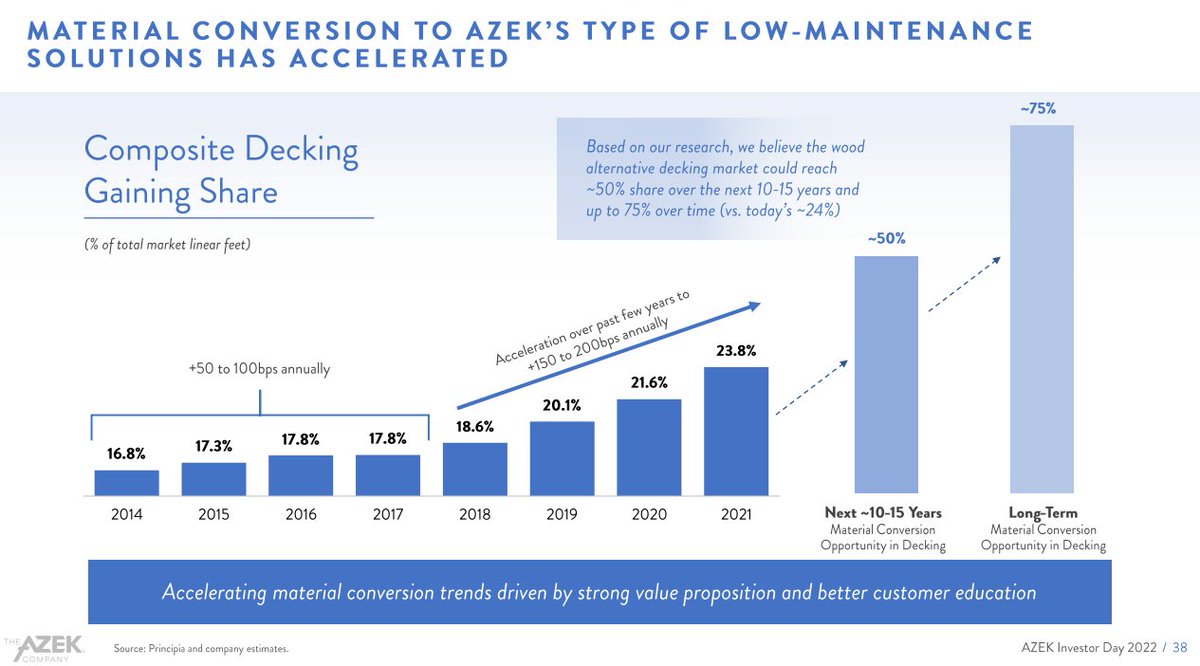

Composite decking made by companies like $TREX & $AZEK still only comprises ~24% of total decking used (in linear ft) despite a vastly superior value proposition vs. wood

Large secular growth opportunity long term as an increasing number of decks built convert to composites

Large secular growth opportunity long term as an increasing number of decks built convert to composites

Both $TREX & $AZEK see ~50-75% share possible long term, providing ~2-3x industry upside

this is before other growth factors that further add to the industries growth opportunity

(i.e. total R&R growth, total decks built, intl expansion, price increases, etc.)

this is before other growth factors that further add to the industries growth opportunity

(i.e. total R&R growth, total decks built, intl expansion, price increases, etc.)

Given $TREX and $AZEK's attractive duopoly, commanding combined ~80% share, nearly all the industries incremental growth should accrue to them

A wide swatch of competitive advantages, high barriers to entry and unique characteristics inherent in the building products space around distribution and contractor, dealer & distributor loyalty make $TREX and $AZEK's duopolistic position highly defensible

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter