#NIIT All about NIIT Demerger. So, NIIT demerger happened and the B2C business now trades at Rs 98. The HIGHLY profitable B2B business is yet to be listed but here is brief analysis.

NIIT has 2 businesses:

B2C: NIIT Limited: Retail learning

B2B: Corporate Learning

NIIT has 2 businesses:

B2C: NIIT Limited: Retail learning

B2B: Corporate Learning

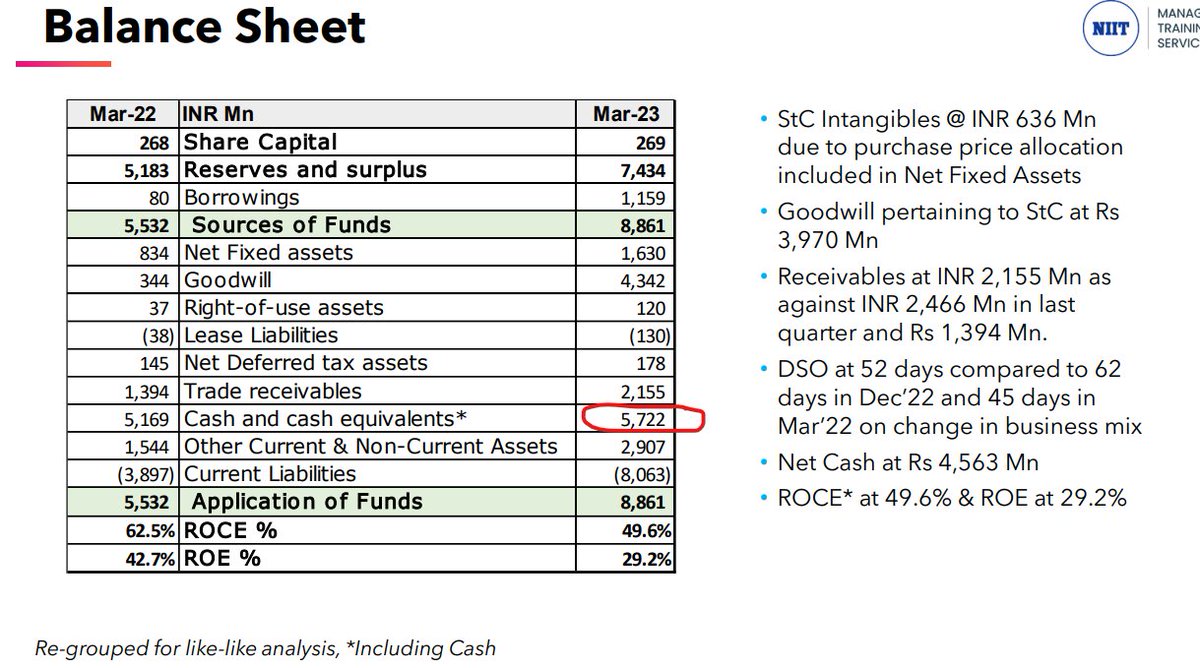

The B2C business is more volatile and did just a breakeven this year where as the corporate learning business is high growth high margin business. Here is P&L for B2B business. So, in B2B, we are getting a 20% growth business at 23% EBITDA margin doing ~200 Cr of PAT

Coming to B2C (NIIT Ltd) business which remains listed and now trades at Rs 98 compared to pre-demerged price of Rs 400, it has a sales of Rs 314 Cr and merely does any profit. Here is the P&L

Now, this is how post demerger scenario looks like. All holding 1 share of NIIT Ltd pre demerger will get 1 share each of both companies post demerger. So, totally, 13.5 Cr shares of both companies will trade.

B2C (NIIT Ltd): At current price of Rs 98, this trades at Rs 1300 Cr

B2C (NIIT Ltd): At current price of Rs 98, this trades at Rs 1300 Cr

valuation with Rs 715 cr cash, Rs 314 Cr of sales and a fluctuating profit. The pre-merger price of Rs 400 had a market capitalization of Rs 5400 Cr which leaves Rs 4100 Cr valuation for to be listed B2B business if assume the same Rs 5400 market capitalization remains. So, we

will get a Rs 200 Cr PAT business with 23% EBITDA margin growing at 20% with Rs 500 cash on books at 20x multiple. The question to ask now is:

Do these 2 businesses deserve a better valuation than above stated scenario or lesser and there the answer would lie if we will value

Do these 2 businesses deserve a better valuation than above stated scenario or lesser and there the answer would lie if we will value

creating or value destructing. Disc: have a pre demerger position at Rs 380. Transacted in last 30 days. I may buy or sell without informing. Alos, these number been taken from latest price data and there could be an error. Please do your own due diligence.

If interested in tracking financial markets, you may follow me. Also, you may subscribe to our youtube channel. Thanks for reading. Like & RT for wider reach 🙏

youtube.com/ScientificInve…

youtube.com/ScientificInve…

• • •

Missing some Tweet in this thread? You can try to

force a refresh