Traders have been infected with the constant urge to trade any condition, even without an entry trigger, any system or any reason.

Make the 6 Changes Below.

1. The Trading Journey.

Please understand that's there's no target or destination to be achieved or reached.

Make the 6 Changes Below.

1. The Trading Journey.

Please understand that's there's no target or destination to be achieved or reached.

Trading is filled with errors, stumbling blockade and even Liquidations that will lead to costly mistakes.

Your aim is to accept that market will change, strategies will become useless and edges will die.

Adapt or Die.

Be ready to learn a new edge, a new Pattern. To restart.

Your aim is to accept that market will change, strategies will become useless and edges will die.

Adapt or Die.

Be ready to learn a new edge, a new Pattern. To restart.

2. Stop Chasing Profits.

The lust of trading lies in its rewards.

The pursuit of profits and prestige can hinder your trading performance, if that's all you concentrate on.

Winners separate emotions from these outcomes.

Be present in the process and not lost with the rewards.

The lust of trading lies in its rewards.

The pursuit of profits and prestige can hinder your trading performance, if that's all you concentrate on.

Winners separate emotions from these outcomes.

Be present in the process and not lost with the rewards.

So take trades based on the strategy you have and not Based on the dreams you have.

Be completely present and focussed on the process of taking a trade, on the trigger for entering a trade and controlling your Risks.

Keep these in control and not focus on your dream profits.

Be completely present and focussed on the process of taking a trade, on the trigger for entering a trade and controlling your Risks.

Keep these in control and not focus on your dream profits.

3. Be a trading business, not a Trader.

I learned this too late. Remove all distraction while trading and delete all Physical inconvenience.

Know the software and the system in and out like the best mason.

And remember, anticipation of success leads to entitlement...

I learned this too late. Remove all distraction while trading and delete all Physical inconvenience.

Know the software and the system in and out like the best mason.

And remember, anticipation of success leads to entitlement...

I learnt that You can find the perfect set-up and execute perfectly, but you can still lose.

Markets change.

You will lose all the time. Just don't lose so much that you lose it all.

Expect losses, have plan B if trade goes wrong and Have Pre-determined Exits.

Know your exits.

Markets change.

You will lose all the time. Just don't lose so much that you lose it all.

Expect losses, have plan B if trade goes wrong and Have Pre-determined Exits.

Know your exits.

4 Unrealised PnL is Just a Number.

Took me a long time to realise- Hindsight thinking in trading should be AFTER the profit is realised and moved to the bank.

Unirealised profits are just smoke and dreams unless captured.

Unrealised profit build up the anticipation for more.

Took me a long time to realise- Hindsight thinking in trading should be AFTER the profit is realised and moved to the bank.

Unirealised profits are just smoke and dreams unless captured.

Unrealised profit build up the anticipation for more.

A Pro Tip- Whenever you want I Screenshot your unrelaises profits to Show off, exit your trade. That's the sign of Euphoria.

Please Pay Special attention to Point 5.

This step will turn you into a real trading Business.

I wish I started doing it earlier, specially in Crypto.

Please Pay Special attention to Point 5.

This step will turn you into a real trading Business.

I wish I started doing it earlier, specially in Crypto.

5. The Auditor Monk.

This is a common sense I wish I syatyes in 2016. Take accounts. Be Okay about it. At a pre determined interval, you must reset.

A. Re-balancing the trading portfolio.

B. Moving a proportion of the profits to cash.

C. Adding the rest to the trading balance.

This is a common sense I wish I syatyes in 2016. Take accounts. Be Okay about it. At a pre determined interval, you must reset.

A. Re-balancing the trading portfolio.

B. Moving a proportion of the profits to cash.

C. Adding the rest to the trading balance.

This keeps your trading business, your risk mindset and the machinery of trading and betting on Check.

You must be your own Monk auditor, do your own scrutiny at regular intervals, move the profits from Ponzi money to real money, at regular intervals.

Do this. Please.

You must be your own Monk auditor, do your own scrutiny at regular intervals, move the profits from Ponzi money to real money, at regular intervals.

Do this. Please.

6. The Fallacy of Backtesting.

Backtesting trading systems is good but it is I'll never fully prepare them for real-world deployment.

As much as fractal traders would argue, history only rhymes, doesn't repeat.

Backtesting trading systems is good but it is I'll never fully prepare them for real-world deployment.

As much as fractal traders would argue, history only rhymes, doesn't repeat.

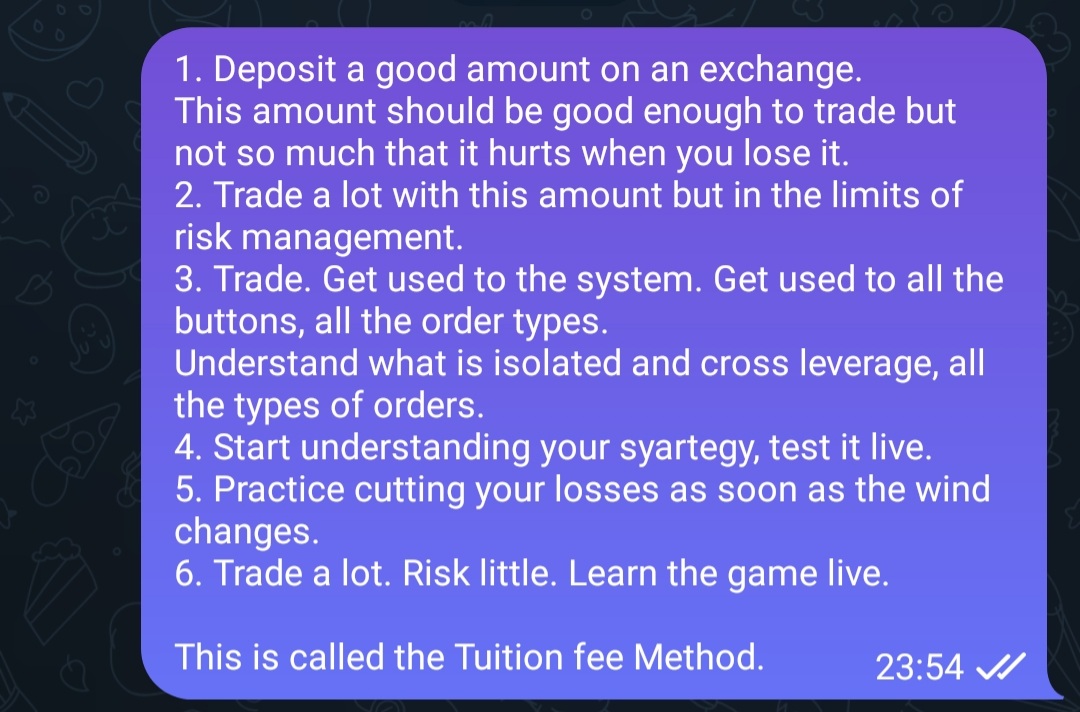

Each trading session is unique. Fractals don't work truly replicate hence here's a way to learn the market via the

'Tuition Fee Method'

Even if you're already an intermediate, you can try this method.

There's no options for beginners, you MUST try this method.

'Tuition Fee Method'

Even if you're already an intermediate, you can try this method.

There's no options for beginners, you MUST try this method.

Learnings

1. No edge will be permanent, your observations will decay. You will have losses. Be in the business regardless.

2. Focus on the trade, scrutize the setup before entering, judge your bias and be slow before entering.

3. Remove all physical distractions while trading.

1. No edge will be permanent, your observations will decay. You will have losses. Be in the business regardless.

2. Focus on the trade, scrutize the setup before entering, judge your bias and be slow before entering.

3. Remove all physical distractions while trading.

4. Understand the software and the setup, the rules like the back of your hand.

5. Don't enter unless you know when and how you will edit in case of a profit or a loss.

6. Don't trade it you don't have a system.

7. Rebalance like a monk, transfer to cash and trading account.

5. Don't enter unless you know when and how you will edit in case of a profit or a loss.

6. Don't trade it you don't have a system.

7. Rebalance like a monk, transfer to cash and trading account.

I wish I had implemented these small changed which would have compounded to huge gains today.

I make Bitcoin Trading Tutorials every week in a Lazy fashion, made for normal IQ people with practical trading on mind.

You can Learn for free there.

Link- t.me/EmperorbtcTA/7…

I make Bitcoin Trading Tutorials every week in a Lazy fashion, made for normal IQ people with practical trading on mind.

You can Learn for free there.

Link- t.me/EmperorbtcTA/7…

• • •

Missing some Tweet in this thread? You can try to

force a refresh