@binance released a report on LSDfi which covers its landscape, profitability, and risks.

Since LSDfi is one of the most potential narratives that I think will lead the market, there's a quick recap for who found the research TL, DR 😜

🧵 👇🏻

Since LSDfi is one of the most potential narratives that I think will lead the market, there's a quick recap for who found the research TL, DR 😜

🧵 👇🏻

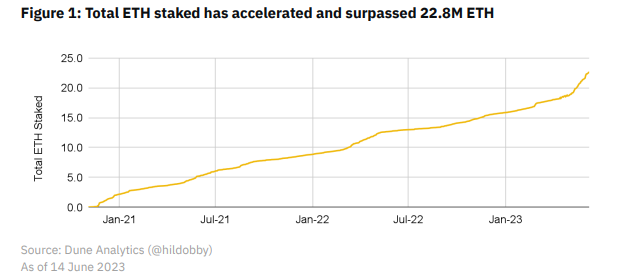

🚀 Rapid development of the $ETH staking market.

With Ethereum's successful transition to PoS and the ability to withdraw staked $ETH after the #Shapella upgrade, staked $ETH has grown rapidly.

Total staked $ETH now exceeds 22.8 million ETH!

With Ethereum's successful transition to PoS and the ability to withdraw staked $ETH after the #Shapella upgrade, staked $ETH has grown rapidly.

Total staked $ETH now exceeds 22.8 million ETH!

💧 Flourishing development of LSD.

Running independent nodes is challenging and costly, so liquidity staking protocols have reduced barriers while maintaining asset liquidity.

Data shows increased staked ETH in the overall LSD staking volume.

Running independent nodes is challenging and costly, so liquidity staking protocols have reduced barriers while maintaining asset liquidity.

Data shows increased staked ETH in the overall LSD staking volume.

💎 Market dominance by a few major players

Lido is the largest staking provider, occupying 28.9% of the market share, followed by centralized exchanges such as Coinbase, Binance, and Kraken.

Lido is the largest staking provider, occupying 28.9% of the market share, followed by centralized exchanges such as Coinbase, Binance, and Kraken.

There are also smaller liquidity staking providers, but their staked ETH amounts are relatively small. Additionally, the fees vary among the providers, but the earnings are generally around 4%.

🔗 Active liquidity staking in the BNB ecosystem with a total staked value of approximately $150 million.

Similar to ETH liquidity staking, BNB stakers receive liquidity staking rewards that can be used in other areas of DeFi, generating further earnings.

Similar to ETH liquidity staking, BNB stakers receive liquidity staking rewards that can be used in other areas of DeFi, generating further earnings.

📖 LSDfi is categorized as follows:

1️⃣ DeFi Field: Users stake and receive LSD as a reward.

2️⃣ CEX Field: Centralized exchanges that offer liquidity staking.

3️⃣ CDP: CDP protocols that use LSD as collateral for minting stablecoins.

1️⃣ DeFi Field: Users stake and receive LSD as a reward.

2️⃣ CEX Field: Centralized exchanges that offer liquidity staking.

3️⃣ CDP: CDP protocols that use LSD as collateral for minting stablecoins.

4️⃣ Index LSDs: Tokens representing a basket of LSD holdings.

5️⃣ Yield Strategies: Protocols that allow users to gain additional earning opportunities.

6️⃣ Money Markets: Facilitating borrowing and lending through LSDs.

5️⃣ Yield Strategies: Protocols that allow users to gain additional earning opportunities.

6️⃣ Money Markets: Facilitating borrowing and lending through LSDs.

👑 The major LSD protocols and providers have relatively concentrated market shares, with the top five accounting for over 81% of the TVL (Total Value Locked).

Lybra is the market leader, rapidly rising since its launch in April, with a TVL exceeding $160 million.

Lybra is the market leader, rapidly rising since its launch in April, with a TVL exceeding $160 million.

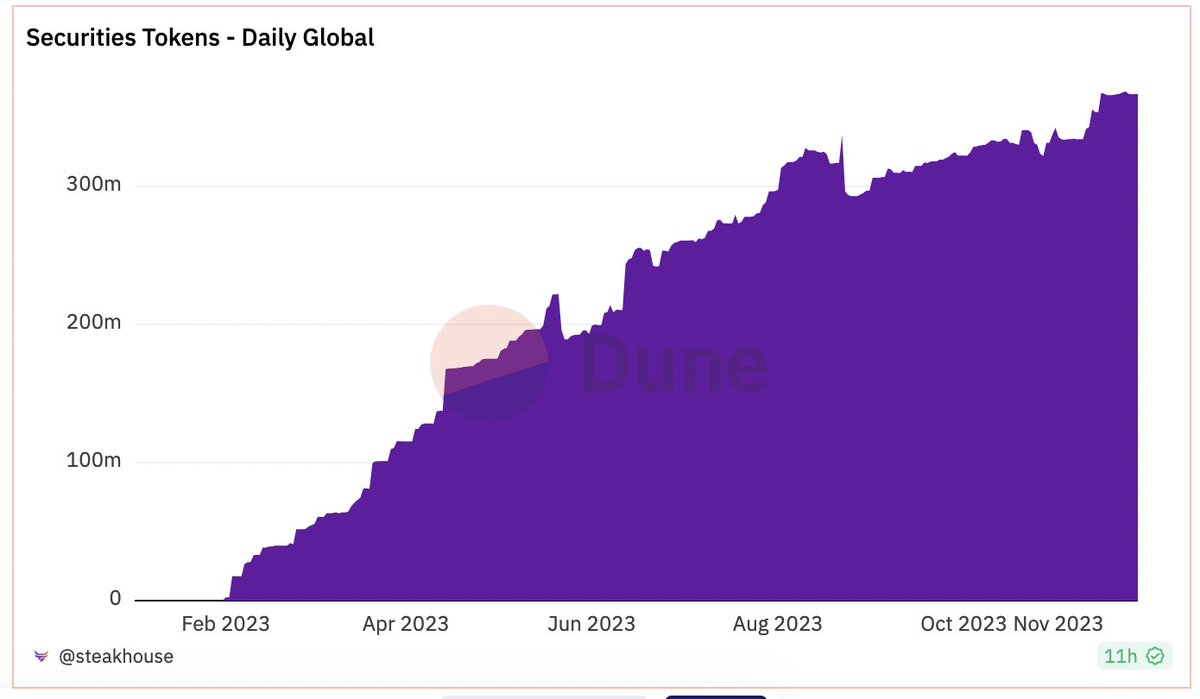

🌙 Rapid growth of LSDfi.

TVL has rapidly increased in recent months, doubling since a month ago and surpassing $400 million.

The desire of LSD holders to maximize their earnings has driven this growth trend.

TVL has rapidly increased in recent months, doubling since a month ago and surpassing $400 million.

The desire of LSD holders to maximize their earnings has driven this growth trend.

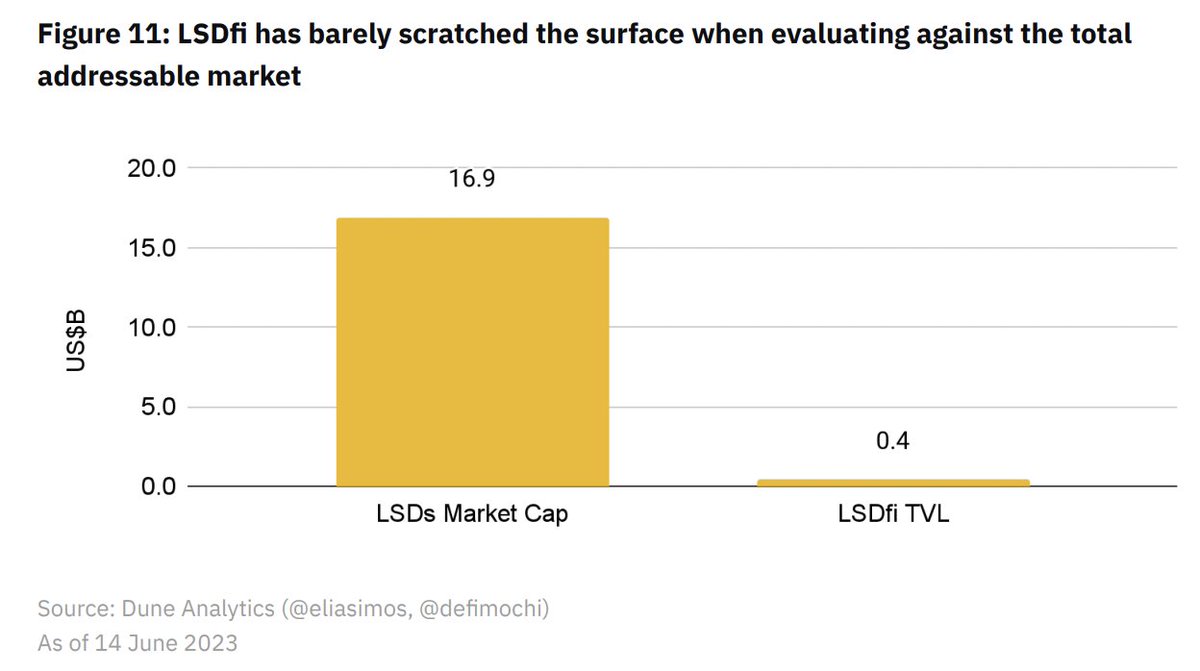

🌐 A long and challenging road ahead.

Despite impressive growth in LSDfi, the total market capitalization of the LSD sector exceeds $16.9 billion, while the total TVL of LSDfi protocols is only $412 million.

The current penetration rate remains relatively low, at less than 3%.

Despite impressive growth in LSDfi, the total market capitalization of the LSD sector exceeds $16.9 billion, while the total TVL of LSDfi protocols is only $412 million.

The current penetration rate remains relatively low, at less than 3%.

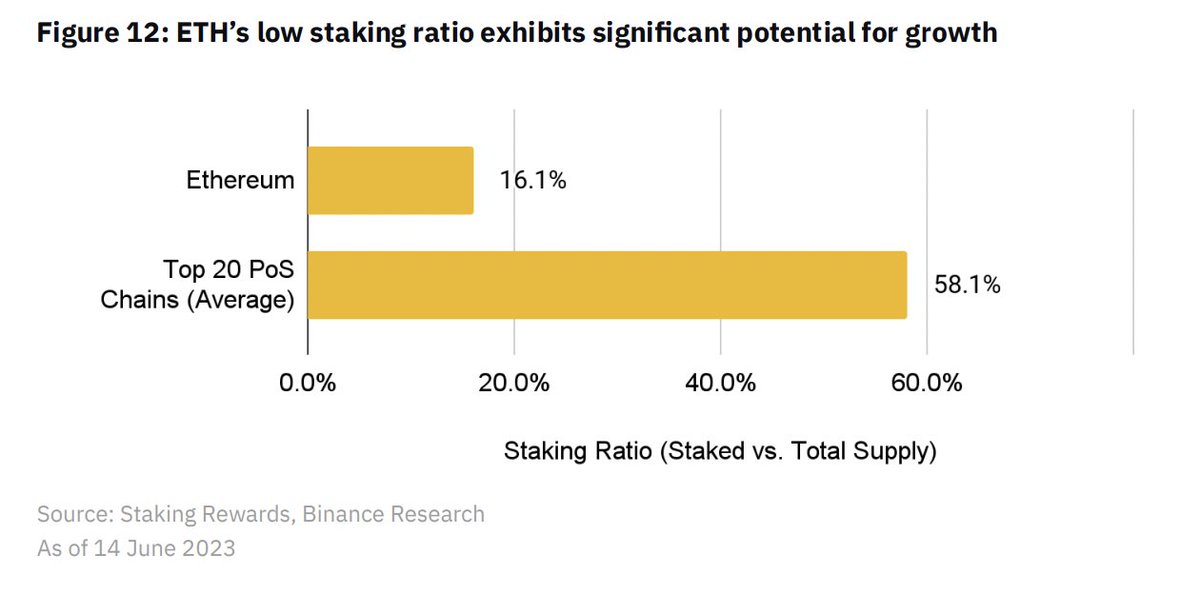

ETH's staking ratio is at 16.1%, lower than the average of 58.1% for top 20 PoS chains.

With post-Shapella withdrawals enabled, staking becomes more attractive due to the ability to exit anytime.

Increasing the staking ratio would benefit LSD and LSDfi protocols.

With post-Shapella withdrawals enabled, staking becomes more attractive due to the ability to exit anytime.

Increasing the staking ratio would benefit LSD and LSDfi protocols.

And that's a wrap!

I hope this analytics can provide you with a clear vision of LSDfi and its potential.

If you found this thread interesting and helpful, please like, retweet, and don't forget to turn on notifications for more insightful content coming your way soon!

I hope this analytics can provide you with a clear vision of LSDfi and its potential.

If you found this thread interesting and helpful, please like, retweet, and don't forget to turn on notifications for more insightful content coming your way soon!

• • •

Missing some Tweet in this thread? You can try to

force a refresh