Sign up to the newsletter here➡️https://t.co/lGh85dLsAG

Writing on Finance & Strategy | AMDG | @INSEAD, CA

How to get URL link on X (Twitter) App

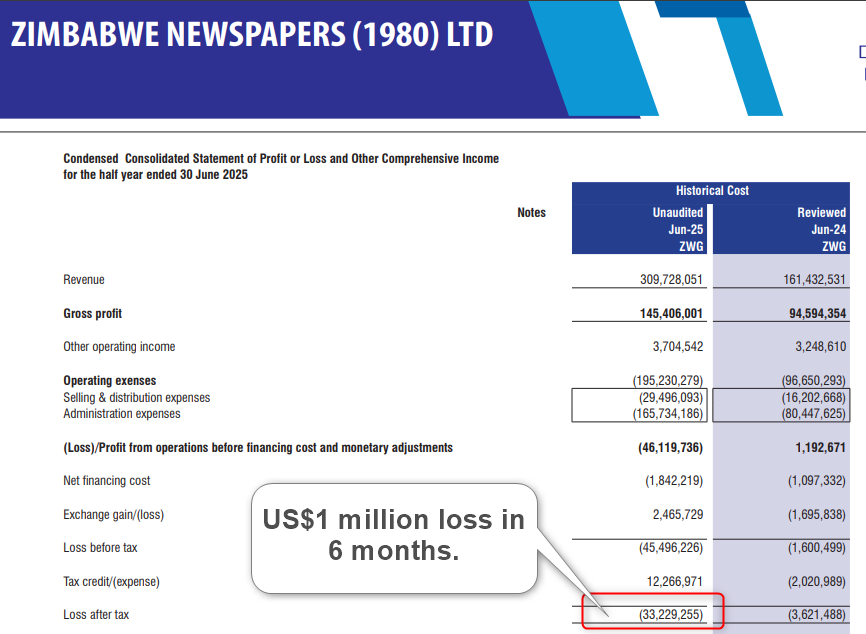

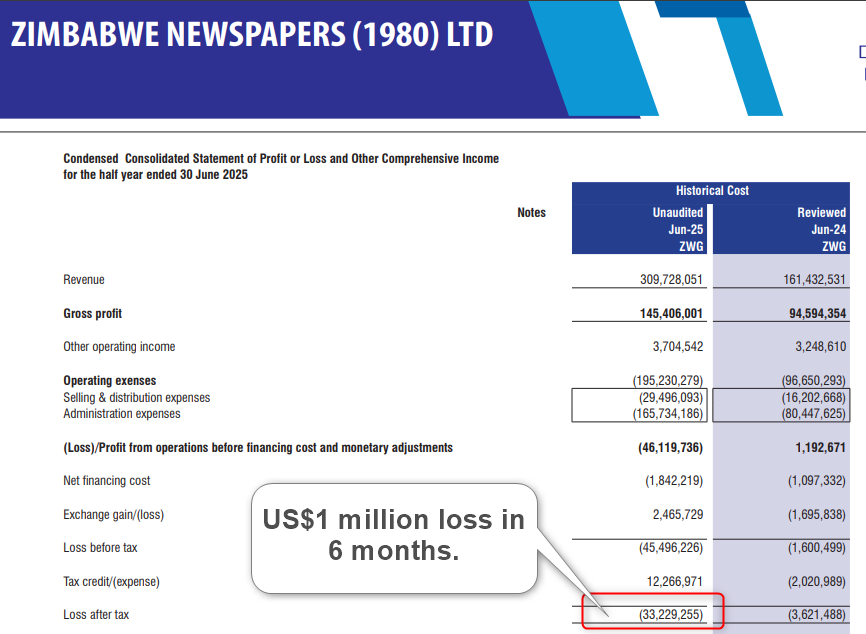

2/10 In the latest results, all the business segments struggled.

2/10 In the latest results, all the business segments struggled.

The Delta Test

The Delta Test

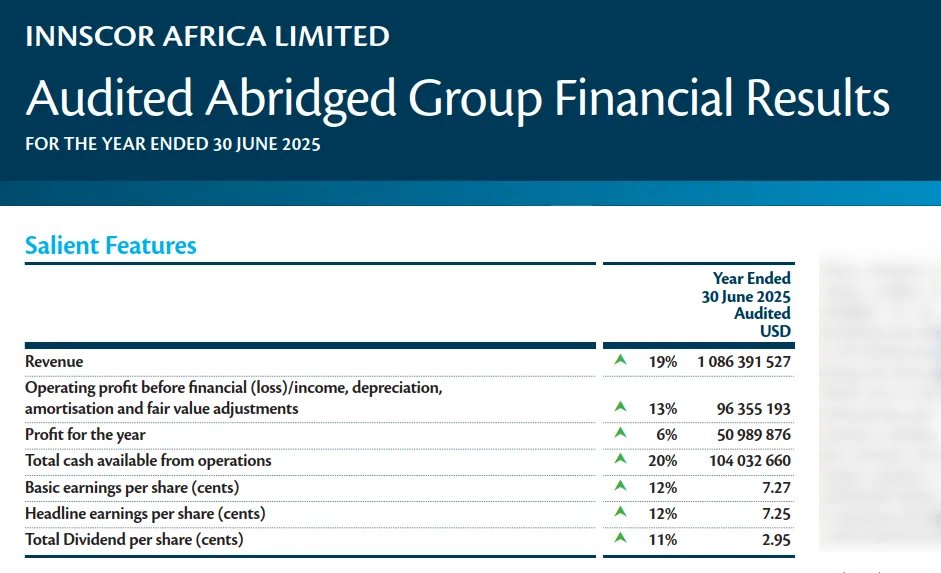

Innscor’s Financial Results

Innscor’s Financial Results

To recap, an investment property is a property held for capital growth and/or earning rental income.

To recap, an investment property is a property held for capital growth and/or earning rental income.

The low ratio of Steward Bank at 8% is surprising. Historically, Steward Bank was positioned to become a leading retail bank through its partnership with EcoCash and Econet, even enabling customers to open a bank account on their phone in just 60 seconds.

The low ratio of Steward Bank at 8% is surprising. Historically, Steward Bank was positioned to become a leading retail bank through its partnership with EcoCash and Econet, even enabling customers to open a bank account on their phone in just 60 seconds.

First Capital Zimbabwe’s Performance

First Capital Zimbabwe’s Performance

Starlink isn't a direct threat to the mobile business; in fact, since Starlink's launch, Econet's income from data revenue has increased by 36%, which is the same rate it was growing the year before.

Starlink isn't a direct threat to the mobile business; in fact, since Starlink's launch, Econet's income from data revenue has increased by 36%, which is the same rate it was growing the year before.

2/11 About the Insurance and Pensions Commission (IPEC)

2/11 About the Insurance and Pensions Commission (IPEC)

2/23 People often define companies by the products they sell. For example, if I sell paint, I'm seen as a paint manufacturer.

2/23 People often define companies by the products they sell. For example, if I sell paint, I'm seen as a paint manufacturer.

2/16 How Did We Get Here?

2/16 How Did We Get Here?

2/7 What is even more impressive is that the event is comfortably profitable.

2/7 What is even more impressive is that the event is comfortably profitable.

2/14 More Money, More Property

2/14 More Money, More Property

2/17 One of the most important elements in retail is location, as it drives foot traffic.

2/17 One of the most important elements in retail is location, as it drives foot traffic.

/2 Demergers are essentially when a company splits off one of its businesses to operate independently and often to list separately.

/2 Demergers are essentially when a company splits off one of its businesses to operate independently and often to list separately.

2/23 About Simbisa Brands

2/23 About Simbisa Brands

2/9 China was late to start manufacturing cars, with the first locally assembled car, the Dongfeng CA71, not being produced until 1958 (see picture below).

2/9 China was late to start manufacturing cars, with the first locally assembled car, the Dongfeng CA71, not being produced until 1958 (see picture below).

By December 1997, Econet had finally been awarded a telecom license.

By December 1997, Econet had finally been awarded a telecom license.

At first glance, OK’s half-year results look pretty good.

At first glance, OK’s half-year results look pretty good.

2/16 Earl Tupper started Tupperware in 1946, and in its early days, it was sold in hardware and department stores.

2/16 Earl Tupper started Tupperware in 1946, and in its early days, it was sold in hardware and department stores.

2/11 Typically, when a multinational company with a well-known brand sells its interest or exits, people tend to feel less optimistic about the company that is left behind.

2/11 Typically, when a multinational company with a well-known brand sells its interest or exits, people tend to feel less optimistic about the company that is left behind.

The last few years, Chinese stocks have taken a beating.

The last few years, Chinese stocks have taken a beating.