1/25

Back in May, TUSD threatened to sue me for even remotely suggesting they'd be related to Justin Sun.

So naturally, I dug in to prove the ownership web of Justin for both TUSD, Huobi and his shell companies around the world.

Back in May, TUSD threatened to sue me for even remotely suggesting they'd be related to Justin Sun.

So naturally, I dug in to prove the ownership web of Justin for both TUSD, Huobi and his shell companies around the world.

2/25

This is just a summary.

Personal/Sensitive info has been removed where reasonable.

Full docs, additional pics and info have been provided to journalists to dig deeper.

Thanks to the dozens of people who shared their info as well.

This is just a summary.

Personal/Sensitive info has been removed where reasonable.

Full docs, additional pics and info have been provided to journalists to dig deeper.

Thanks to the dozens of people who shared their info as well.

3/25

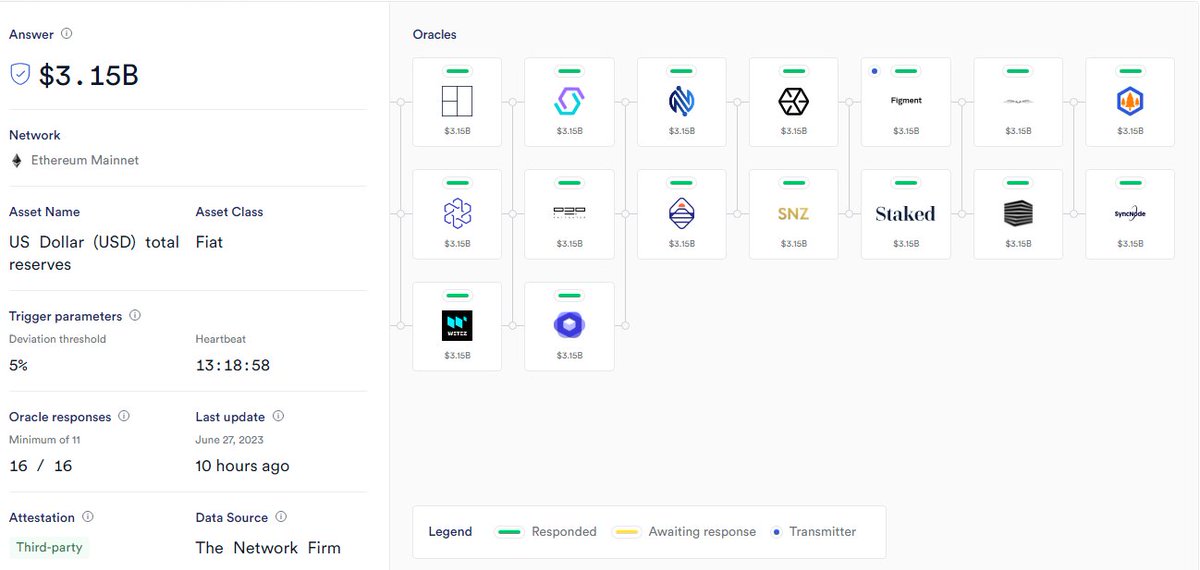

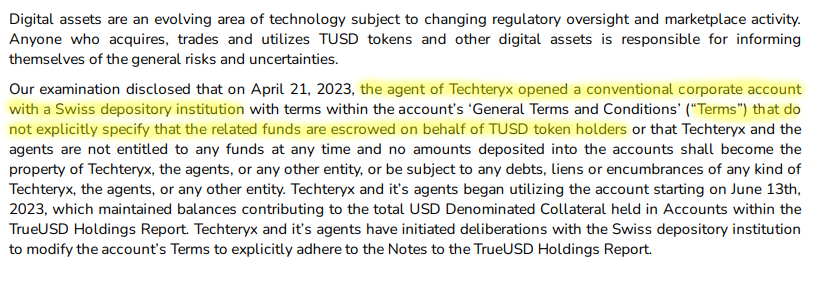

The first red flag I came across was on their own reports statements from their auditor.

It noted:

1) "An agent" of Techteryx opened an account.

2) It was a regular corp account. Not an FBO account, not bankruptcy remote.

The first red flag I came across was on their own reports statements from their auditor.

It noted:

1) "An agent" of Techteryx opened an account.

2) It was a regular corp account. Not an FBO account, not bankruptcy remote.

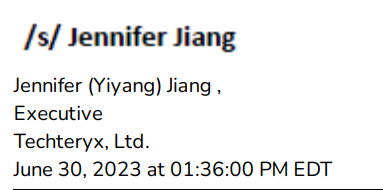

4/25

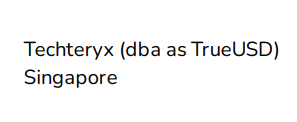

These have been repeatedly signed by two supposed executives of TrueUSD:

-Jennifer "Yiying"/"Yiyang" Jiang

-Steve Liu

Both supposedly of Techteryx a Singapore company.

Which of course Singapore says doesn't exist.

These have been repeatedly signed by two supposed executives of TrueUSD:

-Jennifer "Yiying"/"Yiyang" Jiang

-Steve Liu

Both supposedly of Techteryx a Singapore company.

Which of course Singapore says doesn't exist.

5/25

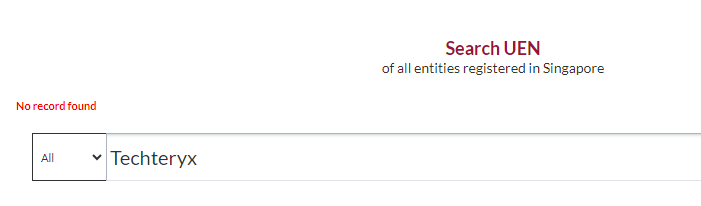

In fact, Steve Liu, Jennifer Jiang, Yiying Jiang and Yiyang Jiang do not show up as the officers of any Singapore company.

But, a Yiying Jiang does show up on another company. DTV Limited - the UK holding company of DLive by Bittorrent.

Owned by Yuchen (Justin Sun)

In fact, Steve Liu, Jennifer Jiang, Yiying Jiang and Yiyang Jiang do not show up as the officers of any Singapore company.

But, a Yiying Jiang does show up on another company. DTV Limited - the UK holding company of DLive by Bittorrent.

Owned by Yuchen (Justin Sun)

6/25

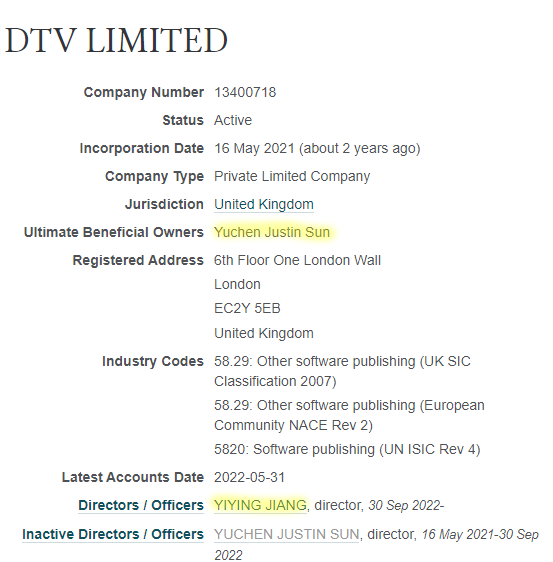

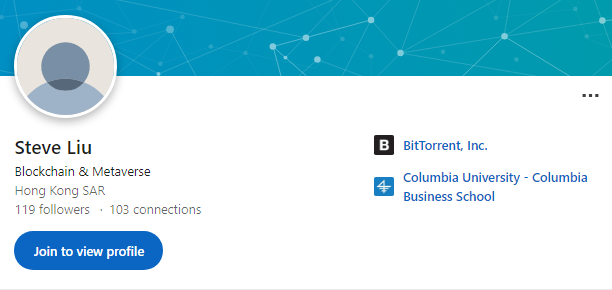

Now BitTorrent is owned by a holding company called Rainberry - which lists both Justin Sun, and Steve Liu, our other supposed executive of Techteryx.

Now BitTorrent is owned by a holding company called Rainberry - which lists both Justin Sun, and Steve Liu, our other supposed executive of Techteryx.

7/25

Now maybe these are just former BitTorrent execs that made their own fund, right?

No.

If we go back to Poloniex which was initially held under Augustech LLC, we'll see Jennifer Yiying Jiang again, holding it on behalf of Sun before he admitted ownership.

Now maybe these are just former BitTorrent execs that made their own fund, right?

No.

If we go back to Poloniex which was initially held under Augustech LLC, we'll see Jennifer Yiying Jiang again, holding it on behalf of Sun before he admitted ownership.

8/25

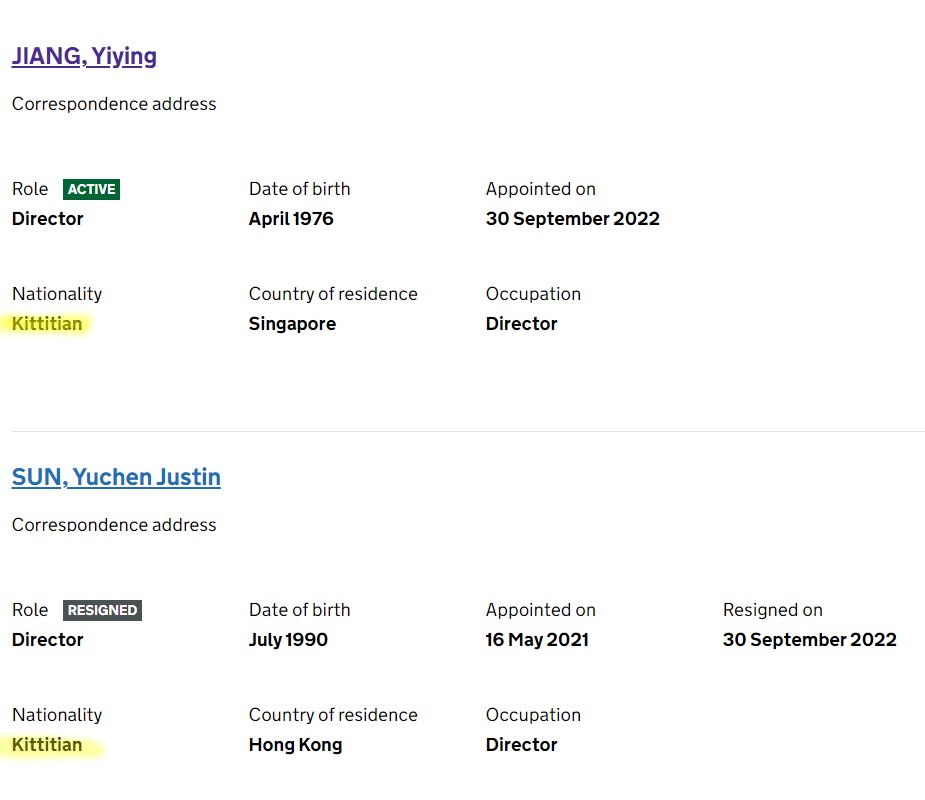

And on the British filing (addresses removed) it notes that both Yiying and Justin are "Kittitian" aka have citizenships from St. Kitts and Nevis.

Which, as far as we know Sun didn't take any employees with him to get island citizenships...BUT

And on the British filing (addresses removed) it notes that both Yiying and Justin are "Kittitian" aka have citizenships from St. Kitts and Nevis.

Which, as far as we know Sun didn't take any employees with him to get island citizenships...BUT

9/25

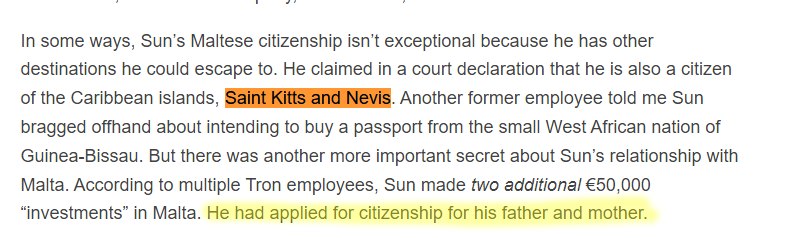

One thing that has been mentioned in interviews is that he applied for citizenships in multiple island nations for his parents as well.

Although based on the date of birth, Yiying would be a bit young to be Justin's mum; or in this case, it's believed his step mum.

One thing that has been mentioned in interviews is that he applied for citizenships in multiple island nations for his parents as well.

Although based on the date of birth, Yiying would be a bit young to be Justin's mum; or in this case, it's believed his step mum.

10/25

Previously his family data was leaked on Twitter (IDs removed, and names of non-participant family removed)

What you'll notice is his Dad "Sun Weike" (who we'll come back to) has a daughter who is 17. Which is Justin's half-sister.

Previously his family data was leaked on Twitter (IDs removed, and names of non-participant family removed)

What you'll notice is his Dad "Sun Weike" (who we'll come back to) has a daughter who is 17. Which is Justin's half-sister.

11/25

Now why is his family relevant at all here?

If you read Chinese, you can look at the snapshots of Chinese corporate structures below - if not, continue on.

Now why is his family relevant at all here?

If you read Chinese, you can look at the snapshots of Chinese corporate structures below - if not, continue on.

12/25

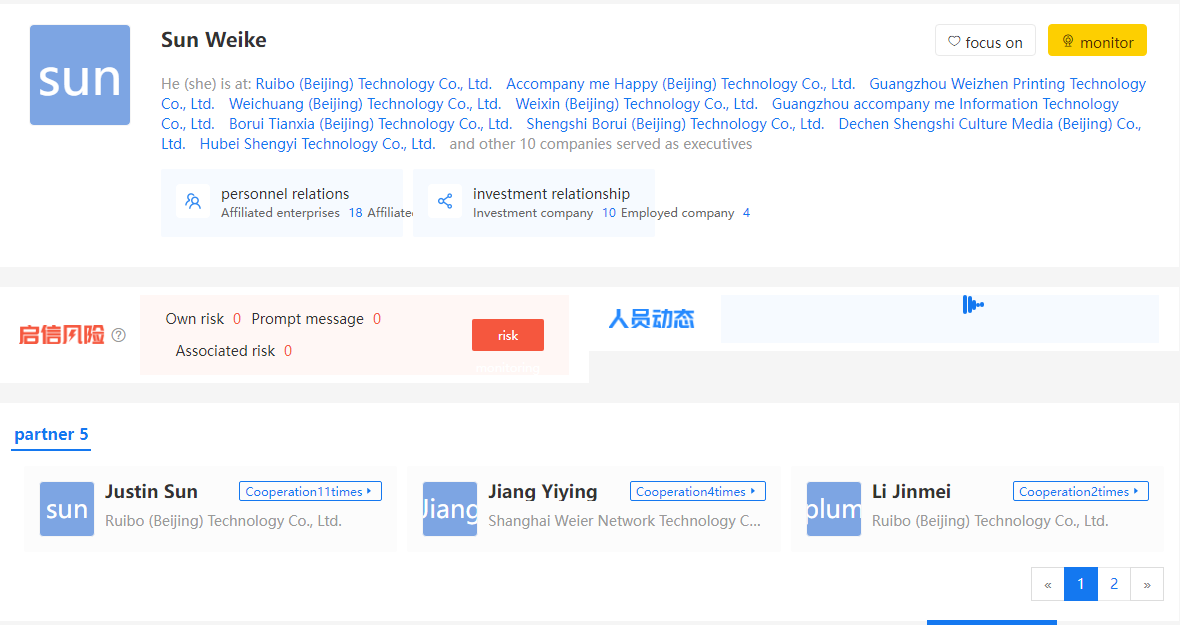

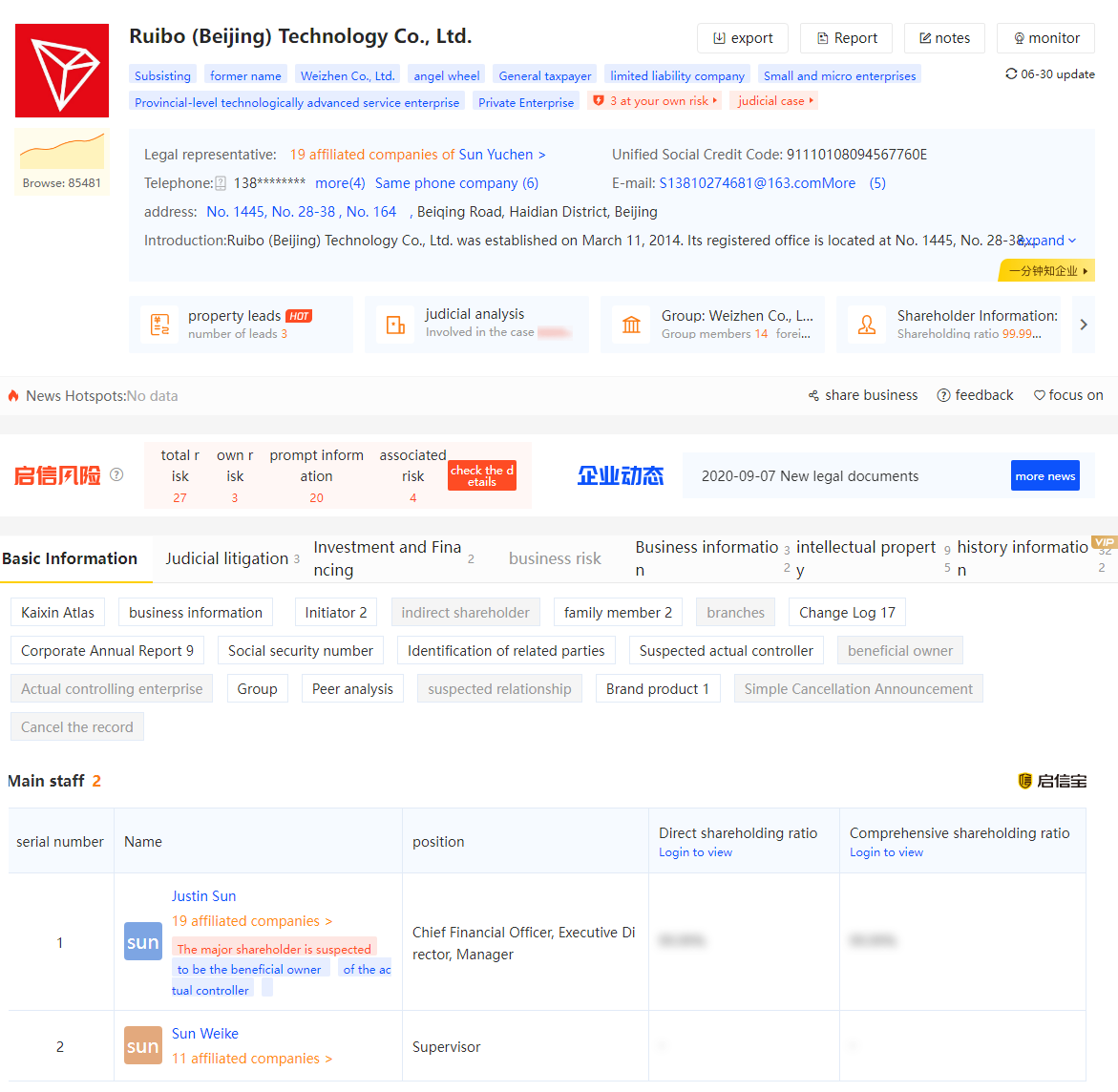

When we look into Sun Weike (孙维柯) we find a huge web of mainland China companies associated with him.

He appears on the board of directors along side:

-Justin Sun

-Jiang Yiying

-Li Jinmei

-Sun Linke (I believe Justin's Uncle)

When we look into Sun Weike (孙维柯) we find a huge web of mainland China companies associated with him.

He appears on the board of directors along side:

-Justin Sun

-Jiang Yiying

-Li Jinmei

-Sun Linke (I believe Justin's Uncle)

13/25

One of these companies is Ruibo Bejing Technology Company, which Justin Sun is listed as an exec of, and has the Tron logo as its logo.

One of these companies is Ruibo Bejing Technology Company, which Justin Sun is listed as an exec of, and has the Tron logo as its logo.

14/25

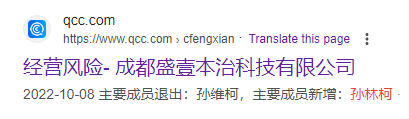

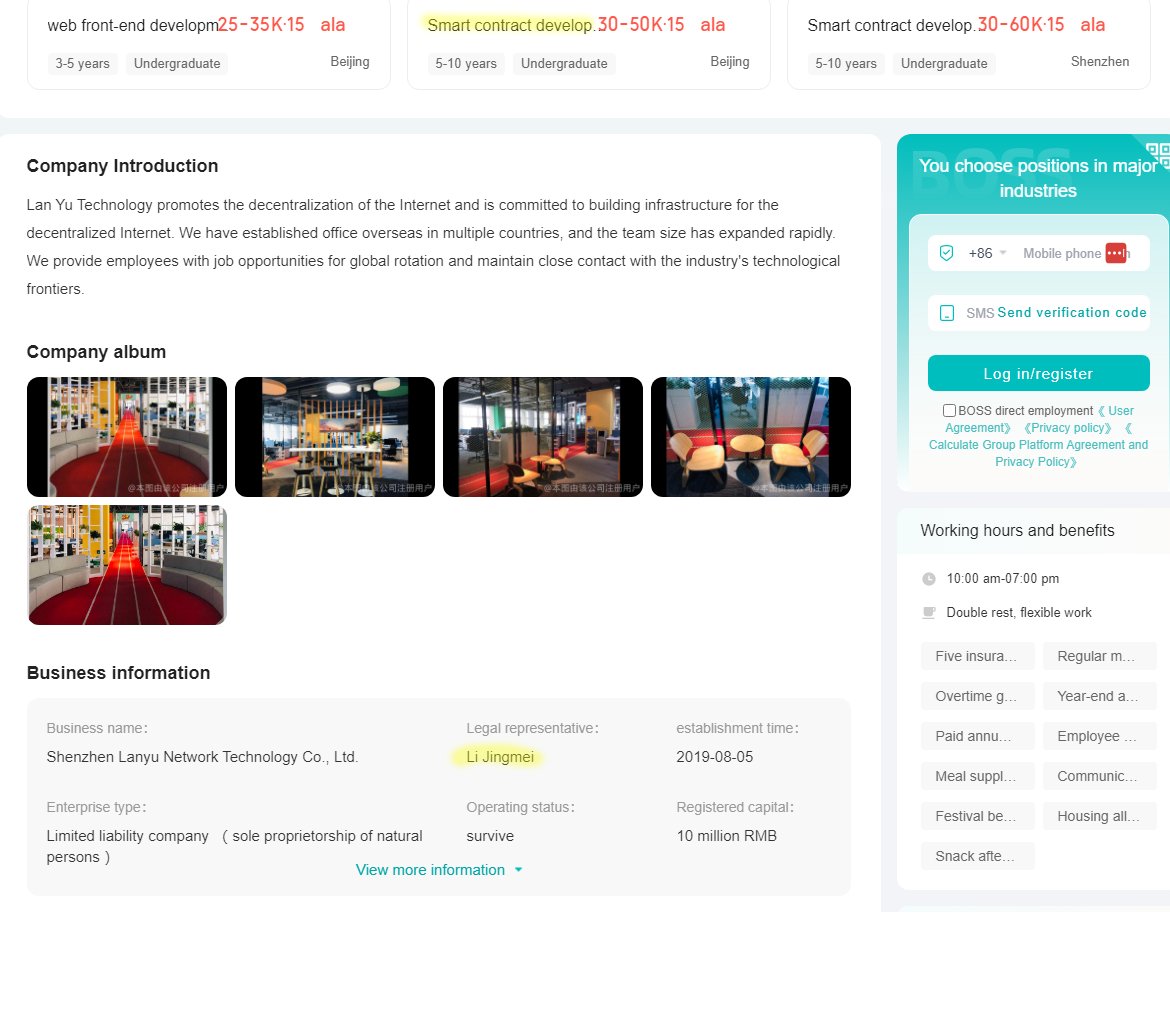

But one of the companies, is "深圳兰宇网络科技有限公司" or the "Shenzhen Lanyu Network Technology Co. Ltd"

Where Google archived a news clip that Sun Weike was replaced as an officer by Sun Linke.

But one of the companies, is "深圳兰宇网络科技有限公司" or the "Shenzhen Lanyu Network Technology Co. Ltd"

Where Google archived a news clip that Sun Weike was replaced as an officer by Sun Linke.

15/25

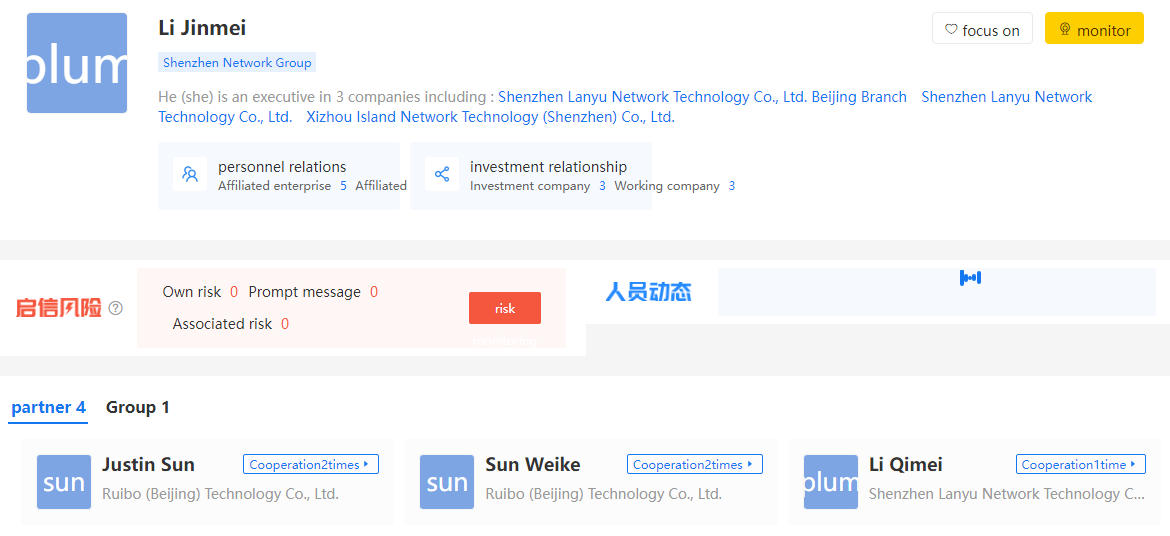

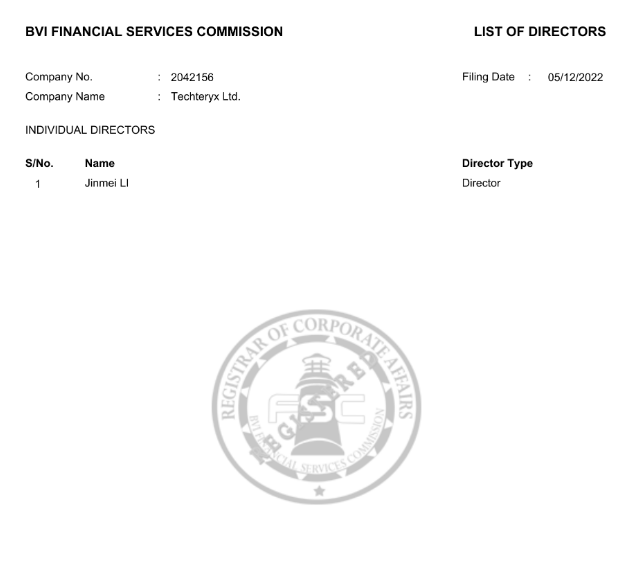

This company and a few others are owned by someone named Li Jinmei.

I can't 100% Li, so I'm not going to dox the person I think it is.

But I believe it may be the ex-wife of Sun Weike, who lives outside of China, hence they feel safe filing her name on documents.

This company and a few others are owned by someone named Li Jinmei.

I can't 100% Li, so I'm not going to dox the person I think it is.

But I believe it may be the ex-wife of Sun Weike, who lives outside of China, hence they feel safe filing her name on documents.

16/25

There is some evidence that Li Jinmei/Jennifer Yiyang/Yiying Jiang/Jiying Jiang might be the same person using switched names given the misspellings, or may be using relatives names without their knowledge.

But is what clear is they run Justin's Chinese entities.

There is some evidence that Li Jinmei/Jennifer Yiyang/Yiying Jiang/Jiying Jiang might be the same person using switched names given the misspellings, or may be using relatives names without their knowledge.

But is what clear is they run Justin's Chinese entities.

17/25

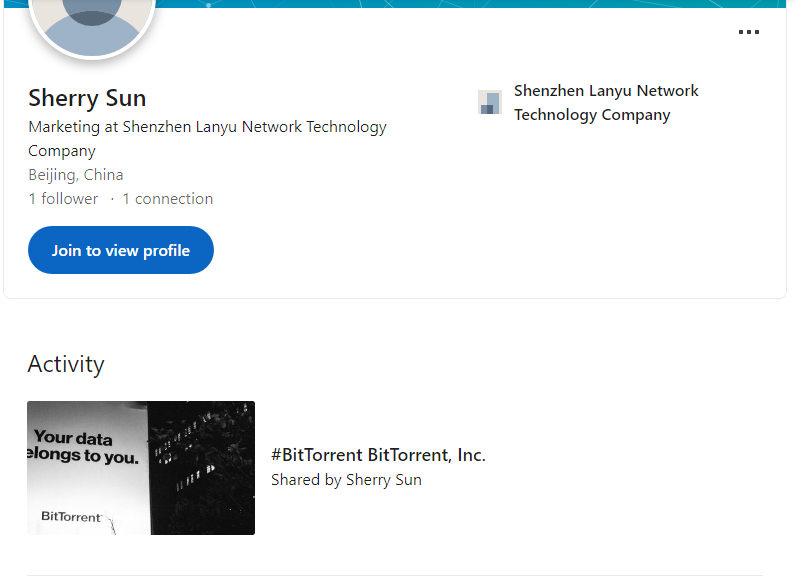

How do we know that Shenzhen Lanyu Network Technology Company is not just a separate company?

First is the profile of Sherry Sun, who works there, who has only ever shared stories of Bittorrent.

How do we know that Shenzhen Lanyu Network Technology Company is not just a separate company?

First is the profile of Sherry Sun, who works there, who has only ever shared stories of Bittorrent.

18/25

The fact that they are an electronics company and have never sold anything on AliExpress and don't even list their supposed inventory.

(Notice that the fake electronics company was the same thing SBF used to get bank accounts with "North Dimension"...)

The fact that they are an electronics company and have never sold anything on AliExpress and don't even list their supposed inventory.

(Notice that the fake electronics company was the same thing SBF used to get bank accounts with "North Dimension"...)

19/25

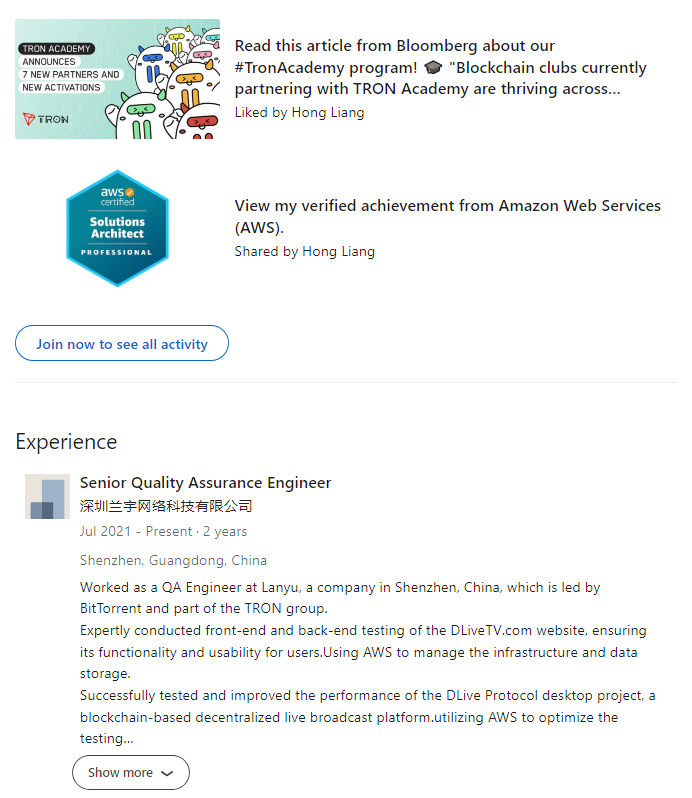

Employee profiles like Michelle Li, who list working there and note they worked on listings for Binance, Huobi, and Kucoin.

Or QA analyst Hong Liang, who does QA for Bittorrent, Tron and DLiveTV.

But they work at "Shenzhen Lanyu Network Technology Company"

Employee profiles like Michelle Li, who list working there and note they worked on listings for Binance, Huobi, and Kucoin.

Or QA analyst Hong Liang, who does QA for Bittorrent, Tron and DLiveTV.

But they work at "Shenzhen Lanyu Network Technology Company"

20/25

And the job listing site that lists Li Jingmei as the owner, and is hiring smart contract developers.

And that Google Cache still show Justin Sun as a shareholder and Bittorrent as a logo

And the job listing site that lists Li Jingmei as the owner, and is hiring smart contract developers.

And that Google Cache still show Justin Sun as a shareholder and Bittorrent as a logo

21/25

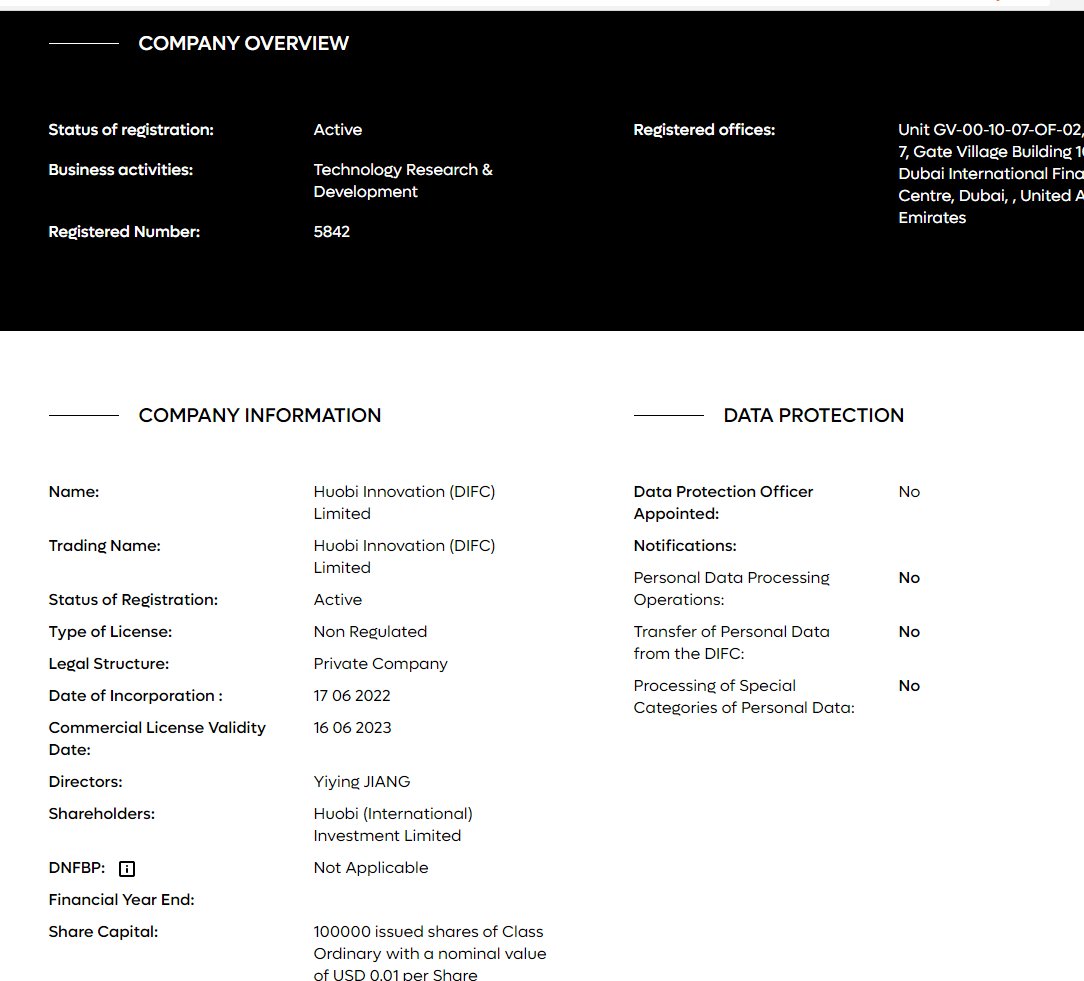

Switching back to Yiying Jiang now, aka, the Jennifer Jiang who signs on behalf of Techteryx.

She's also listed as the director of Huobi Innovation in Dubai.

Which Justin claims to just be "only" an advisor to.

Switching back to Yiying Jiang now, aka, the Jennifer Jiang who signs on behalf of Techteryx.

She's also listed as the director of Huobi Innovation in Dubai.

Which Justin claims to just be "only" an advisor to.

22/25

So we've got:

-Entities related to Justin and his family that own Huobi, Chinese holding companies, and Poloniex.

-Those entities are the signing directors named for Techteryx.

-Techteryx isn't a listed corporate, and had an agent open its Swiss bank.

So we've got:

-Entities related to Justin and his family that own Huobi, Chinese holding companies, and Poloniex.

-Those entities are the signing directors named for Techteryx.

-Techteryx isn't a listed corporate, and had an agent open its Swiss bank.

23/25

Why do this?

Lots of possible reasons, ranging from fraud, laundering your own money in and out of China, or being legitimate but really dumb...

It's unclear why the shell game.

But, if it was legit, why not doesn't Sun just say he owns it and be transparent...

Why do this?

Lots of possible reasons, ranging from fraud, laundering your own money in and out of China, or being legitimate but really dumb...

It's unclear why the shell game.

But, if it was legit, why not doesn't Sun just say he owns it and be transparent...

24/25

What is clear, is that TUSD, Huobi, and the Chinese shell companies are related to Justin his family and partners.

And that this setup is designed to hide and obscure him as the beneficial owner.

Which means it likely isn't in compliance with financial regulations.

What is clear, is that TUSD, Huobi, and the Chinese shell companies are related to Justin his family and partners.

And that this setup is designed to hide and obscure him as the beneficial owner.

Which means it likely isn't in compliance with financial regulations.

25/25

How far it goes is unclear. How much money there is - is unclear.

But if you trust TUSD, you are trusting a stable that Sun/co have the key for, with assets that risk getting seized.

Maybe he's just legit off-shoring his own money - but is it really worth the risk?

How far it goes is unclear. How much money there is - is unclear.

But if you trust TUSD, you are trusting a stable that Sun/co have the key for, with assets that risk getting seized.

Maybe he's just legit off-shoring his own money - but is it really worth the risk?

PS - there is lots more unraveled here, but I was only focused on TUSD.

I don't care about the rest of what Justin does. If he is honest, people can make their own choice which projects to hold.

But if you lie about it and threaten to sue people - that's dumb.

I don't care about the rest of what Justin does. If he is honest, people can make their own choice which projects to hold.

But if you lie about it and threaten to sue people - that's dumb.

In the coming days, you'll likely see articles from some journalists like @CasPiancey who will be digging deeper on this stuff and looking for other connections.

I'm sure he'll do a much better job than just my summary as well.

I'm sure he'll do a much better job than just my summary as well.

fwiw other info coming in, such as a techteryx bvi entity. Will forward that to journalists as well

Will be really interesting to see who the actual officers are on those docs, but I think we'd expect Yiyang on there.

Will be really interesting to see who the actual officers are on those docs, but I think we'd expect Yiyang on there.

Oh surprise its Li Jinmei, who runs the mainland China entities for Tron.

Big thanks to @tier10k for this one.

Big thanks to @tier10k for this one.

cc @CasPiancey thought you'd really like this one.

Starting to look like Li Jinmei, and Yiyang/Yiying Jiang might really be the same person using multiple names even.

Starting to look like Li Jinmei, and Yiyang/Yiying Jiang might really be the same person using multiple names even.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter