You always should try to be as rational as possible.

Here are 7 cheat sheets I use daily to achieve this.

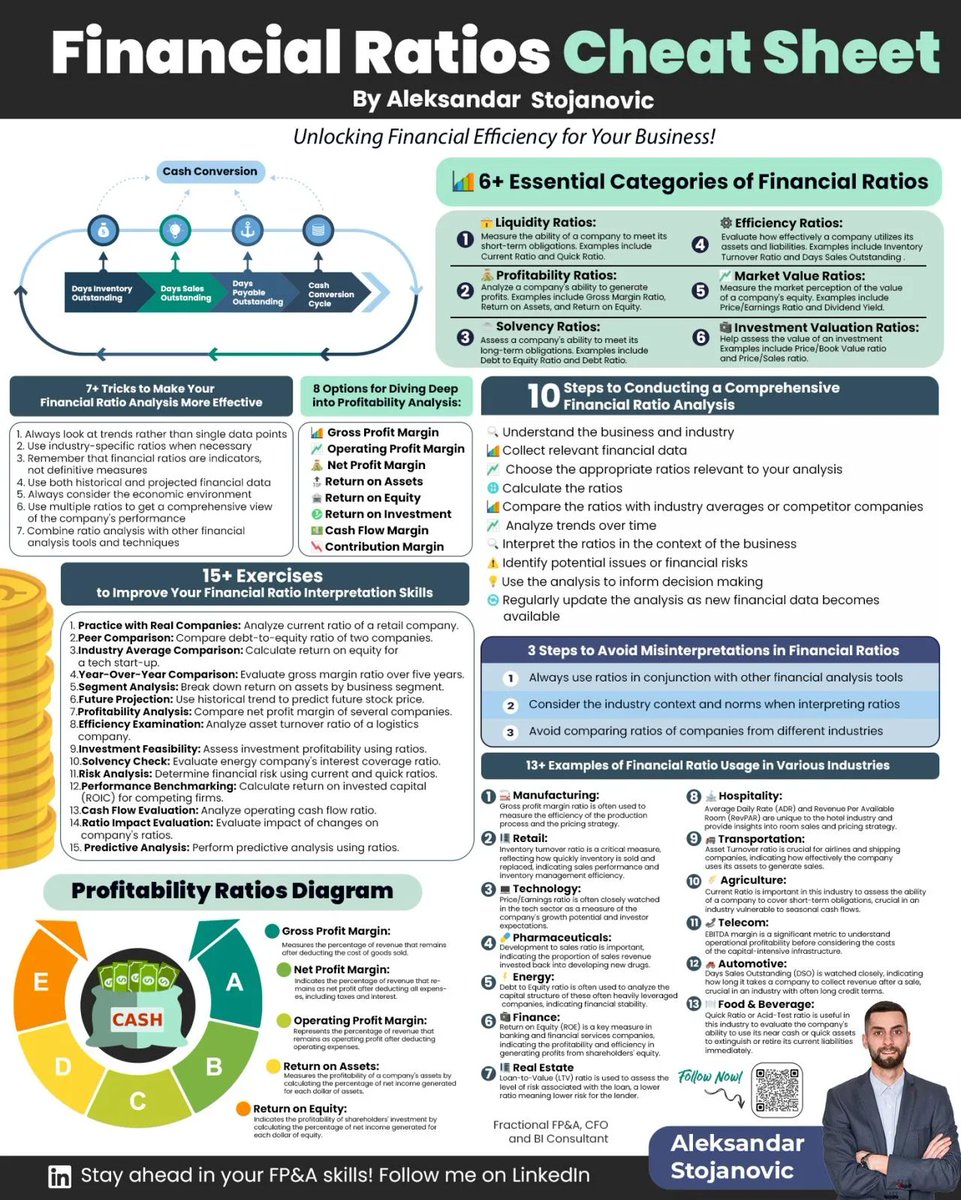

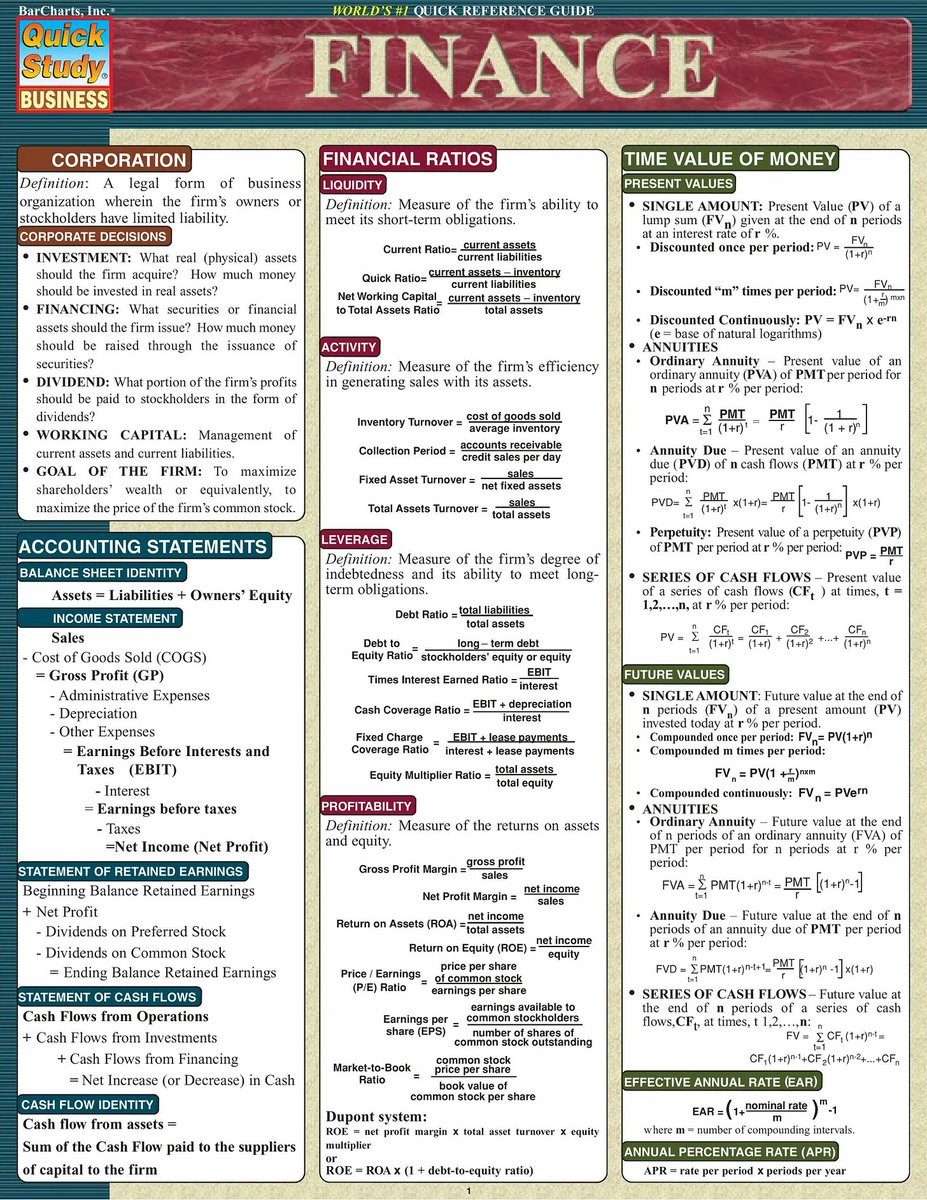

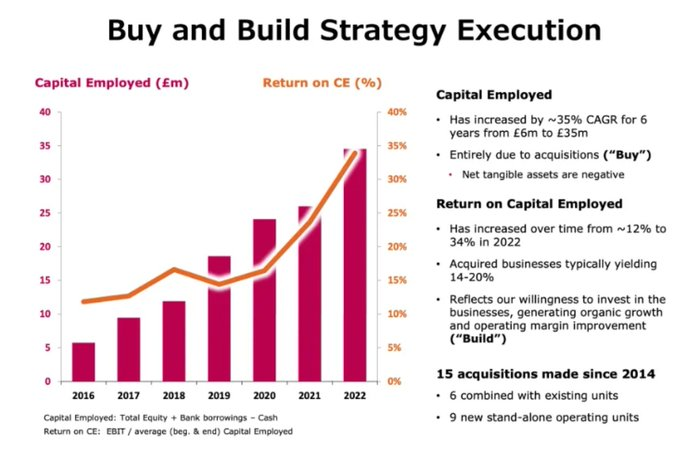

1️⃣ Finance cheat sheet by @BoucherNicolas:

Here are 7 cheat sheets I use daily to achieve this.

1️⃣ Finance cheat sheet by @BoucherNicolas:

That's it for today.

If you liked this, you'll LOVE our brand new e-book about investing and the stock market.

It will be published on Amazon soon, but today you can grab it for free.

Sign up here: https://t.co/D3P4bA3UBneepurl.com/h9kw29

If you liked this, you'll LOVE our brand new e-book about investing and the stock market.

It will be published on Amazon soon, but today you can grab it for free.

Sign up here: https://t.co/D3P4bA3UBneepurl.com/h9kw29

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter