professor, policy consultant, independent journalist and father. Trying to make the world suck less. Follow for the latest in politics, economics and law.

165 subscribers

How to get URL link on X (Twitter) App

2/

2/

https://x.com/adamscochran/status/20234101711421117192/5

https://twitter.com/428333/status/20172553428501672862/23

2/7

2/7

https://x.com/adamscochran/status/20168802170384510452/18

2/12

2/12

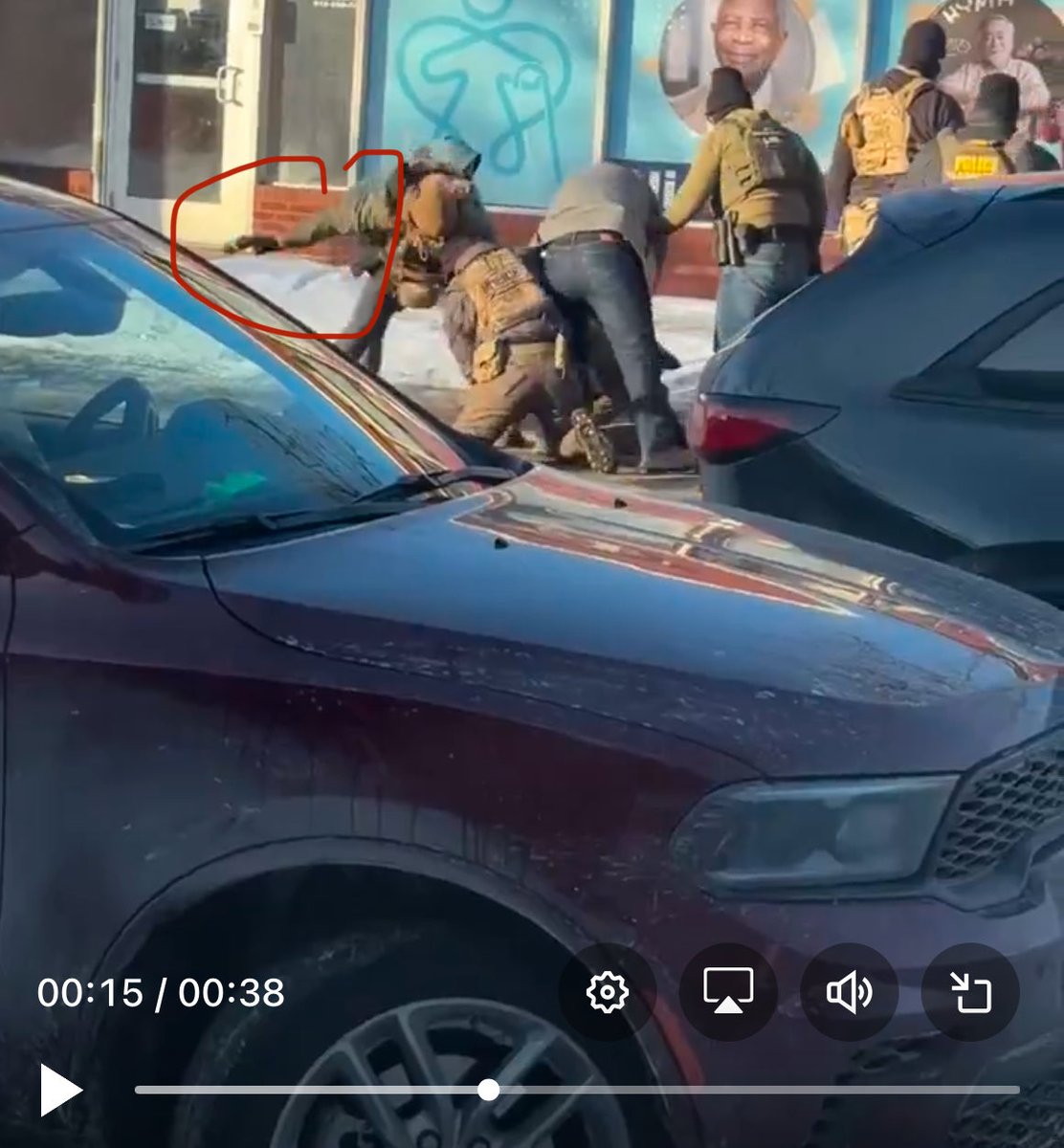

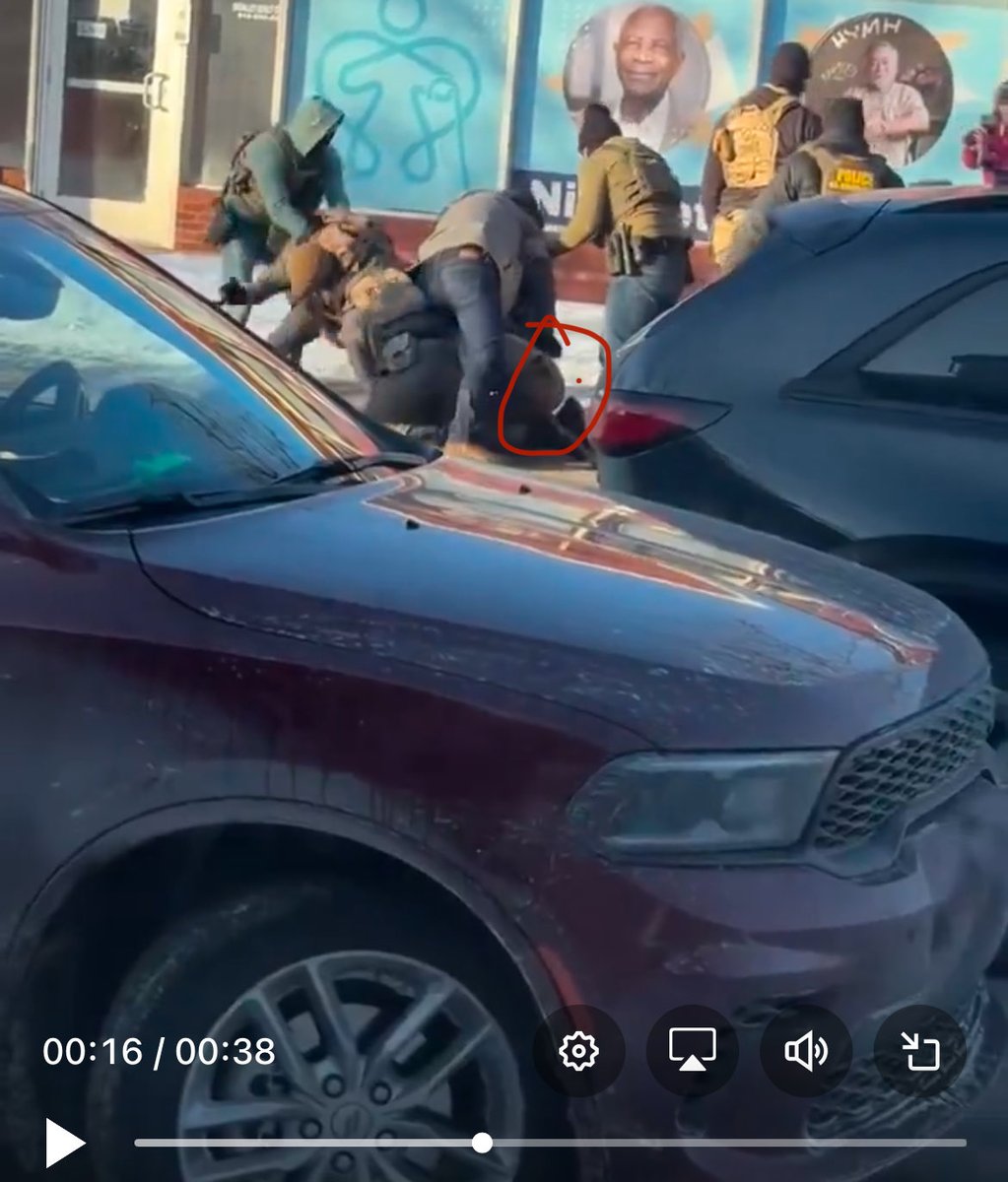

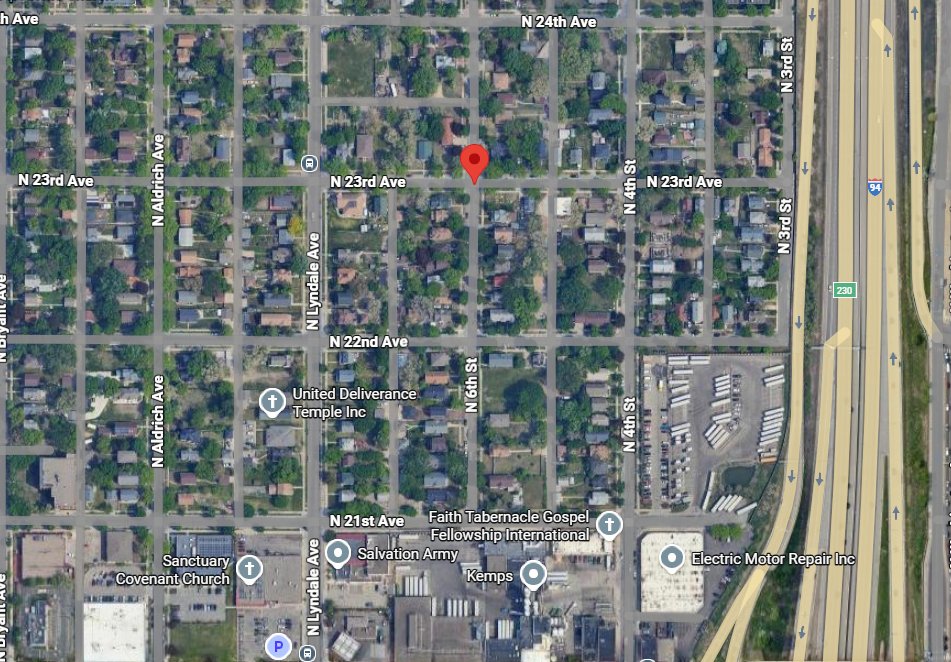

I've verified from prior reporting and 911 call log data the location where ICE tear gassed a 6-month old child:

I've verified from prior reporting and 911 call log data the location where ICE tear gassed a 6-month old child:

https://twitter.com/anthon7yandrews/status/20112026789579367602/24

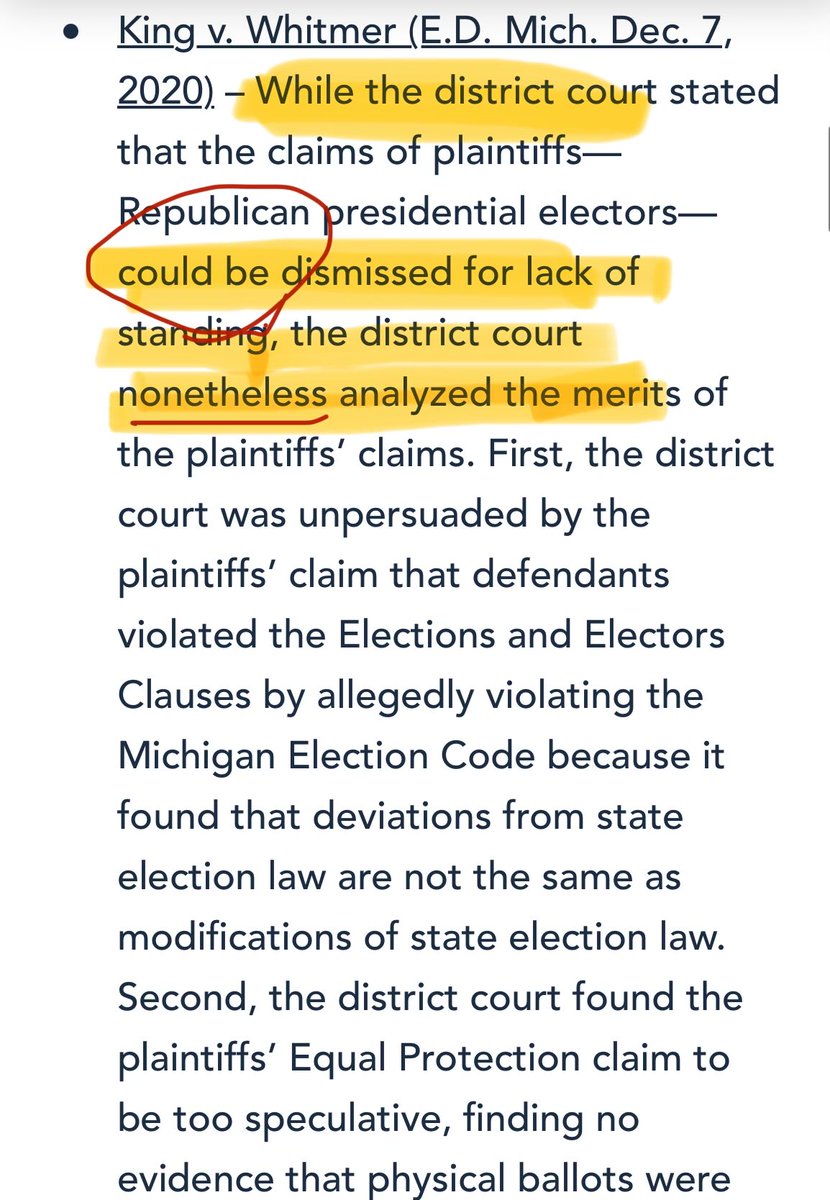

https://twitter.com/TheJusticeDept/status/2003533754912907697

2/25

2/25

2/6

2/6

https://twitter.com/kalshi/status/20016468738206966642/12

https://twitter.com/AGPamBondi/status/20005833756989196572/20

https://twitter.com/meidastouch/status/19986098983436332542/11

https://twitter.com/kyivpost/status/19987143824996846162/16

https://x.com/adamscochran/status/19955855579306724732/22

https://twitter.com/adamonfinance/status/1995500805030400045These questions keep coming up in comments so quick fire context:

2/8

2/8

https://twitter.com/spencerhakimian/status/19893776698936893852/16

https://twitter.com/adamscochran/status/1952878269818187780

https://twitter.com/adamscochran/status/19421131532459422332/15

https://twitter.com/adamscochran/status/1942770426981278007