Peter Lynch is a legendary investor.

He outlined 6 stock categories you MUST know:

🚀 Fast Growers $SHOP $TSLA

🏰 Stalwarts $HD $V

🐢 Slow Growers $JNJ $PG

🔄 Turnarounds $META $PTON

🎢 Cyclicals $BA $CAT

💼 Asset Plays $BRK $IBM

Here is his playbook for each category 👇

He outlined 6 stock categories you MUST know:

🚀 Fast Growers $SHOP $TSLA

🏰 Stalwarts $HD $V

🐢 Slow Growers $JNJ $PG

🔄 Turnarounds $META $PTON

🎢 Cyclicals $BA $CAT

💼 Asset Plays $BRK $IBM

Here is his playbook for each category 👇

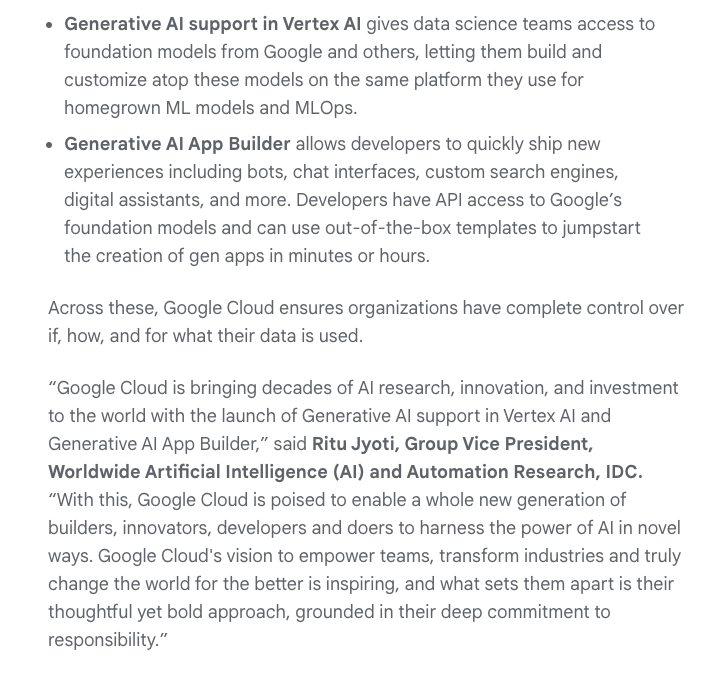

🚀 Fast Growers (like $TSLA, $SHOP)

Playbook: Allocate only a limited portion of your portfolio due to higher risk.

This is Lynch's preferred category:

📈 High Growth Rate (> 20%).

⚖️ Potentially Overvalued.

🏆 Can be huge winners.

⚠️ Risk-Prone.

🦁 Aggressive.

💡 Innovative.

Playbook: Allocate only a limited portion of your portfolio due to higher risk.

This is Lynch's preferred category:

📈 High Growth Rate (> 20%).

⚖️ Potentially Overvalued.

🏆 Can be huge winners.

⚠️ Risk-Prone.

🦁 Aggressive.

💡 Innovative.

🏰 Stalwarts (like $KO, $HD or $V)

Playbook: Own them, don’t trade them.

⚖️ Lower Risk.

📏 Large scale.

🪂 Stable nature

⚓ Portfolio Anchors.

📈 Moderate Growth.

💰 Regular Dividends.

🛡️ Recession Resilience.

Playbook: Own them, don’t trade them.

⚖️ Lower Risk.

📏 Large scale.

🪂 Stable nature

⚓ Portfolio Anchors.

📈 Moderate Growth.

💰 Regular Dividends.

🛡️ Recession Resilience.

🐢 Slow Growers (like $JNJ or $PG)

Playbook: Lynch suggests pruning them from the portfolio. He's not particularly fond of this category.

🪂 Low volatility.

👑 Sector leaders.

🚶 Minimal growth.

💰 Regular dividends.

🛡️ Low risk, low reward.

⚖️ Mature and predictable.

Playbook: Lynch suggests pruning them from the portfolio. He's not particularly fond of this category.

🪂 Low volatility.

👑 Sector leaders.

🚶 Minimal growth.

💰 Regular dividends.

🛡️ Low risk, low reward.

⚖️ Mature and predictable.

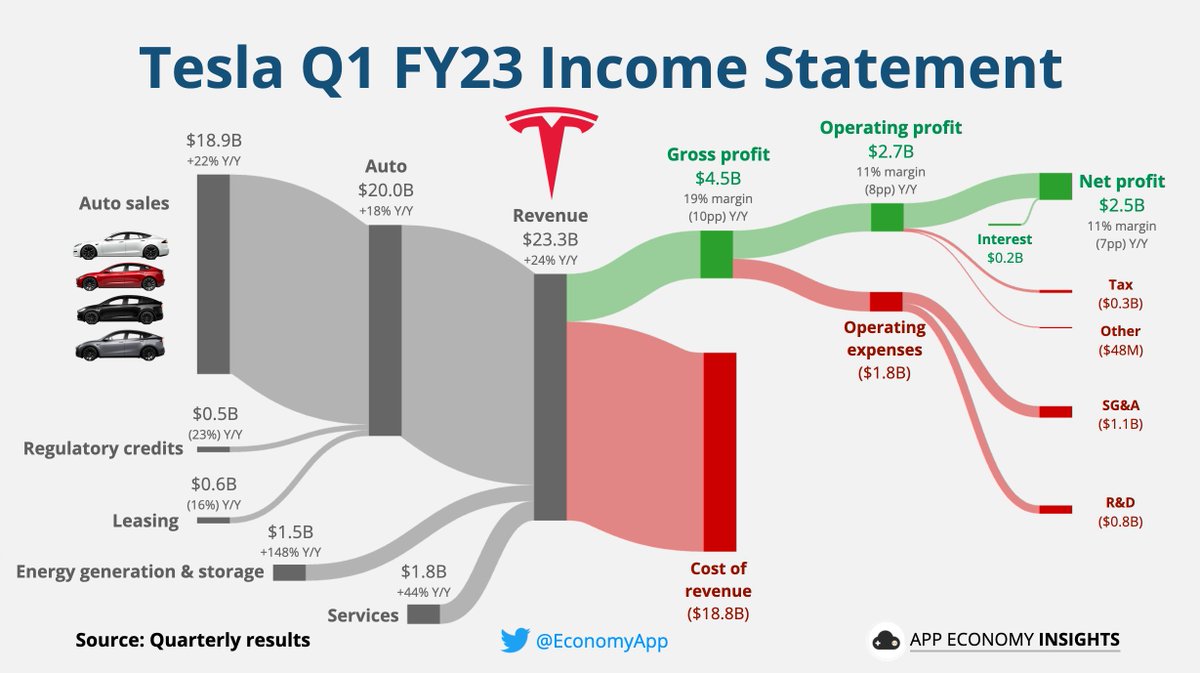

🔄 Turnarounds (like $PTON)

Playbook: Lynch generally steers clear of turnarounds.

Why? They seldom turn.

⚠️ High risk, high reward.

📈 Potential for recovery.

⏳ Patience is required.

🎓 Demands expertise.

📉 Underperforming.

🎲 Volatile.

But exceptions exist $META 👇

Playbook: Lynch generally steers clear of turnarounds.

Why? They seldom turn.

⚠️ High risk, high reward.

📈 Potential for recovery.

⏳ Patience is required.

🎓 Demands expertise.

📉 Underperforming.

🎲 Volatile.

But exceptions exist $META 👇

🎢 Cyclicals

Playbook: A challenging field, best suited for industry insiders, not beginners.

Lynch advises caution.

🚫 Not beginner-friendly.

⏲️ Predictable patterns.

💰 Fluctuating profits.

🏭 Industry-specific.

⌛ Timing is crucial.

🌩️ High volatility.

Playbook: A challenging field, best suited for industry insiders, not beginners.

Lynch advises caution.

🚫 Not beginner-friendly.

⏲️ Predictable patterns.

💰 Fluctuating profits.

🏭 Industry-specific.

⌛ Timing is crucial.

🌩️ High volatility.

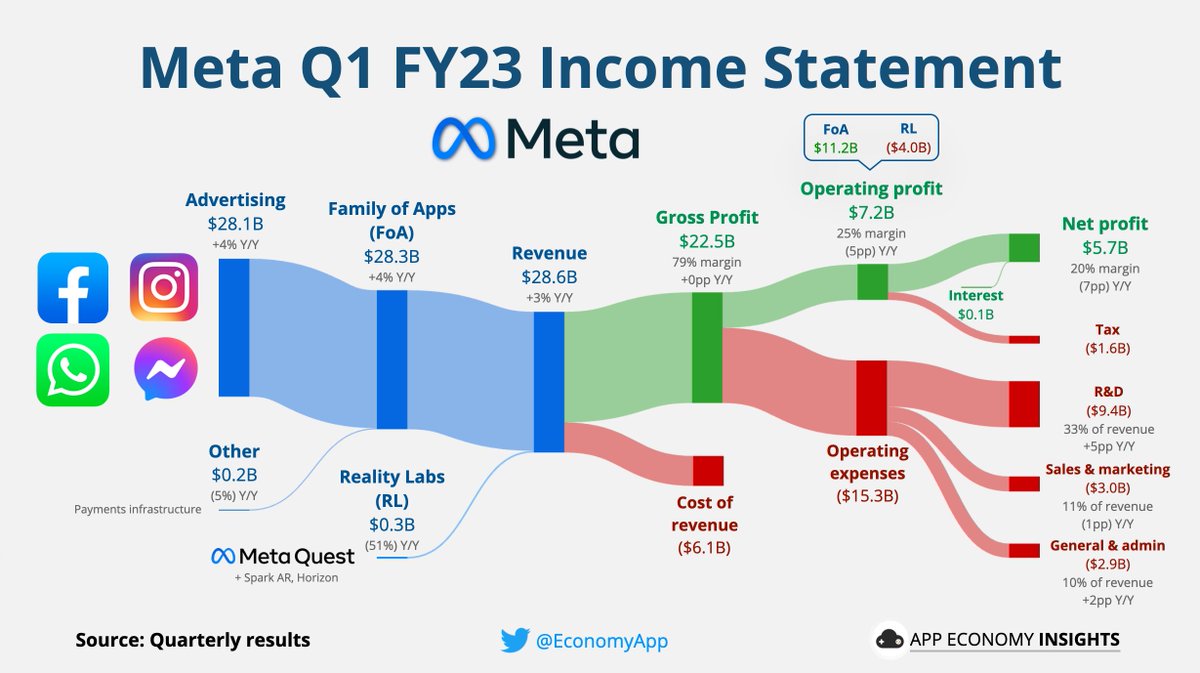

💼 Asset Plays

Playbook: Discover hidden value before the market does and be patient.

🔑 Patience is key.

💰 Seek undervalued assets.

🧠 Tangible or intangible plays.

🔍 Requires thorough analysis.

🎯 Potential acquisition targets.

Example: eBay's spin-off of PayPal $PYPL.

Playbook: Discover hidden value before the market does and be patient.

🔑 Patience is key.

💰 Seek undervalued assets.

🧠 Tangible or intangible plays.

🔍 Requires thorough analysis.

🎯 Potential acquisition targets.

Example: eBay's spin-off of PayPal $PYPL.

But wait, there's more!

Lynch identified favorable stock traits he always looks for.

These traits helped him outperform the market by a factor of 2X over 13 years.

We list them in our full article here 👇

appeconomyinsights.com/p/6-stock-type…

Lynch identified favorable stock traits he always looks for.

These traits helped him outperform the market by a factor of 2X over 13 years.

We list them in our full article here 👇

appeconomyinsights.com/p/6-stock-type…

• • •

Missing some Tweet in this thread? You can try to

force a refresh