Technical Analysis 101🎯

6 Powerful & Simple Price action strategies...📉

...to easily spot the Beginning/End of an

UpTrend/Downtrend in all timeframes & Markets!💹

Ready to Learn?🤓

Let’s go…🧵

#Learnwithtrendlineinvestor

6 Powerful & Simple Price action strategies...📉

...to easily spot the Beginning/End of an

UpTrend/Downtrend in all timeframes & Markets!💹

Ready to Learn?🤓

Let’s go…🧵

#Learnwithtrendlineinvestor

1 -> A Trend Persists until Its Reversal Is Indicated

- In Dow Theory, a trend is assumed to persist until there is evidence to the contrary

- Trend changes are identified by a penetration of a previous significant High or Low

- In Dow Theory, a trend is assumed to persist until there is evidence to the contrary

- Trend changes are identified by a penetration of a previous significant High or Low

2 -> How to identify the end of an uptrend?📈

There are basically 3⃣ types of reversal formations that will signal a change in the direction from uptrend to downtrend

✅ Failure Swing

✅ Non-Failure Swing

✅ Double Top sell

Let's look at them in detail!👀

Save this Image👇

There are basically 3⃣ types of reversal formations that will signal a change in the direction from uptrend to downtrend

✅ Failure Swing

✅ Non-Failure Swing

✅ Double Top sell

Let's look at them in detail!👀

Save this Image👇

Fancy watching a video explanation rather than reading?😀

Watch this video where I explain all of the 'Top Reversal formations'!👀

If not, read on!📚

Watch this video where I explain all of the 'Top Reversal formations'!👀

If not, read on!📚

2.1 -> Failure Swing Reversal

- Price needs to make a high

- followed by a 2nd high which should be a lower high

- Price should now break the Swing Low between these two highs thus generating a Sell signal & signalling the end of a long term uptrend

- Price needs to make a high

- followed by a 2nd high which should be a lower high

- Price should now break the Swing Low between these two highs thus generating a Sell signal & signalling the end of a long term uptrend

2.2 -> Non-failure Swing Reversal

- Price makes a high & then a higher high

- Price should now break the previous swing low, creates a lower low

- Price rises again but fails to cross the previous higher high, creates a lower high

- Price breaks the lower low to generate a sell

- Price makes a high & then a higher high

- Price should now break the previous swing low, creates a lower low

- Price rises again but fails to cross the previous higher high, creates a lower high

- Price breaks the lower low to generate a sell

2.3 -> Double top Reversal

- Price makes a two similar highs

- Price should now break the swing low between the highs thus generating a sell signal

Depending on the position size in the trade, one can wait for a close or sell immediately when price crosses swing low

- Price makes a two similar highs

- Price should now break the swing low between the highs thus generating a sell signal

Depending on the position size in the trade, one can wait for a close or sell immediately when price crosses swing low

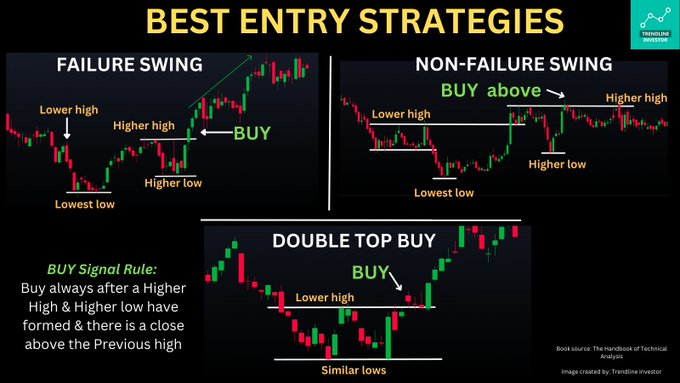

3 -> How to identify the end of a downtrend?

Again, there are 3⃣ types of reversal formations that signal a trend change from down to uptrend

✅ Failure Swing

✅ Non-Failure Swing

✅ Double Top sell

Yes, the names are the same!

Let's look at them in detail👀

Save this Image👇

Again, there are 3⃣ types of reversal formations that signal a trend change from down to uptrend

✅ Failure Swing

✅ Non-Failure Swing

✅ Double Top sell

Yes, the names are the same!

Let's look at them in detail👀

Save this Image👇

Watch this video where I explain all these 3 bottom reversal formations!

If not, read on!📚

If not, read on!📚

3.1 -> Failure Swing Reversal

- Price needs to make a Low & rise

- Price should drop again but shouldn't cross previous low - creating a higher low

- Price should now break the high between these two lows thus generating a Buy signal & signalling the end of a long term downtrend

- Price needs to make a Low & rise

- Price should drop again but shouldn't cross previous low - creating a higher low

- Price should now break the high between these two lows thus generating a Buy signal & signalling the end of a long term downtrend

3.2 -> Non-failure Swing Reversal

- Price makes a low & then a lowest low

- Price should now go straight up above the previous lower high creating a Higher high

- Price should now drop to create a Higher low

- Price should break the Higher high to generate a Buy Signal

- Price makes a low & then a lowest low

- Price should now go straight up above the previous lower high creating a Higher high

- Price should now drop to create a Higher low

- Price should break the Higher high to generate a Buy Signal

3.3 -> Double bottom Reversal

- Price makes a two similar Lows

- Price should now break the swing high between the lows thus generating a Buy signal

Stop loss for all formations will be either Swing high or Swing low depending on Uptrend/Downtrend

- Price makes a two similar Lows

- Price should now break the swing high between the lows thus generating a Buy signal

Stop loss for all formations will be either Swing high or Swing low depending on Uptrend/Downtrend

4 -> Pro-tip for investing/Trading

- The longer the timeframe the more stronger the signals are

- For Swing/Positional trading use Daily charts

- For Investing use Weekly/Monthly charts

- The longer the timeframe the more stronger the signals are

- For Swing/Positional trading use Daily charts

- For Investing use Weekly/Monthly charts

Learnt something? If yes, please👇

1. Retweet the first tweet

2. Follow @dmdsplyinvestor

3. Subscribe to my YouTube channel for more content! youtube.com/c/TrendlineInv…

1. Retweet the first tweet

https://twitter.com/dmdsplyinvestor/status/1667387643162681344?s=20

2. Follow @dmdsplyinvestor

3. Subscribe to my YouTube channel for more content! youtube.com/c/TrendlineInv…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter