How to get URL link on X (Twitter) App

low volume nodes

low volume nodeshttps://x.com/Stoiiic/status/1837386959016112281

Oct 24' Example -

Oct 24' Example -https://x.com/Stoiiic/status/1841968384109642174

Before we get to TPO- Auction Market Theory in a Nutshell

Before we get to TPO- Auction Market Theory in a Nutshell

tldr - im tired boss. price rugging with haste as I'm typing out the update and having to modify lol

tldr - im tired boss. price rugging with haste as I'm typing out the update and having to modify lol

> how does time fit into applied auction market theory?

> how does time fit into applied auction market theory?https://x.com/Stoiiic/status/1875452048491032974

Looking at the last 6 sessions offered a rotation from the low to high, high to low of the established value.

Looking at the last 6 sessions offered a rotation from the low to high, high to low of the established value.

In a range-bound environment the question I'm looking to answer when price navigates towards extremes of value established in a ranging environment:

In a range-bound environment the question I'm looking to answer when price navigates towards extremes of value established in a ranging environment:

https://twitter.com/Stoiiic/status/1887741850414391306

1 min. Coinalyze

1 min. Coinalyze

While reading through George Soros's "Alchemy of Finance" and Brent Donnelly's "Alpha Trader" (in particular, the narrative section), I was struck by several AHA moments.

While reading through George Soros's "Alchemy of Finance" and Brent Donnelly's "Alpha Trader" (in particular, the narrative section), I was struck by several AHA moments.

monthly vwap creeping up into the 99s (Monday Lows) while the upper side std. dev. band is now skirting inside this consolidation value.

monthly vwap creeping up into the 99s (Monday Lows) while the upper side std. dev. band is now skirting inside this consolidation value.

words used during the inauguration with respect to the urgency of setting up the SBR and/or any reference to crypto tax will be key to look out for tomorrow.

words used during the inauguration with respect to the urgency of setting up the SBR and/or any reference to crypto tax will be key to look out for tomorrow.

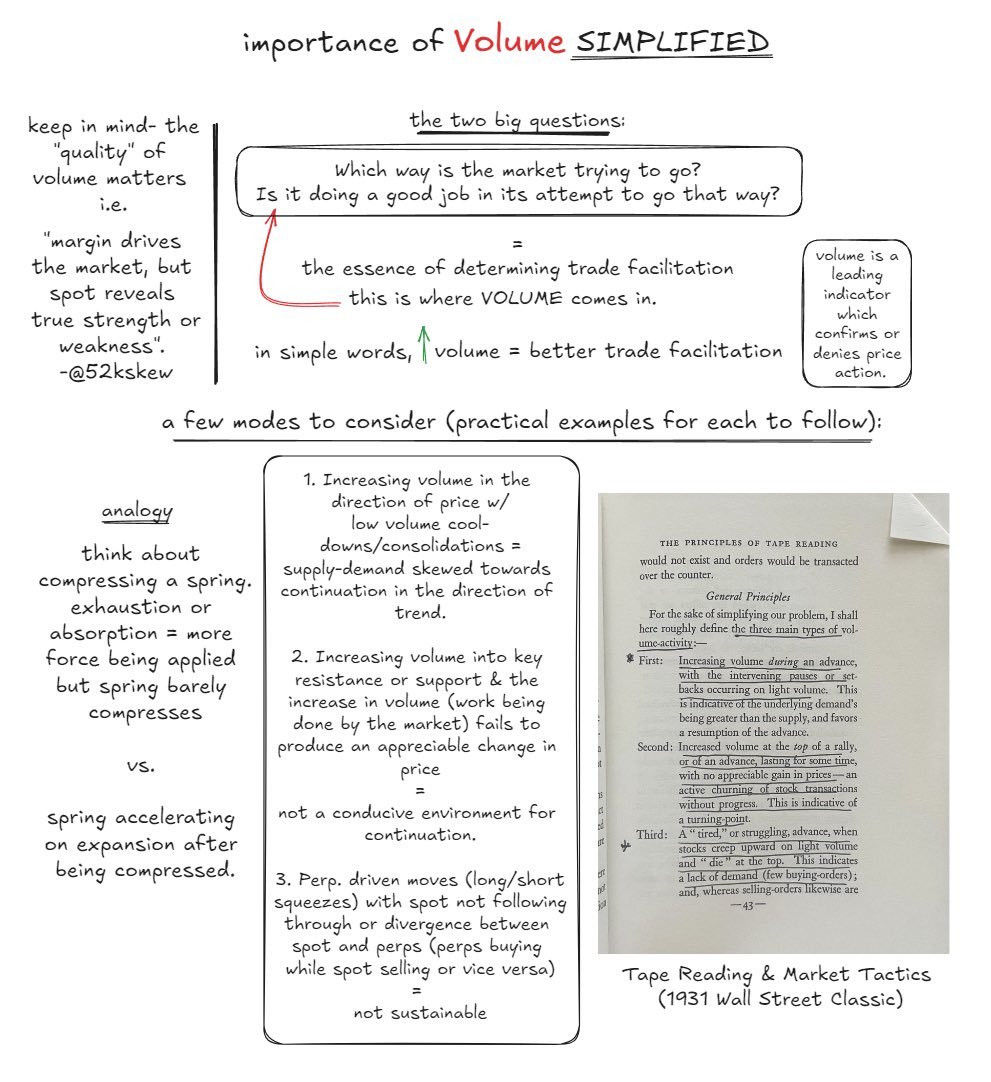

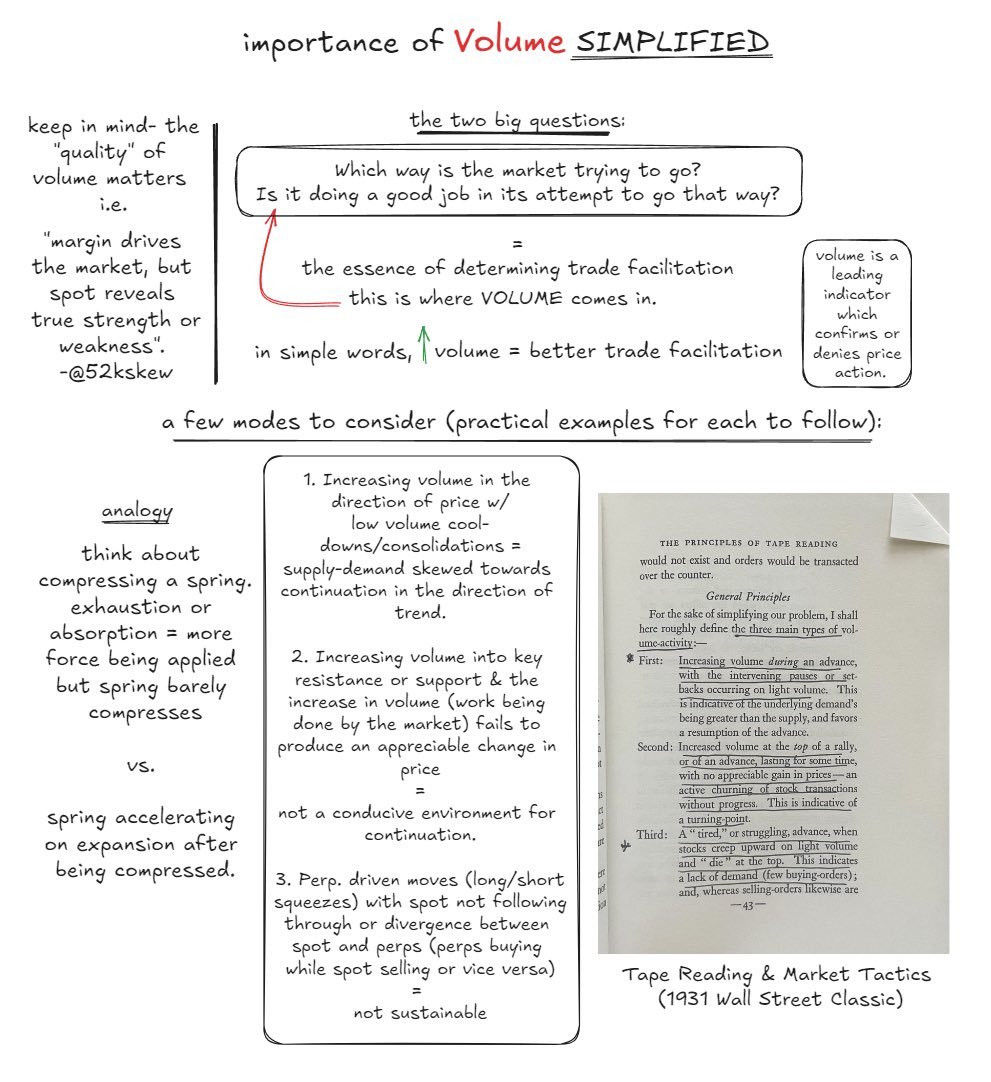

auction market theory

auction market theoryhttps://x.com/Stoiiic/status/1838473856593301845

low volume nodes

low volume nodes https://x.com/Stoiiic/status/1837386959016112281

1. Overview of VWAPs

1. Overview of VWAPshttps://x.com/Stoiiic/status/1777237613637743035