1/23

Hoooooo baby this Prometheum story gets even better.

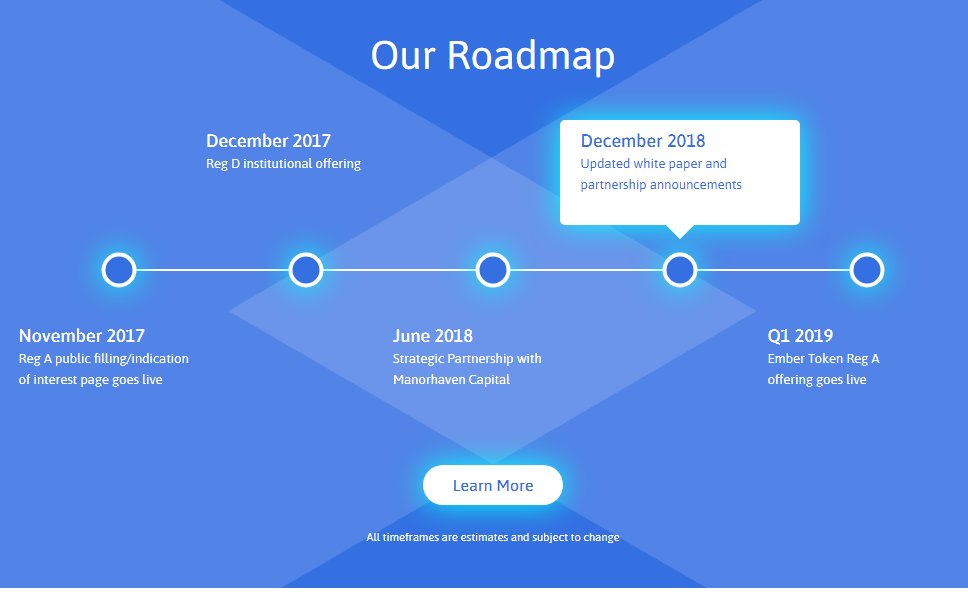

So they started in 2017 when they filled their Reg A+ and aimed to raise $50M.

But how did these random lawyers supposedly get approval from the SEC and FINRA?

Hoooooo baby this Prometheum story gets even better.

So they started in 2017 when they filled their Reg A+ and aimed to raise $50M.

But how did these random lawyers supposedly get approval from the SEC and FINRA?

2/23

Look no further than their team, including Rosemarie Fanelli, who worked for the NYSE and then FINRA

Look no further than their team, including Rosemarie Fanelli, who worked for the NYSE and then FINRA

5/23

-Around since 2017

-Did a Reg A+ filing to issue a token in 2017.

-Have not launched their product since 2017.

-Have a bunch of former SEC and FINRA staff

-Suddenly appear at a hearing parroting political talking points favoring the SEC.

-Around since 2017

-Did a Reg A+ filing to issue a token in 2017.

-Have not launched their product since 2017.

-Have a bunch of former SEC and FINRA staff

-Suddenly appear at a hearing parroting political talking points favoring the SEC.

6/23

They've scrubbed their social media from prior to 2019 which is when they got their current domain on the .com - the previous .info site is still on wayback machine.

On that site they said their genesis block would be 2019...

They've scrubbed their social media from prior to 2019 which is when they got their current domain on the .com - the previous .info site is still on wayback machine.

On that site they said their genesis block would be 2019...

7/23

If you search year by year through Google, you'll notice lots of noise about them in 2017 and 2018.

Then nothing for a while, until the end of 2020 early 2021 where they claim to be SEC regulated and raise $15M

If you search year by year through Google, you'll notice lots of noise about them in 2017 and 2018.

Then nothing for a while, until the end of 2020 early 2021 where they claim to be SEC regulated and raise $15M

8/23

That means it got its approval under Jay Clayton and not the current administration.

It leaned on this commission statement of allowing broker-dealers to hold custody digital assets.

That means it got its approval under Jay Clayton and not the current administration.

It leaned on this commission statement of allowing broker-dealers to hold custody digital assets.

9/23

But even to date, it acknowledges it can't clear or settle transactions and therefore, even though it is registered it cannot operate.

This is from a Bloomberg piece on them:

But even to date, it acknowledges it can't clear or settle transactions and therefore, even though it is registered it cannot operate.

This is from a Bloomberg piece on them:

10/23

Then they go silent again for a few years.

Until suddenly, in late '21 to early '22 they hire former FINRA and SEC staff (still with no clear product)

After which they suddenly get the approvals they've wanted.

Still with no operation.

Then they go silent again for a few years.

Until suddenly, in late '21 to early '22 they hire former FINRA and SEC staff (still with no clear product)

After which they suddenly get the approvals they've wanted.

Still with no operation.

11/23

Now layer this all on with the fact:

-Their fundraise was with Wanxiang a purported CCP affiliate.

-They raised $48M without a product.

-Hired former SEC and FINRA people

-Pay $1.5M to Network 1 Financial Securities

Now layer this all on with the fact:

-Their fundraise was with Wanxiang a purported CCP affiliate.

-They raised $48M without a product.

-Hired former SEC and FINRA people

-Pay $1.5M to Network 1 Financial Securities

12/23

Who is Network 1 Financial?

A shady broker with a Chinese affiliated firm and a horrible compliance track record of more than 20 regulatory or civil actions against them.

(h/t @MattWalshInBos)

Who is Network 1 Financial?

A shady broker with a Chinese affiliated firm and a horrible compliance track record of more than 20 regulatory or civil actions against them.

(h/t @MattWalshInBos)

13/23

But it gets better - that broker was the one behind the Ice Tea company that pivoted to a blockchain project in 2017 as a scam.

As well as another offering that was a blockchain pivot that the SEC charged for fraud. (h/t @collins_belton)

But it gets better - that broker was the one behind the Ice Tea company that pivoted to a blockchain project in 2017 as a scam.

As well as another offering that was a blockchain pivot that the SEC charged for fraud. (h/t @collins_belton)

14/23

In 2022 again, mostly quiet, until they announce they've "launched their ATS"

They claim that their ATS supports digital asset securities including:

"Flow, Filecoin, The Graph, Compound and Celo"

Of course, since none of these are securities they can't have...

In 2022 again, mostly quiet, until they announce they've "launched their ATS"

They claim that their ATS supports digital asset securities including:

"Flow, Filecoin, The Graph, Compound and Celo"

Of course, since none of these are securities they can't have...

15/23

So they claim this ATS has existed for well over a year and that it is integrated with "Anchorage Digital Bank" (hey @Anchorage - any comment?)

But no one has heard of it, and it is supposedly now clearing regular crypto assets via an ATS?

So they claim this ATS has existed for well over a year and that it is integrated with "Anchorage Digital Bank" (hey @Anchorage - any comment?)

But no one has heard of it, and it is supposedly now clearing regular crypto assets via an ATS?

16/23

But that statement where they claimed to be offering those tokens was in 22.

The Bloomberg article from earlier where they said they don't have an offering, can't clear and settle and *hope* to list assets in the future...was from May 2023...

But that statement where they claimed to be offering those tokens was in 22.

The Bloomberg article from earlier where they said they don't have an offering, can't clear and settle and *hope* to list assets in the future...was from May 2023...

17/23

So if they launched their ATS in 2022, why, in 2023 are they talking about intent to launch and their hands being tied?

Why are they suddenly showing up as a Congressional Witness?

So if they launched their ATS in 2022, why, in 2023 are they talking about intent to launch and their hands being tied?

Why are they suddenly showing up as a Congressional Witness?

18/23

Why are the tokens they listed in '22 (Filecoin, Flow, et al) many of the same tokens that the SEC has now first listed in their actions against Coinbase and Binance?

Why are the tokens they listed in '22 (Filecoin, Flow, et al) many of the same tokens that the SEC has now first listed in their actions against Coinbase and Binance?

19/23

There are three possible answers:

1) These are plants who are being given a sweet regulatory deal in exchange for engaging in the way the SEC wanted to (just like Gary was working on with SBF)

There are three possible answers:

1) These are plants who are being given a sweet regulatory deal in exchange for engaging in the way the SEC wanted to (just like Gary was working on with SBF)

20/23

2) These guys are using their SEC and FINRA connections to push an agenda to get certain assets deemed securities and for them to be the only approved player to capture the market.

2) These guys are using their SEC and FINRA connections to push an agenda to get certain assets deemed securities and for them to be the only approved player to capture the market.

21/23

3) These guys are grifters who raised a ton of money from sketchy sources and for years have been twisting worst and progress to continue to ride the grift.

3) These guys are grifters who raised a ton of money from sketchy sources and for years have been twisting worst and progress to continue to ride the grift.

22/23

I don't know which one it is, but something is rotten here.

With all the efforts Coinbase, Kraken and other reputable firms have put into putting their best foot forward - it is impossible to believe this sketchy agency got the green light.

I don't know which one it is, but something is rotten here.

With all the efforts Coinbase, Kraken and other reputable firms have put into putting their best foot forward - it is impossible to believe this sketchy agency got the green light.

23/23

Even a cursory glance shows that this is not someone you should greenlight, especially not as the first in the space.

Plants, patsies, or opportunists - its unclear, but the fact Gensler is letting them run around with SEC approval is a red flag.

Even a cursory glance shows that this is not someone you should greenlight, especially not as the first in the space.

Plants, patsies, or opportunists - its unclear, but the fact Gensler is letting them run around with SEC approval is a red flag.

After writing this all out - I feel as if Elizabeth Warren is about to personally kick down my front door, drag me off to some blacksite where they keep the aliens, and waterboard me for unearthing her plants or something...

• • •

Missing some Tweet in this thread? You can try to

force a refresh