AlixPartners connections Carol Flaton and Holly Etlin were appointed on Jan 24th and Feb 2nd, respectively.

AlixPartners connections Carol Flaton and Holly Etlin were appointed on Jan 24th and Feb 2nd, respectively.

Curiously, the board of Bed Bath had their RSAs cash-exchange cancelled the same day Flaton was appointed, Jan 24th.

It's possible the new appointees schemed in Jan/Feb to rework the company's store footprint and ultimately restructure it's leasing debt in bankruptcy court.

It's possible the new appointees schemed in Jan/Feb to rework the company's store footprint and ultimately restructure it's leasing debt in bankruptcy court.

"There's a strategy behind everything. Everything fits. Thinking this way taught me to compete in many things"

"his determination to see 'the strategy behind everything', to decipher how the pieces of that strategy fit together, would make him the terror of the corporate world."

"his determination to see 'the strategy behind everything', to decipher how the pieces of that strategy fit together, would make him the terror of the corporate world."

An updated look at the gaping hole in the company's financials shows an outlook less bleak than reported.

$BBBY now has an est. $3.1b in assets w $1.6b in NOLs creating a tax-loss carry-forward, against $3.5b in debt including $1b in unsecured bonds, to review in my next post.

$BBBY now has an est. $3.1b in assets w $1.6b in NOLs creating a tax-loss carry-forward, against $3.5b in debt including $1b in unsecured bonds, to review in my next post.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter