crypto enthusiast | gems hunter 👾 DYOR - NFA 🫥 #RWA #AI #InfoFI 👩🏻💻 https://t.co/QruSUnHpVg

How to get URL link on X (Twitter) App

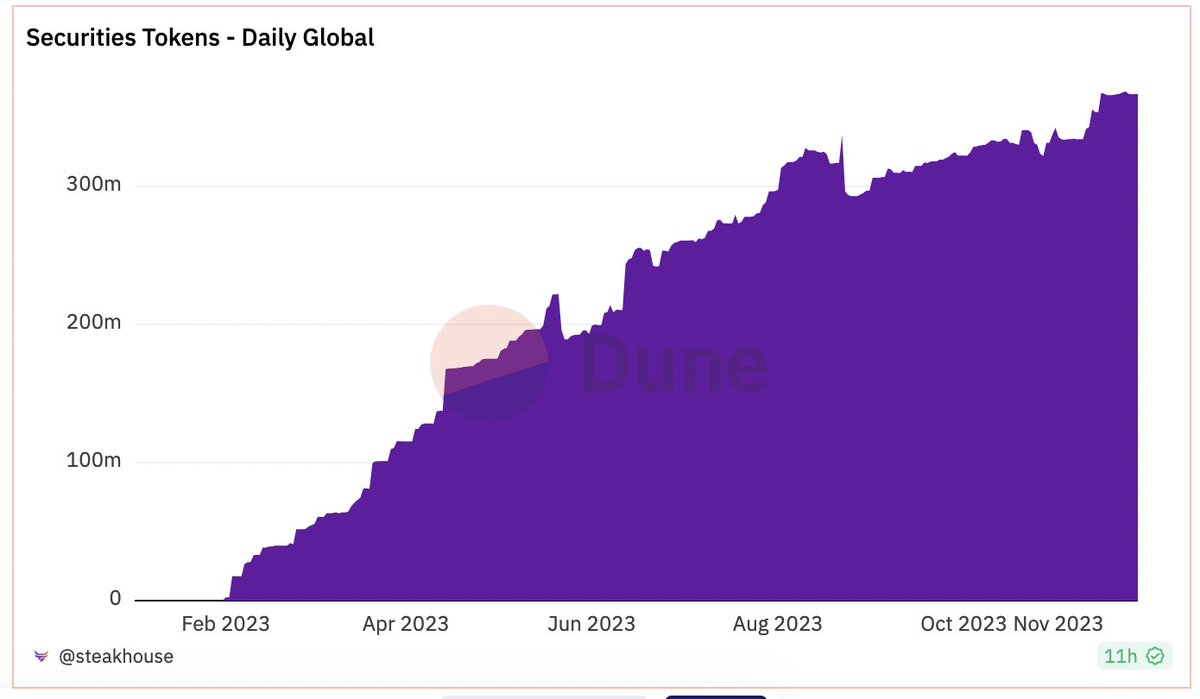

What can we expect to see in the near future?

What can we expect to see in the near future?

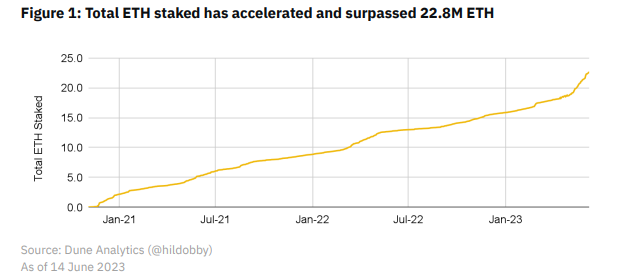

🚀 Rapid development of the $ETH staking market.

🚀 Rapid development of the $ETH staking market.

📌 This thread will conclude with:

📌 This thread will conclude with: