For those following the #SPX early-morning settlement saga and "the market is going to collapse due to all the deltas coming off", here is another perspective to ponder:

👉 There's no rational reason to have fireworks.

A few thoughts on the setup into the open...

A 🧵 :

👉 There's no rational reason to have fireworks.

A few thoughts on the setup into the open...

A 🧵 :

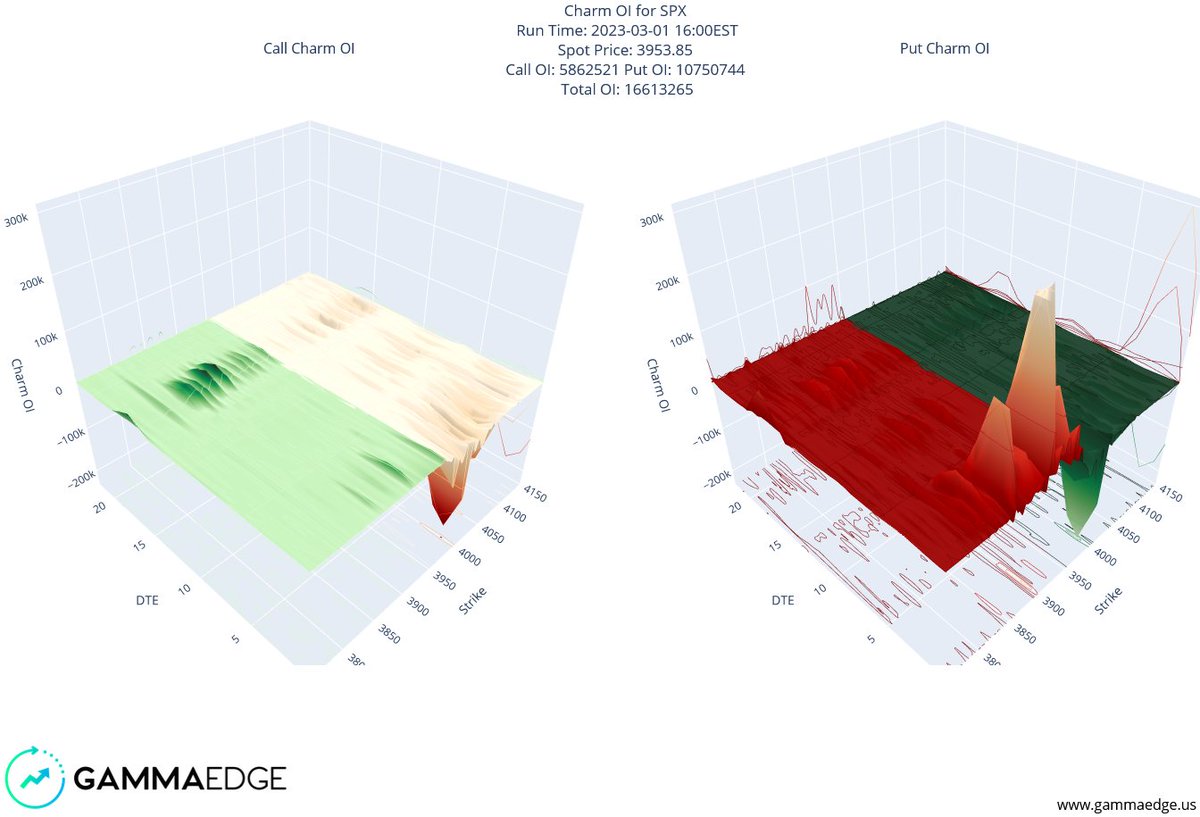

1/ The following graphic helps us to understand how to visualize "if-then" outcomes.

It's not a perfect model, but we believe that concept is valid.

The basic premise is that the market knows where the hockey puck is going and is mostly hedged.

Here's why:

It's not a perfect model, but we believe that concept is valid.

The basic premise is that the market knows where the hockey puck is going and is mostly hedged.

Here's why:

2/ Circle 1: What is shown is just the SPX AM-settled component.

For this thread, we have restricted THIS display to just the AM's.

Normally, the SPX Gamma Dash (without the " ^ " before the "SPX Gamma Dash") is both the AM and PM (Combo) combined.

For this thread, we have restricted THIS display to just the AM's.

Normally, the SPX Gamma Dash (without the " ^ " before the "SPX Gamma Dash") is both the AM and PM (Combo) combined.

3/ Circle 2: It's early in the morning east coast time in the US as we write this, and we don't receive final OI updates until about 7:45 am ET.

The actual OI numbers may change, but the concept here is the same.

The actual OI numbers may change, but the concept here is the same.

4/ Circle 3: About 4.7M SPX AM-settled contracts are set to settle at the opening print, +/-

Again, this does NOT include the SPX PM-settled component, which is in -play but does not expire until the end of the market day.

Again, this does NOT include the SPX PM-settled component, which is in -play but does not expire until the end of the market day.

5/ Circle 4: Shaded green area shows where there is a high probability of the option closing ITM / OTM, both for puts/calls.

This is a pure guess, but it's based on anticipating an opening gap, if there is one, being less than 1%.

This is a pure guess, but it's based on anticipating an opening gap, if there is one, being less than 1%.

6/ Circle 5: Shaded yellow area shows where there is a lower probability of the option closing ITM/OTM for both puts/calls.

Again, this a pure guess, but we could gap up or down, which will change moneyness.

Again, this a pure guess, but we could gap up or down, which will change moneyness.

7/ Circle 6 - Circle 9: Shows puts/calls that are presumed ITM/OTM.

Terminal delta level is indicated in each region, and we believe there is a high probability that what is stated is true.

Terminal delta level is indicated in each region, and we believe there is a high probability that what is stated is true.

8/ Circle 10: This is the dealers' amount to hedge if the levels are not already hedged.

Again, we are constraining this to +/- 1% in anticipation of a gap.

Actual mileage may vary.

The concept is the same independent of the actual numbers.

Again, we are constraining this to +/- 1% in anticipation of a gap.

Actual mileage may vary.

The concept is the same independent of the actual numbers.

9/ We discuss these things and so much more.

Come join a phenomenal community of traders and educators!

gammaedge.us

Come join a phenomenal community of traders and educators!

gammaedge.us

We hope this thread has provided value for you.

Follow us @GammaEdges for helpful content on trading, trend following, and making the options market actionable.

Like/Retweet the first tweet below if you learned something new:

Follow us @GammaEdges for helpful content on trading, trend following, and making the options market actionable.

Like/Retweet the first tweet below if you learned something new:

https://twitter.com/GammaEdges/status/1669661455724195841

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter