Bridges in the Multi-chain of Madness

The siloed liquidity of blockchains has become a nuisance for users trying to explore the multi-chain universe.

A number of bridges have emerged to serve this critical need.

How does the bridging landscape look like today?

Let’s find out:

The siloed liquidity of blockchains has become a nuisance for users trying to explore the multi-chain universe.

A number of bridges have emerged to serve this critical need.

How does the bridging landscape look like today?

Let’s find out:

2/ Foreword

For this comparative analysis, only multi-chain bridges are included, in a period from January to May 2023. Also, native bridges exclusively between L2s and Ethereum are not analyzed.

For this comparative analysis, only multi-chain bridges are included, in a period from January to May 2023. Also, native bridges exclusively between L2s and Ethereum are not analyzed.

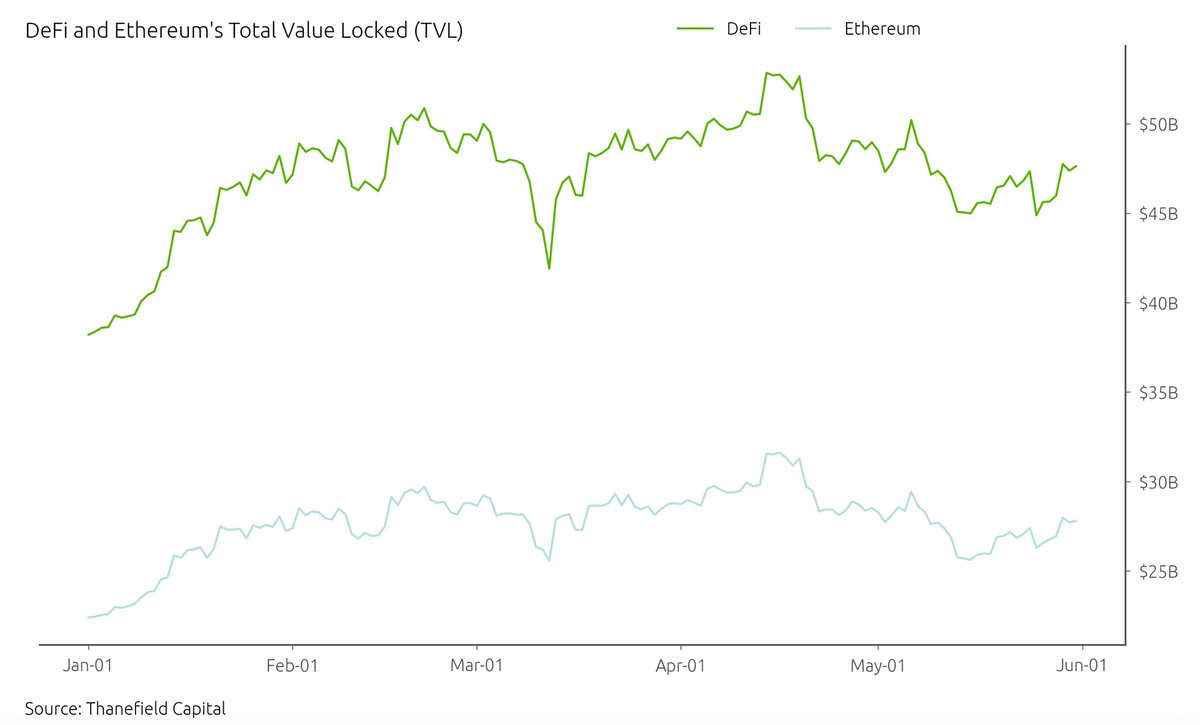

3/ Ethereum makes up 58% of DeFi TVL

The total TVL in DeFi is $47.6B, with Ethereum making up for $27.8B of it.

As the blockchain with the highest liquidity, other networks will seek to draw a portion of the liquidity to themselves.

The total TVL in DeFi is $47.6B, with Ethereum making up for $27.8B of it.

As the blockchain with the highest liquidity, other networks will seek to draw a portion of the liquidity to themselves.

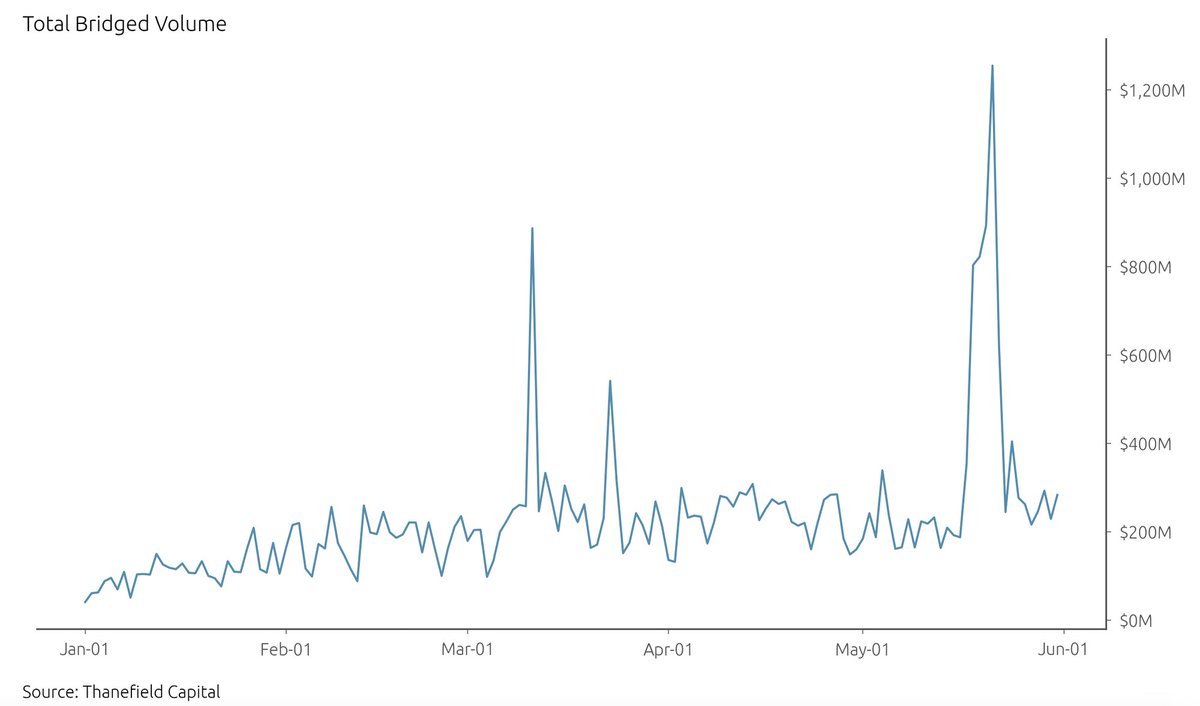

4/ Total bridged volume is increasing

Bridging solutions have facilitated an average daily volume of $225M, representing less than 1% of Ethereum’s total TVL.

Let’s dive in to the analysis:

Bridging solutions have facilitated an average daily volume of $225M, representing less than 1% of Ethereum’s total TVL.

Let’s dive in to the analysis:

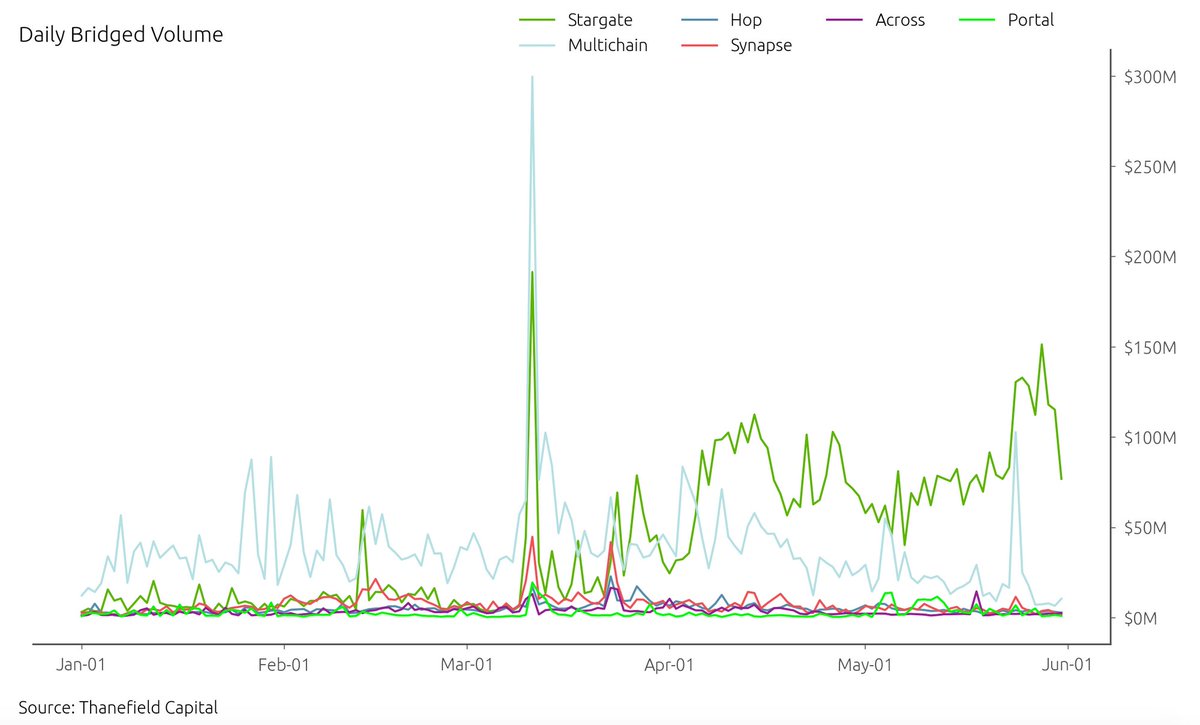

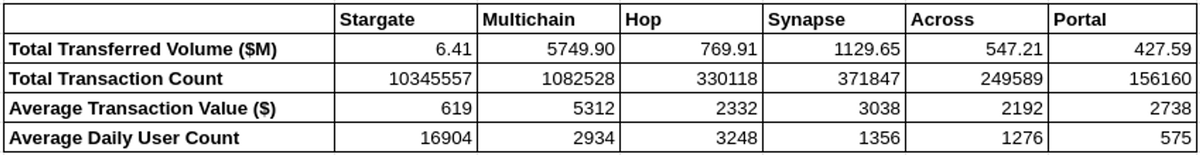

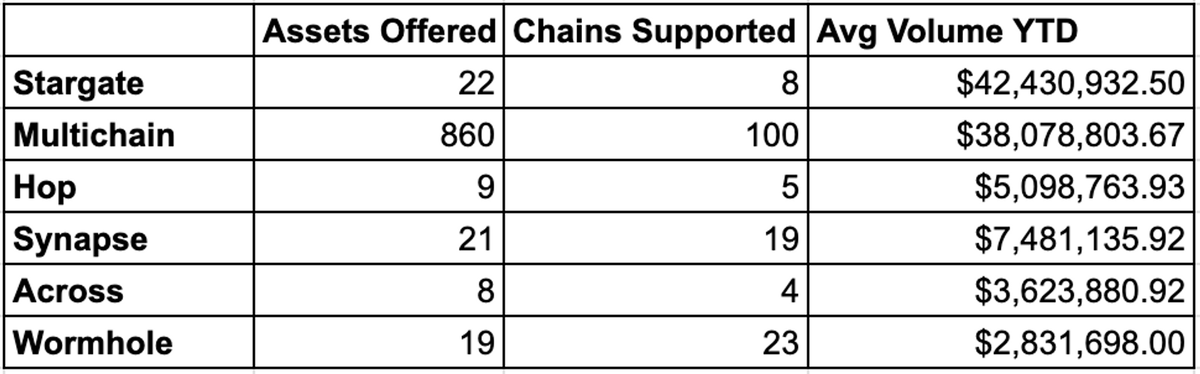

5/ Stargate has facilitated 42.9% of total bridged volume

Stargate is the most used bridge, with an average of $42.4M in bridged volume.

Next comes Multichain at 38.5%, with an average of $38M.

Stargate is the most used bridge, with an average of $42.4M in bridged volume.

Next comes Multichain at 38.5%, with an average of $38M.

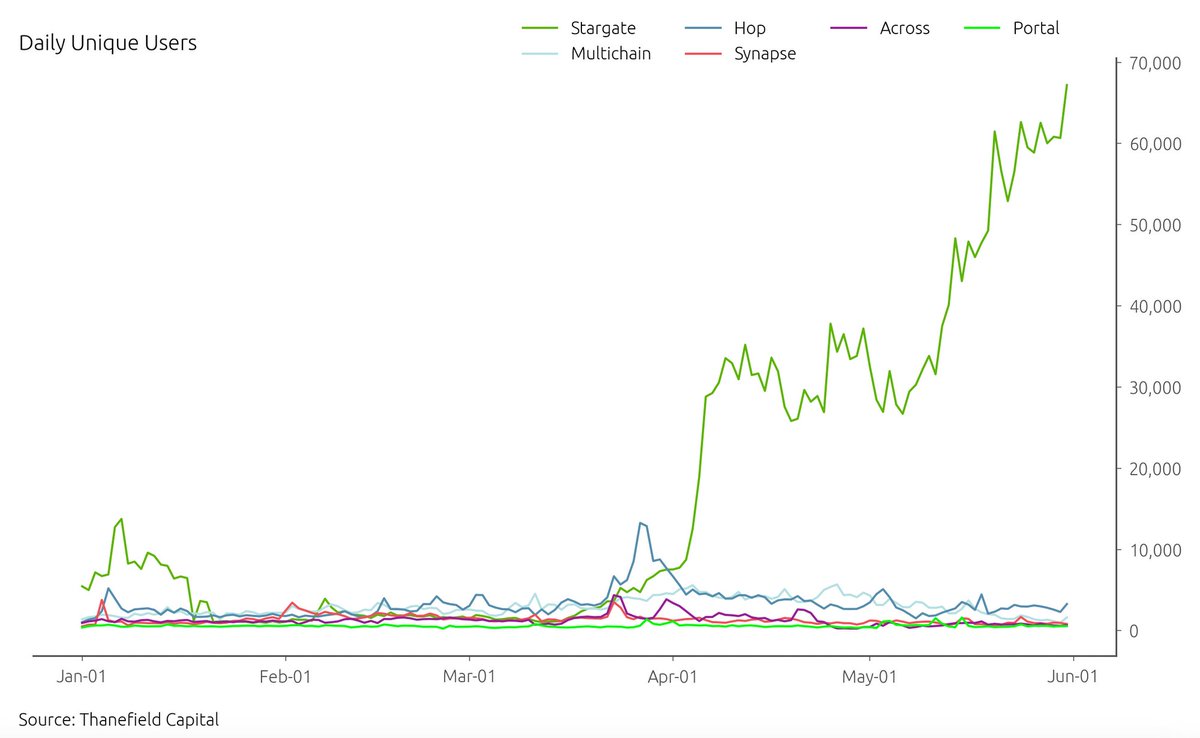

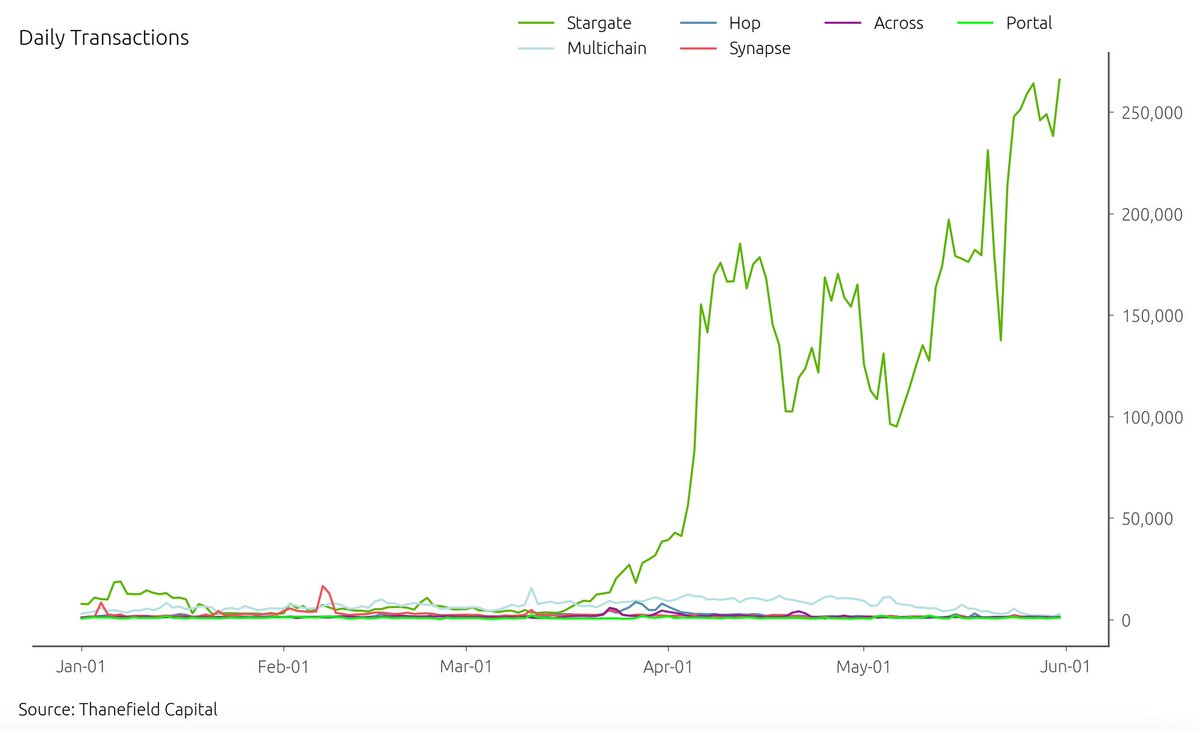

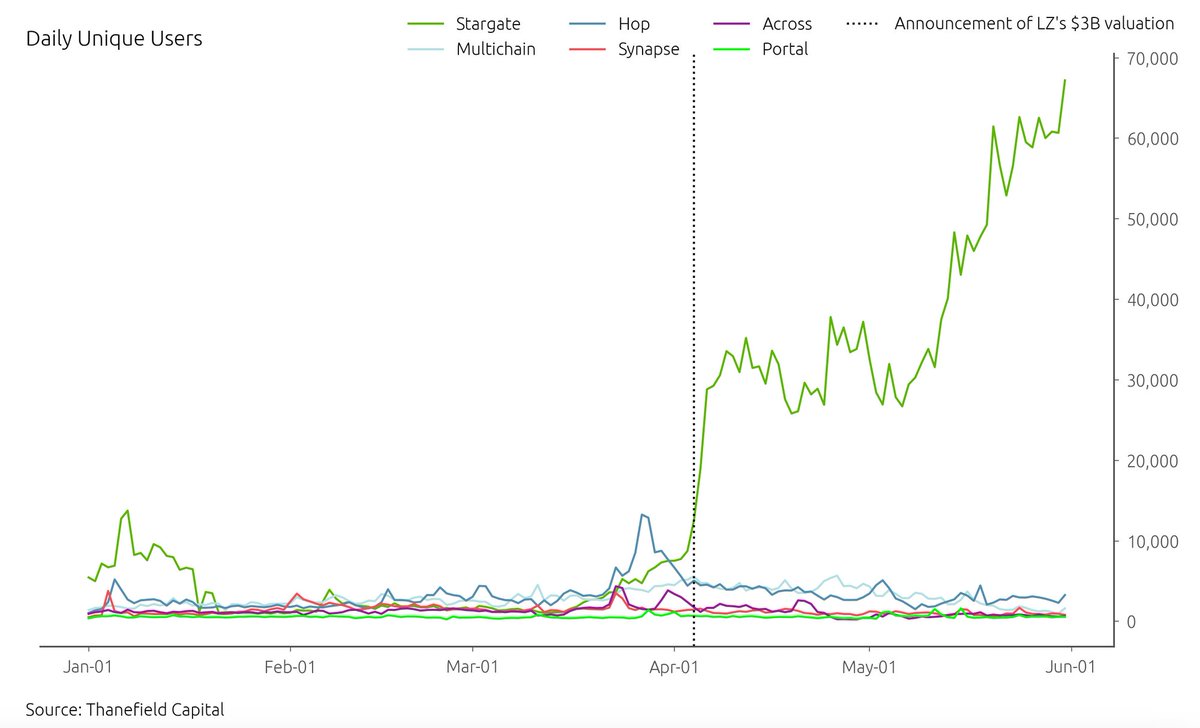

6/ Stargate dominates in unique users and transactions

Stargate contributes to 82.5% of transactions and 64.3% of unique users, averaging 68k transactions and 17k users daily.

It is followed by Multichain with 7k transactions and 3k users, an almost 90% decrease from the leader

Stargate contributes to 82.5% of transactions and 64.3% of unique users, averaging 68k transactions and 17k users daily.

It is followed by Multichain with 7k transactions and 3k users, an almost 90% decrease from the leader

7/ Multichain has facilitated an average of $5.3k in transaction value

On the lower end of the spectrum, Stargate saw $619 in average transaction value.

This metric, paired with the number of users, suggests that Stargate is the go-to bridge for the average user.

On the lower end of the spectrum, Stargate saw $619 in average transaction value.

This metric, paired with the number of users, suggests that Stargate is the go-to bridge for the average user.

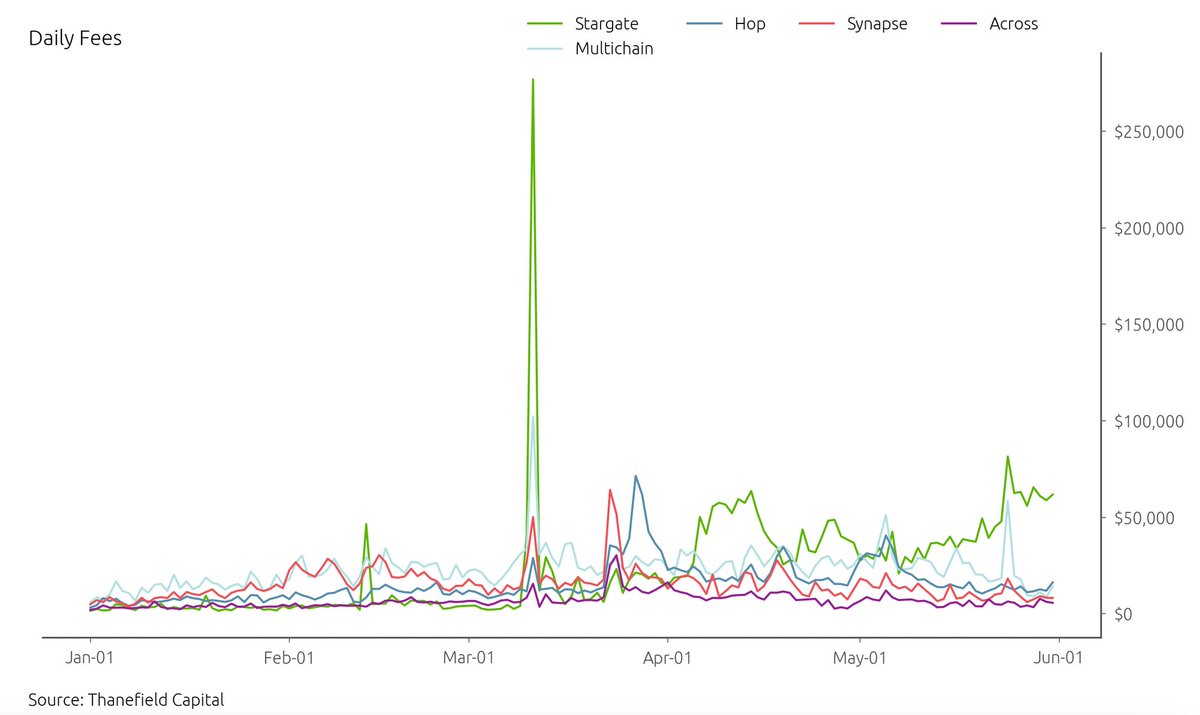

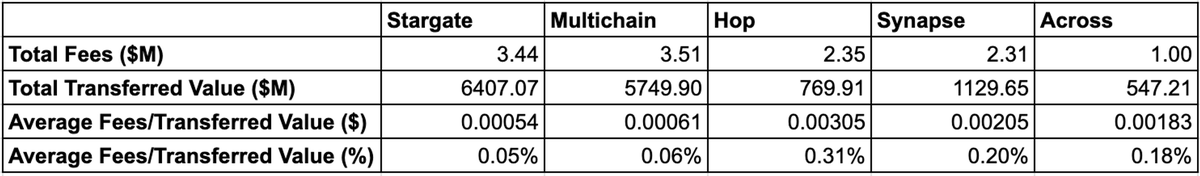

8/ Multichain has generated a total of $3.5M in fees

Multichain averages $23.2k in daily fees, contributing to 27.8% of the total fees generated.

They are closely followed by Stargate with $3.4M of total fees generated, with an average of $22.7k daily fees.

Multichain averages $23.2k in daily fees, contributing to 27.8% of the total fees generated.

They are closely followed by Stargate with $3.4M of total fees generated, with an average of $22.7k daily fees.

9/ Stargate has collected an average of 0.0005$ per $1 transferred value

This amounts to a 0.05% fee on every transaction, and is the lowest among all bridges.

Hop Protocol, on the other hand, is the highest one at an average of 0.31% fees.

This amounts to a 0.05% fee on every transaction, and is the lowest among all bridges.

Hop Protocol, on the other hand, is the highest one at an average of 0.31% fees.

10/ Musings

As the cross-chain future comes into fruition, users will be drawn to bridges that supports the greatest number of assets and chains while charging the lowest fees.

In this aspect, Multichain is well-positioned, as it leads in number of supported assets and chains.

As the cross-chain future comes into fruition, users will be drawn to bridges that supports the greatest number of assets and chains while charging the lowest fees.

In this aspect, Multichain is well-positioned, as it leads in number of supported assets and chains.

11/

However, user and transaction metrics indicate that Stargate is currently the most popular bridge to use, facilitating the largest transfer volume for the greatest number of users.

Stargate’s popularity could be due to users gaining exposure for a potential LayerZero airdrop

However, user and transaction metrics indicate that Stargate is currently the most popular bridge to use, facilitating the largest transfer volume for the greatest number of users.

Stargate’s popularity could be due to users gaining exposure for a potential LayerZero airdrop

12/

In conclusion, Stargate, leading in bridged volume and user base with its low-fee structure, is well-positioned to dominate the growing multi-chain landscape.

As DeFi evolves, bridging will become increasingly important and will be vital in shaping the multi-chain future.

In conclusion, Stargate, leading in bridged volume and user base with its low-fee structure, is well-positioned to dominate the growing multi-chain landscape.

As DeFi evolves, bridging will become increasingly important and will be vital in shaping the multi-chain future.

• • •

Missing some Tweet in this thread? You can try to

force a refresh