Work in progress

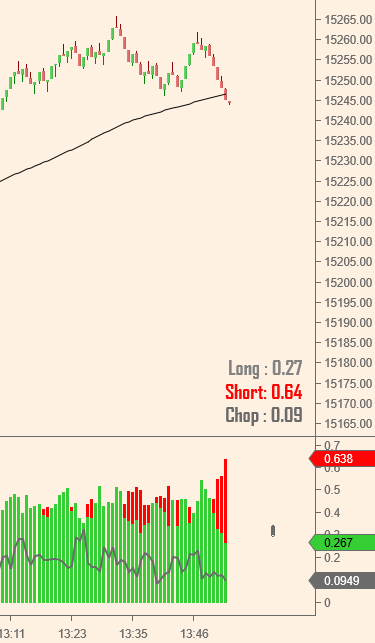

KNN ML - Stores all the patterns of past bars, then iterates over all those patterns finding the closest X matches to now, and from those matches, calculates the probability of what happens next. Simple ML, but quite well suited to this, I think

KNN ML - Stores all the patterns of past bars, then iterates over all those patterns finding the closest X matches to now, and from those matches, calculates the probability of what happens next. Simple ML, but quite well suited to this, I think

You do have to believe, however, that past history is in fact reflective of what might happen in the future...

So, I had quite a bit of fun (only smashed 3 things!) with this yesterday. I like it. I think it gives me real-time probabilities, which is what I am always looking for. Anyway - Now I ask for some ideas from you 😁

If you could consider just a few metrics to determine short-term price action, what would they be?

I've tried ROC, Vol, and above/below mean. Other ways might be, abve/blw the open/vwap, in or out of value, etc.

Any suggestions? My eyes have a little more blood left in them yet😂

I've tried ROC, Vol, and above/below mean. Other ways might be, abve/blw the open/vwap, in or out of value, etc.

Any suggestions? My eyes have a little more blood left in them yet😂

Got some questions. So A Simple explanation of what this is. Its basically a vote. Ask 100, or 200

or whatever people what will happen based on their past experience, and go with the majority.

or whatever people what will happen based on their past experience, and go with the majority.

Could not help myself. I am not trading but just did a 1 lot. Quick scalp. Testing software! lol. #coffeemoney

I promise to take no more trades!

For the techies amongst you. This is how long it takes to make a prediction with around 10,000 samples in the dataset. So, quite capable of running on small time frame bars in real-time, and this is still dev code

Result took : 00:00:00.0040113

Result took : 00:00:00.0040113

On a 3 x larger timeframe chart, just to see...

Looks good to me, but I have been fooled before!

No settings or optimisation for this change, btw - It's all full auto!

Looks good to me, but I have been fooled before!

No settings or optimisation for this change, btw - It's all full auto!

Increased training period to 60 days and window to 10k bars. Looks better (even though it was already good!), and with a few tweaks, is still way fast!

Result took : 00:00:00.0025595

I can save this now, and put the chart period back to just a few days, to save NT from dying!

Result took : 00:00:00.0025595

I can save this now, and put the chart period back to just a few days, to save NT from dying!

btw - I will add my own 2 brain farts to this list

Wicks on candles

USD

If you've already tried this, please lmk

Wicks on candles

USD

If you've already tried this, please lmk

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter