Sharing Sovrenn Times for yesterday so that everyone knows how it looks like. Please retweet for maximum reach 😀

Get Sovrenn Times at Rs. 999 per year. Link below:

Sovrenn.com/times

Sovrenn Times (8 June edition)

#Aurionpro: Aurionpro becomes 1st Indian company to… twitter.com/i/web/status/1…

Get Sovrenn Times at Rs. 999 per year. Link below:

Sovrenn.com/times

Sovrenn Times (8 June edition)

#Aurionpro: Aurionpro becomes 1st Indian company to… twitter.com/i/web/status/1…

#VaTechWabag: Company has secured an order for Designing, Building and Operating of a Water Treatment Plant with a capacity of 270 Million Litres per Day (MLD) worth INR 420 Cr from City and Industrial Development Corporation (CIDCO) Maharashtra.

Get Sovrenn Times at Rs. 999 per… twitter.com/i/web/status/1…

Get Sovrenn Times at Rs. 999 per… twitter.com/i/web/status/1…

#ZenTechnologies: Zen Technologies Limited secured an order of worth INR 202 Cr from the Ministry of Defence, Government of India. Company looks forward to securing additional sizeable contracts within the next quarter.

Get Sovrenn Times at Rs. 999 per year. Link below:… twitter.com/i/web/status/1…

Get Sovrenn Times at Rs. 999 per year. Link below:… twitter.com/i/web/status/1…

#KPEnergy: Company successfully completed development activities and charged the 140MW power evacuation system for wind-solar hybrid power project at Fulsar site in Taluka Talaja, District Bhavnagar, Gujarat. The power evacuation system comprised of 140MW hybrid Pooling… twitter.com/i/web/status/1…

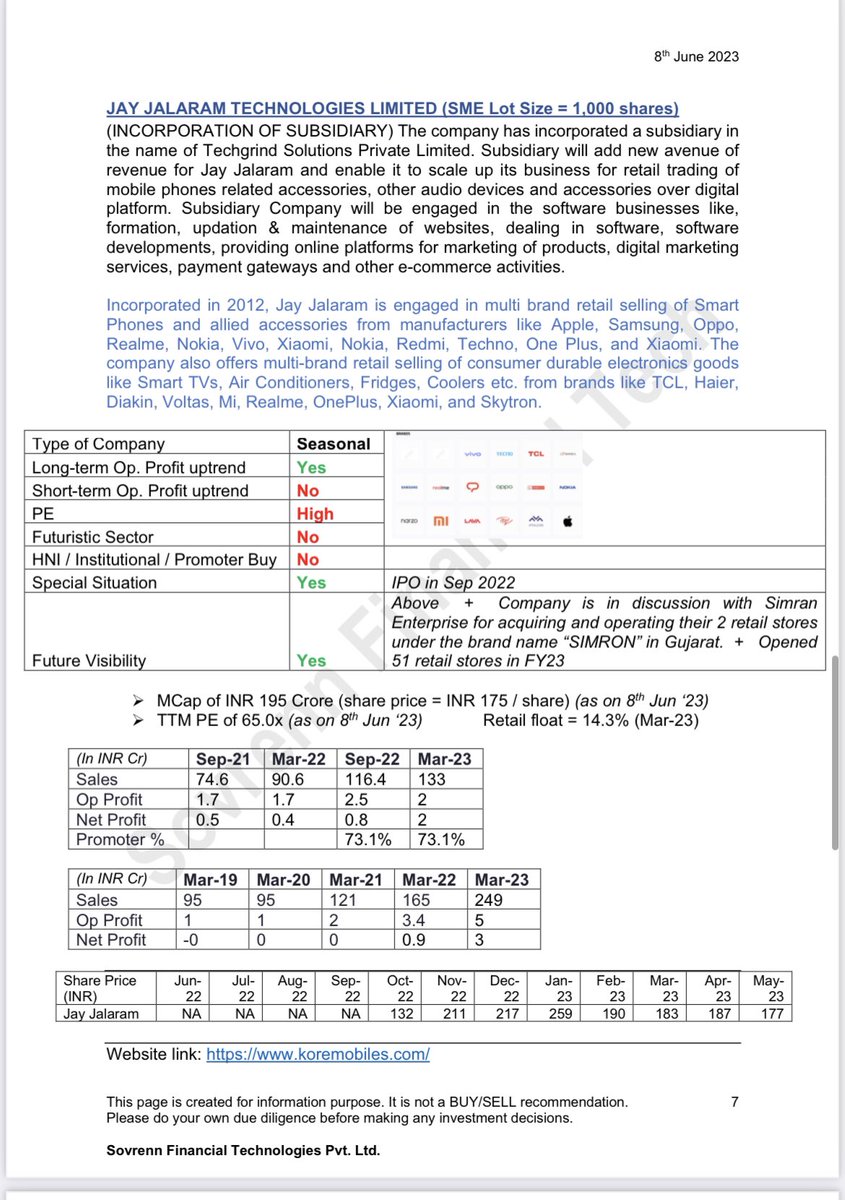

#JayJalaram: The company has incorporated a subsidiary in the name of Techgrind Solutions Private Limited. Subsidiary will add new avenue of revenue for Jay Jalaram and enable it to scale up its business for retail trading of mobile phones related accessories, other audio devices… twitter.com/i/web/status/1…

Please follow us at @sovrennofficial

Kindly Retweet so that everyone gets access to high quality information 😀

Kindly Retweet so that everyone gets access to high quality information 😀

https://twitter.com/aditya_joshi12/status/1667167120550170624

• • •

Missing some Tweet in this thread? You can try to

force a refresh