Most of you wont read this

Layer Zero Maxi @CC2Ventures allegedly crafted an L0 guide sheet too powerful for twitter

The compromise was to post a public wallet

Those willing to transcribe the txns = alpha

So thats what I did

How to craft a high-quality custom $ZRO route🧵

Layer Zero Maxi @CC2Ventures allegedly crafted an L0 guide sheet too powerful for twitter

The compromise was to post a public wallet

Those willing to transcribe the txns = alpha

So thats what I did

How to craft a high-quality custom $ZRO route🧵

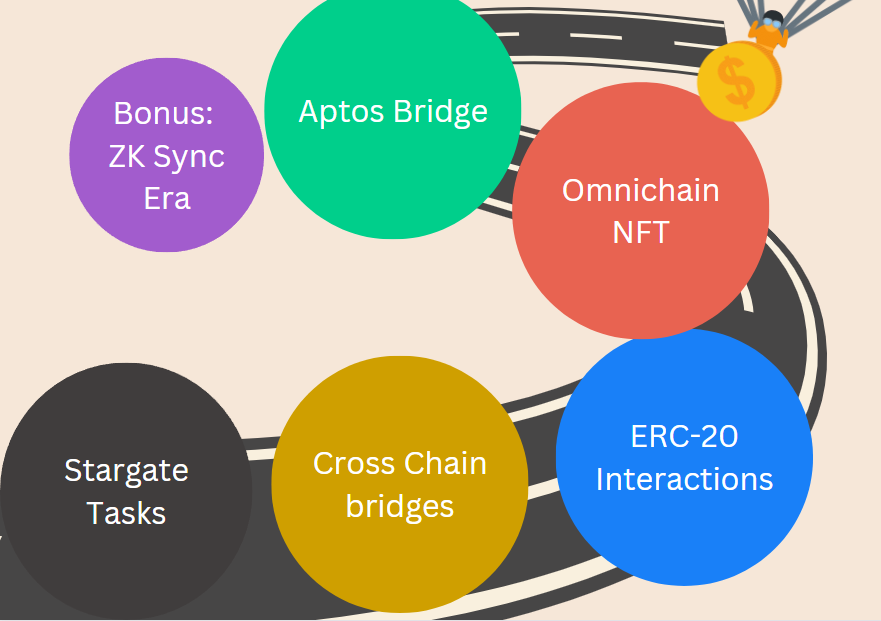

The easiest way to craft a route is to categorize the different types of L0 interactions

Then take various parts from each category and string them together

1/ @StargateFinance interactions

includes staking STG, snapshot voting, providing liquidity, using native bridge

Then take various parts from each category and string them together

1/ @StargateFinance interactions

includes staking STG, snapshot voting, providing liquidity, using native bridge

2/ Cross chain swap dapps that use L0 contract

some of these route the volume through Stargate anyways but not always

this will also increase your total unique contracts

these include @_WOOFi @MugenFinance @OmniBTC @SushiSwap @lifiprotocol @BungeeExchange

some of these route the volume through Stargate anyways but not always

this will also increase your total unique contracts

these include @_WOOFi @MugenFinance @OmniBTC @SushiSwap @lifiprotocol @BungeeExchange

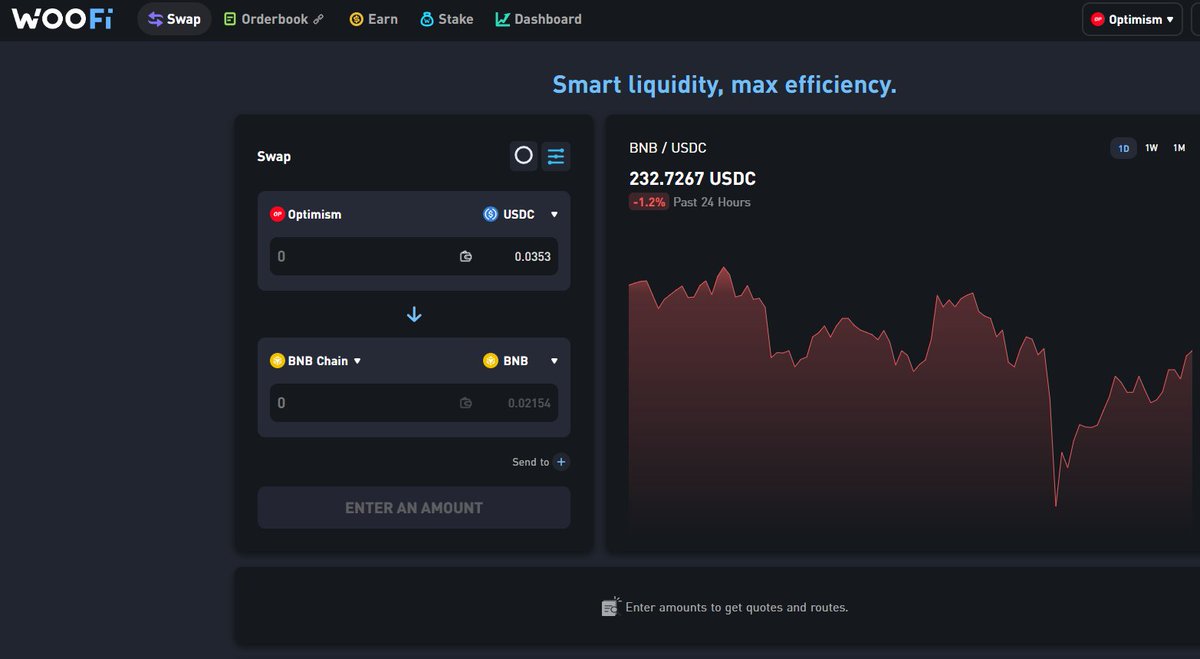

WooFI (great for getting gas on new chain) followed by mugen, were the least painful to use in my experience

LIFI and Bungee are technically bridge aggregators but both are good tools and dont have a token yet, pick the stargate options when using them (L0 contract)

LIFI and Bungee are technically bridge aggregators but both are good tools and dont have a token yet, pick the stargate options when using them (L0 contract)

3/ "ERC-20 Core" Interactions

this generally involves buying a token of a protocol and using its bridge feature (which interacts with L0 contract)

you bridge that token to various other chains and then selling it (or interact with the dapps by staking, ect)

this generally involves buying a token of a protocol and using its bridge feature (which interacts with L0 contract)

you bridge that token to various other chains and then selling it (or interact with the dapps by staking, ect)

these are great "filler" interactions between your "main" interactions of just bridging volume cross chain

you dont want to be that guy who just spams stargate cross chain bridge interactions 5 times a day and does nothing else

some of these bridgeable tokens include:

you dont want to be that guy who just spams stargate cross chain bridge interactions 5 times a day and does nothing else

some of these bridgeable tokens include:

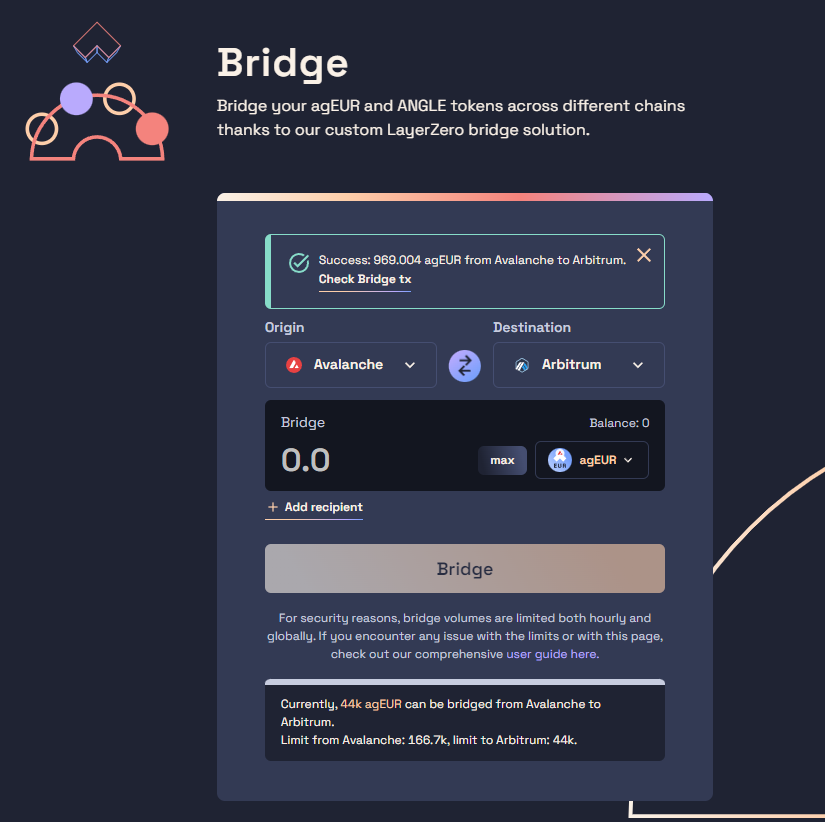

agEUR from @AngleProtocol

$JOE from @traderjoe_xyz

$RDNT from @RDNTCapital

BTC.b from @BorderlessBTCb, (avax<->arbitrum has less slippage = you lose less money on swaps/bridging)

Optional: add liquidity (for min 1 week) to some of these dapps

$JOE from @traderjoe_xyz

$RDNT from @RDNTCapital

BTC.b from @BorderlessBTCb, (avax<->arbitrum has less slippage = you lose less money on swaps/bridging)

Optional: add liquidity (for min 1 week) to some of these dapps

From here it basically gets progressively more niche where youll be interacting with more niche dapps and chains, but generally the slippage is higher

some examples

$STEAK from @steakhut_fi (arb<->avax)

$MMY from @mummyftm (fantom)

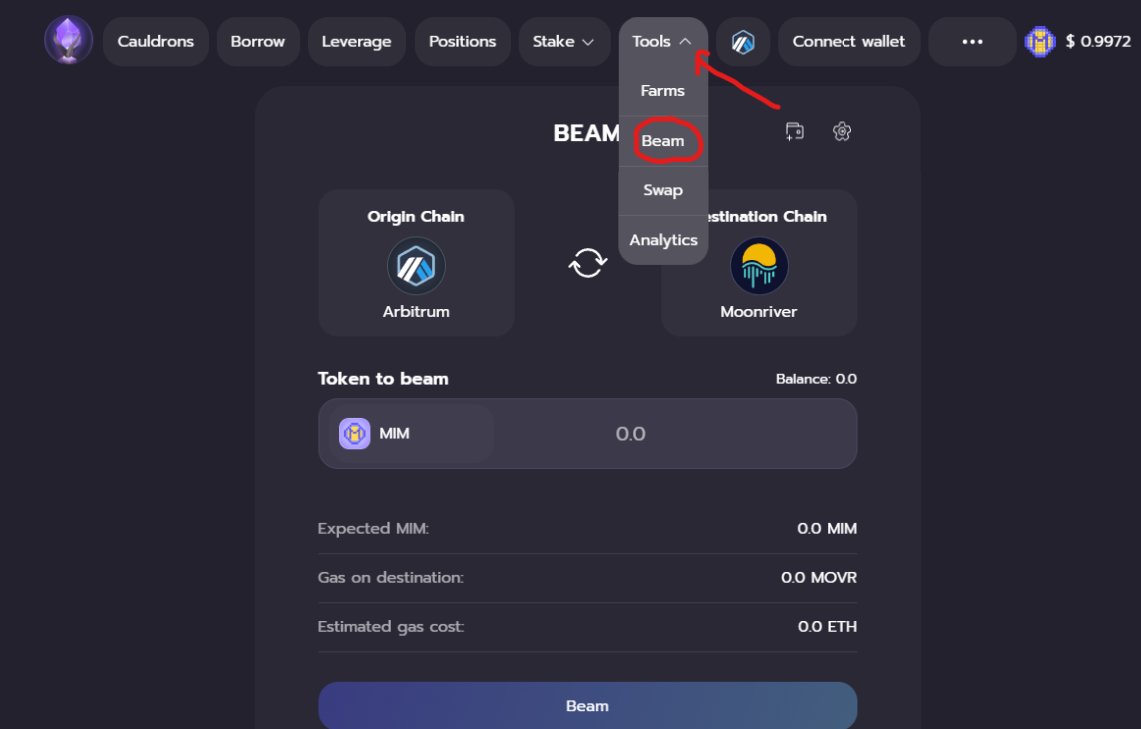

$MIM stablecoin from @MIM_Spell (moonriver)

some examples

$STEAK from @steakhut_fi (arb<->avax)

$MMY from @mummyftm (fantom)

$MIM stablecoin from @MIM_Spell (moonriver)

agEUR, JOE, RDNT, BTC.b were least painful for me, dont need to go overkill and youll need to play around with it a bit

Ex some may not hit chains that you havent already hit yet, sometimes the site is down or is buggy or there isnt support between certain chains anymore

Ex some may not hit chains that you havent already hit yet, sometimes the site is down or is buggy or there isnt support between certain chains anymore

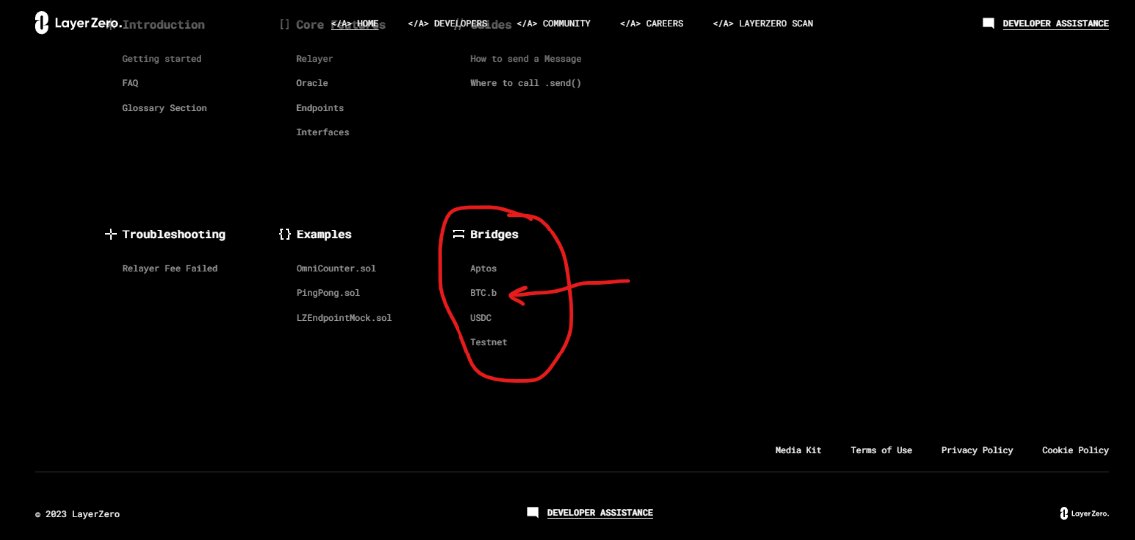

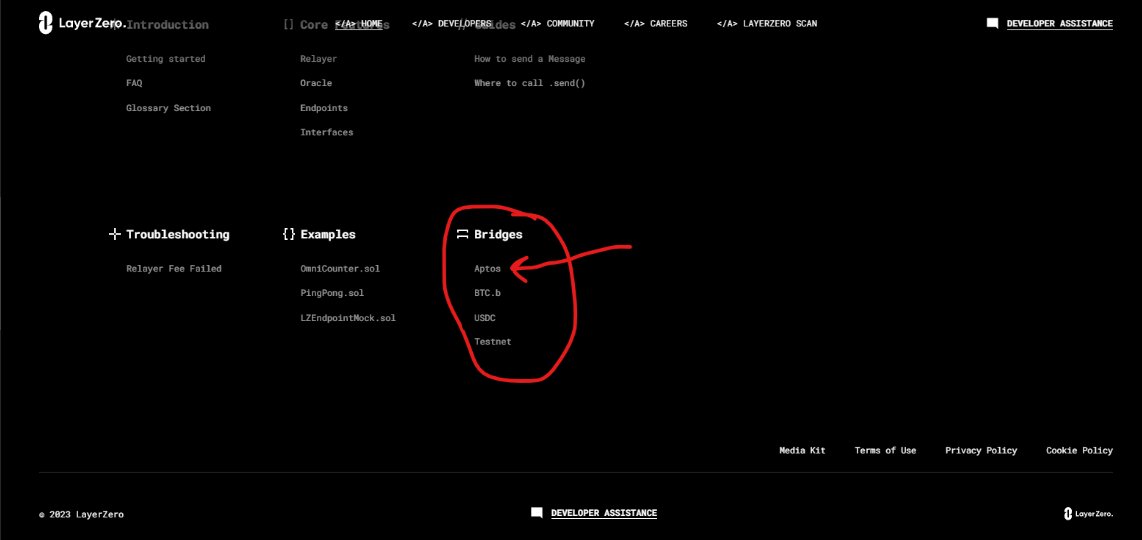

4/ Aptos bridge

I put this in its own category as it should be put at the end of a rotation as it takes 5 days to get your funds back FROM Aptos (2.5 if you use bridge from L0 website)

L0 has its own Aptos bridge which is their only "main" bridge other than Stargate & BTC.b

I put this in its own category as it should be put at the end of a rotation as it takes 5 days to get your funds back FROM Aptos (2.5 if you use bridge from L0 website)

L0 has its own Aptos bridge which is their only "main" bridge other than Stargate & BTC.b

So this type of interaction stands out to me

other Aptos bridges that use L0 but arnt by L0 include

@PontemNetwork @ThalaLabs and @PancakeSwap (bridge $cake doesnt have long wait time)

other Aptos bridges that use L0 but arnt by L0 include

@PontemNetwork @ThalaLabs and @PancakeSwap (bridge $cake doesnt have long wait time)

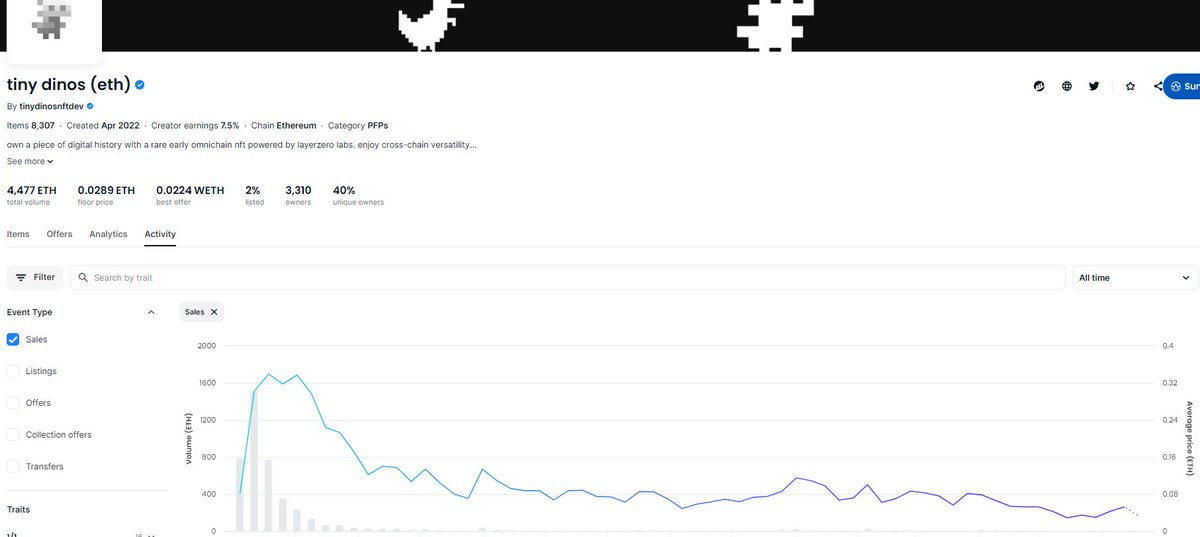

5/ Omnichain NFTs

Likely be a multiplier criteria

2 ways to go about this one

Buy an OG omninft collection on ETH mainnet

OG means thats its been around for a while and has some form of community or buy pressure that you can actually sell back into with minimal issue

Likely be a multiplier criteria

2 ways to go about this one

Buy an OG omninft collection on ETH mainnet

OG means thats its been around for a while and has some form of community or buy pressure that you can actually sell back into with minimal issue

Main ones are (from most to least expensive) Lil pudgies from @pudgypenguins, Gh0sts from @gh0stlygh0sts and Dinos from @tinydinosnft

Would only do this if you want a bigger ETH mainnet footprint and $30 gas per wallet is minimal funds for you

Would only do this if you want a bigger ETH mainnet footprint and $30 gas per wallet is minimal funds for you

Alternative:

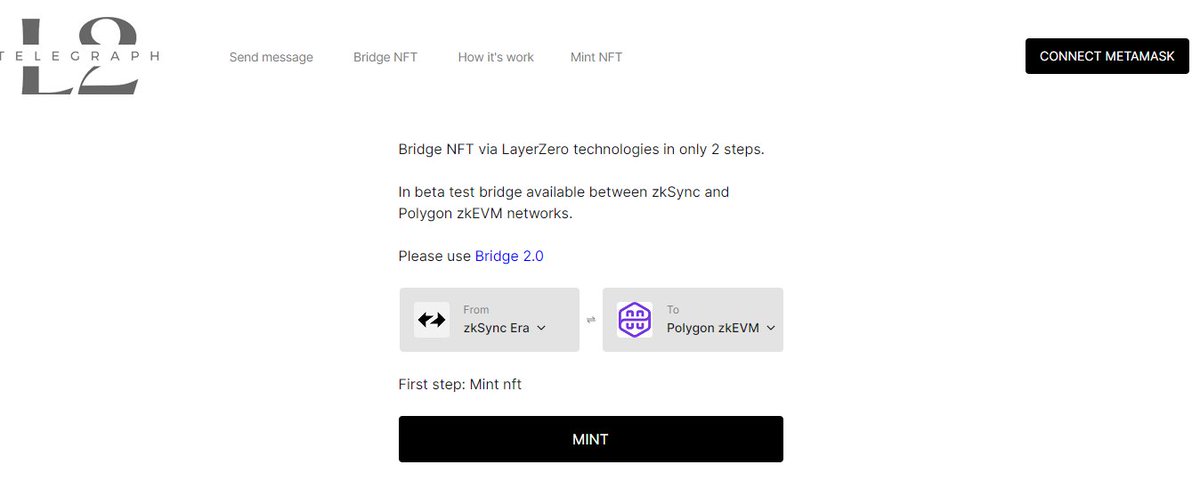

Various dapps that allow you to create/mint and bridge NFT on the "cheap EVM chains" which I call "the core 5" (bsc, poly, avax, op, arb)

@holographxyz @PolyhedraZK @l2telegraph @merkly_com

Try to bridge to more niche chains like zk sync era, polygon zkevm

Various dapps that allow you to create/mint and bridge NFT on the "cheap EVM chains" which I call "the core 5" (bsc, poly, avax, op, arb)

@holographxyz @PolyhedraZK @l2telegraph @merkly_com

Try to bridge to more niche chains like zk sync era, polygon zkevm

BONUS

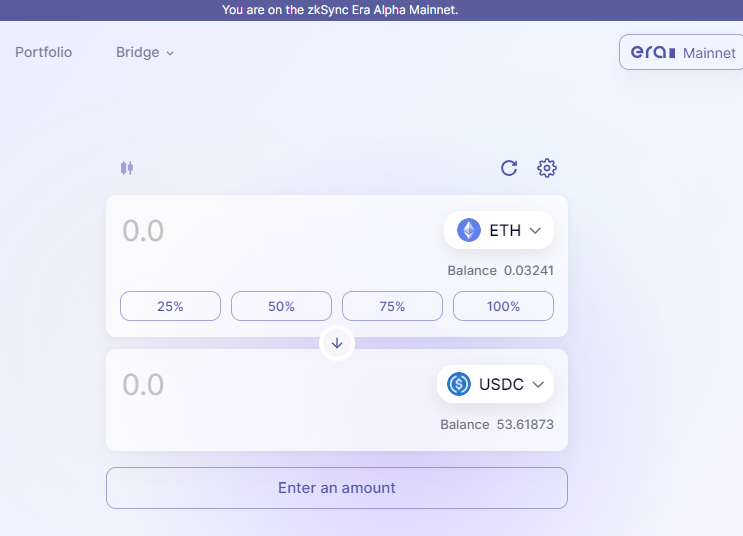

Splice in some form of ZK Sync Era interactions/footprint into the route

You should absolutely have some sort of footprint on zk, but this is a much longer-term play, token is easily 10+ months away

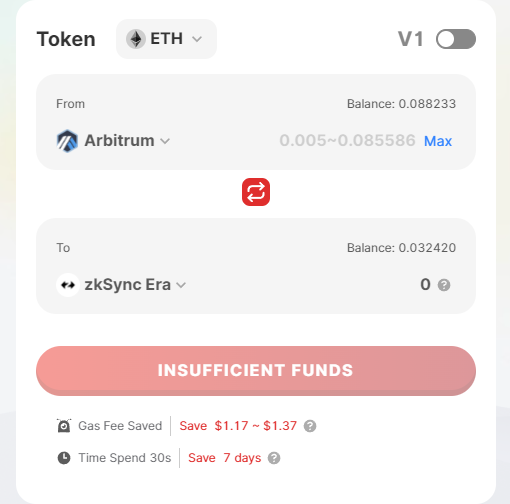

use @Orbiter_Finance, @layerswap (both tokenless) Woo, Bungee to bridge

Splice in some form of ZK Sync Era interactions/footprint into the route

You should absolutely have some sort of footprint on zk, but this is a much longer-term play, token is easily 10+ months away

use @Orbiter_Finance, @layerswap (both tokenless) Woo, Bungee to bridge

Do the standard actions, makes some swaps add some liquidity if you can, not much to interact with currently

Main dapps right now are @syncswap @izumi_Finance @velocorexyz @mute_io

Short term: hit min 8 txns and $120 volume (& min $120 liquidity)

over time 21+ txns 1k+ volume

Main dapps right now are @syncswap @izumi_Finance @velocorexyz @mute_io

Short term: hit min 8 txns and $120 volume (& min $120 liquidity)

over time 21+ txns 1k+ volume

Ok cool, but thats a lot of info and ive already probably scrolled/clicked off this thread by now

So how do I use this to make my own routes?

Ex. of a short route would be:

-Initially fund your wallet with native gas for any of "the core 5" chains using a CEX (ideally) or Woo

So how do I use this to make my own routes?

Ex. of a short route would be:

-Initially fund your wallet with native gas for any of "the core 5" chains using a CEX (ideally) or Woo

-fund wallet with ETH on Arb

-stargate tasks (stake STG, add LP, vote snapshot) use stargate to bridge to OP

(use mugen or woo if you need to swap into native gas token for destination chain)

-stargate tasks (stake STG, add LP, vote snapshot) use stargate to bridge to OP

(use mugen or woo if you need to swap into native gas token for destination chain)

-ERC20 task - buy agEUR on Angle on OP and bridge to various chains (that have gas on them) ending on OP and selling agEUR

-Mint NFT via @holographxyz, bridge from BSC->polygon

-use aptos bridge, use L0 aptos bridge to bridge back

Start new rotation with different interactions

-Mint NFT via @holographxyz, bridge from BSC->polygon

-use aptos bridge, use L0 aptos bridge to bridge back

Start new rotation with different interactions

Your overall goal is basically

Do min 1 interaction from each category in any order (aptos is last though)

Eventually hit min the Core 5 chains

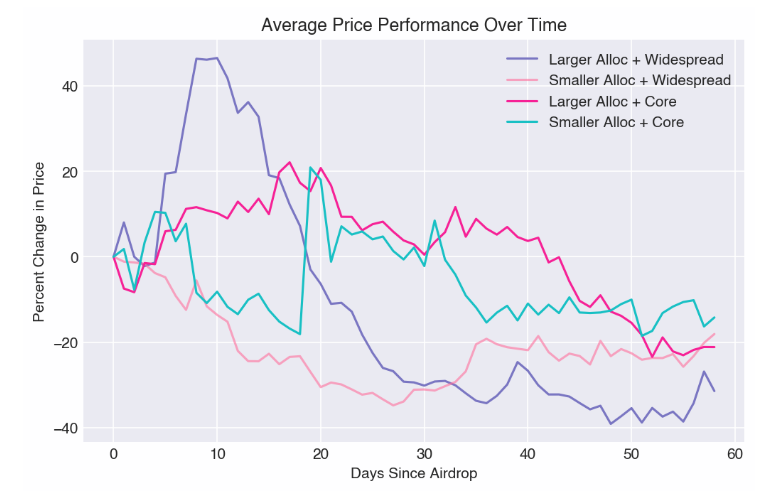

Eventually have 21+ txs, $10k+ in volume, 2-3+ distinct months, to pass thresholds that put you in the top ~60-70% of wallets

Do min 1 interaction from each category in any order (aptos is last though)

Eventually hit min the Core 5 chains

Eventually have 21+ txs, $10k+ in volume, 2-3+ distinct months, to pass thresholds that put you in the top ~60-70% of wallets

Some general tips I would also note are:

If you have to pick start with the "core 5" as the dapp compatibility and slippage is generally the best among these chains

interacting with just 3 different chains = above 46% of all wallets, 5 chains = above 72%

Avoid ETH mainnet

If you have to pick start with the "core 5" as the dapp compatibility and slippage is generally the best among these chains

interacting with just 3 different chains = above 46% of all wallets, 5 chains = above 72%

Avoid ETH mainnet

Dont spam high amounts of low volume txns

Dont spam all of the tasks/interactions within a route in a short time period (Ex. Arbitrum gave -1 point if all of a wallets txn history happened within 48hrs)

Dont use the same amount of $ or interaction pattern between wallets

Dont spam all of the tasks/interactions within a route in a short time period (Ex. Arbitrum gave -1 point if all of a wallets txn history happened within 48hrs)

Dont use the same amount of $ or interaction pattern between wallets

Have ~$5 in native gas token on each of the Core 5 chains is best way to start = saves you time later

You can fund via CEX, or refuel tool from Bungee, or Woo if you have funds already on a Core 5 chain

You can fund via CEX, or refuel tool from Bungee, or Woo if you have funds already on a Core 5 chain

You dont have to do the interaction categories in the order I listed them in, but save the Aptos one for the end due to wait time bridging FROM Aptos

Going to save the txn transcription & takeaways of the CC2 txn route for another thread because its long (20+ tweets in itself)

Going to save the txn transcription & takeaways of the CC2 txn route for another thread because its long (20+ tweets in itself)

That's it, if you found this @info_insightful

Interact with the FIRST tweet in the thread and follow if you want to read more high-quality threads

I also make overview content on projects/platforms and web3 games

So youll have to endure that if you just want the airdrop stuff

Interact with the FIRST tweet in the thread and follow if you want to read more high-quality threads

I also make overview content on projects/platforms and web3 games

So youll have to endure that if you just want the airdrop stuff

https://twitter.com/info_insightful/status/1674764815968129024

@AngryBellick @CC2Ventures Sorry first "would" should be "wouldn't"

• • •

Missing some Tweet in this thread? You can try to

force a refresh