@ThanefieldCap

Venture & Market Research

TG: https://t.co/q6cmmpf4zG

How to get URL link on X (Twitter) App

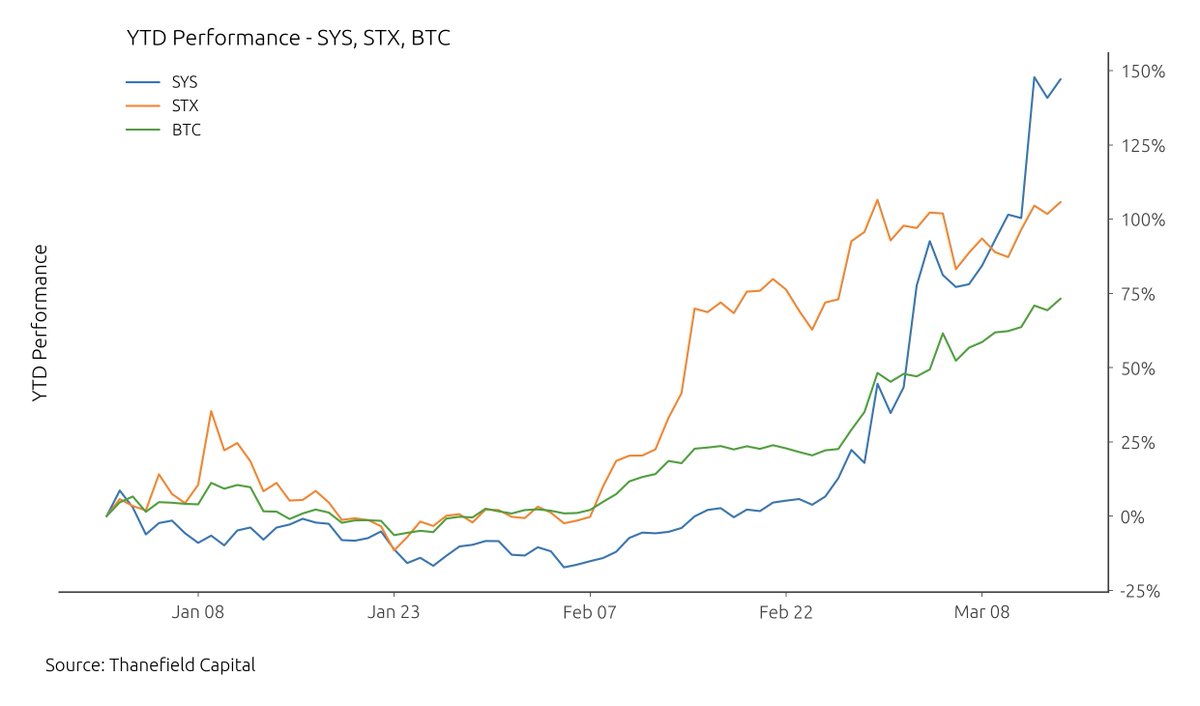

Of the projects with existing tokens, we highlight $STX (@Stacks) and $SYS (@syscoin), both of which have traded as beta to bitcoin and have significantly outperformed BTC YTD.

Of the projects with existing tokens, we highlight $STX (@Stacks) and $SYS (@syscoin), both of which have traded as beta to bitcoin and have significantly outperformed BTC YTD.

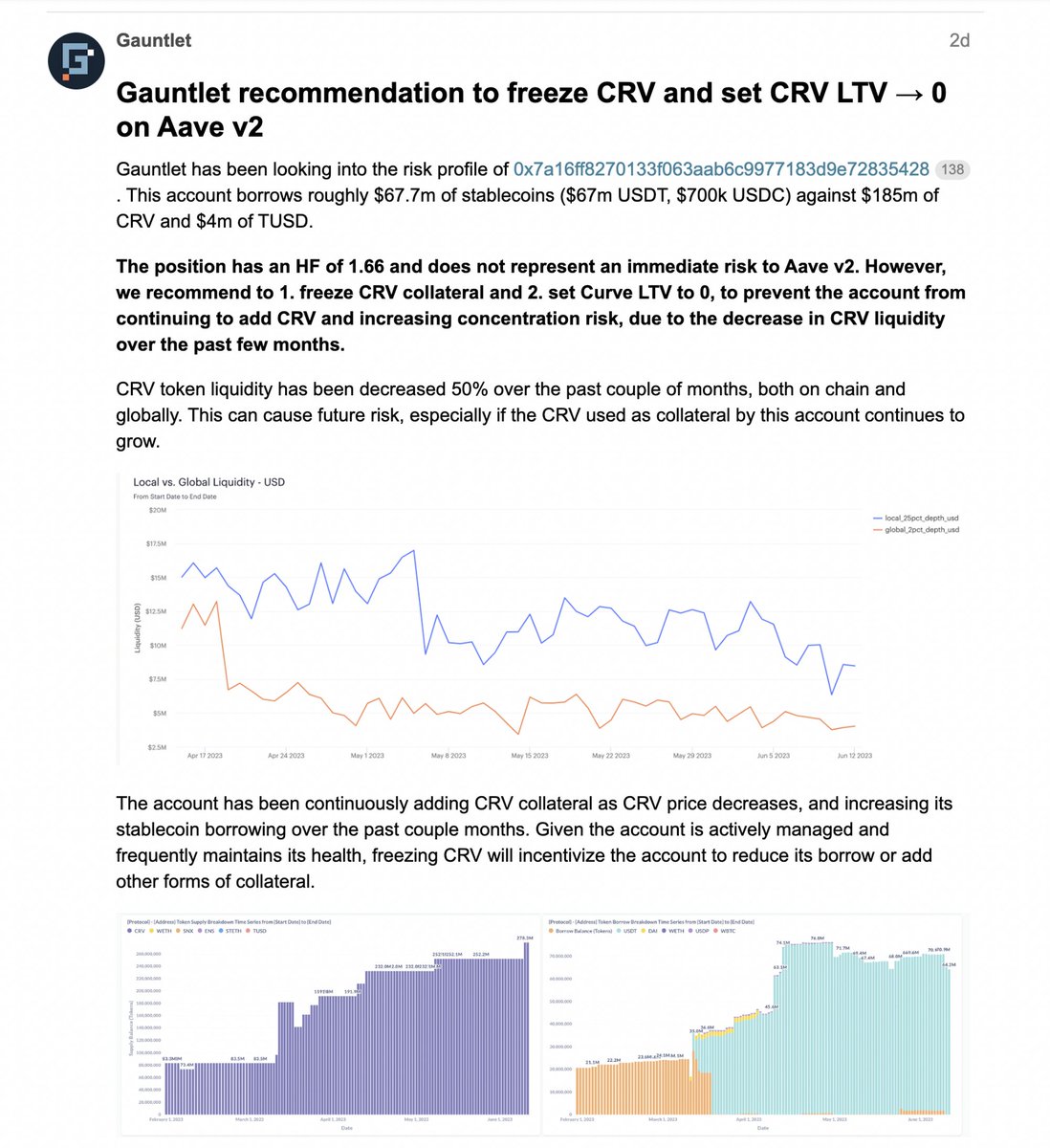

2/ Given these risks, new deposits and loans have been paused on Aave V2.

2/ Given these risks, new deposits and loans have been paused on Aave V2.

2/ Foreword

2/ Foreword

2/ Trading volume has increased by 38% the past two months, with total daily trading volume increasing from $931M to $1288M.

2/ Trading volume has increased by 38% the past two months, with total daily trading volume increasing from $931M to $1288M.

2/ 40% of all Fantom assets, excluding its native $FTM token, are issued by Multichain.

2/ 40% of all Fantom assets, excluding its native $FTM token, are issued by Multichain.

2/ Following Lido V2, the interest in staked $ETH remains strong.

2/ Following Lido V2, the interest in staked $ETH remains strong.

1/ 66% decrease in bridged amount

1/ 66% decrease in bridged amount

1/ First comes 0x4a2c, famously known as dimethyltryptamine.eth.

1/ First comes 0x4a2c, famously known as dimethyltryptamine.eth.

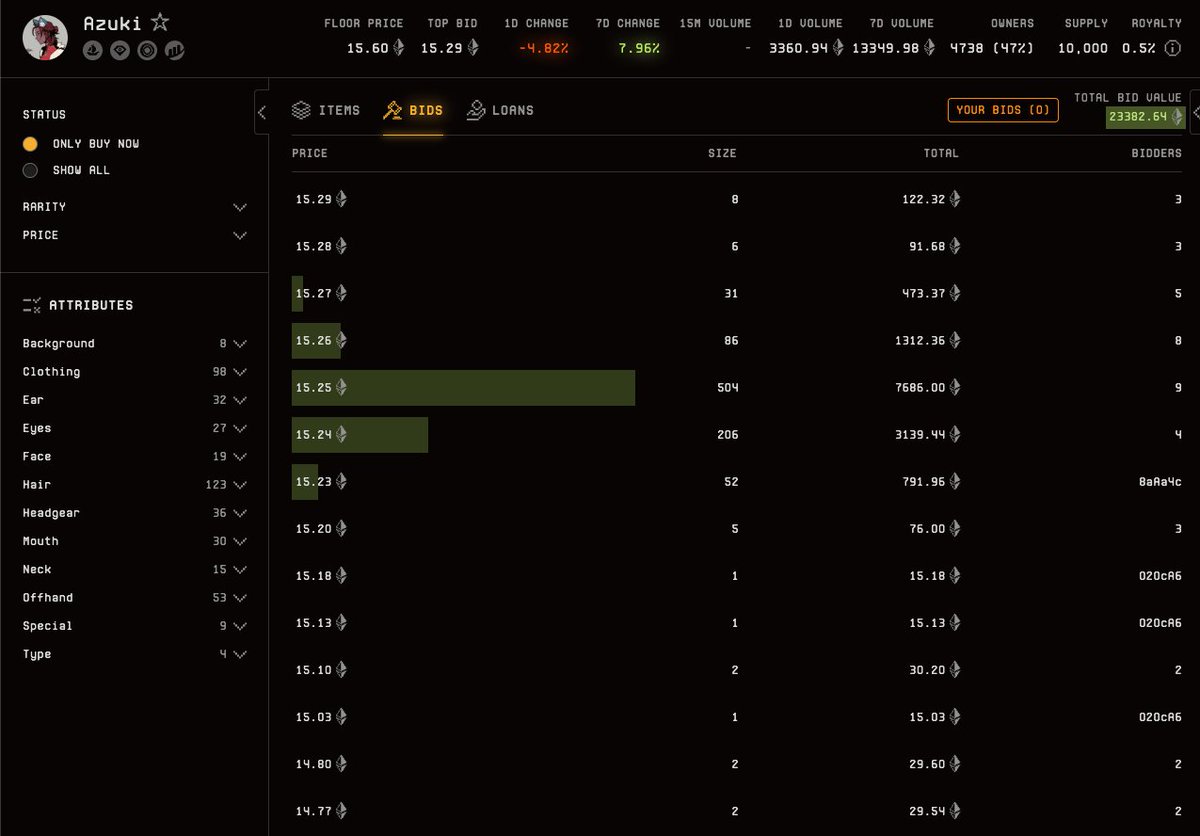

2/ Blur’s strategy

2/ Blur’s strategy

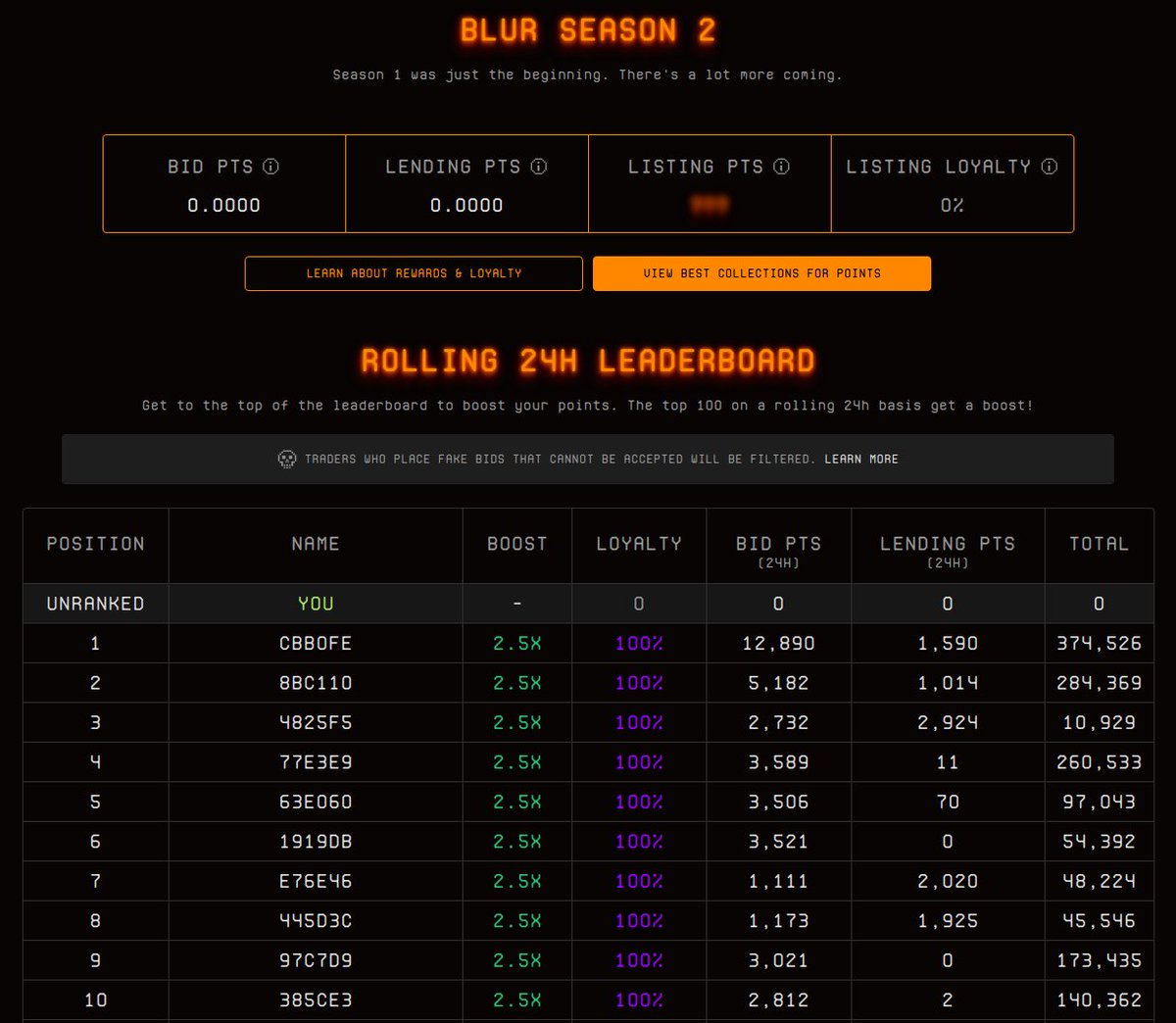

2/ 0x8BC11, a Blur power user, ranks #2 on the Rolling 24H Leaderboard with almost 7000 $ETH ($12.7M) deposited into the Blur Pool for bids. Major deposits include 2000 $ETH added 49 days ago and 4000 $ETH added 21 days ago.

2/ 0x8BC11, a Blur power user, ranks #2 on the Rolling 24H Leaderboard with almost 7000 $ETH ($12.7M) deposited into the Blur Pool for bids. Major deposits include 2000 $ETH added 49 days ago and 4000 $ETH added 21 days ago.

2/ What is Blend?

2/ What is Blend?

2/ When analyzing the distribution of trades on Uniswap V2, we spotted some unusual activity.

2/ When analyzing the distribution of trades on Uniswap V2, we spotted some unusual activity.

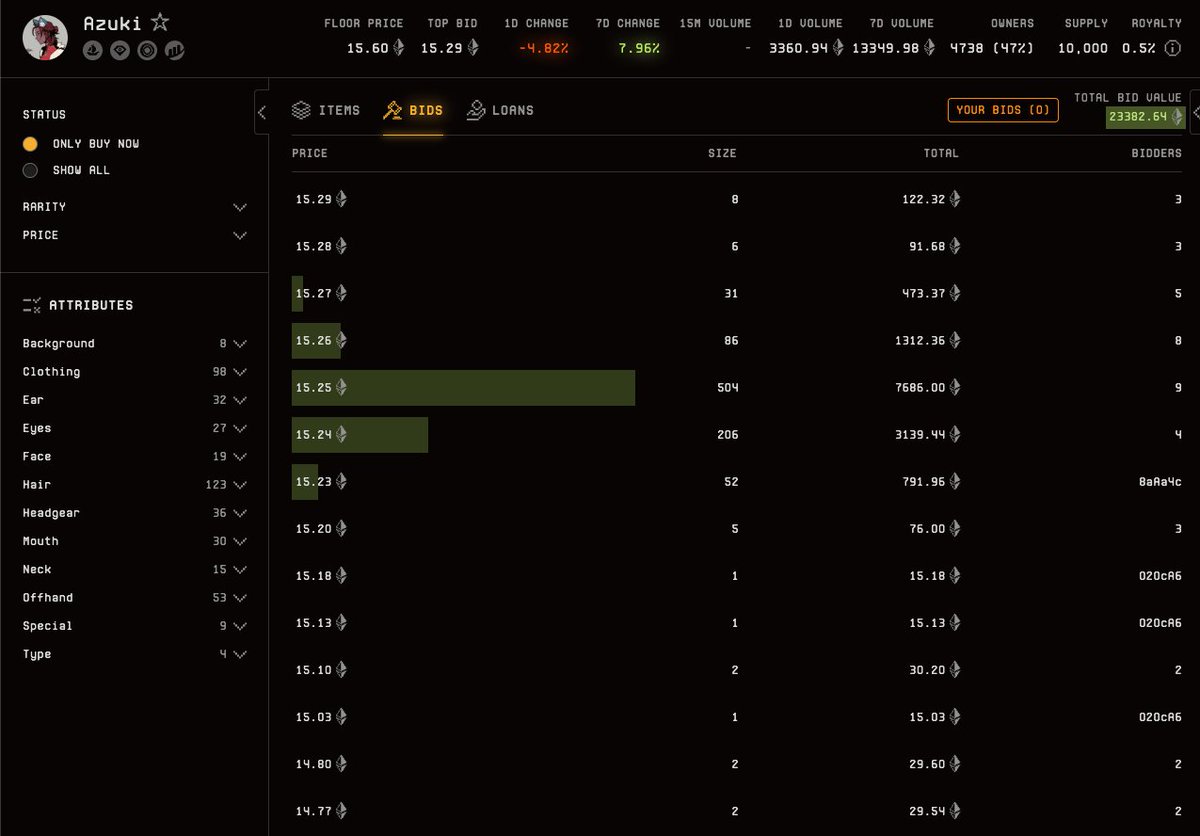

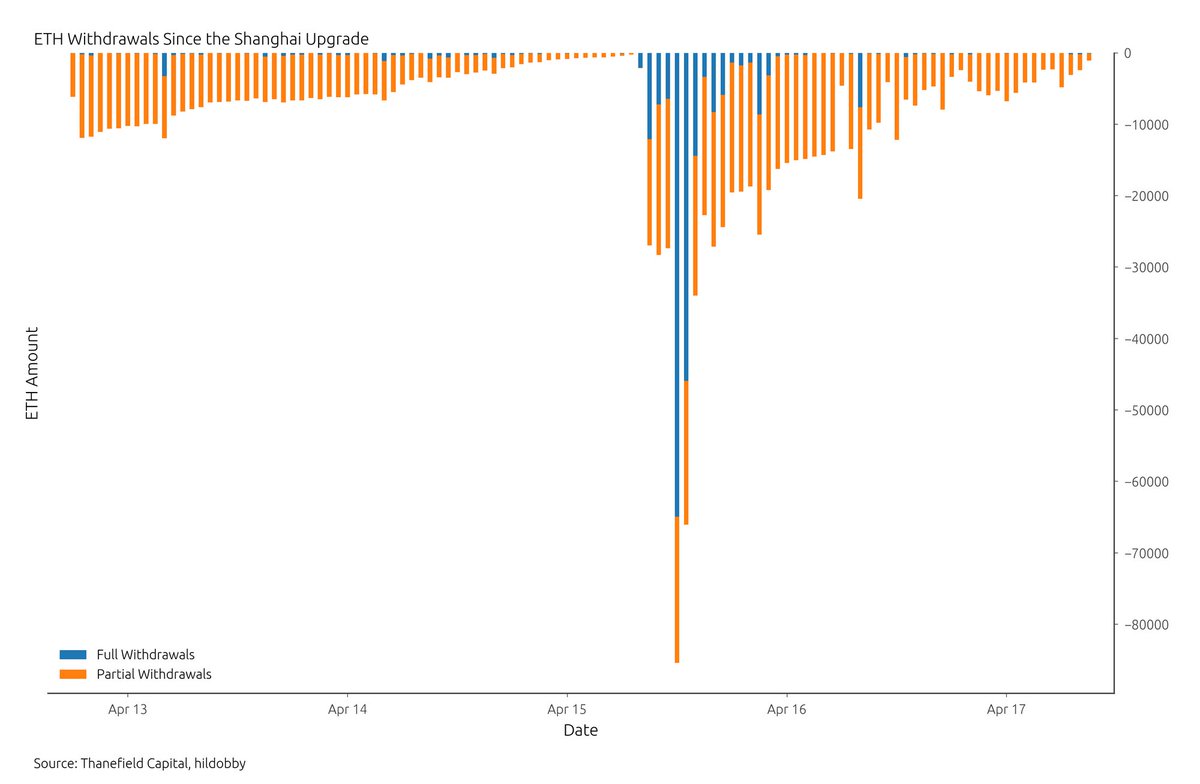

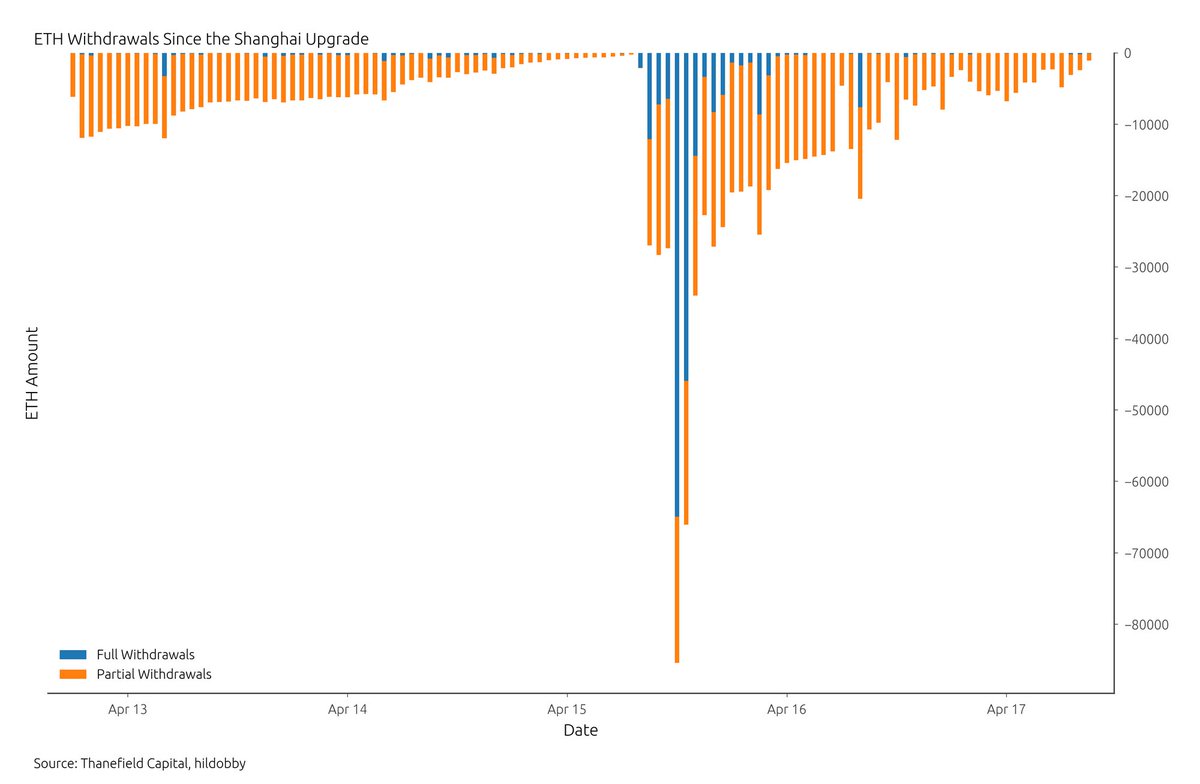

2/ For context, here are the key metrics since April 12th:

2/ For context, here are the key metrics since April 12th:

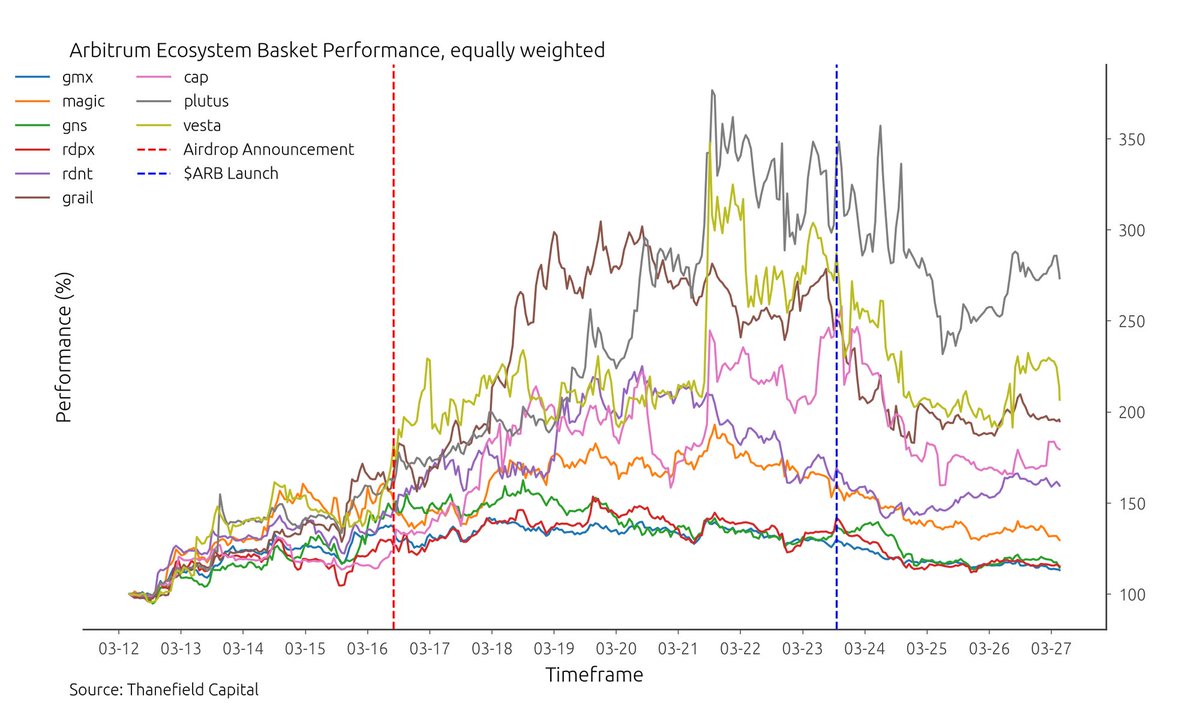

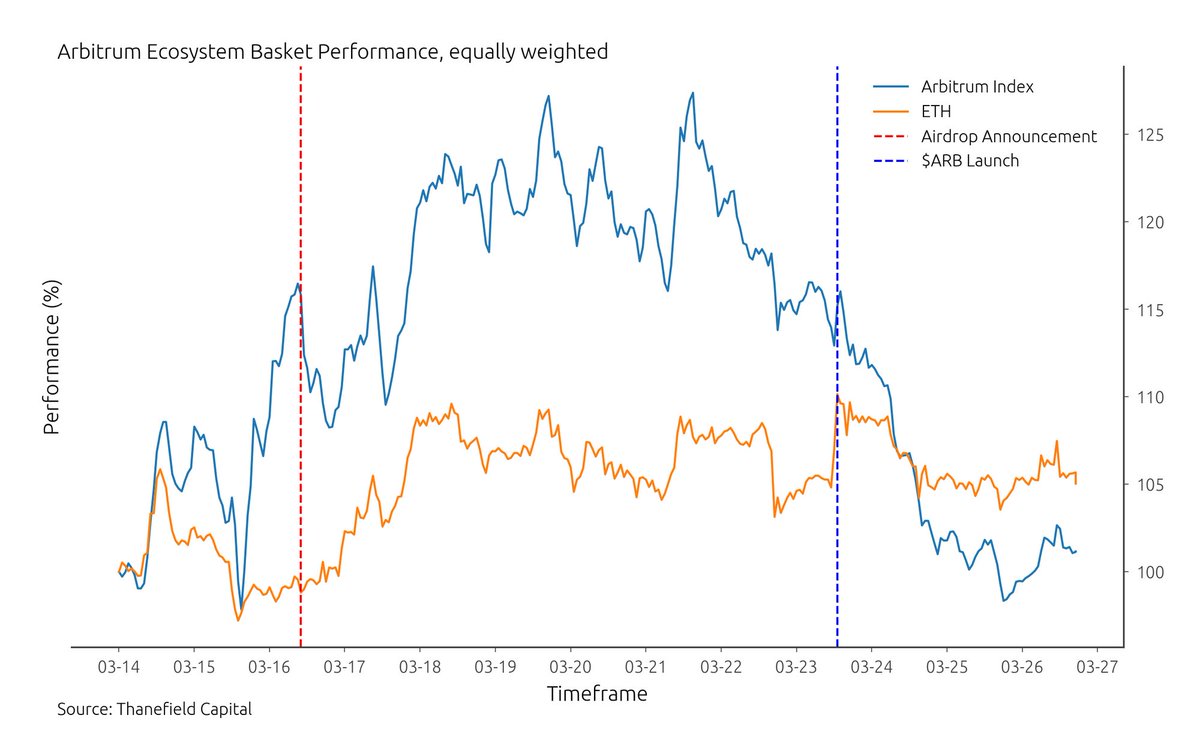

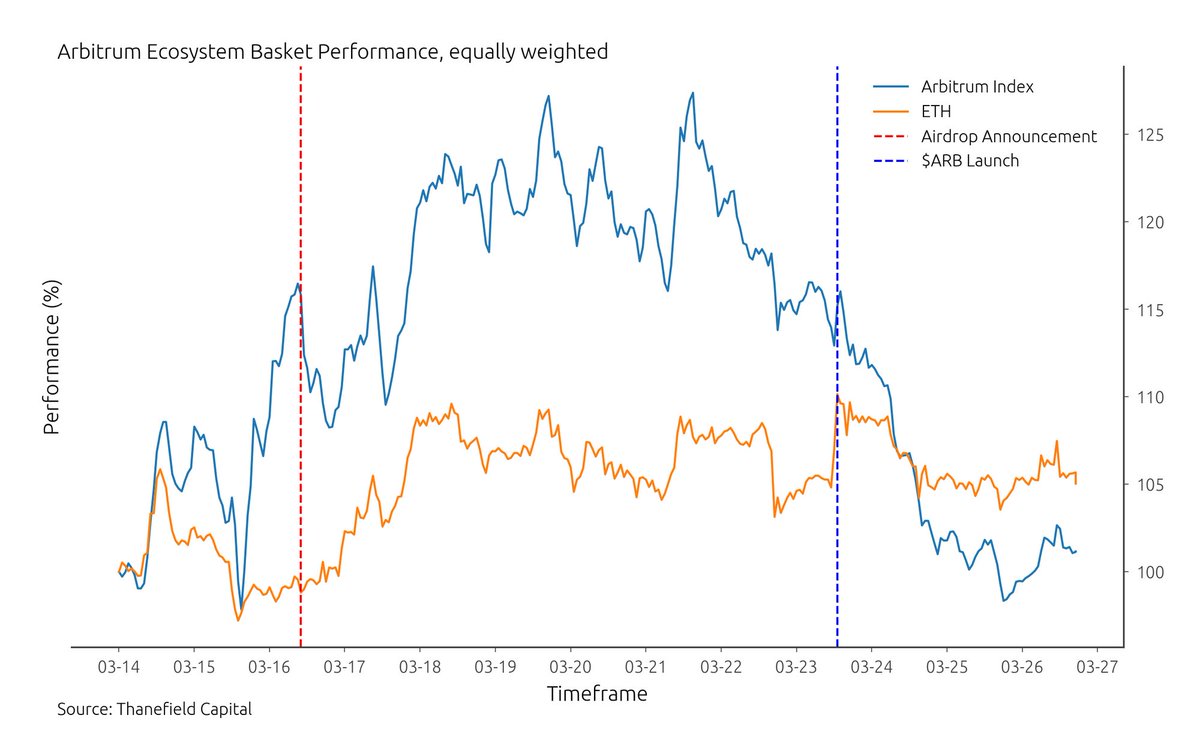

2/ For this analysis, we've created an equally weighted basket of Arbitrum ecosystem tokens, consisting of the most important native assets.

2/ For this analysis, we've created an equally weighted basket of Arbitrum ecosystem tokens, consisting of the most important native assets.