1. Why 🌎International Companies Like Standard Chartered Exit Markets Like #Zimbabwe🇿🇼

Standard Chartered Zimbabwe was a profitable bank that had been in Zim for over 130 years. A week ago, they exited Zimbabwe. Why?

Thread + V11s👇🏾#StanChart #FBC

Standard Chartered Zimbabwe was a profitable bank that had been in Zim for over 130 years. A week ago, they exited Zimbabwe. Why?

Thread + V11s👇🏾#StanChart #FBC

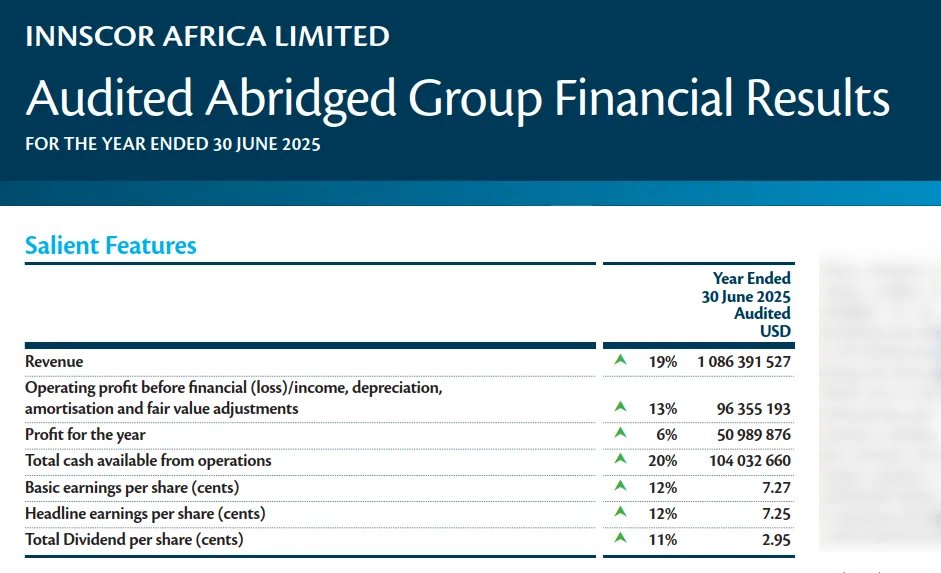

2. Standard Chartered (StanChart) in Zim was a solid bank making good money. In 2016 StanChart made $13 Million in profit and was the 3rd largest bank by deposits in Zimbabwe.

3. Compared to StanChart Globally, however, the Zim operation was still a “small fish"

StanChart Zim Revenue = $55.02 Million

StanChart Group Revenue = $14.06 Billion

StanChart Zim Size = 0.4%

The good thing was in 2016 the small fish had limited drama & was profitable.

StanChart Zim Revenue = $55.02 Million

StanChart Group Revenue = $14.06 Billion

StanChart Zim Size = 0.4%

The good thing was in 2016 the small fish had limited drama & was profitable.

4. When you are a small fish in a big pond not attracting unwanted attention is very important.

That is what StandChart Zim did from 2016 - 2018.

They did not really feature in the StanChart Group Annual report & when they did it was for good news -they had won an award👏🏾

That is what StandChart Zim did from 2016 - 2018.

They did not really feature in the StanChart Group Annual report & when they did it was for good news -they had won an award👏🏾

5. In 2019, however, that changed. Zimbabwe was suddenly called out in the annual report because it had contributed to the increase of Credit Grade 12 Balances😤 (which is really bad see why in the next tweet).

6. Credit Grade 12 is the worst rating aside from defaulting.

Think of that friend who never pays anyone back - Credit Grade 12.

Zim being called out despite being only 0.4% of the business was a bad sign.

This wasn't necessarily local management's fault however...

Think of that friend who never pays anyone back - Credit Grade 12.

Zim being called out despite being only 0.4% of the business was a bad sign.

This wasn't necessarily local management's fault however...

7. ...These downgrade issues were probably linked to the reintroduction of the Zim Dollar in Feb 2019.

Whatever the case, the small fish had started to pollute the water in the pond and attract attention,

Whatever the case, the small fish had started to pollute the water in the pond and attract attention,

8. The following year, 2020, Zim was again in the group's annual report. This time because of a decrease in Credit RWA driven by the depreciation of ZWD against the US Dollar.

Whilst not technically always a bad thing it was clear that Zim was on the radar due to currency risks.

Whilst not technically always a bad thing it was clear that Zim was on the radar due to currency risks.

9. In 2021, Zim showed up again more related to COVID.

Considering StanChart is in 59 Countries, it's interesting how Zim ended up as one of the examples - attracting attention again.

Why does being mentioned in the annual report matter? See the next tweet...

Considering StanChart is in 59 Countries, it's interesting how Zim ended up as one of the examples - attracting attention again.

Why does being mentioned in the annual report matter? See the next tweet...

10. The annual report is the most important document a public company releases yearly. The CEO, CFO, Directors etc spend 100s hours reviewing it.

A small operation should not keep popping up with anything but good news.

Otherwise, Execs start asking why are we in that market.

A small operation should not keep popping up with anything but good news.

Otherwise, Execs start asking why are we in that market.

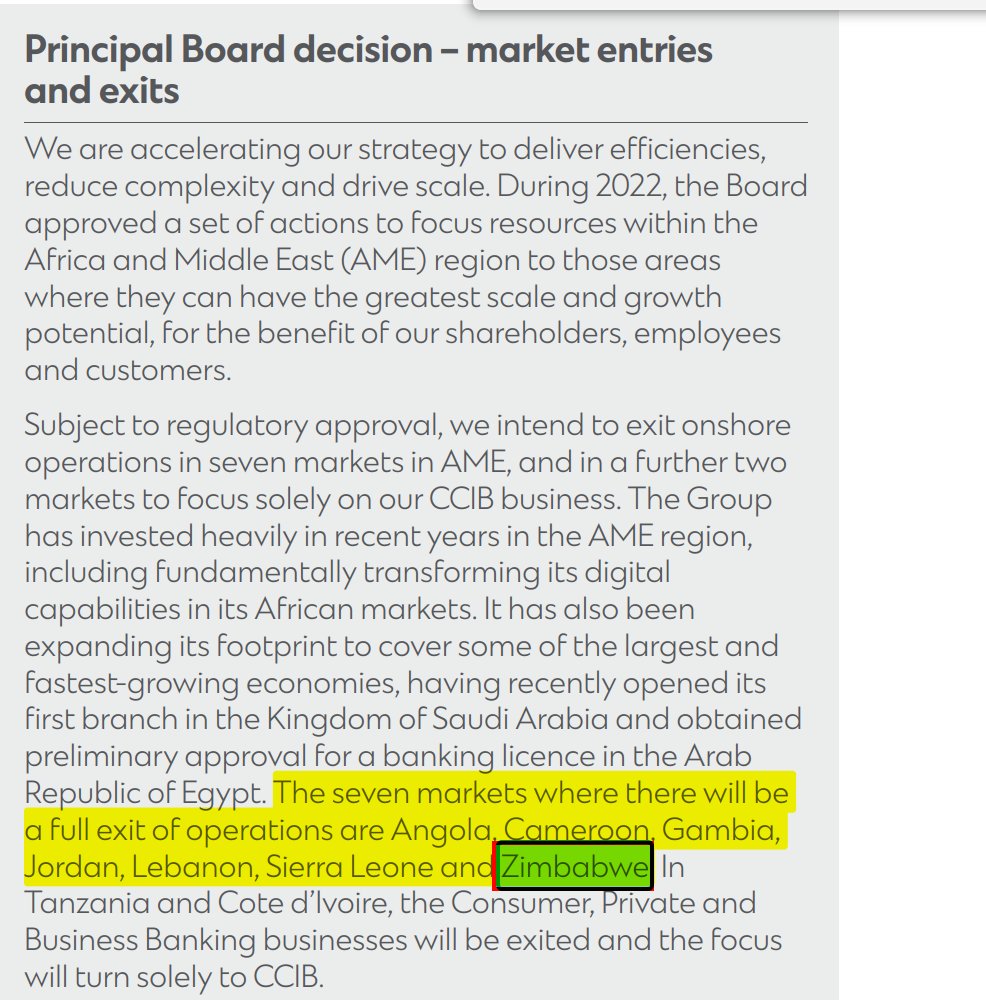

11. Unsurprisingly in 2022 the decision was announced. StanChart would be exiting 7 markets including Zimbabwe to focus on the "most significant opportunities for growth" (i.e. bigger fish that swim nicely)

The small fish was getting kicked out of the pond.

The small fish was getting kicked out of the pond.

12. The exit was completed last week with FBC acquiring 100% of Standard Chartered. Another international company bowing out of Zim.

The same applies to most Global companies when small markets become a headache - the effort is not worth the return and so they rather exit.

The same applies to most Global companies when small markets become a headache - the effort is not worth the return and so they rather exit.

13. In conclusion, if you are a small market like Zim, to prevent foreign companies from existing - you need to be stable, & predictable, & not take management's attention.

This is not easy in Zim & so other companies may still follow.

What do you think? Comment & Retweet👏🏾

This is not easy in Zim & so other companies may still follow.

What do you think? Comment & Retweet👏🏾

• • •

Missing some Tweet in this thread? You can try to

force a refresh