Why and how does price move in a market?

If your answer is "due to lack of buyers or sellers", it is time to read this thread.

Some nuances and complexities to this but we'll keep it simple for this one. Promise.

Auction Market Theory (AMT)- A Primer (THREAD)

If your answer is "due to lack of buyers or sellers", it is time to read this thread.

Some nuances and complexities to this but we'll keep it simple for this one. Promise.

Auction Market Theory (AMT)- A Primer (THREAD)

AMT explains how buyers and sellers interact in markets.

Price is driven by market orders (takers) overwhelming limit orders (makers).

Imagine the limit orders as "walls" (passive) that are attacked by market orders that are cannon balls being hurled at the walls (aggressive)

Price is driven by market orders (takers) overwhelming limit orders (makers).

Imagine the limit orders as "walls" (passive) that are attacked by market orders that are cannon balls being hurled at the walls (aggressive)

The auction exists for the purpose of facilitating trades + seek "fair value" of the asset.

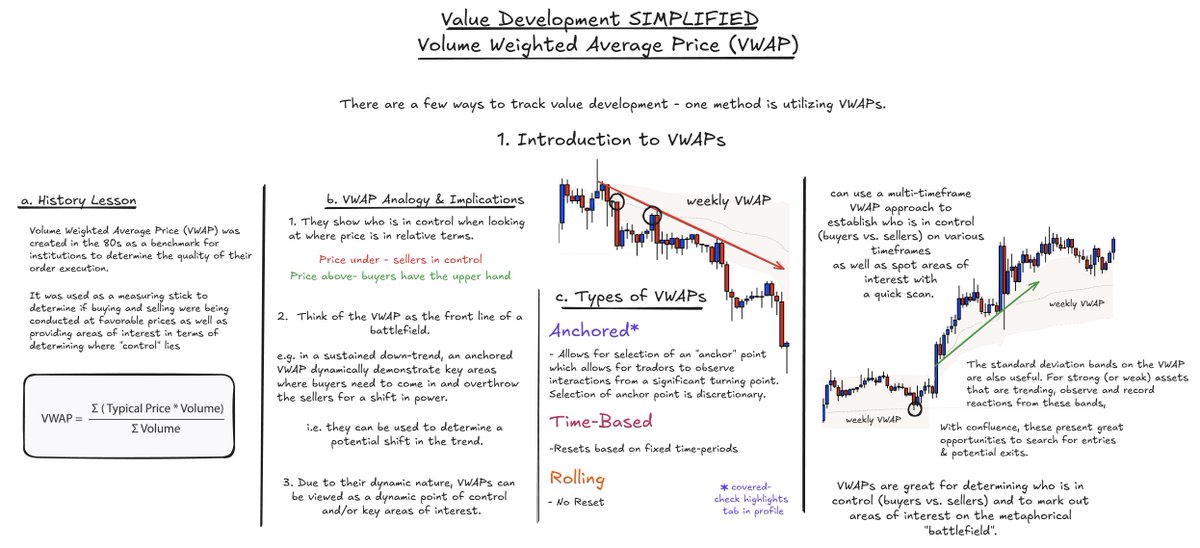

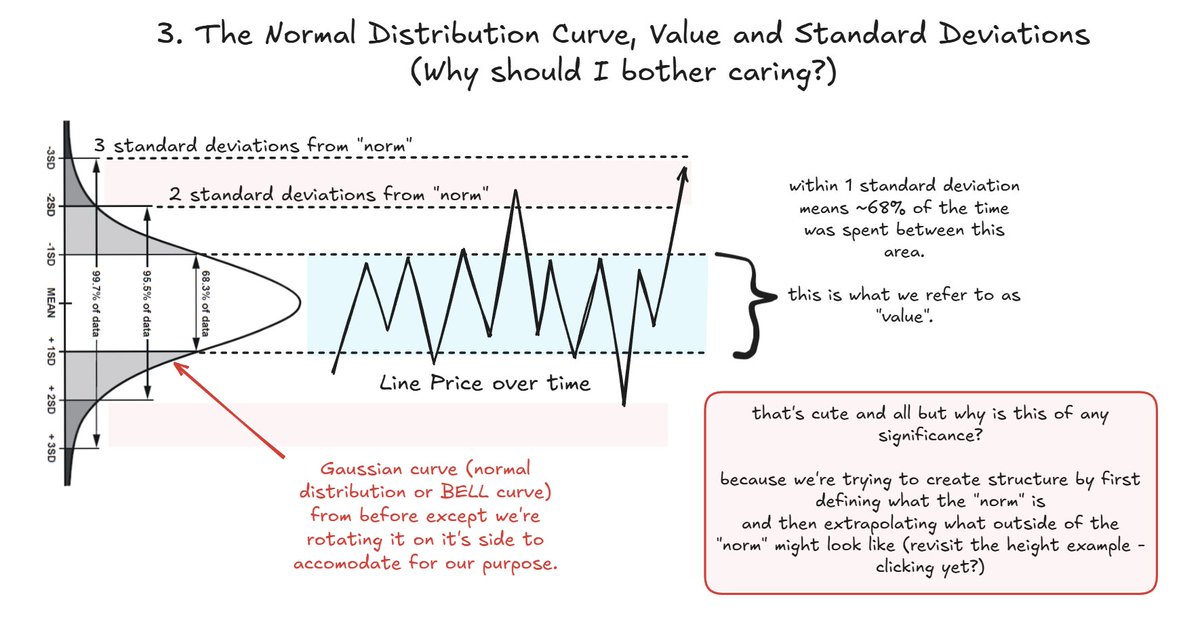

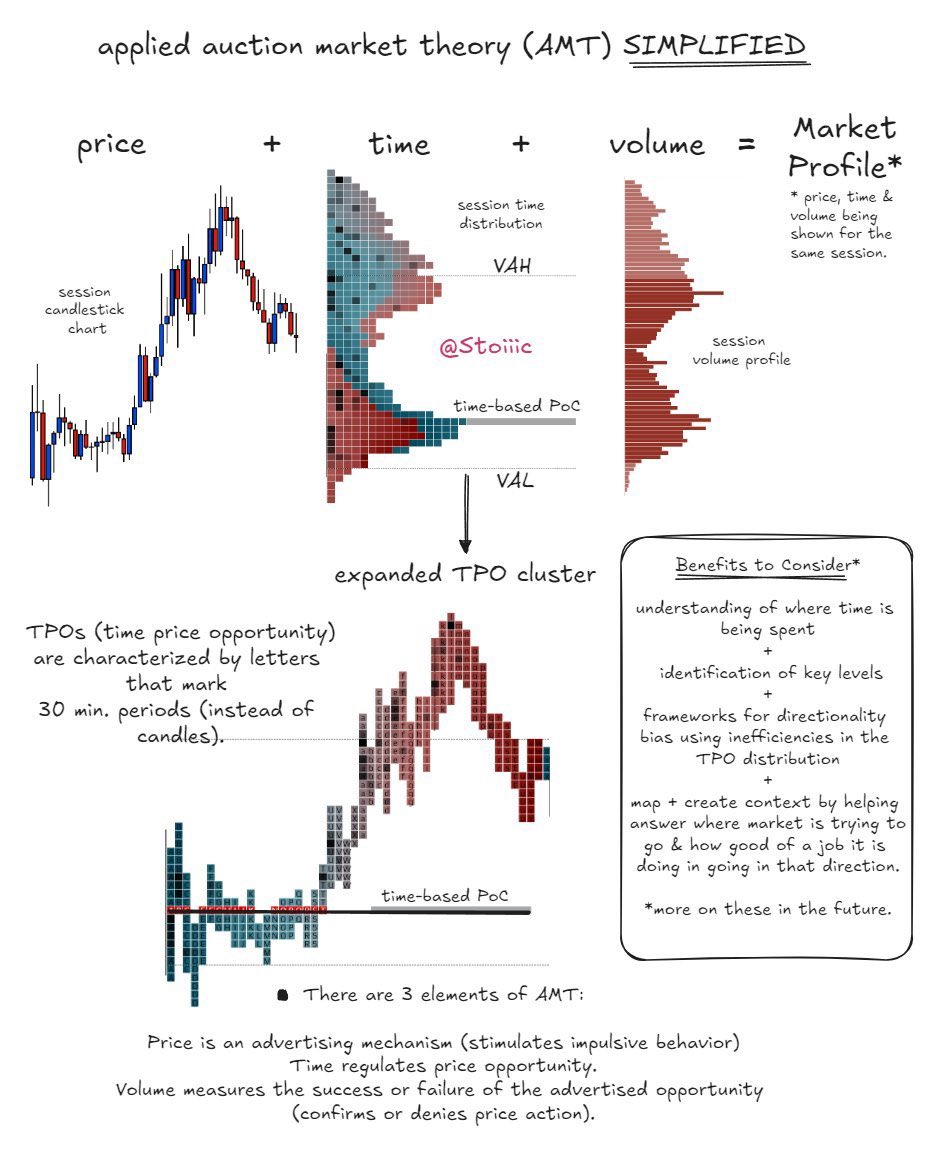

Fair Value is the price area where the most amount of trades are facilitated. This is determined by amount of time spent at price + associated volume.

Fair Value is the price area where the most amount of trades are facilitated. This is determined by amount of time spent at price + associated volume.

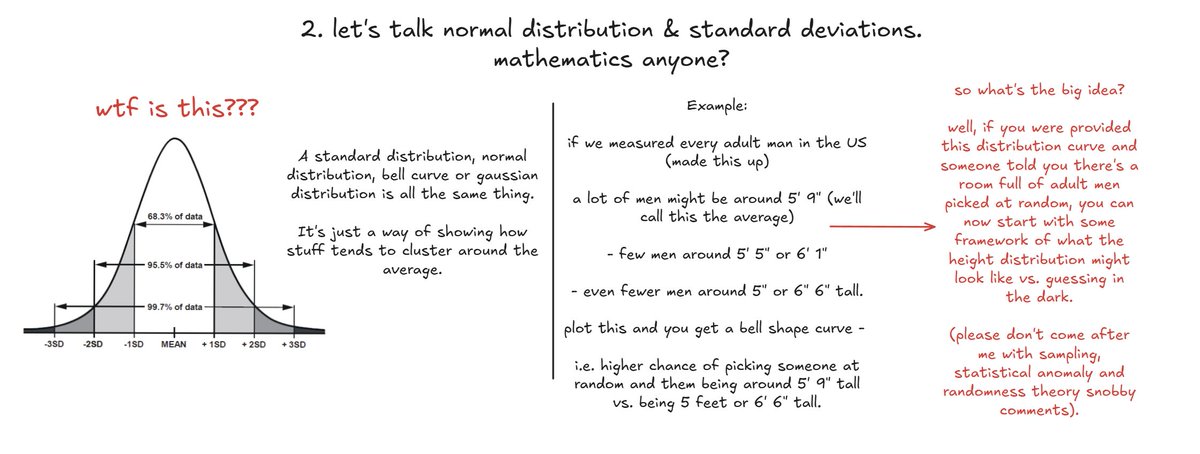

The fair value is the area in the distribution where ~70% of the trades have taken place (within 1 standard deviation).

The point of control (PoC) is determined by the price where the most amount of time is spent (can also be looked at through volume).

The point of control (PoC) is determined by the price where the most amount of time is spent (can also be looked at through volume).

Typically, the time-based PoC and the volume PoC will line up. One aspect to consider here is virgin or naked PoCs. Naked PoCs that have not been tested by price are levels to consider (magnet) - the older these are the more relevant they become especially when price is trending.

Speaking of trending, AMT characterizes the markets as cycling b/w two modes:

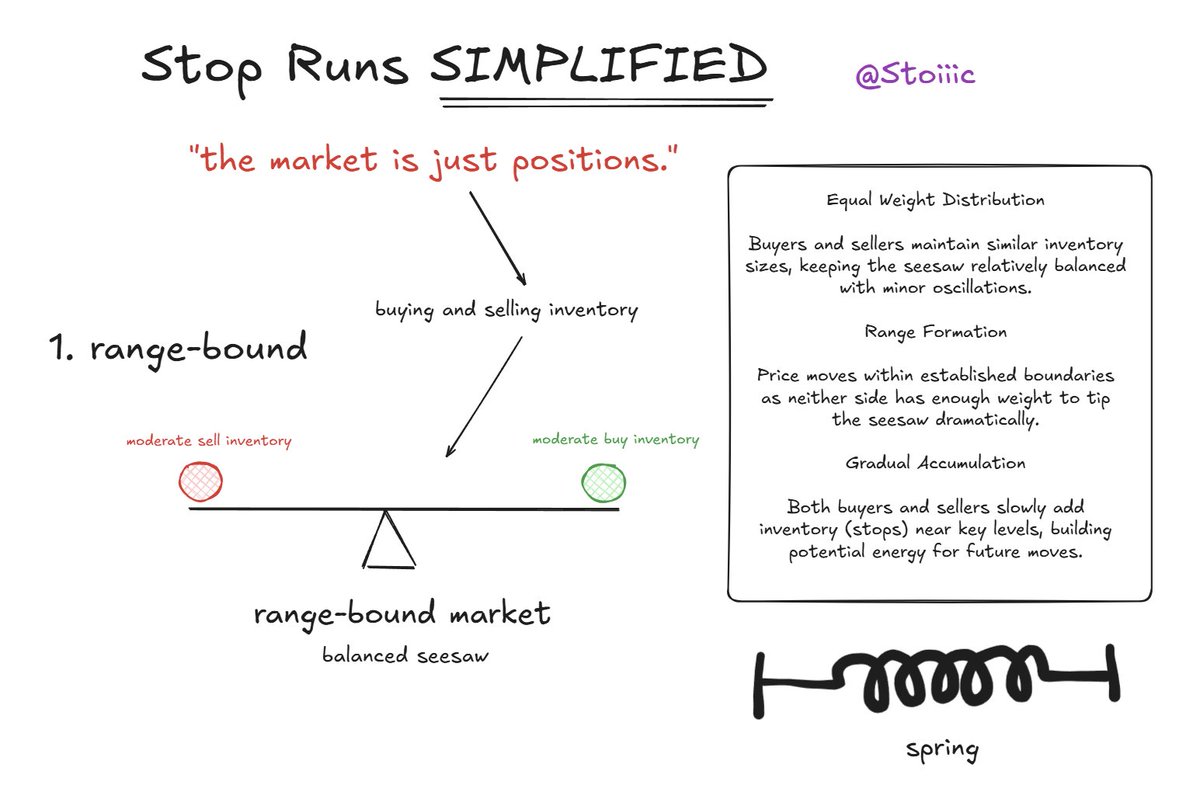

Balance (Ranging Market)- Indicating indecision

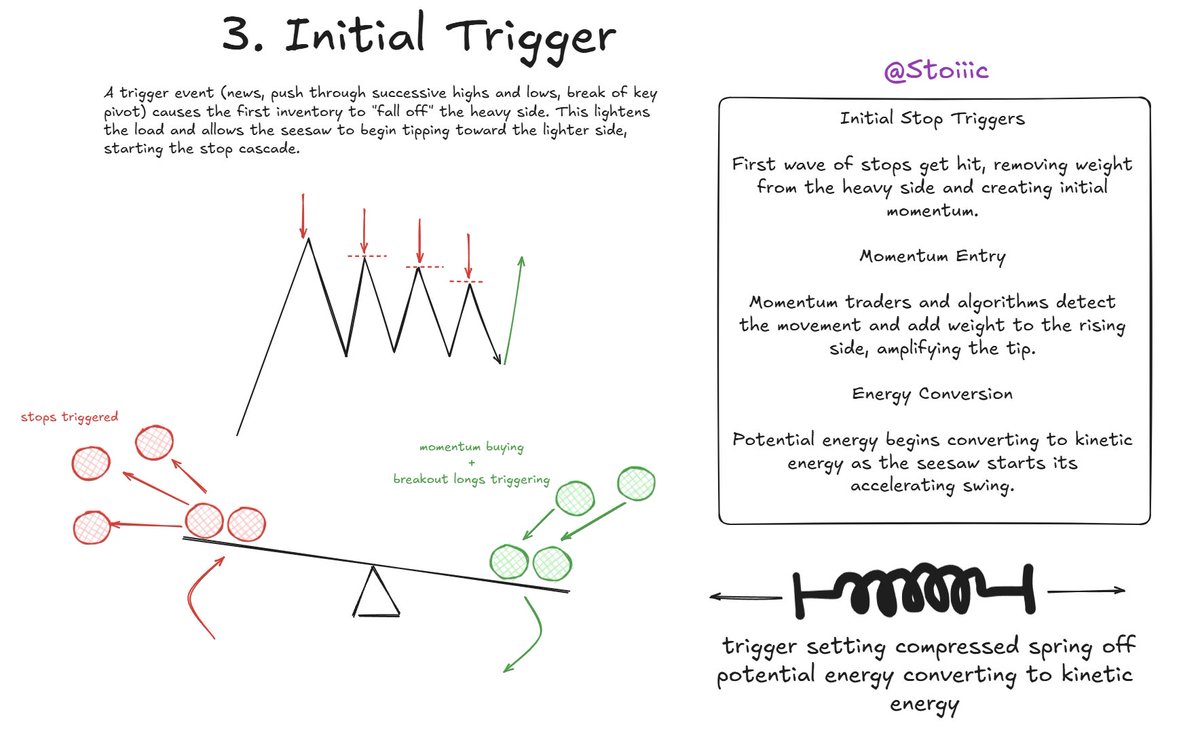

Imbalance (Trending Market) - Aggressive Conviction

~80% of the time the market is in balance or ranging.

Gud Resource: https://t.co/TEvbs4sS2Ibuff.ly/3r7SA47

Balance (Ranging Market)- Indicating indecision

Imbalance (Trending Market) - Aggressive Conviction

~80% of the time the market is in balance or ranging.

Gud Resource: https://t.co/TEvbs4sS2Ibuff.ly/3r7SA47

In a balanced market, buyers and sellers can be seen conducting a majority of their business in a range (i.e. chop).

The price will rotate b/w the high and low of the value area. Also referred to as Value Area High (VAH) and Value Area Low (VAL).

The price will rotate b/w the high and low of the value area. Also referred to as Value Area High (VAH) and Value Area Low (VAL).

In a trending market, one-sided "aggressive" participants decide that they have had enough of the established range and will push the price outside of balance. Once price is moved out of balance (price discovery), the auction will usually seek balance at a previously value area.

There are three elements of AMT:

1. Price - seen as an advertising mechanism. Price invokes emotion and is noisy on it's own.

2. Time - provides insight into areas of interest

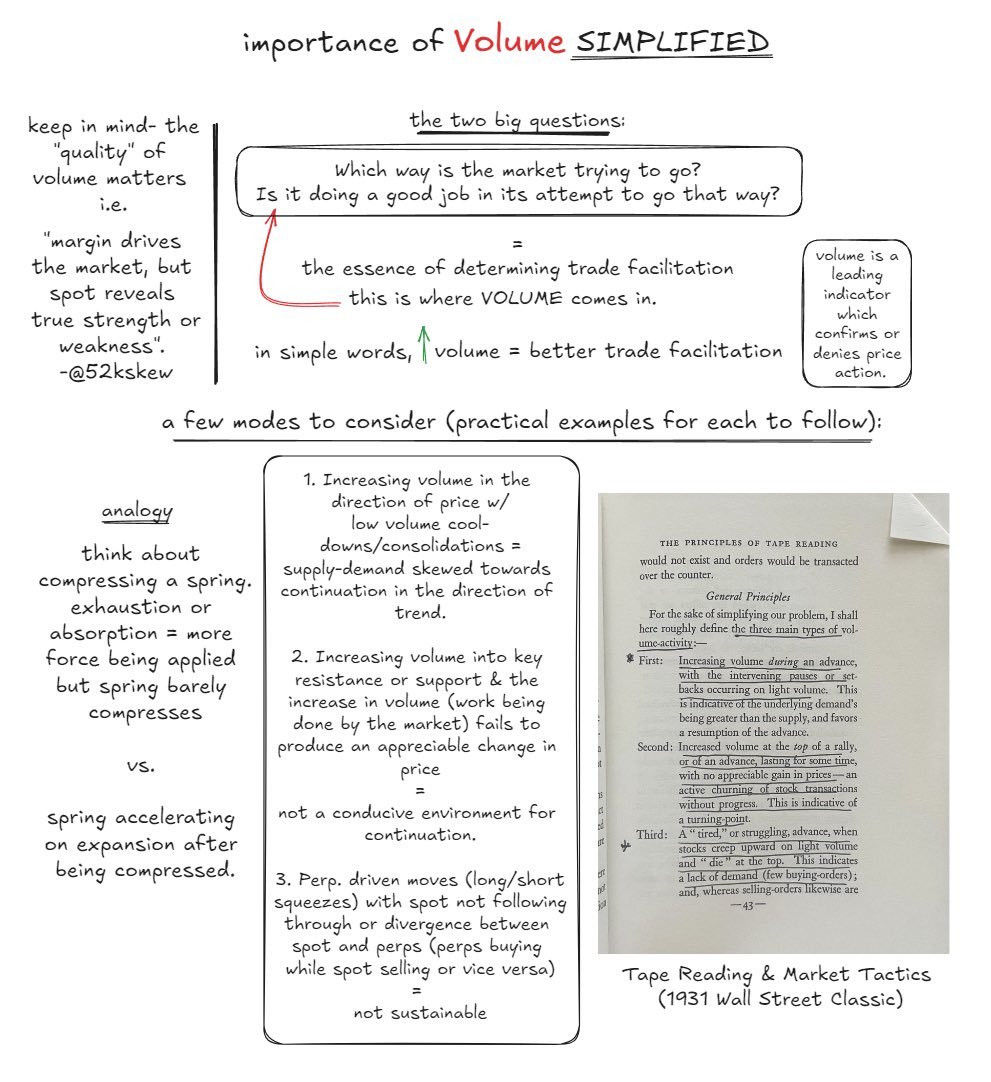

3. Volume- shows behavior of market participants

1. Price - seen as an advertising mechanism. Price invokes emotion and is noisy on it's own.

2. Time - provides insight into areas of interest

3. Volume- shows behavior of market participants

Understanding AMT provides you with the opportunity to deploy a strategy that is in line with the flow of the market i.e. identifying mean reversion opportunities when the market is in balance and positioning for expansions when the market is posed to shift to imbalance.

Having a handle on market dynamics via AMT is one of the pieces of puzzle to be able to "map" the market and gauge sentiment.

Market Profile and Volume Profile are the other pieces. When used in conjunction, this trio is powerful to position you for quality trades.

Market Profile and Volume Profile are the other pieces. When used in conjunction, this trio is powerful to position you for quality trades.

The AMT axiom is "it is impossible to forecast the future movement of market prices, but it’s quite possible to make a logical assumption on the basis of behavior of the market players."

It is a useful framework that you can consider, study and test as part of your system.

It is a useful framework that you can consider, study and test as part of your system.

Further Reading + Great Resources:

@TraderMagus Video-

Jump Start Trading Article- https://t.co/v9I2kI44TK.

ATAS Article- https://t.co/3Bztl279E5

@BitcoinTrad3r Video- https://t.co/tS33x7qeSm

@abetrade Post- https://t.co/gg2cyDyzpkbuff.ly/435i67o

buff.ly/3NQOuWN

buff.ly/3NTnm9U

buff.ly/3pukNl9

buff.ly/3r7SA47

@TraderMagus Video-

Jump Start Trading Article- https://t.co/v9I2kI44TK.

ATAS Article- https://t.co/3Bztl279E5

@BitcoinTrad3r Video- https://t.co/tS33x7qeSm

@abetrade Post- https://t.co/gg2cyDyzpkbuff.ly/435i67o

buff.ly/3NQOuWN

buff.ly/3NTnm9U

buff.ly/3pukNl9

buff.ly/3r7SA47

@TraderMagus @BitcoinTrad3r @abetrade Will be diving into market profile, volume profile next or perhaps start delving into breaking down options in a simple-to-understand manner (see a gap in knowledge in this area).

Let me know in the comments if you'd like to suggest any subjects. Open to feedback.

Let me know in the comments if you'd like to suggest any subjects. Open to feedback.

@TraderMagus @BitcoinTrad3r @abetrade For anyone interested, I am running workshops in partnership w/ @VestExchange

Next one will be on: Trading Long-Tail Assets (crypto).

Summary of the one that was done on Funding Rates: buff.ly/3COqEVw

Next one will be on: Trading Long-Tail Assets (crypto).

Summary of the one that was done on Funding Rates: buff.ly/3COqEVw

@TraderMagus @BitcoinTrad3r @abetrade @VestExchange In conclusion, developing a system is individually dependent and requires relentless iteration + "skin in the game"

Understanding market dynamics and order-flow is something to consider to improve the odds in your favor.

If this was helpful, hit RT to share with fellow tradors

Understanding market dynamics and order-flow is something to consider to improve the odds in your favor.

If this was helpful, hit RT to share with fellow tradors

• • •

Missing some Tweet in this thread? You can try to

force a refresh