🍃 The Offshore Wind Megathread 🍃

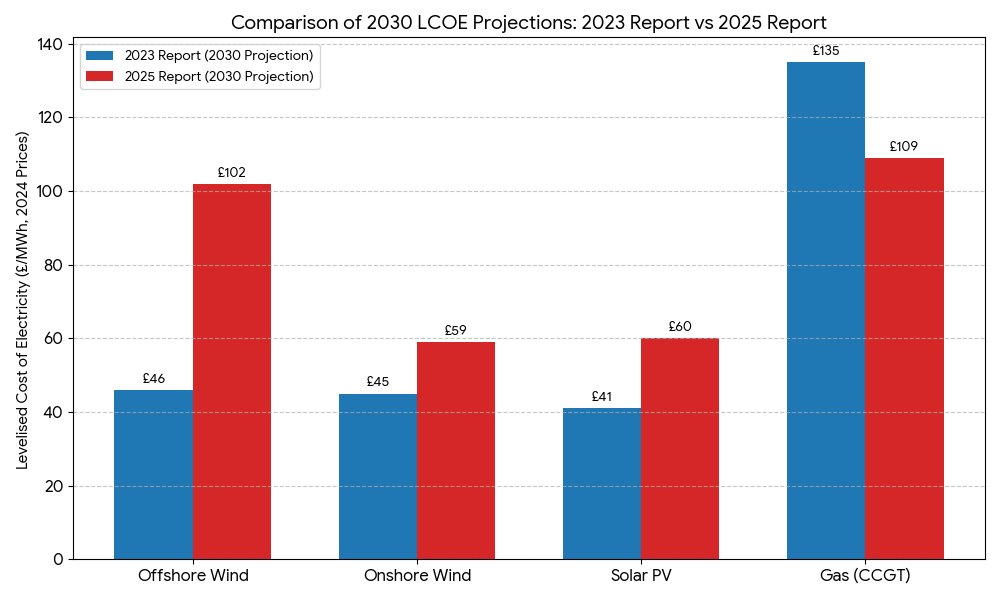

How many times have you seen on TV or read on Twitter that wind power is cheap and that's where the Government should focus its efforts?

Let's have a look at why that isn't remotely true.

#windenergy #greenenergy #renewables

How many times have you seen on TV or read on Twitter that wind power is cheap and that's where the Government should focus its efforts?

Let's have a look at why that isn't remotely true.

#windenergy #greenenergy #renewables

@BrknMan @aDissentient @7Kiwi MW not GW, it's late.

@BrknMan @aDissentient @7Kiwi I will say its possible for outliers. HR3 is a shallow, near shore farm and it was built before turbine costs shot up.

That's not the trend were seeing in the UK.

That's not the trend were seeing in the UK.

@halhod Though not covered here there are many that dispute it's greener credentials also

There are 35 tweets in this thread. Buggy Twitter doesn't always show them all in line, sometimes I see to 27, sometimes 30. You have to click on the last you can see to get the rest.

I notice the view counts for the later ones are much lower.

I notice the view counts for the later ones are much lower.

@halhod Also capex is 60-70% of the levelised cost and anything built recently is going to be 38% more expensive than pre 2021 just due to increased turbine costs.

@paterson_vm @fergustp Safe

@aDissentient @peterbatt Also there's the inconvenient fact that the IPCC says they are getting more expensive and why.

The global drop from 15 to 20 is due to a raft of near shore, shallow Chinese projects. It's not a true global trend.

The global drop from 15 to 20 is due to a raft of near shore, shallow Chinese projects. It's not a true global trend.

@aDissentient @peterbatt Here's the study.

Its up to 2019 I think and the costs fall within both Hughes and Montford own estimates.

sciencedirect.com/science/articl…

Its up to 2019 I think and the costs fall within both Hughes and Montford own estimates.

sciencedirect.com/science/articl…

@peterbatt @fergustp @aDissentient Hughes, Montford, the Science Direct study I sent you and the IPCC all agree offshore wind is increasing in price.

There is only one person with a case of denialism here Peter.

There is only one person with a case of denialism here Peter.

@peterbatt @fergustp @aDissentient Let's make this easy.

Show me anything that says the costs of offshore wind are falling that doesn't include CfD bid prices.

Show me anything that says the costs of offshore wind are falling that doesn't include CfD bid prices.

@peterbatt @MingleDandy @fergustp @aDissentient And would save everyone hundreds of pounds a month, at least £400, and thousands over the coming years.

@peterbatt @MingleDandy @fergustp @aDissentient You started off your responses by saying that we should ignore such people. So maybe you should?

And the article you said contains science? It's arguments in order are,

1. It's really more than 1% (you can say that about everyone, in which case it's still 1%).

And the article you said contains science? It's arguments in order are,

1. It's really more than 1% (you can say that about everyone, in which case it's still 1%).

@peterbatt @MingleDandy @fergustp @aDissentient 2. 1% is actually big (It's not)

3. History matters (not to future planning it doesn't)

4. We are influencial (we can be influencial without crippling ourselves).

5. China is actually great (lol)

Zero science.

3. History matters (not to future planning it doesn't)

4. We are influencial (we can be influencial without crippling ourselves).

5. China is actually great (lol)

Zero science.

If you enjoyed this and want to read something interesting about UK water in light of the Thames Water news then read my thread below.

https://twitter.com/LoftusSteve/status/1677596779724906498?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh