When faced with a decision, you choose a character:

1. Investor: Long-term thinker who delays gratification; sacrifices short-term pleasure for long-term reward

2. Borrower: Short-term thinker unwilling to delay gratification; experiences short-term pleasure with long-term cost

1. Investor: Long-term thinker who delays gratification; sacrifices short-term pleasure for long-term reward

2. Borrower: Short-term thinker unwilling to delay gratification; experiences short-term pleasure with long-term cost

The Investor makes an investment.

An investment compounds with a positive rate of return into the future.

That investment—whether financial, physical, relationship, or anything else—is worth much more at a date in the future.

Our future self cashes in on that value.

An investment compounds with a positive rate of return into the future.

That investment—whether financial, physical, relationship, or anything else—is worth much more at a date in the future.

Our future self cashes in on that value.

The Borrower takes out a loan.

The loan provides upfront pleasure, but comes with a catch: Interest!

The interest accrues on top of the value of the loan. Even at a low rate, the value to be repaid has ballooned at a date in the future.

Our future self is stuck with the bill.

The loan provides upfront pleasure, but comes with a catch: Interest!

The interest accrues on top of the value of the loan. Even at a low rate, the value to be repaid has ballooned at a date in the future.

Our future self is stuck with the bill.

Entrepreneur and investor @naval refers to "uphill decisions" as the choice to take the more difficult path in the short-term.

His logic is that the path with more short-term pain is typically the one with the largest potential for compounded long-term gain.

His logic is that the path with more short-term pain is typically the one with the largest potential for compounded long-term gain.

The core principle is simple:

The best of life comes from investing: from making the decision to do something difficult now to enjoy rewards of the compounding later.

Most things that feel good now will feel bad later, and most things that feel bad now will feel good later.

The best of life comes from investing: from making the decision to do something difficult now to enjoy rewards of the compounding later.

Most things that feel good now will feel bad later, and most things that feel bad now will feel good later.

I have observed a variety of applications of the Investor vs. Borrower idea:

• Time Decisions

• Relationship Decisions

• Health Decisions

• Financial Decisions

Here are a few examples:

• Time Decisions

• Relationship Decisions

• Health Decisions

• Financial Decisions

Here are a few examples:

Time Decisions

Procrastination is the most common manifestation of the Borrower mindset.

When you procrastinate, you take out a loan in the form of free time now, but you pay for it later when your future self is stuck with the bill in the form of stressful last minute work.

Procrastination is the most common manifestation of the Borrower mindset.

When you procrastinate, you take out a loan in the form of free time now, but you pay for it later when your future self is stuck with the bill in the form of stressful last minute work.

Relationship Decisions

Difficult conversations are a classic example of upfront pain for long-term gain.

It's easier to be a Borrower, to put them off. This is a loan that accrues interest and eventually must be paid.

Time rarely solves anything. Invest now or regret it later.

Difficult conversations are a classic example of upfront pain for long-term gain.

It's easier to be a Borrower, to put them off. This is a loan that accrues interest and eventually must be paid.

Time rarely solves anything. Invest now or regret it later.

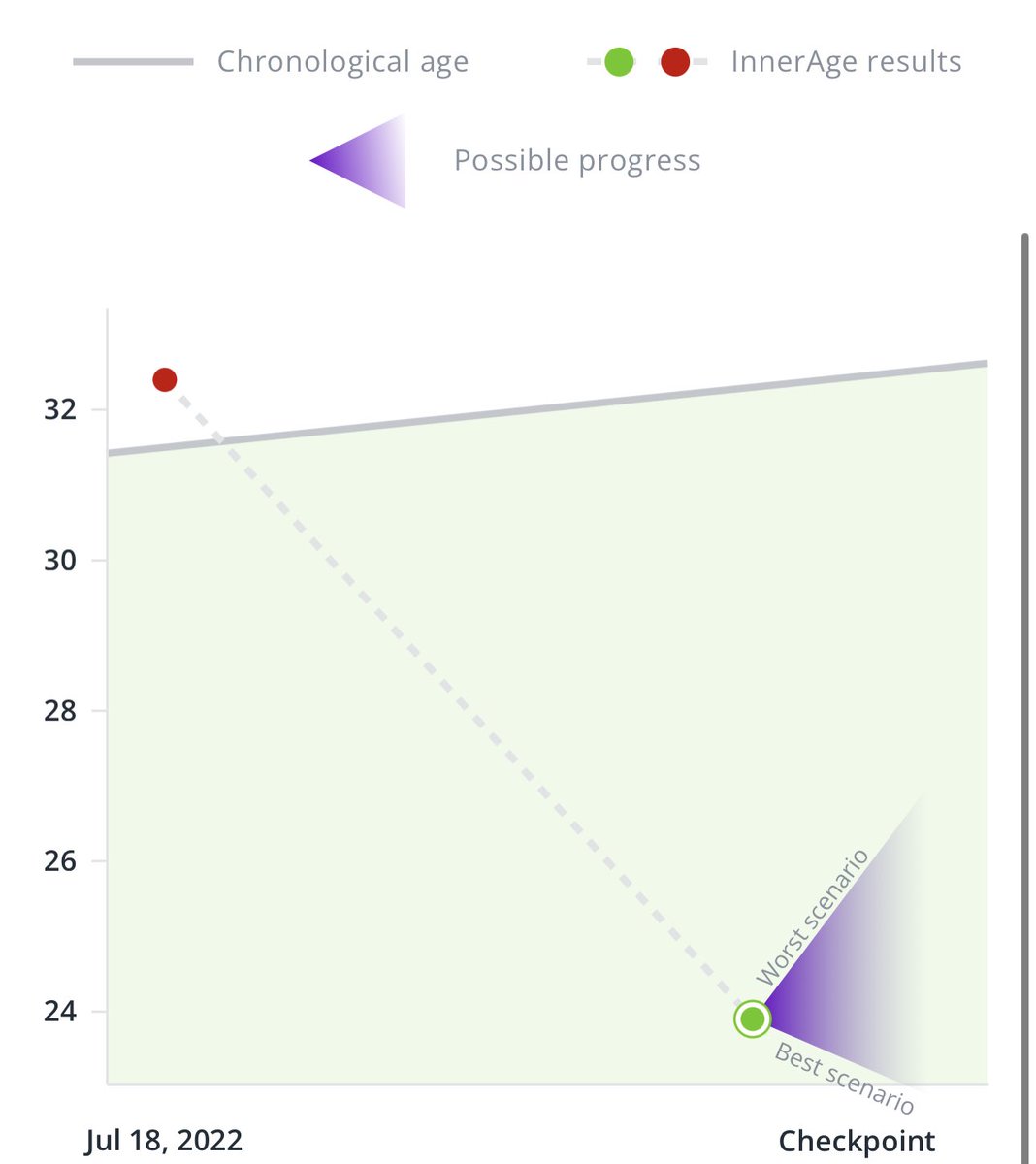

Health Decisions

When you choose short-term pleasure—in the form of inactivity, social media doom scrolling, binge drinking, whatever—you are taking out a loan with a steep cost in the future.

You'll never regret being an investor with your physical and mental health.

When you choose short-term pleasure—in the form of inactivity, social media doom scrolling, binge drinking, whatever—you are taking out a loan with a steep cost in the future.

You'll never regret being an investor with your physical and mental health.

Financial Decisions

When you choose to buy something you cannot presently afford, by using credit cards or "buy now pay later" tools, you are taking out a loan that eventually has to be paid.

This is *ok* in moderation, but it can quickly reach a tipping point, so be wary.

When you choose to buy something you cannot presently afford, by using credit cards or "buy now pay later" tools, you are taking out a loan that eventually has to be paid.

This is *ok* in moderation, but it can quickly reach a tipping point, so be wary.

The Investor vs. Borrower idea is one that I can't unsee in my own life.

When I'm faced with a key decision, I ask myself two questions:

• Am I an Investor or Borrower?

• What would an Investor do here?

My goal: To have a high ratio of Investor to Borrower behavior.

When I'm faced with a key decision, I ask myself two questions:

• Am I an Investor or Borrower?

• What would an Investor do here?

My goal: To have a high ratio of Investor to Borrower behavior.

Important: My goal is not a 100% Investor mindset!

That would leave no room for the fun short-term decisions that add texture to life.

Every now and then, I want to sleep in, order that large ice cream, or splurge on those Taylor Swift concert tickets I can't quite afford.

That would leave no room for the fun short-term decisions that add texture to life.

Every now and then, I want to sleep in, order that large ice cream, or splurge on those Taylor Swift concert tickets I can't quite afford.

3 key lessons:

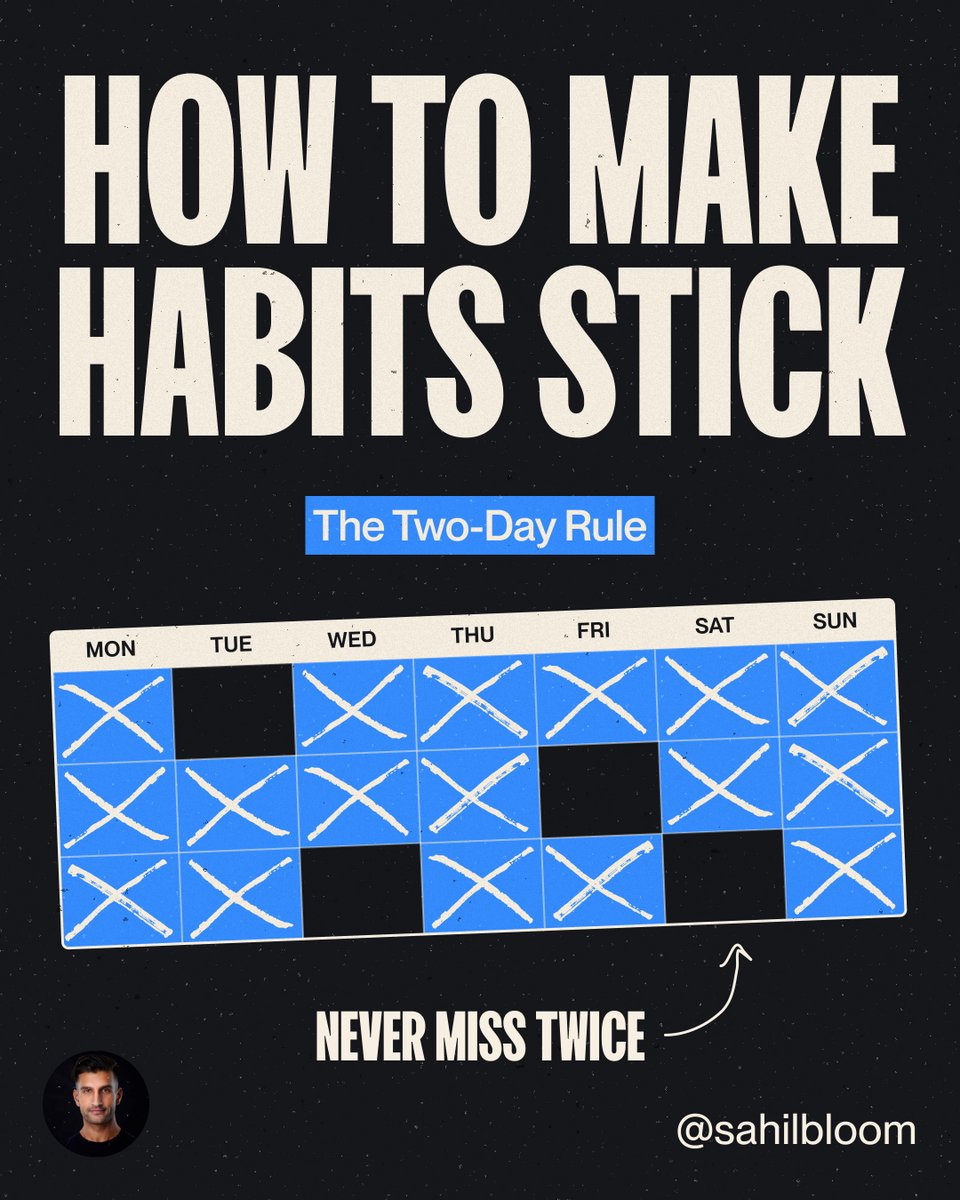

1. Find the ideal ratio of Investor to Borrower behavior

2. Consider how your present actions are impacting your future self

3. Embrace your point of balance.

If you enjoyed, follow me @SahilBloom and RT the original tweet in the thread to share it with others.

1. Find the ideal ratio of Investor to Borrower behavior

2. Consider how your present actions are impacting your future self

3. Embrace your point of balance.

If you enjoyed, follow me @SahilBloom and RT the original tweet in the thread to share it with others.

https://twitter.com/sahilbloom/status/1674400467244179456

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter