• App Economy investor

• French in Silicon Valley

• Gaming industry veteran

• Previously @PwC & @BandaiNamcoUS

• 200K+ read my newsletter How They Make Money

9 subscribers

How to get URL link on X (Twitter) App

Key sections of a 10-K:

Key sections of a 10-K:

🚀 Fast Growers (like $TSLA, $SHOP)

🚀 Fast Growers (like $TSLA, $SHOP)

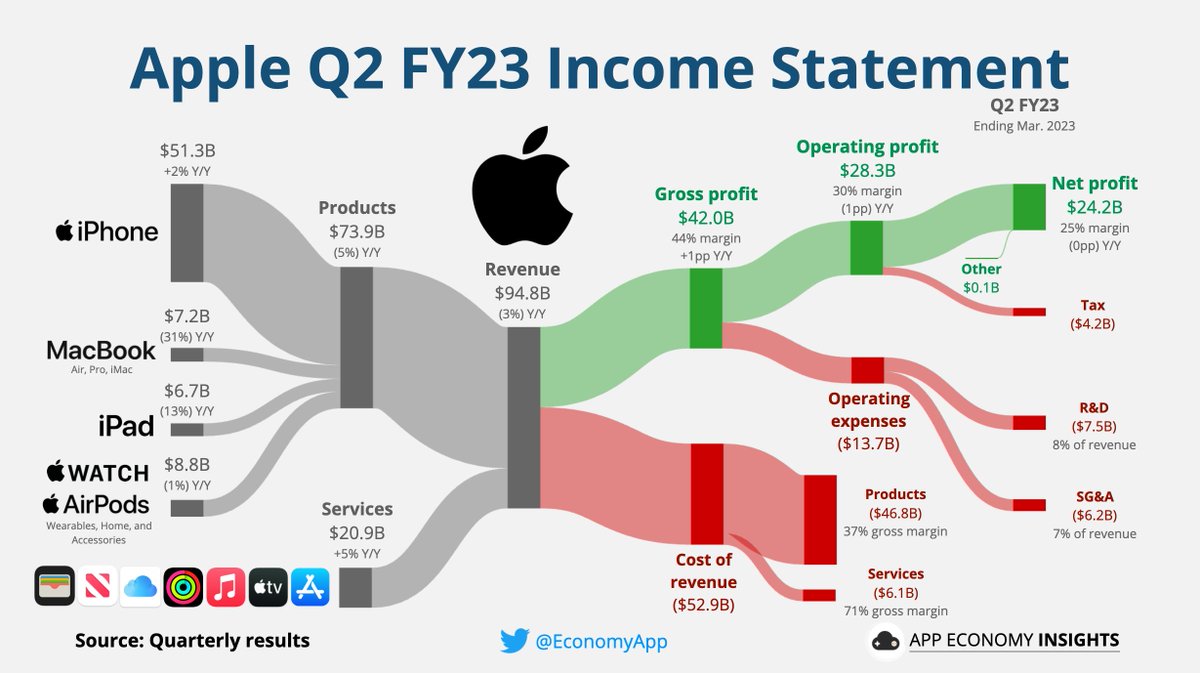

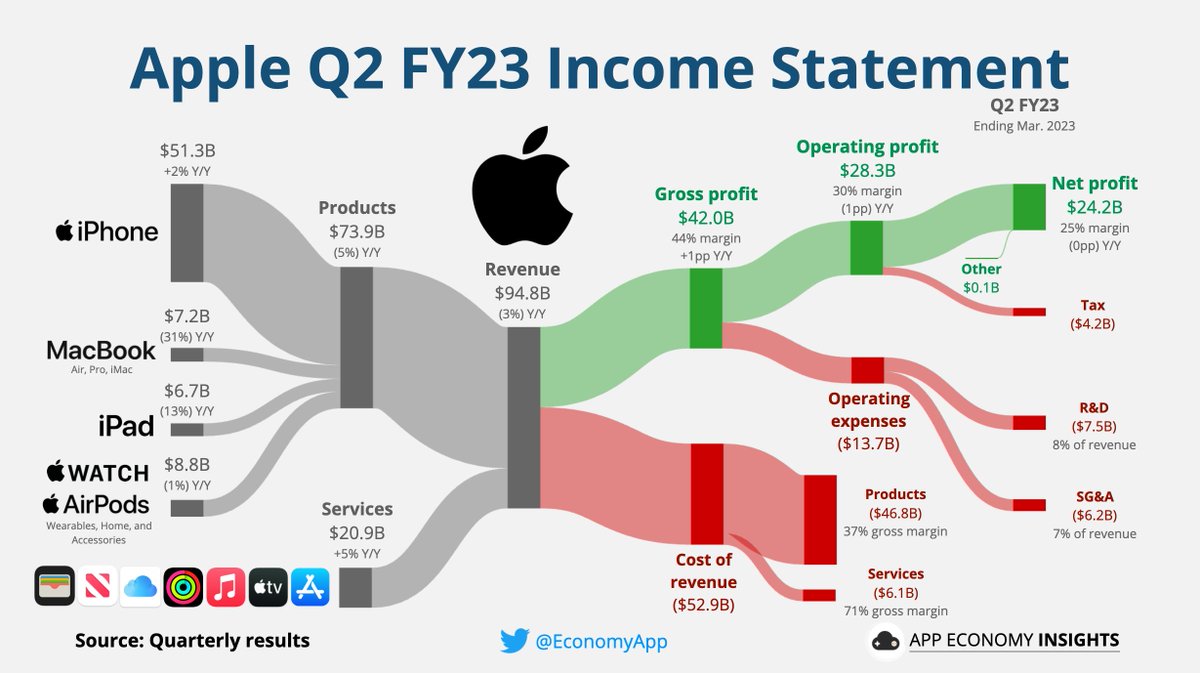

$AAPL Apple revenue breakdown.

$AAPL Apple revenue breakdown.

💡 “Show me the incentive and I will show you the outcome.”

💡 “Show me the incentive and I will show you the outcome.”

1) NVIDIA DGX Cloud.

1) NVIDIA DGX Cloud.

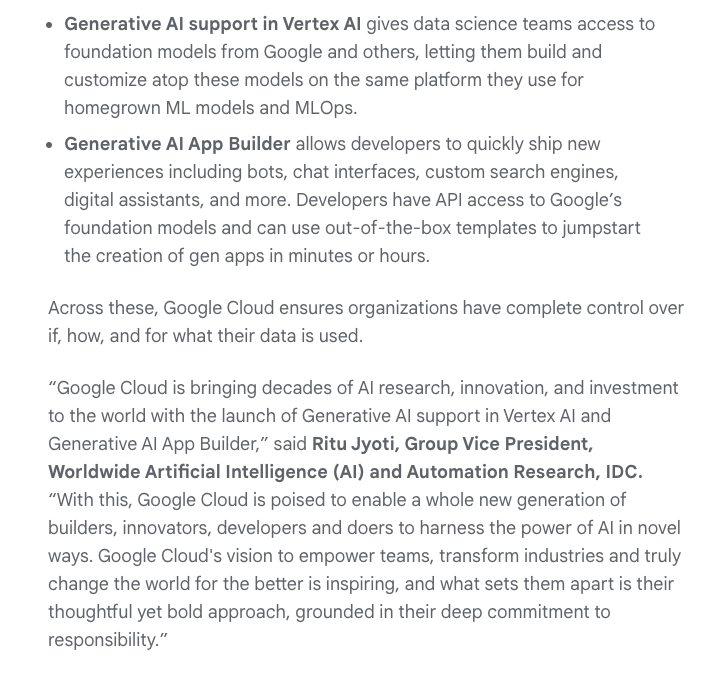

Google Cloud will launch generative AI products to empower developers with enterprise-level safety, security, and privacy.

Google Cloud will launch generative AI products to empower developers with enterprise-level safety, security, and privacy.

$META's restructurings are expected by May.

$META's restructurings are expected by May.

$CRWD Q4 FY23 margins:

$CRWD Q4 FY23 margins:

App Economy Portfolio allocation 1/2023:

App Economy Portfolio allocation 1/2023:

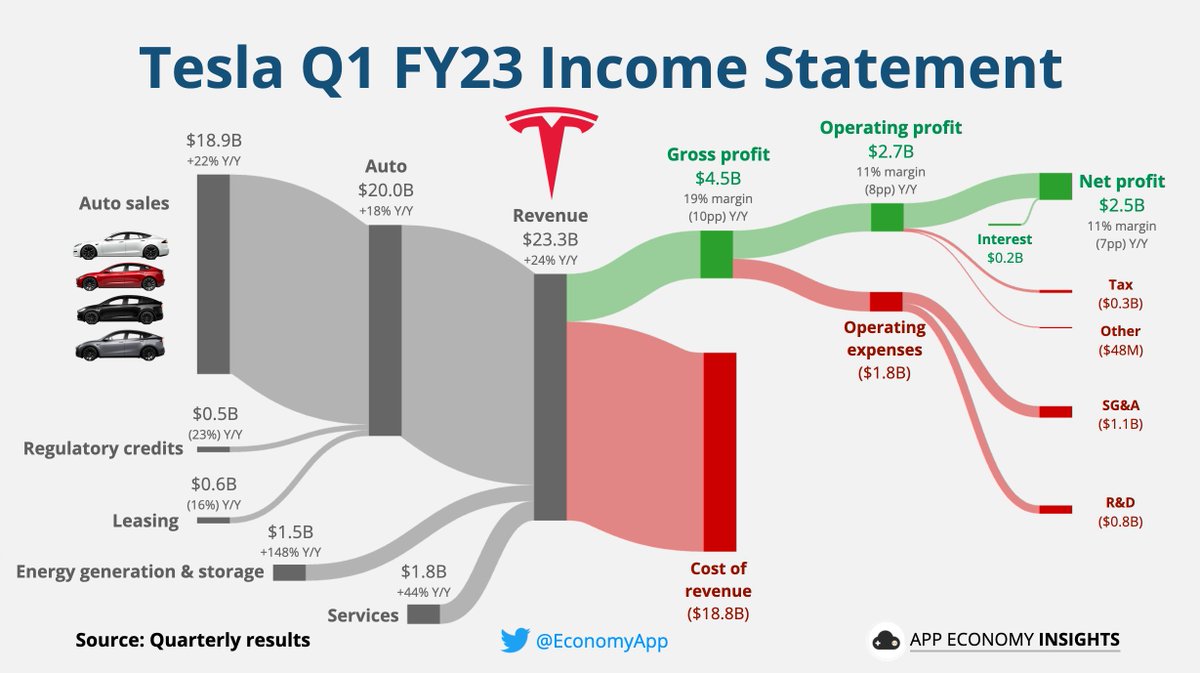

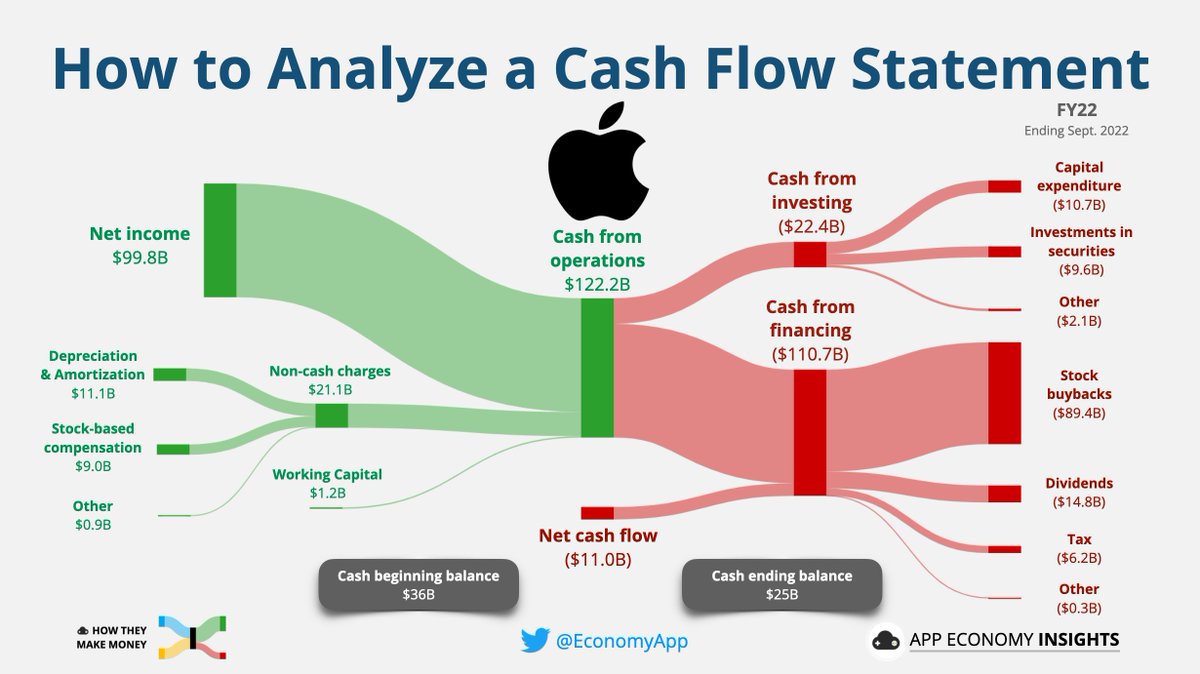

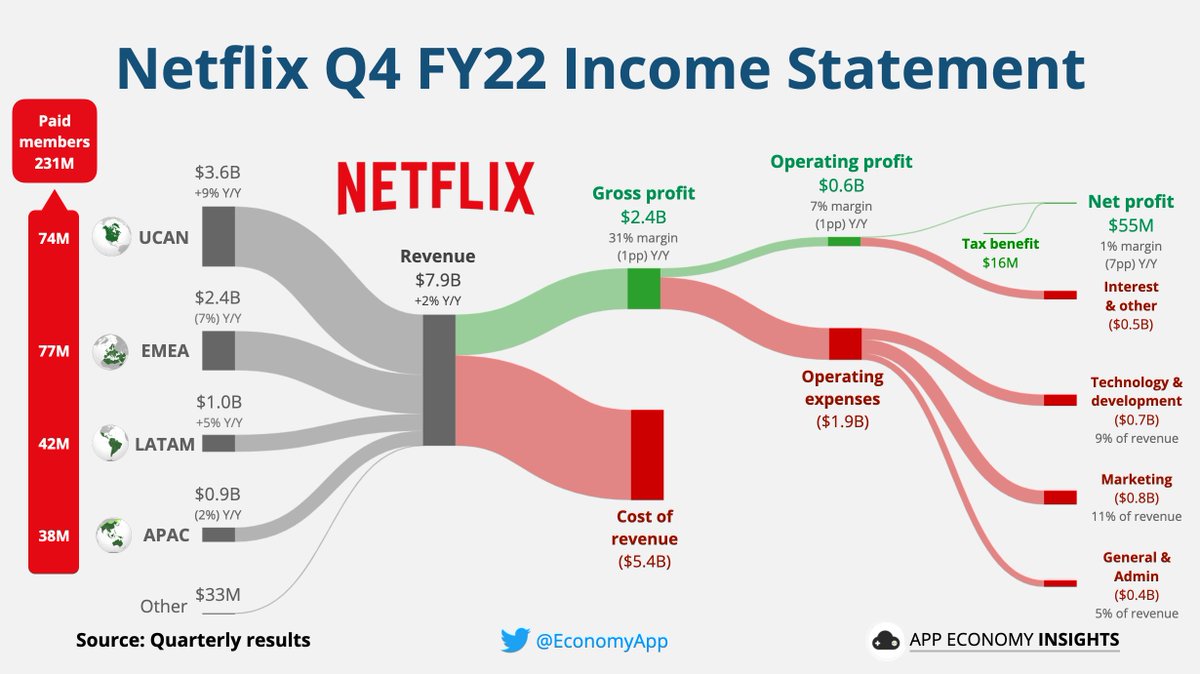

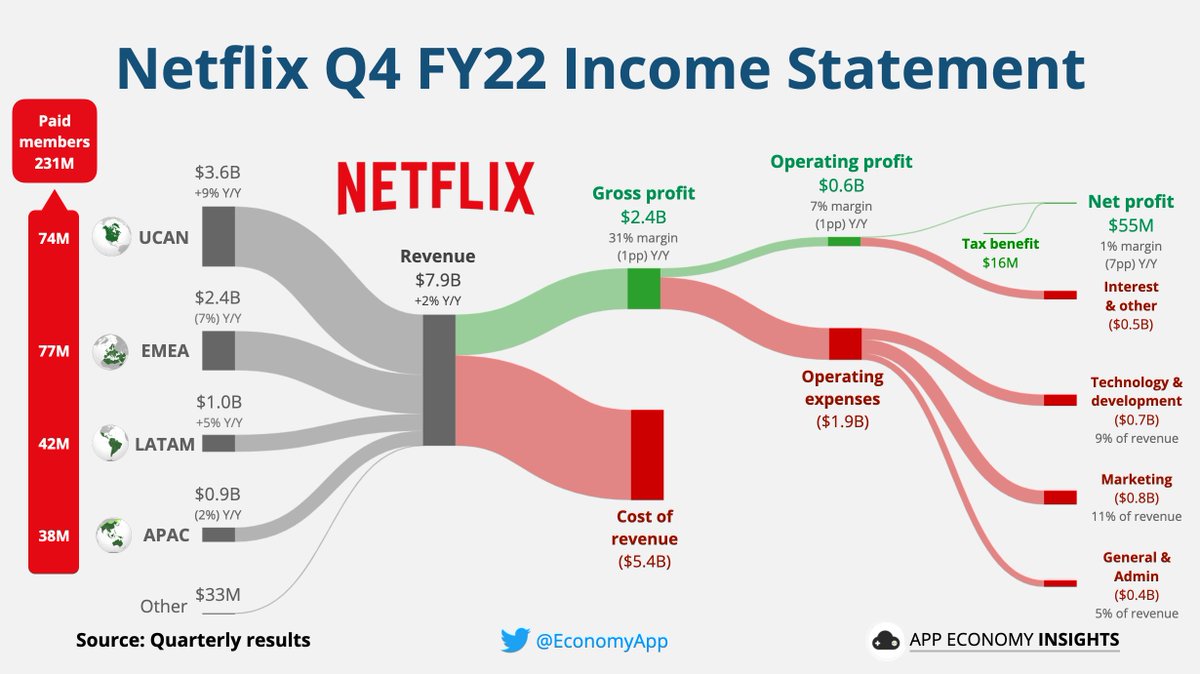

💡 Income Statement

💡 Income Statement

$NFLX Leadership update:

$NFLX Leadership update:

App Economy Portfolio allocation 11/2022:

App Economy Portfolio allocation 11/2022:

$CRWD Q3 FY23 Margins:

$CRWD Q3 FY23 Margins:

App Economy Portfolio allocation 10/2022:

App Economy Portfolio allocation 10/2022:

I focus on the business, not the stock.

I focus on the business, not the stock.

Fortune's Future 50 for 2021:

Fortune's Future 50 for 2021:

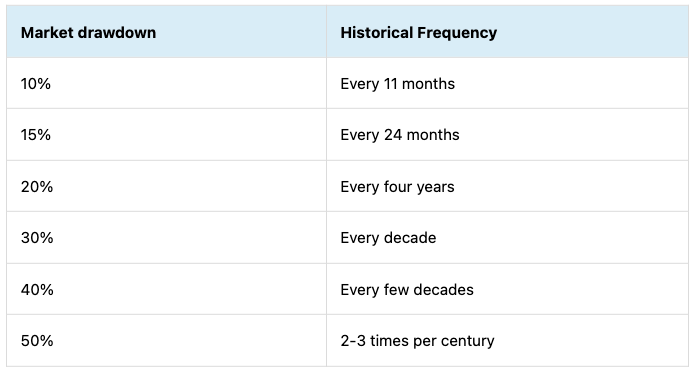

1) Ask yourself how much drawdown you can cope with.

1) Ask yourself how much drawdown you can cope with.