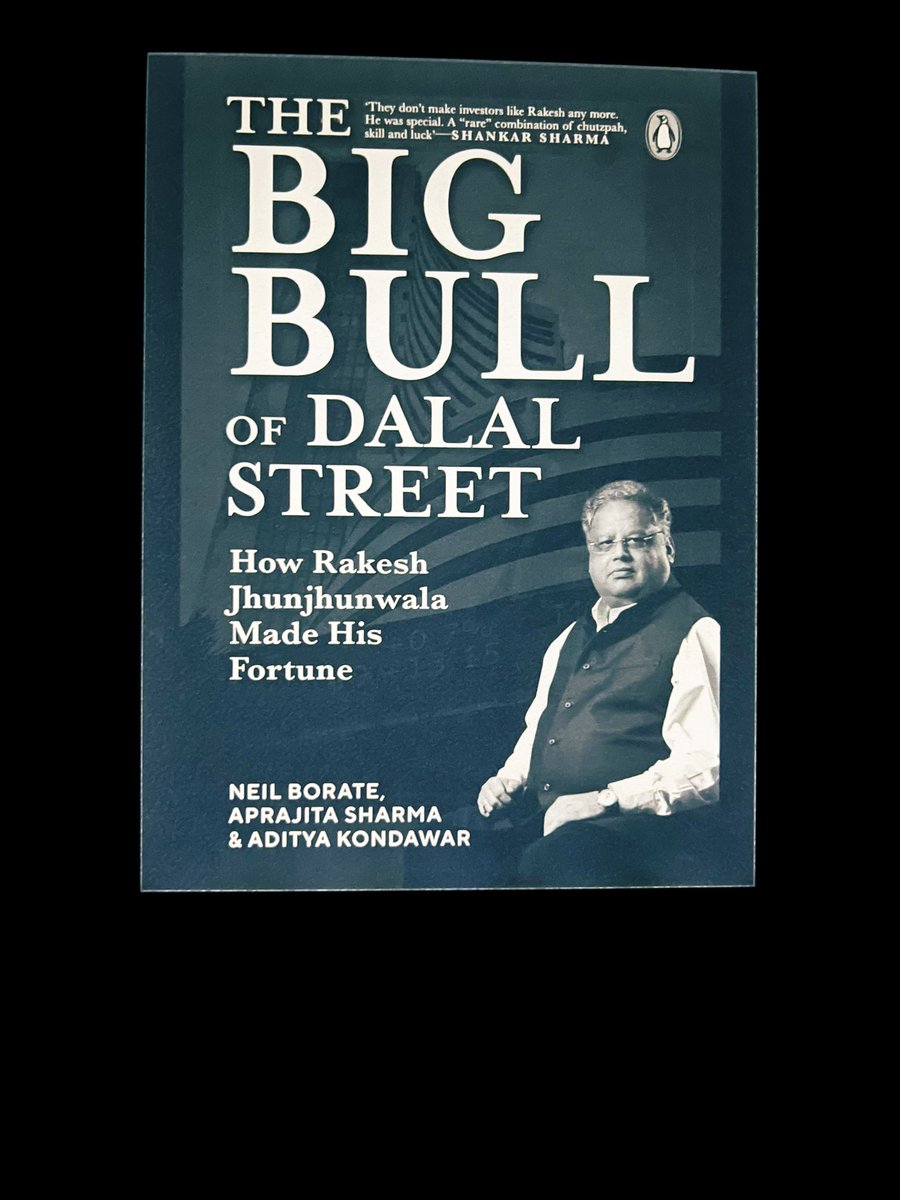

Finally Completed this Amazing First Dedicated Book on Rakesh Jhunjhunwala’s Stock market Wisdom, insights , success stories, failures & also about his life by

@ActusDei

@aditya_kondawar

@apri_sharma

A thread 🧵 on

Rakesh Jhunjhunwala's Mantras to Pick Stocks ,

@ActusDei

@aditya_kondawar

@apri_sharma

A thread 🧵 on

Rakesh Jhunjhunwala's Mantras to Pick Stocks ,

There are the aspects which, according to Jhunjhunwala, should be followed to pick multi-bagger stocks:

1) Keep an open mind

Be receptive to what the world is showing you. By 'keep an open mind',

1) Keep an open mind

Be receptive to what the world is showing you. By 'keep an open mind',

RJ means that one has to observe their surroundings. Some of the great stock ideas come when you least expect it. Your observation about how everyone is using a certain technology, product or service & which listed player is behind it can help you land great stock op-portunities.

2) Opportunity

one needs to assess the market opportunity as to how big an opportunity the company is looking at as its market size grows. The opportunity and market size should move in tandem. This is what provides a long runway for growth..

one needs to assess the market opportunity as to how big an opportunity the company is looking at as its market size grows. The opportunity and market size should move in tandem. This is what provides a long runway for growth..

There has to be a big change or a turnaround happening. The greatest wealth is earned when change happens, Rakesh would say. The business model should have entry barriers

3) Corporate governance

is about the management and how someone runs their company their behaviour with their staff, vendors, distributors and others and their behaviour with money. Are they running their business with fru-gality? One needs to look into this stuff.

is about the management and how someone runs their company their behaviour with their staff, vendors, distributors and others and their behaviour with money. Are they running their business with fru-gality? One needs to look into this stuff.

A hard-working and honest management is important. Rakesh excelled at studying people and betting on them. Why he loved Tata Group stocks was only because of the sheer integrity of the management

4)Competitive ability

The company must have something superior in terms of competition against its peers, be it the brand, technology or capital. It should be a market leader.

The company must have something superior in terms of competition against its peers, be it the brand, technology or capital. It should be a market leader.

5) Valuations

Finally, there is the price at which you are buying it. Even a great company bought at the wrong price (high valuations) will hurt your returns. So, price is important. Learn to value a company. Read valuations.

Finally, there is the price at which you are buying it. Even a great company bought at the wrong price (high valuations) will hurt your returns. So, price is important. Learn to value a company. Read valuations.

The last one

6) Constant monitoring

Even though a long-term investor, he would keep monitoring how his portfolio companies were performing. He would often turn up in investor calls to quiz the management about the business prospects or other actions.

6) Constant monitoring

Even though a long-term investor, he would keep monitoring how his portfolio companies were performing. He would often turn up in investor calls to quiz the management about the business prospects or other actions.

If he felt the initial thesis was failing or the business model hadn't turned out the way he anticipated, he would prefer to sell his stakes.

Source- The Big bull of Dalal street -Book

Source- The Big bull of Dalal street -Book

Summary.

1) Keep an open mind

2) Opportunity

3) Corporate governance

4)Competitive ability

5) Valuations

6) Constant Monitoring

#Investing

#Rakeshjhunjhunwala

#Indianstockmarket

1) Keep an open mind

2) Opportunity

3) Corporate governance

4)Competitive ability

5) Valuations

6) Constant Monitoring

#Investing

#Rakeshjhunjhunwala

#Indianstockmarket

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter