In this Detailed Thread 🧵 I'll look to Analyse 'HPL ELECTRIC & POWER'⚡⚡ Business, Fundamentals, Financials, Technicals, Management, Order Book, Growth Potential💹, Industry Trigger, Valuation Metrics♎⚖️, Competitors, Risk Factor, Peers Comparison etc.

#HPLELECTRIC

#HPLELECTRIC

Each and every neeche details about HPL Electric ⚡⚡ will be covered in this Detailed Thread

☑️ABOUT THE COMPANY

🏅HPL Electric & Power Limited is a leading electrical equipment manufacturer in India operating for the past 40 years.

☑️ABOUT THE COMPANY

🏅HPL Electric & Power Limited is a leading electrical equipment manufacturer in India operating for the past 40 years.

🏅The Company has significant presence across five key product verticals of electric equipment – Metering Solutions, Modular Switches, Switchgears, LED Lighting and Wires

and Cables.

🏅It caters to a wide spectrum of customer segments, such as power utilities, government

and Cables.

🏅It caters to a wide spectrum of customer segments, such as power utilities, government

agencies, and retail and institutional customers, with a strong brand recall as a trusted electrical brand.

🏅It exports its finest engineering goods to more than 42 countries in regions of Asia, Africa, Europe, UK and Indian Sub-continent through the overseas logistic partners.

🏅It exports its finest engineering goods to more than 42 countries in regions of Asia, Africa, Europe, UK and Indian Sub-continent through the overseas logistic partners.

☑️Market Share

🏅The company is the largest manufacturer of on-load change-over switches with a 50% market share in the country.

🏅It also has a market share of 20% in the domestic Electric Meters Market.

🏅It also has 5% market share in the Low-voltage Switchgear Market.

🏅The company is the largest manufacturer of on-load change-over switches with a 50% market share in the country.

🏅It also has a market share of 20% in the domestic Electric Meters Market.

🏅It also has 5% market share in the Low-voltage Switchgear Market.

🏅It is the 5th largest LED manufacturer in the country.

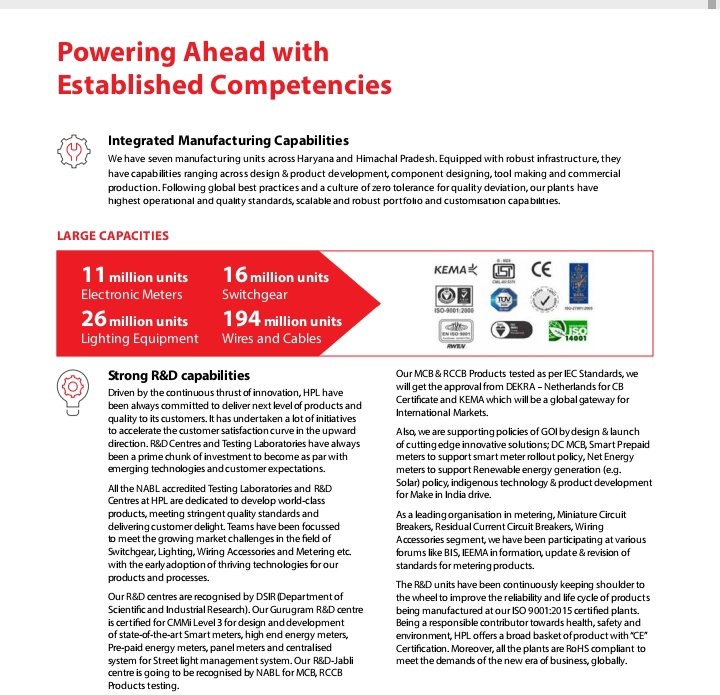

☑️Manufacturing Capabilities

🏅The Company has seven manufacturing facilities at Gurugram, Jubli, Kundli & Gahraunda with end-to-end capabilities.

🏅Its well organised supply chain is supported by 21 warehouses across

☑️Manufacturing Capabilities

🏅The Company has seven manufacturing facilities at Gurugram, Jubli, Kundli & Gahraunda with end-to-end capabilities.

🏅Its well organised supply chain is supported by 21 warehouses across

India.

🏅Its manufacturing process is supported by 2 R&D facilities in Gurugram & Kundli with more than 100 engineers

☑️Established Distribution Network

🏅HPL has established a pan-India distribution network with 900+ authorised dealers and 45,000+ retailers across India in

🏅Its manufacturing process is supported by 2 R&D facilities in Gurugram & Kundli with more than 100 engineers

☑️Established Distribution Network

🏅HPL has established a pan-India distribution network with 900+ authorised dealers and 45,000+ retailers across India in

order to reinforce its brand presence and leverage on the growing potential of India’s electrical equipment industry in metros and Tier I and II cities.

🏅The company plans to increase the retailers to 1,00,000 by March 2025

☑️Revenue Breakup

🏅Metering products contributes

🏅The company plans to increase the retailers to 1,00,000 by March 2025

☑️Revenue Breakup

🏅Metering products contributes

53%, the rest is from Consumer & Industrial 47%.

☑️Order Books

🏅The company has a strong order book of Rs 1500+ cr with meter & systems contributing 82% and the consumer and industrial segment contributing 18% of the current order book.

☑️Order Books

🏅The company has a strong order book of Rs 1500+ cr with meter & systems contributing 82% and the consumer and industrial segment contributing 18% of the current order book.

☑️Product Mix

🏅METERS SEGMENT

💫INDUSTRIAL APPLICATION

(Digital Panel Meters, Digital Energy Meter, Multi Function Meter, Load Manager & Demand Controller, Din Rail Meter, Power Factor Control & Regulators)

💫Domestic & Commercial Application

(1PH Direct Connection/LCD

🏅METERS SEGMENT

💫INDUSTRIAL APPLICATION

(Digital Panel Meters, Digital Energy Meter, Multi Function Meter, Load Manager & Demand Controller, Din Rail Meter, Power Factor Control & Regulators)

💫Domestic & Commercial Application

(1PH Direct Connection/LCD

Meters 3P Direct Connection Counter/LCD Meters, Trivector Meters, Dual Source Projection Meters, Long Range Integrated Meter, Import Export- Net Meter, Meter Cover Boxes)

💫Metering Solutions

(IR & IRDA Meters, LPR Metering Solution, Data Acquisition & Billing, Solution,

💫Metering Solutions

(IR & IRDA Meters, LPR Metering Solution, Data Acquisition & Billing, Solution,

• • •

Missing some Tweet in this thread? You can try to

force a refresh