3 years ago, I turned $350 to almost $1,000,000+

Here's 10 lessons I wish I knew 🧵:

(includes my next big swing play)

Here's 10 lessons I wish I knew 🧵:

(includes my next big swing play)

Follow my trading partner @itsmichaelluu if you are struggling on stopping out and selling early:

https://twitter.com/1061650783333040129/status/1668409321997369344

1. We're in an upward trending (bull) market.

• We're still extremely early on the bull market run.

• By year end I think we trade above $460-$470

• Best to buy LEAPS and longer-term options to hold.

• Then scalp $SPY each day to add money to buy more LEAPS.

• We're still extremely early on the bull market run.

• By year end I think we trade above $460-$470

• Best to buy LEAPS and longer-term options to hold.

• Then scalp $SPY each day to add money to buy more LEAPS.

2. Most of the time buy more calls then puts.

• The market has turned from bearish to bullish.

• The FEDS will pause interest rates here.

• Most dips are being bought up now.

• Tomorrow most likely RED day since it will be hawkish tone.

• The market has turned from bearish to bullish.

• The FEDS will pause interest rates here.

• Most dips are being bought up now.

• Tomorrow most likely RED day since it will be hawkish tone.

3. When the market gets toppy or overbought.

• At those key levels that's where I would sell or trim my position to lock in gains.

• Only at key resistance levels on the $SPY weekly or monthly time frames.

• Do your best not to sell early or it will mess you up.

• At those key levels that's where I would sell or trim my position to lock in gains.

• Only at key resistance levels on the $SPY weekly or monthly time frames.

• Do your best not to sell early or it will mess you up.

4. Learn to trade pull backs and reversals.

• This is powerful so you can add on dips for big winning positions.

• So you can jump into big trends when they move back down to support.

• Master being able to get into the trend by getting calls.

vimeo.com/596889502/deb0…

• This is powerful so you can add on dips for big winning positions.

• So you can jump into big trends when they move back down to support.

• Master being able to get into the trend by getting calls.

vimeo.com/596889502/deb0…

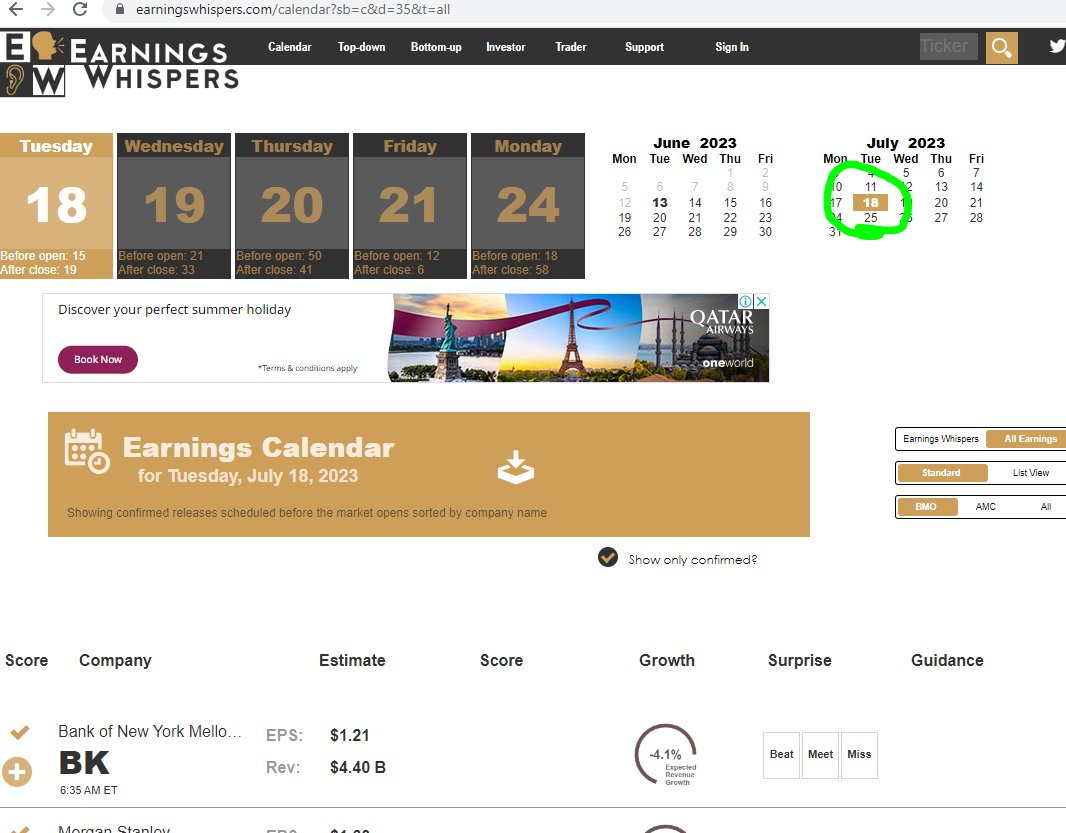

5. Earnings season will be extremely bullish.

• Guidance for companies are strong.

• Earnings price action is dictated 60% from its guidance.

• There will be P/E multiple expansion.

• Plan ahead of time so look at earnings calendar early.

• Guidance for companies are strong.

• Earnings price action is dictated 60% from its guidance.

• There will be P/E multiple expansion.

• Plan ahead of time so look at earnings calendar early.

This is my $UPST analysis for you to review. This is how much analysis I do to get ahead of the market.

https://twitter.com/1061650783333040129/status/1665750790751780874

6. $SPY is very predictable.

• Follow the important dates of the market like FOMC, CPI.

• September every year at Jackson Hole event is a big.

• Learn what a trending day looks like vs a choppy day so you don't waste your capital.

• Follow the important dates of the market like FOMC, CPI.

• September every year at Jackson Hole event is a big.

• Learn what a trending day looks like vs a choppy day so you don't waste your capital.

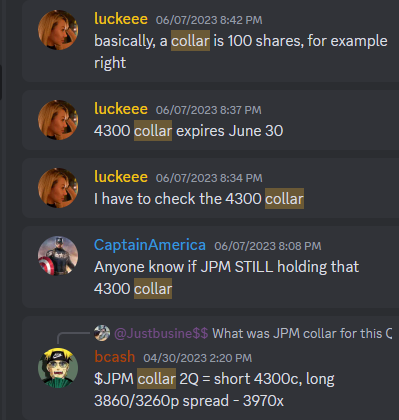

7. Follow closely the option flow and gamma levels.

• This is where you can find the market ranges and expected moves.

• Follow what the banks are planning to do next so you can stay ahead of them.

• Read my notes here with my students to figure out where market is going.

• This is where you can find the market ranges and expected moves.

• Follow what the banks are planning to do next so you can stay ahead of them.

• Read my notes here with my students to figure out where market is going.

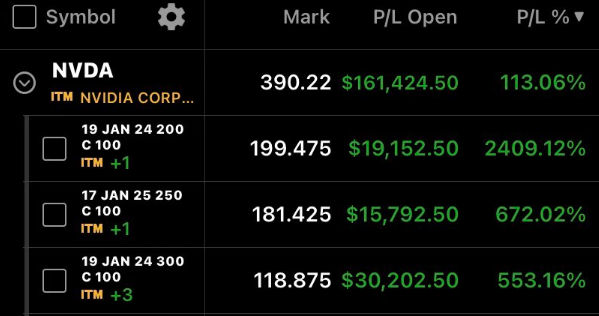

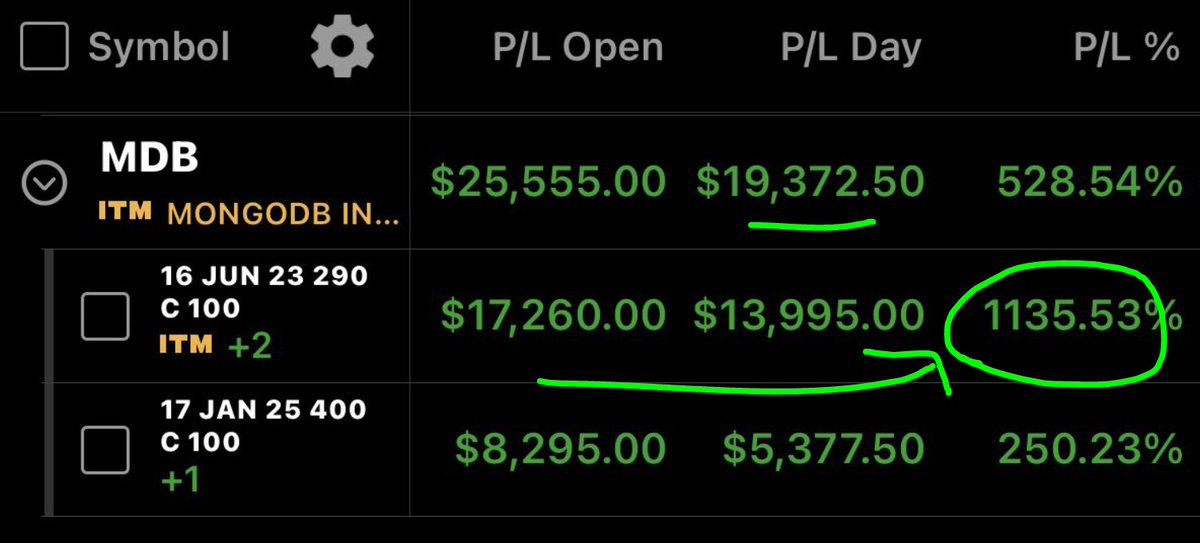

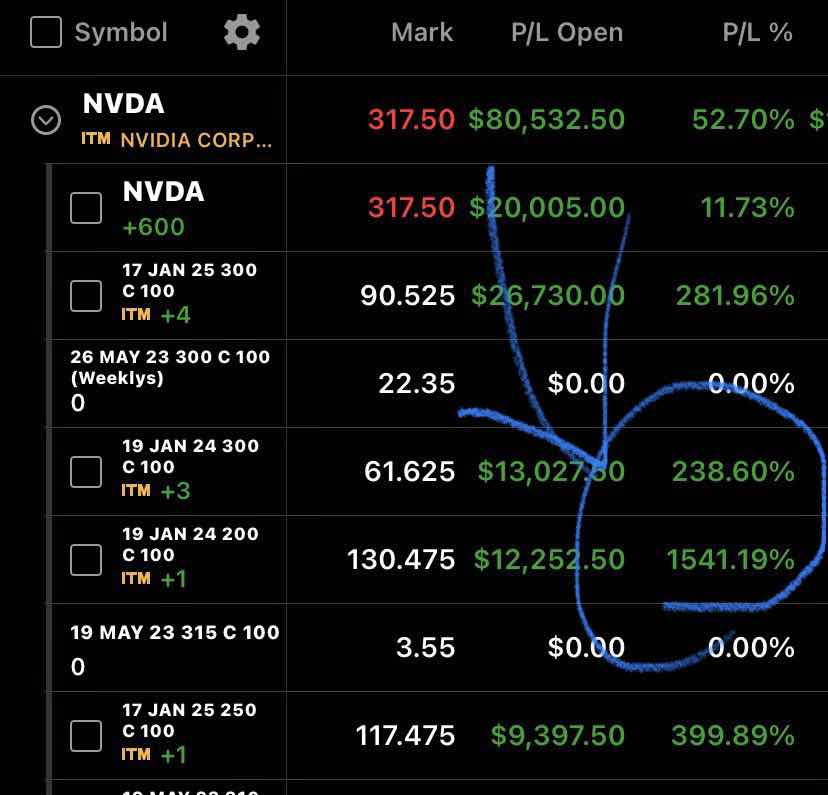

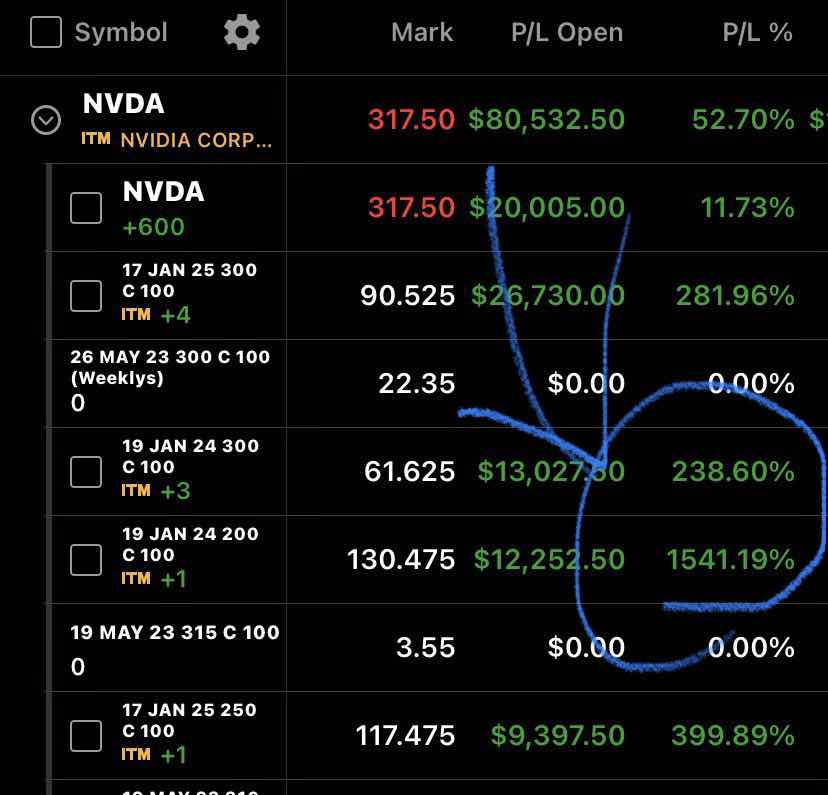

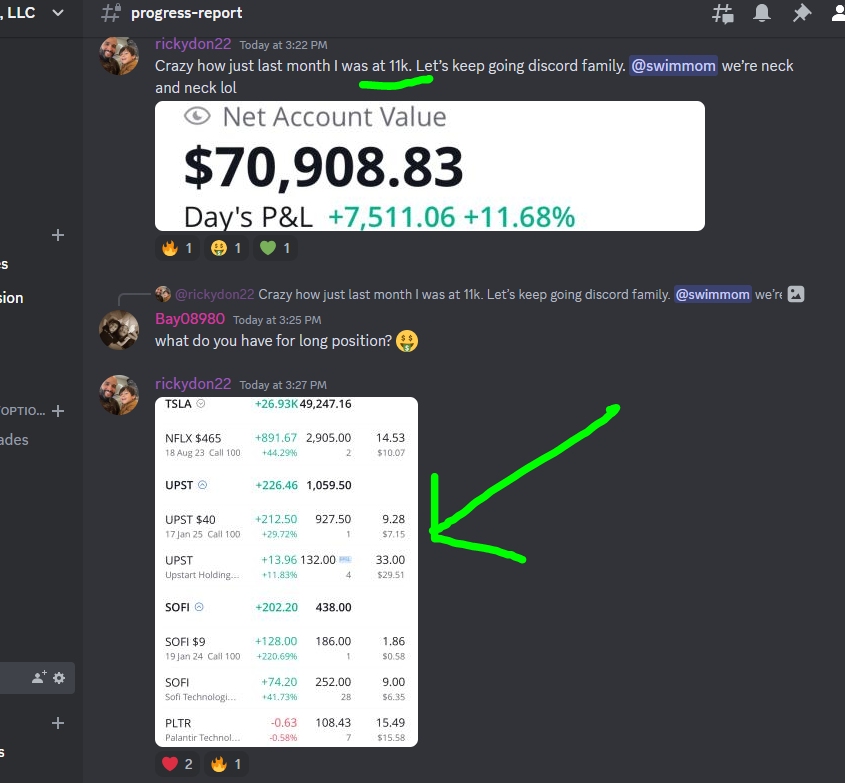

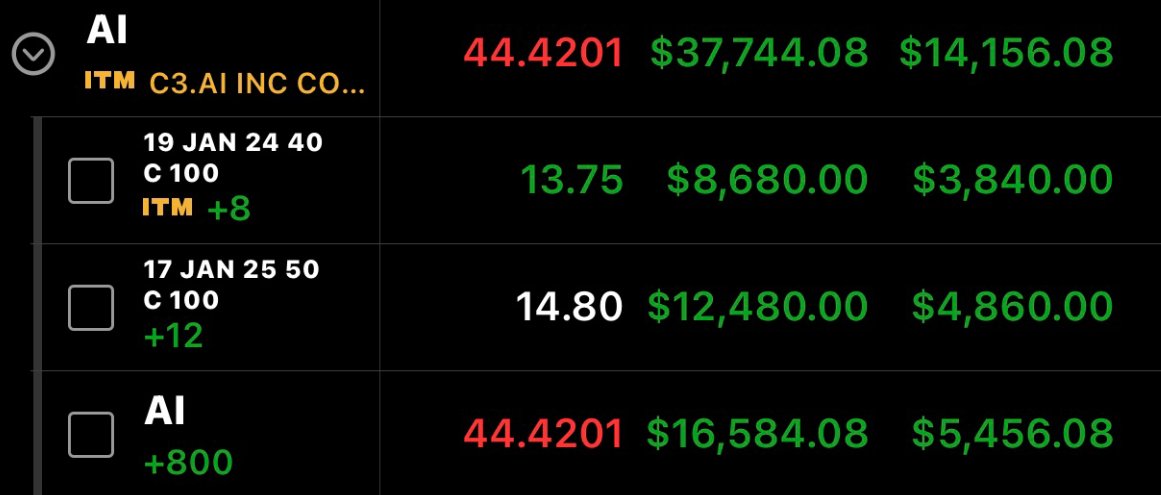

8. Buy the strongest companies only and hold them.

• Don't be distracted by anything else.

• Focus on $TSLA $AMZN $GOOG $NVDA $AMD $AAPL $AI $MSFT $META

• You'd be surprised how fast the gains compound once you are deep in the money.

• Don't be distracted by anything else.

• Focus on $TSLA $AMZN $GOOG $NVDA $AMD $AAPL $AI $MSFT $META

• You'd be surprised how fast the gains compound once you are deep in the money.

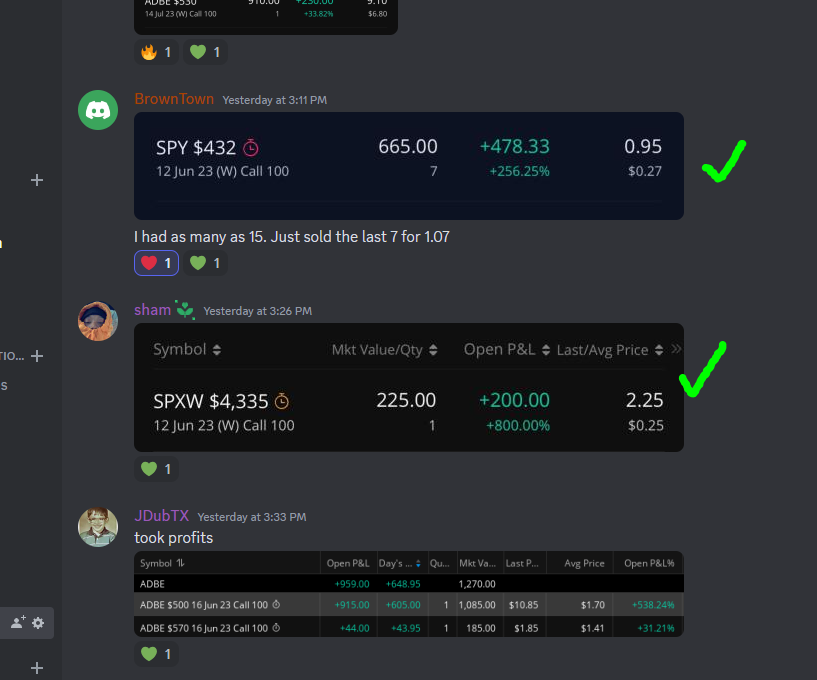

9. Focus on getting calls to go long and selling at tops.

• Don't try to predict where the top is.

• On days where you buy calls and market is red. Stop trading.

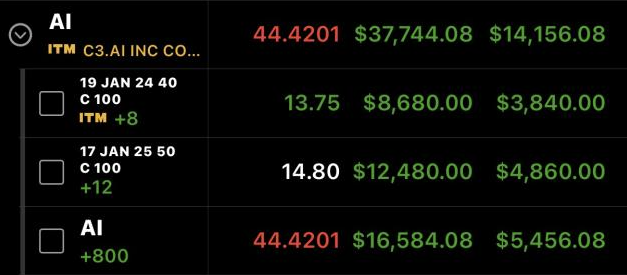

• Look how far out my options go!

• And yes, you can do this with a small account $500-$1000+

• Don't try to predict where the top is.

• On days where you buy calls and market is red. Stop trading.

• Look how far out my options go!

• And yes, you can do this with a small account $500-$1000+

10. On days where you buy calls and market is red. Stop trading.

• Do not fight the trend.

• The market sells off because of news.

• News is random and can happen anytime.

• Be patient and wait for adds to buy strong companies.

• Do not fight the trend.

• The market sells off because of news.

• News is random and can happen anytime.

• Be patient and wait for adds to buy strong companies.

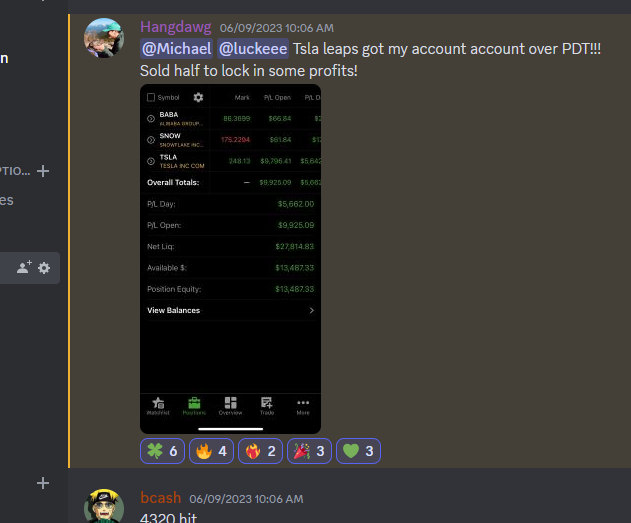

$TSLA is my next big swing play.

• Q2 Delivery numbers are coming out soon at the end of June 2023.

• Earnings Q2 will be bullish.

• $7500 EV credit makes their Model 3 under $25,000.

• I would wait on big pull backs to get LEAPS for 2024 and 2025

• Q2 Delivery numbers are coming out soon at the end of June 2023.

• Earnings Q2 will be bullish.

• $7500 EV credit makes their Model 3 under $25,000.

• I would wait on big pull backs to get LEAPS for 2024 and 2025

Did you find this helpful?

If you are struggling with trading psychology watch this 1HR lesson as I discuss with my students how to overcome your fears and build confidence:

vimeo.com/833968323/d498…

vimeo.com/833968323/d498…

Make no excuses and be determined to outwork everyone.

Comment "AI" if you are interested in my analysis and swing ideas AI plays to help you grow your account!

Comment "AI" if you are interested in my analysis and swing ideas AI plays to help you grow your account!

https://twitter.com/1061650783333040129/status/1667188398212386821

Follow me @SuperLuckeee for more of my personal trading lessons and analysis.

- RT to share with your audience and help others.

- RT to share with your audience and help others.

https://twitter.com/1061650783333040129/status/1668769647154348033

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter