EKI Energy...a story.

Auditor of EKI Energy resigned in Nov'22, stating emphatically there was no dispute with management, and audit for H1FY23 was completed by them w/ clean limited review report.

But in Q3FY23, new auditor Walker Chandiok trashed the financials.

(1/12)

Auditor of EKI Energy resigned in Nov'22, stating emphatically there was no dispute with management, and audit for H1FY23 was completed by them w/ clean limited review report.

But in Q3FY23, new auditor Walker Chandiok trashed the financials.

(1/12)

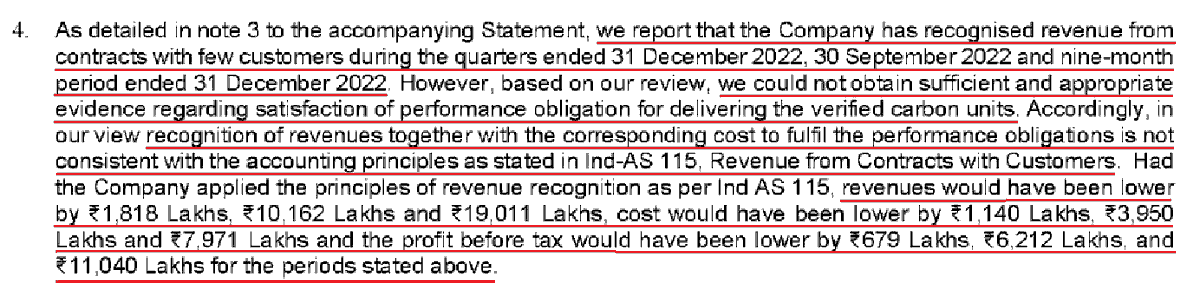

Management has recognised revenue, AGAINST opinion of auditor, in absence of fulfillment of contractual performance obligations!

In polite words, this seems to be fake revenue. 190 crore sales (~10%) and 110 crore (~40%) PAT. Almost half PAT is possibly...non-existent.

(2/12)

In polite words, this seems to be fake revenue. 190 crore sales (~10%) and 110 crore (~40%) PAT. Almost half PAT is possibly...non-existent.

(2/12)

Now, EKI has STILL not released Q4FY23 results. It says this is because Walker Chandiok has to re-audit H1FY23 which was done by previous auditor. Seems like a valid reason, except it begs the question - why wasn't re-audit of H1FY23 being done since Nov'22?

(3/12)

(3/12)

To summarise so far, Walker Chandiok called 9MFY23 financials as 'made up' by the management. What is shocking is that the flagged issue, performance of contractual obligations, is mostly matter of FACT not opinion - management simply decided otherwise.

(4/12)

(4/12)

Full audit takes place only at the end of the year, so you can chipkao whatever you want in the interim?

How is this not misrepresentation of financials?

Interestingly, number of shareholders has shot up 2200% in 9MFY23 while price has dropped 75%!

(5/12)

How is this not misrepresentation of financials?

Interestingly, number of shareholders has shot up 2200% in 9MFY23 while price has dropped 75%!

(5/12)

Around the time this stock was peaking, lots of articles started coming out in dubious media showing the 80x price rise....distribution tactics? Especially when it coincides subsequently with supposedly cooked up financials to enable offloading to retail?

(6/12)

(6/12)

Even now reputed media like LiveMint carry pieces highlighting the 'multibagger' returns of this stock - and not surprisingly, the number of shareholders has FURTHER increased from 44K to 52K. Oh you unwitting doyens of investor welfare.

(7/12)

(7/12)

So here's the summary:

(1) 80x price rise based on tight shareholding

(2) After peak in Q4FY22, financials supposedly cooked up for 9MFY23

(3) During cooking period, 25x rise in public shareholders while price dropped 75%.

(4) Party's over, unravelling begins

(8/12)

(1) 80x price rise based on tight shareholding

(2) After peak in Q4FY22, financials supposedly cooked up for 9MFY23

(3) During cooking period, 25x rise in public shareholders while price dropped 75%.

(4) Party's over, unravelling begins

(8/12)

This is a very fit case for @SEBI_India to initiate forensic audit for previous fiscals too, especially considering auditor allegations + almost nil cash flow in FY22 - means all the financials are only on paper (and perhaps not even that, if auditor to be believed).

(9/12)

(9/12)

In H1FY23, EKI showed OCF of ~150 crore, mostly from managing inventories and trade receivables. And remember, Walker Chandiok has already called out improper recognition of revenue and profits...which should also impact the cash flow statement....cannot trust these nos!

(10/12)

(10/12)

Walker Chandiok and EKI are probably having a massive tiff for the last 6 months over finalising FY23 accounts.

Wonder how this ends, will management 'convince' the auditor or will auditor take a stand?

Either way, there is enough here for @SEBI_India to investigate.

(11/12)

Wonder how this ends, will management 'convince' the auditor or will auditor take a stand?

Either way, there is enough here for @SEBI_India to investigate.

(11/12)

EKI's auditor issues are known, but I have been observing this vaporware since IPO and felt it was useful to contextualise the sequence of events - many will say promoter shareholding has not changed - but the real game is probably in the background!

(12/12)

(12/12)

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter