We are going to do another. It's not a 2007/2008 thread.

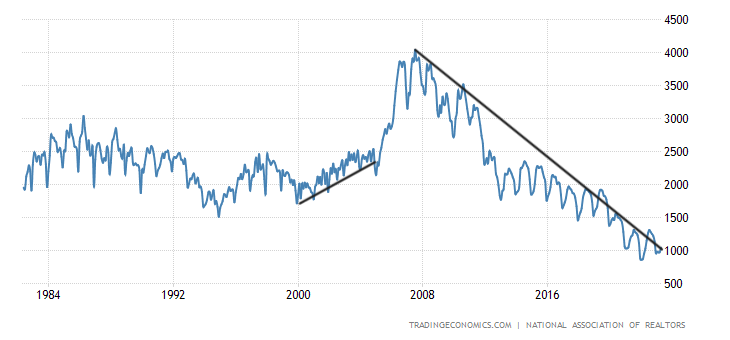

1. 2007 had 4 million active listings 🫡

1. 2007 had 4 million active listings 🫡

https://twitter.com/CNBCTheExchange/status/1669409592927764498

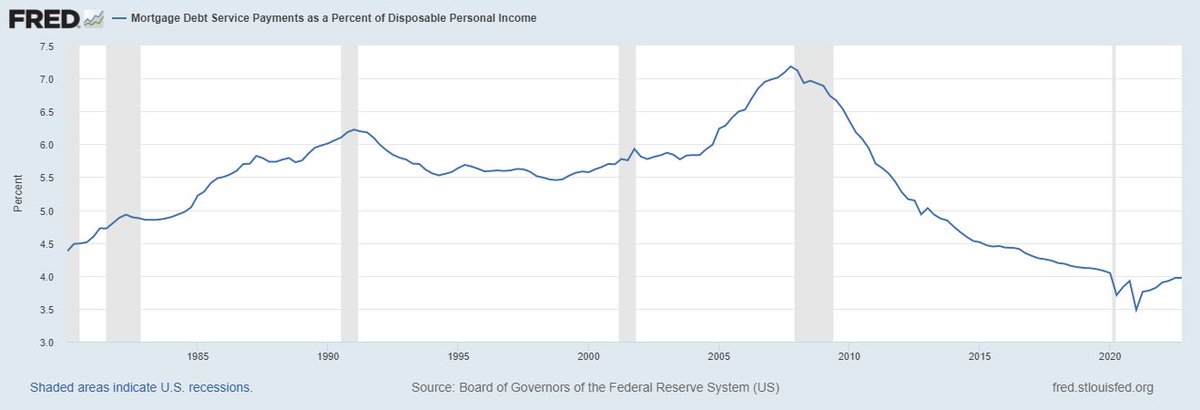

2. We had massive credit stress build-up in 2005, 2006, 2007, and 2008. All before the job loss recession in 2008

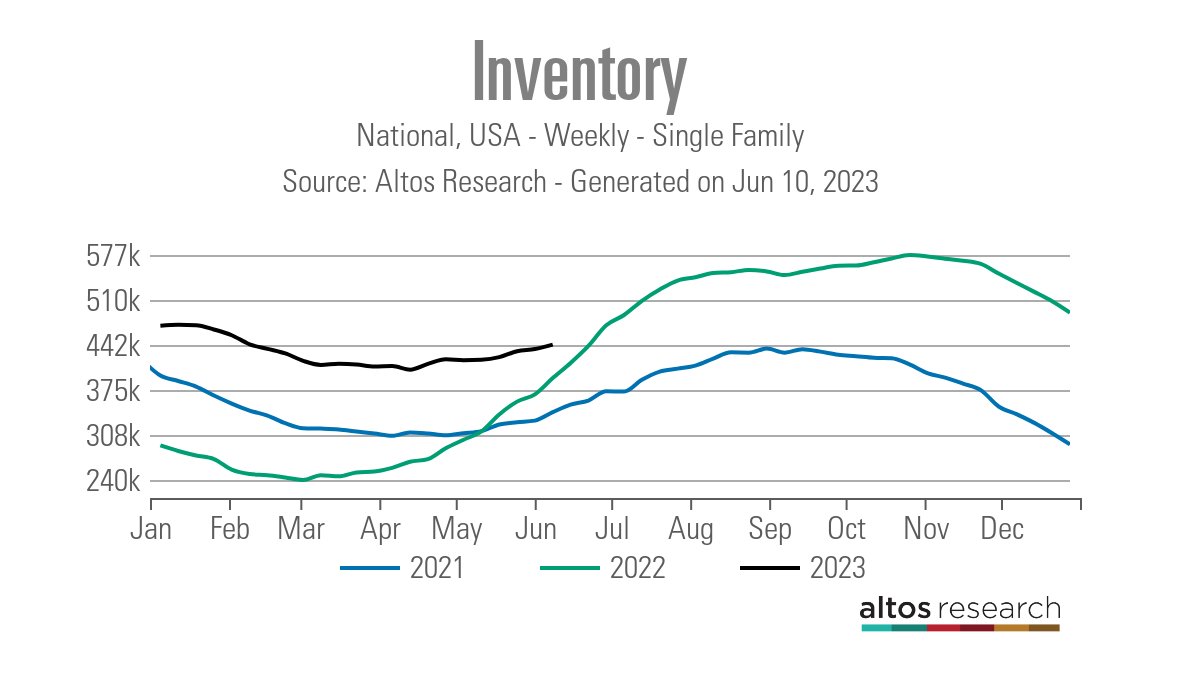

3. We already had the sales crash, and we have gotten to historically low levels with total inventory levels not getting back to 2019 levels

It's crazy to think, but the active listings inventory is weeks away from printing negative year-over-year data 🤨

Part of the issue we have is new listing housing data. In 2021 and 2022 new listing data was trending at all-time lows. Even when we had 3% mortgage rates.

2023 it created a brand new all-time low data set

2023 it created a brand new all-time low data set

Key:

1- Credit channels run inventory channels

2- Homeowners are doing fine; they have low total debt cost vs. their total wages

3- Distress selling is minimal today

With some clarity of 2022/2023 data, this podcast will be an educational tutorial.

housingwire.com/podcast/logan-…

1- Credit channels run inventory channels

2- Homeowners are doing fine; they have low total debt cost vs. their total wages

3- Distress selling is minimal today

With some clarity of 2022/2023 data, this podcast will be an educational tutorial.

housingwire.com/podcast/logan-…

@KellyCNBC If anyone says 2007/2008 housing, hopefully, the data above will make it clear that it isn't

Unlike the NAR data, which is around 1,040,000 this year, we track the live weekly active & new listings data. We are currently at 443,000 single-family homes as of last week.

That's more than last year, but last year home sales collapsed; now it's just stabilized, nothing more.

That's more than last year, but last year home sales collapsed; now it's just stabilized, nothing more.

Suppose you want to use the NAR data for reference. Historically we are between 2-2.5 million. The peak in 2007 was over 4,000,000 when sales crashed back then, currently at 1,040,000.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter