LSDfi is where the next money will flow.

#Binance has just released their LSDfi Report.

10 Insights you need to know (+ list of most promising projects)

A Comprehensive Thread🧵👇

#Binance has just released their LSDfi Report.

10 Insights you need to know (+ list of most promising projects)

A Comprehensive Thread🧵👇

1/ First things first, bookmark this thread for later reference.

There's a lot of info to digest here!

There's a lot of info to digest here!

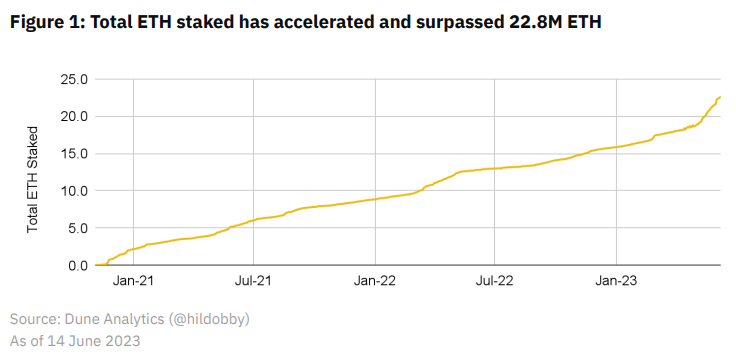

2/ The State of LSDs

The transition of Ethereum to a PoS network + the Shapella upgrade (enablement of staked ETH withdrawals) contributed to massive growth in staking.

The transition of Ethereum to a PoS network + the Shapella upgrade (enablement of staked ETH withdrawals) contributed to massive growth in staking.

4/ For those who don't know, LSDs refer to those tokens issued by liquid staking platforms.

These platforms come with two main benefits👇

These platforms come with two main benefits👇

5/ Lower Access Barriers

Previously, you would have to run a solo node to participate in the staking process. This requires heavy capital, which most users don't have.

These platforms allow everyone to stake their assets, reducing the entry barriers.

Previously, you would have to run a solo node to participate in the staking process. This requires heavy capital, which most users don't have.

These platforms allow everyone to stake their assets, reducing the entry barriers.

6/ Retain of liquidity

Through LSD platforms, users can stake their assets and retain their liquidity. This is achieved by issuing a liquid staking token that users can use freely in other protocols.

Through LSD platforms, users can stake their assets and retain their liquidity. This is achieved by issuing a liquid staking token that users can use freely in other protocols.

7/ ETH Staking Landscape

Currently, Lido is the largest player, with a 28.9% market share, followed by CEXs like Coinbase, Binance, and Kraken.

Currently, Lido is the largest player, with a 28.9% market share, followed by CEXs like Coinbase, Binance, and Kraken.

8/ LSDs can be rebasing or reward-bearing tokens.

Rebasing tokens = change in balance

Reward-bearing tokens = change in value

Rebasing tokens = change in balance

Reward-bearing tokens = change in value

9/ Short Overview of BNB Landscape

Within the BNB Chain ecosystem, Ankr is the largest liquid staking provider, with more than 214,000 BNB staked with the protocol.

Within the BNB Chain ecosystem, Ankr is the largest liquid staking provider, with more than 214,000 BNB staked with the protocol.

10/ LSDFi

"LSDfi refers to DeFi protocols built on top of liquid staking derivatives. By offering additional yield-generating opportunities, LSDfi protocols allow LSD holders to put their assets to work and maximize yield".

"LSDfi refers to DeFi protocols built on top of liquid staking derivatives. By offering additional yield-generating opportunities, LSDfi protocols allow LSD holders to put their assets to work and maximize yield".

12/ DeFi LSDs: These are the protocols that we just covered, enabling users to partake in staking and receive LSDs in return.

• @LidoFinance

• @Rocket_Pool

• @ankr

• @fraxfinance

• @staderlabs

• @stakewise_io

• @LidoFinance

• @Rocket_Pool

• @ankr

• @fraxfinance

• @staderlabs

• @stakewise_io

13/ CEX LSD: Centralized Exchanges enabling users to partake in staking.

• @coinbase

• @binance

• @krakenfx

• @coinbase

• @binance

• @krakenfx

14/ CDP Stablecoins: Protocols allowing users to mint stablecoins using LSDs as collateral.

• @CurveFinance

• @LybraFlnanceLSD

• @raft_fi

• @PrismaFi

• @CurveFinance

• @LybraFlnanceLSD

• @raft_fi

• @PrismaFi

15/ Index LSDs: Protocols that issue tokens representing a basket of LSDs.

• @indexcoop

• @unsheth_xyz

• @indexcoop

• @unsheth_xyz

16/ Yield Strategies: Protocols that enable users to access additional yield opportunities.

• @Instadapp

• @pendle_fi

• @Flashstake

• @swellnetworkio

• @asymetrix_eth

• @parallaxfin

• @Instadapp

• @pendle_fi

• @Flashstake

• @swellnetworkio

• @asymetrix_eth

• @parallaxfin

17/ Money Market: Protocols that enable lending and borrowing using LSDs.

• @AAve

• @gravitaprotocol

• @ZeroLiquid_xyz

• @SiloFinance

• @AAve

• @gravitaprotocol

• @ZeroLiquid_xyz

• @SiloFinance

18/ The LSDfi landscape is relatively concentrated, with the top 5 players possessing over 81%of TVL.

Lybra is the market leader, and its rise to the top has been rapid, considering the project only went live on its mainnet in April.

Lybra is the market leader, and its rise to the top has been rapid, considering the project only went live on its mainnet in April.

19/ LSDFi Overview

There is a wide variety of projects, from CDP stablecoins to automated yield strategies.

With time, it is foreseeable that there will be more innovation in the space, benefitting LSD holders by providing more yield-generating options.

There is a wide variety of projects, from CDP stablecoins to automated yield strategies.

With time, it is foreseeable that there will be more innovation in the space, benefitting LSD holders by providing more yield-generating options.

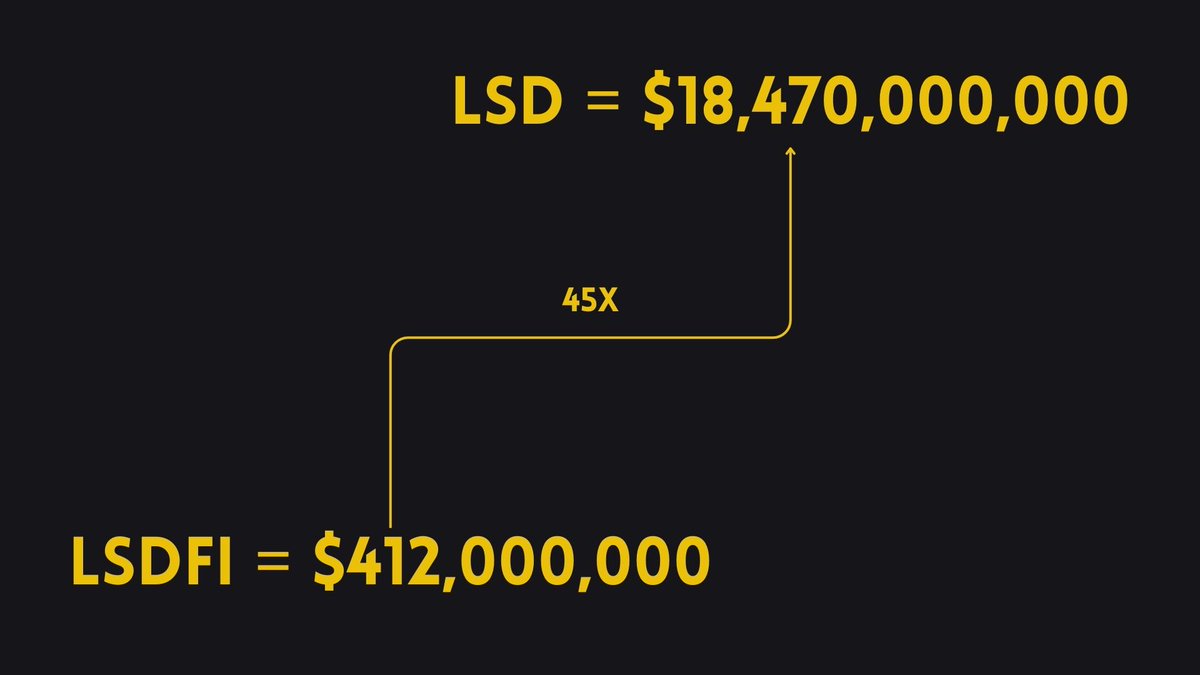

20/ Growth of LSDFi

As the narrative gained steam, cumulative TVL in top LSDfi protocols crossed the US$400M mark and has more than doubled since a month ago.

As the narrative gained steam, cumulative TVL in top LSDfi protocols crossed the US$400M mark and has more than doubled since a month ago.

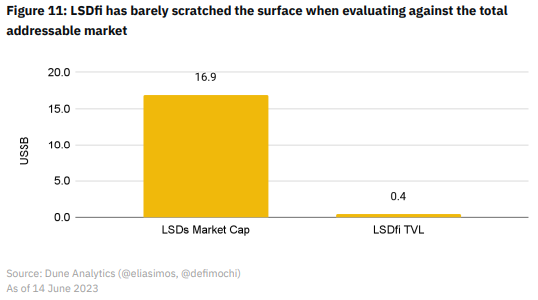

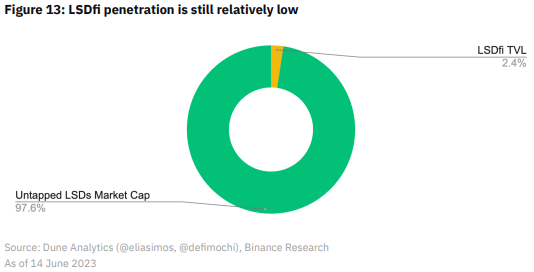

21/ This growth was led by the increase in staked ETH after the Shapella upgrade.

However, the sector is still extremely small, with over $16.9B in LSDs on Ethereum and a TVL of only $412M in LSDFi protocols.

~2% penetration.

However, the sector is still extremely small, with over $16.9B in LSDs on Ethereum and a TVL of only $412M in LSDFi protocols.

~2% penetration.

22/ LSDfi Outlook

The staking ratio of ETH is significantly lower than the average of the top 20 PoS chains.

ETH Ratio: 16.1%

Average Ratio: 58.1%

The staking ratio of ETH is significantly lower than the average of the top 20 PoS chains.

ETH Ratio: 16.1%

Average Ratio: 58.1%

23/ This gap should narrow in the future as the enablement of withdrawals has increased the attractiveness of staking.

Users have full control over their assets as they can exit their position at any time.

Users have full control over their assets as they can exit their position at any time.

24/ Demand for staking is further evident from the current validation queue of 46 days.

What does it mean?

Any new validator wishing to enter the network and stake their ETH must wait 46 days.

What does it mean?

Any new validator wishing to enter the network and stake their ETH must wait 46 days.

25/ As LSDs continue to gain traction and more holders look to generate yield, we will likely see more innovative projects aiming to capitalize on rising demand.

TVL in LSDfi protocols currently represents less than 3% of the total addressable market.

TVL in LSDfi protocols currently represents less than 3% of the total addressable market.

26/ Special mentions:

@Louround_

@CryptoKoryo

@IamZeroIka

@arndxt_xo

@rektdiomedes

@thehiddenmaze

@defi_mochi

@0xCrypto_doctor

@DeFi_Finest

@belizardd

@defiprincess_

@splinter0n

@Defi0xJeff

@nobrainflip

@francescoweb3

@Slappjakke

@the_smart_ape

@WinterSoldierxz

@0xSalazar

@Louround_

@CryptoKoryo

@IamZeroIka

@arndxt_xo

@rektdiomedes

@thehiddenmaze

@defi_mochi

@0xCrypto_doctor

@DeFi_Finest

@belizardd

@defiprincess_

@splinter0n

@Defi0xJeff

@nobrainflip

@francescoweb3

@Slappjakke

@the_smart_ape

@WinterSoldierxz

@0xSalazar

27/ Tagging some LSD chads:

@0xsurferboy

@CryptoStreamHub

@karl_0x

@DefiIgnas

@rektdiomedes

@CryptoShiro_

@crypto_linn

@ardizor

@Defi_Maestro

@LouisCooper_

@defi_mochi

@crypthoem

@TheDeFISaint

@0xTindorr

@DeFiMinty

@0x_gremlin

@wacy_time1

@leshka_eth

@0xsurferboy

@CryptoStreamHub

@karl_0x

@DefiIgnas

@rektdiomedes

@CryptoShiro_

@crypto_linn

@ardizor

@Defi_Maestro

@LouisCooper_

@defi_mochi

@crypthoem

@TheDeFISaint

@0xTindorr

@DeFiMinty

@0x_gremlin

@wacy_time1

@leshka_eth

@0xsurferboy @CryptoStreamHub @karl_0x @DefiIgnas @rektdiomedes @CryptoShiro_ @crypto_linn @ardizor @Defi_Maestro @LouisCooper_ @defi_mochi @crypthoem @TheDeFISaint @0xTindorr @DeFiMinty @0x_gremlin @wacy_time1 @leshka_eth That's a wrap!

If you enjoyed this thread:

1. Follow me @Moomsxxx for more of these

2. RT the tweet below to share this thread with your chads

If you enjoyed this thread:

1. Follow me @Moomsxxx for more of these

2. RT the tweet below to share this thread with your chads

https://twitter.com/2860479536/status/1670446076682289153

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter